Mitigating climate policy costs

Davide Furceri is Deputy Division Chief of the Development Macroeconomic Division at the International Monetary Fund, Michael Ganslmeier works at LSE as a Fellow in the Methodology Department, and Jonathan D Ostry is a Non-Resident Fellow at Bruegel and Professor of the Practice of Economics at Georgetown University in Washington, DC

The global agreement to move away from coal, oil and natural gas, reached at the December 2023 COP28 climate summit in Dubai, exceeded the expectations of some, but was seen by others as a compromise that fell short of phasing out fossil fuels entirely.

Nevertheless, it is a small step towards the ultimate goal of reducing reliance on fossil fuels in reality. Progress will now depend on policies adopted by countries and on the decisions of households and firms in response to new incentive structures.

Perhaps the greatest roadblock to a greener future is the hesitancy of politicians to implement such policies and structures, which should ideally alter incentives away from fossil fuels quickly and fundamentally.

Politicians hesitate to act on the grounds of economic efficiency alone, even though median voters in many countries have become greener over time and support for ambitious climate change policies remains strong among the electorate (Van der Duin et al 2023).

But such support is far from unconditional and depends on the changes to people’s lives climate policies will require1. For politicians, the concern is that insufficient attention paid to the economic and social impact of environmental policies will hurt them in the run-up to elections.

Politicians’ fears have a rational basis in terms of possible blame for the collateral effects of green policies that may create economic hardship. Such losses may be immediate, visible and concentrated, while the benefits of climate policy may be diffuse and postponed, and perhaps even invisible to voters (since they amount to the prevention of environmental damage).

Distributional consequences associated with the phasing out of combustion engine vehicles and traditional domestic heating systems, however, are immediately visible to voters. Opposition to such effects is understandable.

The status quo bias in policymaking is not new. It plagues areas including contending with unsustainable fiscal deficits or implementing productivity-enhancing reforms (structural reforms). War-of-attrition models (for example, Alesina and Drazen, 1989) have been used to study policy outcomes in situations when there are multiple veto players, and welfare-enhancing reforms with the potential to make everyone better off are delayed until one of the veto players concedes, once it becomes apparent that the cost of continuing to fight exceeds the cost of the concession (the loss – or distributional penalty – from the reform itself).

The sentiment that there is a political penalty to be paid from structural reform (Ostry et al 2019, 2021) was expressed in the 1990s by Jean Claude Juncker before he became President of the European Commission: “We all know what to do; we just don’t know how to get re-elected once we’ve done it.”

Niccolò Machiavelli expressed a similar idea half a millennium earlier when he warned that reformers would have as enemies “all those who have done well under the old conditions” and only “lukewarm defenders” in those who may do well in the new situation.

What will it cost?

In Furceri et al (2023) we estimated the average effect of climate change policies (CCPs) on popular support for the government implementing them. We used the OECD’s Environmental Policy Stringency (EPS) indicators (Botta and Kozluk, 2014) as proxies for CCPs, and the International Country Risk Guide2 Index of Popular Support to proxy the level of government support. Our assessment covered 30 developed and emerging economies between 2001 and 2015 (see Furceri et al 2023, for technical details).

The popular support measure is based on opinion polls and scaled between 0 (high risk of losing office) and 4 (low risk). The OECD’s EPS measure is the most comprehensive source for environmental policy measures across countries (28 OECD and six BRICS countries) and time (1990 to 2015)3. All policy indicators are scaled from 0 (not stringent at all) to 6 (very stringent).

In addition to its wide geographical and temporal coverage, the dataset includes both market-based and non-market-based measures, such as indices of taxation of emissions, trading schemes and feed-in tariffs (market-based), and indices of emission limits and research and development subsidies (non-market-based). The availability of these sub-indices allowed us to test whether some instruments are politically costlier than others.

Policy design can be tweaked to make CCPs more acceptable to voters

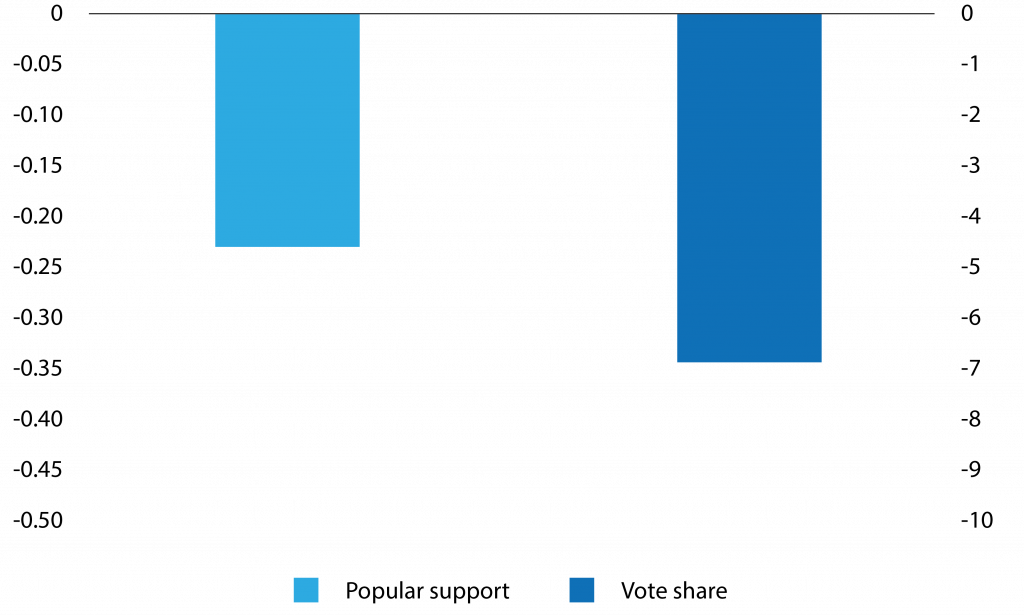

We found that, overall, increasing environmental policy stringency has significantly negative and sizeable effects on popular support for the government. A government moving from the first to the third quartile of the EPS distribution will experience on average a 10 percent decline in popular support (Figure 1)4.

This impact is equivalent to a decline in vote share of about 11 percent during election years – a sizable impact, especially when electoral outcomes are close. These results are robust to alterative sets of controls and the magnitude of the coefficients does not change with model specification.

We also used an instrumental variable (IV) approach to estimate the causal effect of CCPs on popular support for the government5. Our instrument interacts a time-varying global term capturing cross-national pressure for climate change policies (the occurrence and impact of global extreme weather events) and a country-specific term capturing the vulnerability of a country to climate change (such as the length of its coastline as a gauge of vulnerability to rising sea levels). The IV estimates suggest a much larger political cost of CCPs than the estimates described above6.

Figure 1. Impact of stricter environmental policy on popular support (left axis) and vote share (right axis)

Note: The left bar shows the effect on popular support of an increase in EPS, while the right bar shows the impact on vote share for the incumbent in election years from a change in EPS.

Source: Furceri et al (2023).

Unpacking the cost

More detailed examination shows, however, that careful policy design offers pathways to mitigate the political costs, in three respects. First, the adverse effect on popular support is markedly different depending on the type of instrument used.

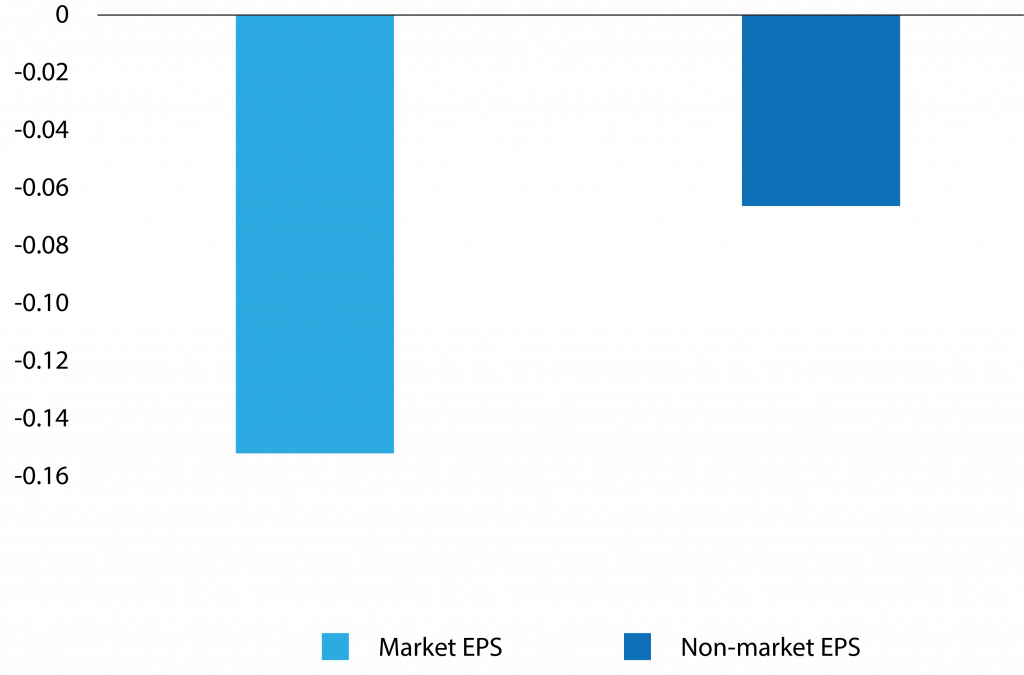

Market-based measures, such as emissions taxes, lead to significant drops in popular support (Figure 2). But non-market-based measures such as emission limits do not entail significant political costs.

Though many economists see Pigouvian taxation as the first-best corrective tool for carbon emissions, opting for second-best nonmarket-based measures can be an effective alternative when market-based measures are not politically viable.

Figure 2. Effect of market- and non-market-based instruments on popular support

Note: Bars denote effect of a change in climate change policies on popular support for the government. Dark (light) blue indicates that the effects are (not) statistically significant at the 10 percent level.

Source: Furceri et al (2023).

Second, timing and country characteristics matter. Political costs are higher when CCPs are adopted in times of high global fuel prices, but are statistically insignificant at times of low fuel prices (Figure 3)7. These findings suggest that political costs depend on the visibility of the reform and on the existing price level of affected products (eg. fuel).

CCPs also create a greater political backlash when adopted in economies that depend heavily on dirty energy sources. Economic diversification is thus an important overarching consideration.

Third, political costs are higher when inequality is relatively high and when social benefits – in the form of direct transfers to households, unemployment benefits and active labour market policies to help job reallocation – are relatively low8.

Remarkably, if inequality is low and benefits are high, the political cost of CCPs are statistically not different from zero (Figure 3). Climate-related policymaking is thus ultimately a social question, and sufficient social-insurance mechanisms are vital to enable the adoption of CCPs in a politically feasible fashion.

Figure 3. The impacts of changes in CCPs on popular support: role of global energy prices. inequality, and social insurance mechanisms

Note: Dark (light) shading indicates (in)significance of the effect at the 10 percent level. Top and bottom income shares in the figure refer to shares of pre-tax national income.

Source: Furceri et al (2023).

Policy design can help deliver a pathway out of political hesitancy

Successful implementation of climate-change policies requires political and popular support. Policy design is critical, in terms of instrument choice and the social policies that accompany a tightening of CCPs.

Market-based instruments (taxes) seem far more politically toxic than non-market-based instruments (emission limits and regulations). Generous social welfare policies and active labour market policies are essential to mitigate the political costs from environmental policies.

Research has shown that some environmental policies are unpopular among some voters, but there is little evidence on how adoption of CCPs affects the popularity of the government overall.

Our research sheds some light on how environmental legislation translates into political costs for incumbents, and how policy design can be tweaked to make CCPs more acceptable to voters.

Endnotes

1. See for example Jonathan Ostry, ‘Politics, as well as economics, matter when making climate policy’, Financial Times, 27 August 2023.

2. See https://www.prsgroup.com/explore-our-products/icrg/.

3. As our data ends in 2015, it was not possible to test within our sample whether the COP21 meeting in 2015, where the Paris Agreement was adopted, raising the ambition of government policies on climate change and increasing public awareness of the science around climate change, had an impact on the relationship between environmental policies and popular support.

4. The EPS varies from 0 to 6. A movement from the first to the third quartile of the EPS distribution corresponds to a movement of about 1.5 points.

5. The IV approach makes use of four alternative instruments, with each being the interaction between a global time-varying term and a constant country term. In all cases, the first-stage estimates suggested that the instrument is strong and statistically significant. To test the validity of the instruments, we checked whether the instruments have a direct effect on popular support by including them (stepwise) as additional controls in the baseline model: the instruments are invariably insignificant. We also directly tested the association of the baseline residuals with the instruments and found the relationship to be indistinguishable from zero. These findings support the validity of the instruments.

6. The direction of the bias in OLS is unclear ex ante. On the one hand, governments might require political capital to implement unpopular reforms. This mechanism implies a positive effect of the dependent variable on our policy variable and biases the OLS estimate towards zero. On the other hand, a government might implement CCPs because its unpopularity implies it has little to lose from reforming. This would imply a negative effect of popular support on CCPs and thus the possibility that the OLS estimate could overestimate the true effect. It turns out that the magnitude of the IV coefficient is (more than) three times larger than the OLS estimate, which suggests that OLS estimates are biased towards zero. This is informative given that the direction of bias is ambiguous ex-ante. See Furceri et al (2023) for details.

7. These results are obtained in a model in which the change in EPS is interacted with a smooth transition function of the level of world energy prices. It is also the case that political costs are higher within one year of an election and are statistically insignificant at other times over the electoral calendar: Furceri et al (2023).

8. These results were obtained in a richer model in which the change in CCPs is interacted with the level of inequality or the generosity of social benefits using smooth transition functions of each. The inequality measures consist of: the GINI (net and gross); top and bottom income shares (1 percent, 10 percent and 20 percent). The social insurance measures (sourced from the OECD), sometimes referred to as ‘fiscal sweeteners’, consist of: total public social expenditure as a percent of GDP; public social expenditure for active labour market policies as percent of GDP; public social expenditure for unemployment benefits as percent of GDP; social benefits to households in cash; and social benefits to households in kind.

References

Alesina, A and A Drazen (1989) ‘Why are Stabilizations Delayed?’ Working Paper 3053, National Bureau of Economic Research.

Botta, E and T Kozluk (2014) ‘Measuring Environmental Policy Stringency in OECD Countries: A Composite Index Approach’, OECD Economics Department Working Papers 1177, Organisation for Economic Co-operation and Development.

Furceri, D, M Ganslmeier and JD Ostry (2023) ‘Are climate change policies politically costly?’ Energy Policy 178, 113175.

Ostry, JD, P Loungani and A Berg (2019) Confronting Inequality: How Societies Can Choose Inclusive Growth, Columbia University Press

Ostry, JD, A Berg and S Kothari (2021) ‘Growth-Equity Trade-offs in Structural Reforms’, Scottish Journal of Political Economy 68(2): 209-237

Van der Duin, D, F Nicoli and B Burgoon (2023) ‘How Sensitive are Europeans to Income Losses Related to Climate Policies?’ Analysis, 19 December, Bruegel.

This article was originally published on Bruegel.