Understanding the WTO e-commerce moratorium

Andrea Andrenelli is a Trade Policy Analyst and Javier López González a Senior Economist, at the Organisation for Economic Co-Operation and Development (OECD)

The last two decades have seen momentous shifts in globalisation as a result of digital transformation (Baldwin 2019, Winters and Borchert 2021, Savona 2020). During this time, the WTO moratorium on applying customs duties on electronic transmissions, the only WTO provision that applies explicitly to digital trade, has underpinned a stable, predictable, and duty-free environment for digital trade to thrive (IMF et al 2023).

At the last WTO Ministerial Conference, after difficult negotiations, the moratorium was renewed, and WTO members agreed to continue discussions on its scope, definition, and impact.

What is the e-commerce moratorium and why is it controversial?

The WTO e-commerce moratorium is a commitment to continue the current practice of not applying customs duties (ie. tariffs) on electronic transmissions. However, since ‘electronic transmissions’ were never defined, there is room for interpretation about the precise scope of the commitment.

Recently, several WTO members have raised questions about the opportunity costs of the moratorium1. Chief among their concerns is the potential loss of ‘policy space’ in the context of rapid technological change and potential losses in customs revenue due to the ‘dematerialisation’ of goods trade. For these WTO members, the lack of clarity on issues of scope and definition makes it difficult to understand the potential value, or opportunity cost of the moratorium.

In a recent paper (Andrenelli and López-González 2023), we review regional trade agreement provisions related to the electronic transmissions, provide new estimates of the potential foregone revenue implications of the moratorium, and explore some of the potential impacts of not renewing the moratorium on trade and competitiveness.

What can we learn from regional trade agreements about the scope and definition of the moratorium?

Some WTO members question whether the moratorium applies to the ‘content’ of the transmission (that is, the actual movies or e-books downloaded) or its ‘carrier medium’ (the bits and bytes that carry the content)2. Questions have also been raised about whether the Moratorium affects the ability of countries to apply other, internal, taxes beyond customs duties, or if the Moratorium erodes other commitments made in the WTO.

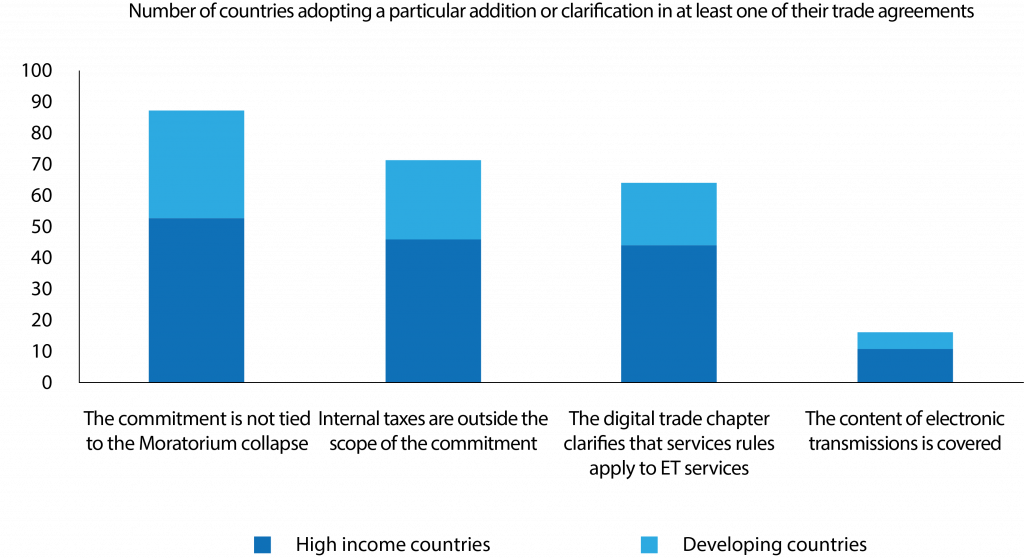

Much can be learnt about the potential scope of the moratorium by looking at how countries have approached customs duties on electronic transmissions in their trade agreements. Analysis using the Trade Agreement Provisions on Electronic Commerce and Data (TAPED) database (Burri et al 2022) shows that, of the 105 regional trade agreements (RTAs) with an e-commerce chapter (by end of 2022), 100 included a provision on the non-imposition of customs duties on electronic transmissions (NICDET provision for short). More detailed analysis of these provisions reveals that (Figure 1):

-The majority of NICDET commitments, 88%, are not tied to the e-commerce moratorium. Specifically, 54 high income and 33 developing countries would continue not imposing customs duties on electronic transmissions, at least on a reciprocal basis, even if the moratorium were to lapse.

-The majority of NICDET provisions clarify that internal taxation is outside the scope of commitments. Most countries do not see the commitment as having implications for applying other forms of taxation, including value added taxes (VAT) or goods and services taxes (GST).

-Digital trade chapters generally reaffirm that measures related to electronic delivery fall within the scope of obligations and exceptions related to services (eg. the General Agreement on Trade in Services (GATS) or regional trade agreement commitments and flexibilities remain). This suggests that the moratorium is unlikely to restrict ‘policy space’ beyond the non-imposition of tariffs.

-Since 2015, members have started to clarify that NICDET commitments apply to the content of electronic transmissions. There are no trade agreements clarifying that NICDET provisions apply to the ‘carrier medium’.

Figure 1. Non-imposition of customs duties on electronic transmissions (NICDET) commitments in regional trade agreements can provide useful guidance on the interpretation of the potential scope and definition of the moratorium

Note: Income group classification based on the 2022-2023 World Bank classification, where developing countries refers to lower-middle-income and upper-middle-income countries.

Source: Andrenelli and López-González (2023).

Some countries define electronic transmissions as ‘digital products’ which include computer programmes, text, video, images, sound recordings, and other products that are digitally encoded. Others clarify that ‘deliveries by electronic means shall be considered as the provision of services’. Others just use the term ‘electronic transmissions’, without any further clarifications.

However, differences in definitions have not prevented the conclusion of NICDET provisions between countries with different definitions3. While for some the lack of a precise definition might be considered a challenge, for others it is a way of enabling a variety of views to coexist.

Our analysis suggests that the potential foregone revenue costs of the Moratorium are small and that its lapse would come at the expense of wider gains in the economy

What are the potential fiscal implications of the moratorium?

Some WTO members worry that not imposing customs duties on electronic transmissions may lead to foregone customs revenue. That is, a country importing a movie via an electronic transmission foregoes the tariff revenue associated with its import via a physical carrier medium, such as through a DVD. They argue that the rapid pace of digitalisation increases the scale of the problem, especially for developing countries, which tend to charge higher tariffs on these items.

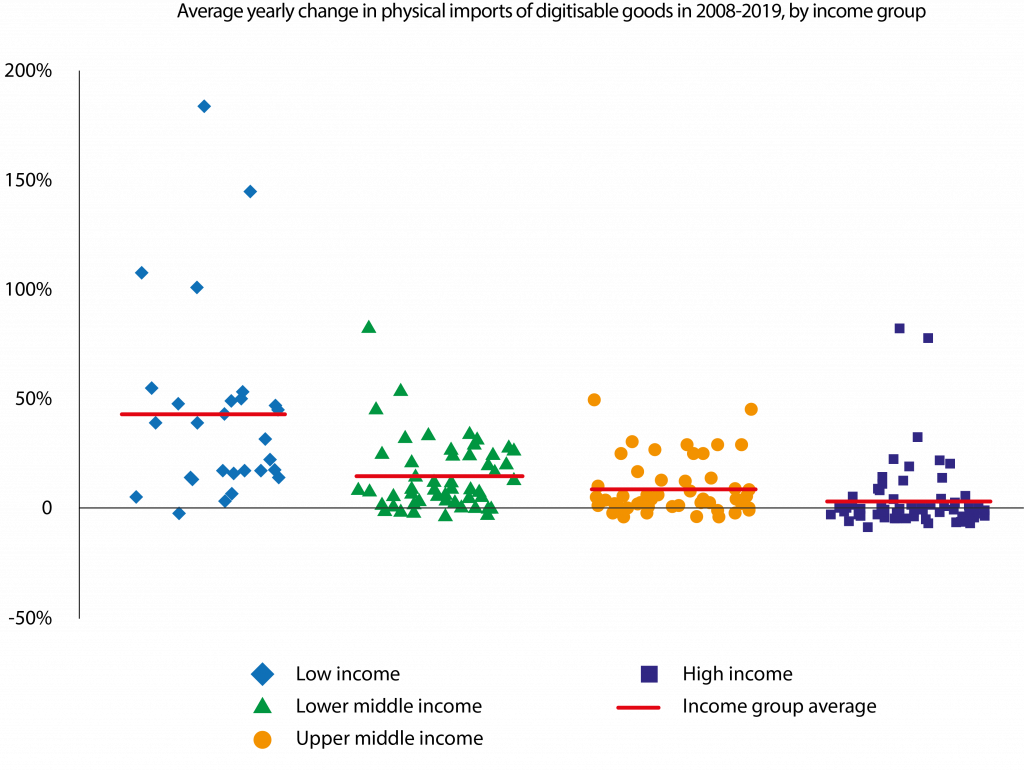

However, imports of ‘digitisable goods’, which are physical goods that can be digitised and subsequently sent across borders digitally (e.g. CDs, books, calendars, videotapes), have generally been growing over the last decade, especially in developing countries (Figure 2), continuing to generate tariff revenue.

Figure 2. Imports of digitisable goods have been growing, particularly in low-income countries

Note: Markers represent individual countries. Based on 206 countries and territories. Red lines show the income group average. The horizontal axis line indicates 0% average growth. Calculations based on BACI data.

Source: Andrenelli and López-González (2023).

Accurately assessing the potential foregone revenue implications of the moratorium is not easy given uncertainties about scope and definition. However, we argue that existing empirical studies (Banga 2022, 2019) have not addressed three important issues that bias current estimates upwards.

The first is that existing commitments and practices, such as NICDET provisions or other preferences granted in regional trade agreements, limit the ability of countries to raise tariffs on digitisable goods and electronic transmissions, even in the absence of the e-commerce moratorium.

The second is that not all trade that can be electronically transmitted will be (as seen above, imports of digitisable goods have actually been increasing for many countries). The third is that assessments need to consider the potential offsetting effects of VATs/GSTs applied on growing digital imports.

We find that the foregone customs revenue that can be attributed to the moratorium is small – on average 0.68% of total customs revenue or 0.1% of overall government revenue. Given higher tariffs and lower levels of commitments, impacts are on average higher for low-income countries (0.33% of government revenue), and lower for high income country (0.01%).

That said, for 77 of 106 countries analysed, standard VAT/GST taxes applied on digital services imports which are ‘born digital’ completely offset the customs revenue effects of the moratorium4.

These findings underscore the potential to find fiscal solutions, based on consumption taxes, to collect revenue on immaterial imports based on widely adopted and internationally accepted standards (OECD 2017). These taxes are efficient and have a demonstrated capacity of increasing tax revenues (Hanappi et al 2024).

In addition, since single rates tend to apply, there is no need to spend resources identifying how to classify products into detailed nomenclatures or to determine their origin. These taxes also target final, instead of intermediate consumption, which, as we will show below, is important.

What benefits are at stake with the potential lapse of the e-commerce moratorium?

We find that tariffs on electronic transmissions have the potential to hit low-income country trade most. If existing tariffs on digitisable goods were to be applied to digital services (which is where electronic transmissions are measured in existing trade statistics) imports of low-income countries would fall by 32% and exports would fall by 2.5%.

This is because more than 80% of digital services exports of low-income countries are to middle income countries which have more scope to increase tariffs. For middle-income countries, losses would be of 6% and 0.4% and for high-income countries of 0.04% and 0.5%, respectively.

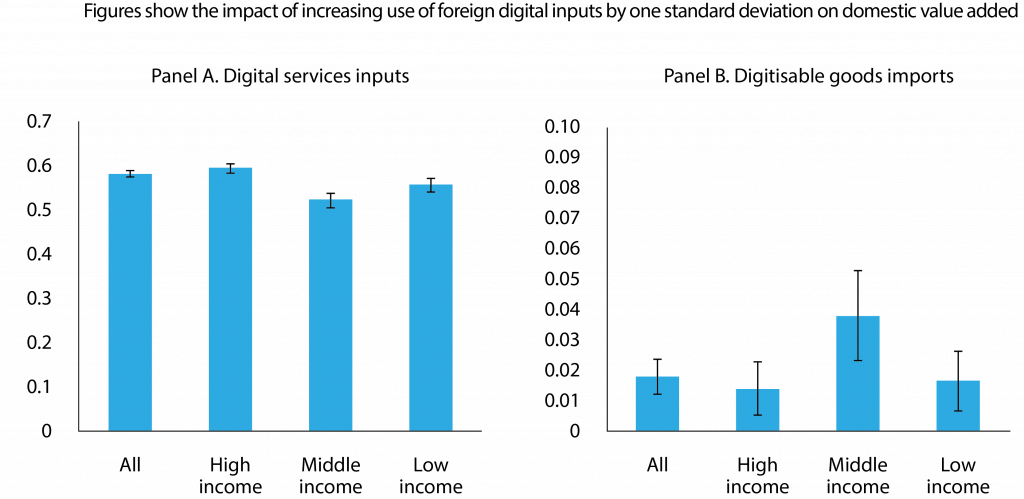

Evidence also shows that the use of foreign digital inputs and digitisable goods contributes to domestic competitiveness, measured as changes in the domestic value added in final consumption (Figure 3). This suggests that trade cost increases arising from the termination of the Moratorium would lead to losses in domestic competitiveness. Therefore, there is a self-interest argument for maintaining a duty-free environment for electronic transmissions.

Figure 3. Digital inputs are key determinants of domestic competitiveness

Note: Standardised regression coefficients capturing impact of increasing digital services inputs and digitisable goods imports on domestic value added with confidence intervals (95%). Calculations based on data from TRAINS and ITPDE.

Source: Andrenelli and López-González (2023)

The impact of greater barriers on electronic transmissions is also likely to be asymmetric, affecting small and medium-sized enterprises (SMEs) most. Analysis using the World Bank Enterprise Survey (WBES) suggests that being able to deliver trade digitally is associated with higher propensities to export of smaller firms and not larger ones.

Since SMEs generally have a lower propensity to export than larger firms, the ability to deliver products digitally may be an important mechanism to reach foreign markets, and this channel may be affected by the Moratorium lapse.

There is a strong economic case for keeping electronic transmissions free from tariffs

Overall, our analysis suggests that the potential foregone revenue costs of the Moratorium are small and that its lapse would come at the expense of wider gains in the economy.

Endnotes

1. See WTO Communications WT/GC/W/747, WT/GC/W/798 and WT/GC/W/833.

2. See WTO Communication WT/GC/W/859

3. For example, the EU-Canada agreement relies on flexible language, calling these “a delivery transmitted by electronic means”, to bridge existing differences.

4. ‘Born digital’ trade is proxied using data on trade in computer, audio-visual, and information services imports. The intuition is that this captures growth in trade that might not have been previously delivered via physical carrier media. For instance, the is no physical goods equivalent of cloud computing services.

References

Andrenelli, A and J López-González (2023), “Understanding the scope, definition and impact of the e-commerce Moratorium”, OECD Trade Policy Papers, No. 275, OECD Publishing, Paris.

Baldwin, R (2019), The globotics upheaval: Globalisation, robotics and the future of work, Oxford University Press.

Banga, R (2019), “Growing Trade in Electronic Transmissions: Implications for the South”, UNCTAD Research Paper, No. 29, UNCTAD, Geneva.

Banga, R (2022), “WTO Moratorium on Customs Duties on Electronic Transmissions: How much tariff revenue have developing countries lost?”, South Centre Research Paper 157.

Burri, M, M Vasquez Callo-Müller and K Kugler (2022), “TAPED: Trade Agreement Provisions on Electronic Commerce and Data”, University of Lucerne.

Hanappi, T, A Jakubik and M Ruta (2023), “Fiscal Revenue Mobilization and Digitally Traded Products: Taxing at the Border or Behind It?”, IMF Notes No. 2023/005.

Hanappi, T, A Jakubik and M Ruta (2024), “Why the WTO moratorium on digital tariffs should be extended”, VoxEU.org, 26 February.

IMF, OECD, UNCTAD, WBG, WTO (2023), Digital trade for development.

OECD (2017), International VAT/GST Guidelines, OECD Publishing, Paris.

Savona, M (2020), “Governance models for redistribution of data value”, VoxEU.org, 17 January.

Winters, A and I Borchert (2021), “Addressing impediments to digital trade: A new eBook”, VoxEU.org, 27 April.

Authors’ note: The opinions expressed and arguments employed are those of the authors and do not represent the official views of the OECD or of its member countries. This article was originally published on VoxEU.org.