The European defence industrial strategy

Guntram B Wolff is a Senior Fellow at Bruegel

In the context of the war in Ukraine and the deteriorating security situation on the continent, the European defence industrial strategy (EDIS), proposed on 5 March1, aims to achieve “EU readiness through a responsive and resilient European defence industry.” Putting aside the unfortunate acronym2, the strategy is an important plan with a lot of detail, providing deep insights into Brussels’s thinking on a sector that has for a long time been rather neglected in policymaking.

According to the strategy, the European defence technological and industrial base (EDTIB) – the EU defence industry broadly defined including SMEs working in the sector – had an estimated turnover of €70 billion and exports worth more than €28 billion in 2021, employing around 500,000 people. Boosting the production capacity of the EDTIB is important both for the delivery of ammunition and weapons for Ukraine and for the defence readiness of European countries.

The EDIS plan aims to reduce fragmentation in the European defence industry and reduce weapons imports. It has a goal of increasing the value of intra-EU defence trade to 35 percent of the value of the EU defence market by 2030 and of ensuring that by 2030 at least 50 percent of EU countries’ defence procurement comes from the EDTIB. Finally, it wants to ensure that member states procure at least 40 percent of defence equipment in a collaborative manner.

The strategy document sets the tone in the European debate towards a more positive assessment of the defence industry. It also rightly calls for less fragmentation and a stronger single market for defence products. It summarises many key figures and data. Yet, it also raises many questions, both on facts and on why the proposed strategy is superior to the current shape of Europe’s defence industry. There are also important omissions. Four aspects of EDIS might need modification.

Too positive?

First, the strategy’s assessment of EDTIB capacities is overly positive. While ammunition production has increased substantially in the last two years, it still falls short of needs. Industry players such as Rheinmetall give lower numbers than the 1.4 million shells that the strategy document claims that EDTIB will produce in 20243.

Certainly, Europe has fallen short of producing and delivering the promised one million shells by March4. It is estimated that only by 2026 will Europe be able to produce enough ammunition for Ukraine5. UK think tank RUSI estimates that Russia has been able to increase its production of shells to over 2 million per year6, giving it an advantage for 2024 and possibly 2025. And while RUSI also identified significant challenges for Russian production after 2025 because of limitations in capacity to refurbish old equipment, it does highlight that Russia has been able to secure foreign supply from Belarus, Iran, North Korea and Syria.

Newer reported NATO intelligence estimates suggest that Russia produces even 3 million shells per year, almost three times as much as the US and Europe combined7. In short, EDIS appears to downplay the immediate challenge of producing enough weapons and ammunition for Ukraine and the replenishing of European stocks.

Second, EDIS aims at a much higher domestic share of production to meet procurement needs without properly explaining why this is desirable. In fact, while 60 percent of European defence procurement was spent on non-EU military imports during 2006-16 (Fiott, 2019), that number jumped substantially to 78 percent from February 2022 to June 2023, according to EDIS (Commission and High Representative, 2024).

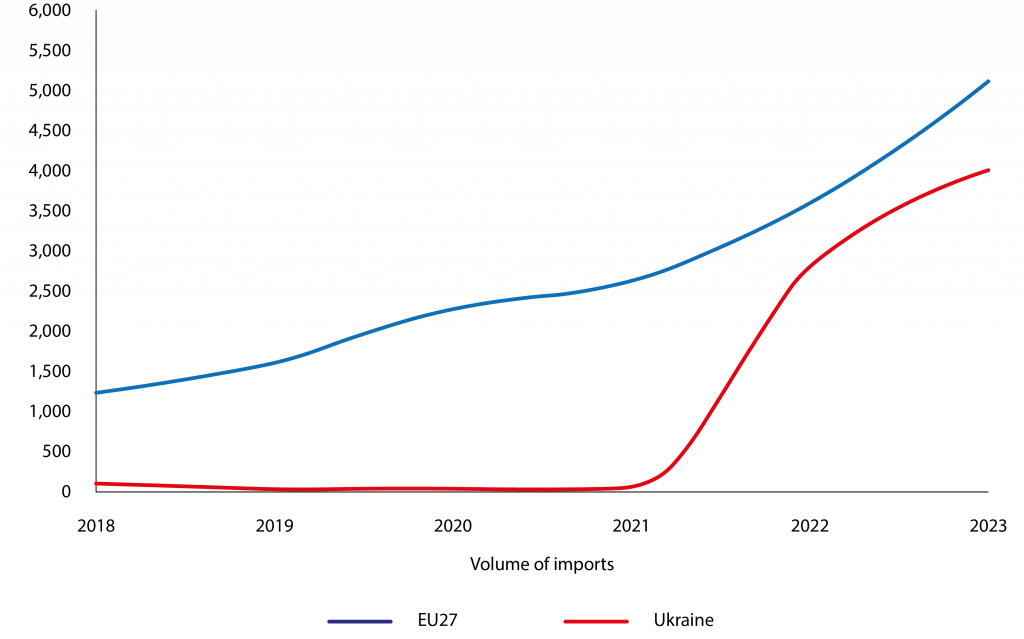

Figure 1 shows how weapons imports into the EU, Ukraine and, to the extent measurable, also in Russia, have increased. Cleary, imports have been necessary and their increase constitutes an important part of the military response. Under EDIS, the import share would be brought below 50 percent by 2030, but the plan does not argue why this is important.

Figure 1. Arms imports (trend indicator values*)

Note: * the graph shows SIPRI trend-indicator values (TIV), in millions, for arms imports. This variable measures the volume of international transfers of major arms (conventional weapons), as opposed to financial value, and is an indicator of transfers of military capability. For details.

Source: Bruegel based on SIPRI Arms Transfers Database.

Using global supplies to respond to the demand shock for defence products was clearly important for Europe. Also, Russia has increased its arms imports from Iran and North Korea substantially, though publicly available data on this is scarce and Figure 1 therefore likely underestimates Russia’s actual imports.

The data shows exactly what basic economics would predict: a regional demand shock is met by increased imports. At the same time, the shock has led to an increase in production capacity, both domestically and internationally. Production capacity in Europe has been rising in the last two years, though too slowly to meet demand.

Given the continuously high demand for ammunition in Europe and the time it takes to increase production and replenish stocks, it is not clear whether the import share should fall, as EDIS proposes. To see the import share fall to below 50 percent by 2030 would be a massive change.

In practice, an expansion of domestic production could well be accompanied by an increase in the import share, given the extraordinary rate of consumption of military hardware as seen in the last two years.

A more integrated single market for defence products would help reduce costs with better use of comparative advantages and the ability to increase scale in production

Three arguments might be made for a lower import share:

First, the aim could be to develop domestic industries by re-directing demand to domestic suppliers. This industrial policy approach has some merits in the medium to long term – indeed, arms production and development and the benefits of innovation from defence R&D depend on sufficient demand – and European domestic demand for EDTIB was rather low because of underinvestment in defence over decades.

Moreover, to benefit from cutting-edge technology, domestic production and demand is important in the security field. After all, the US imports relatively little from the EU and if it does, there are typically strong obligations on intellectual property.

For example under the US International Traffic in Arms Regulation, the US government can restrict exports of foreign-produced products that it buys or is a partner in, in order to restrict technology, data and knowledge transfer out of the US.

To build a strong and globally leading EU arms industry, domestic demand is thus important. Yet, the demand increase in the last two years and also the likely demand for the next few years appears to outpace domestic supply capacities.

Some of the demand for the next few years will also be for replenishment of current systems, rather than for development of new technologies. The industrial policy argument therefore appears more relevant for the medium to long terms than for the coming years.

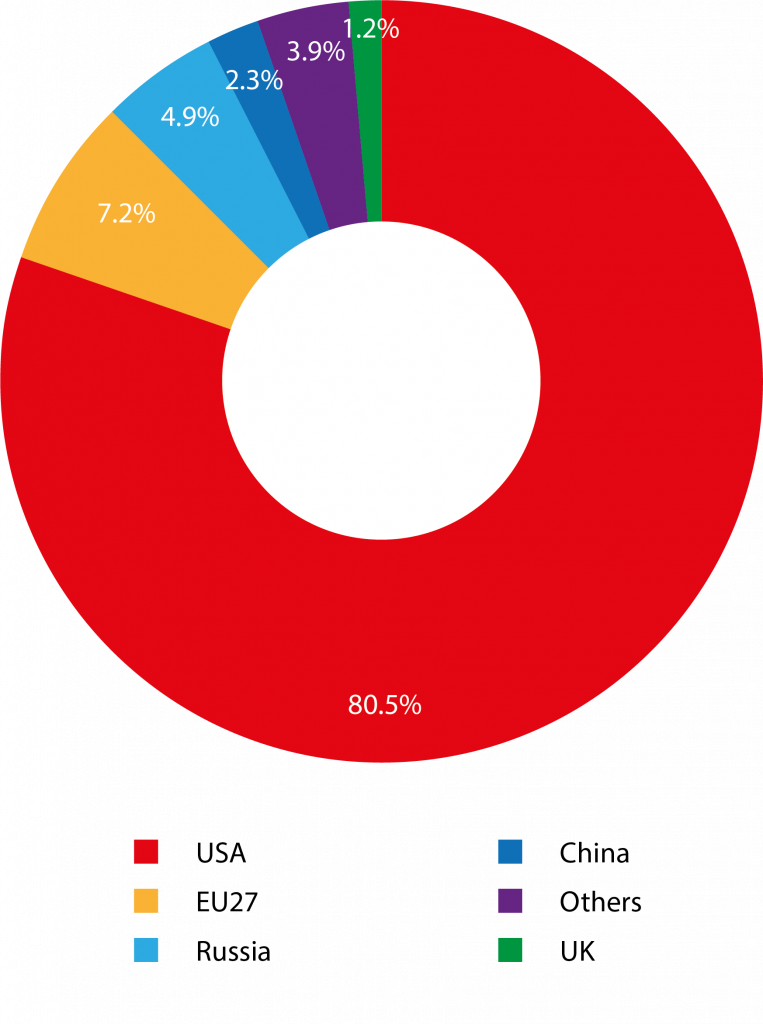

Second, the writers of EDIS might be concerned about a shift in US position in global arms supply. The US is currently by a wide margin the biggest exporter of weapons (Figure 2). European countries buy substantial amounts of their military hardware from US producers.

Conversely, however, the US imports relatively little military hardware; the US exports about 20 times as much as it imports. It is not clear why a US president would want to sell fewer weapons to Europe. Certainly, a transactional president like former President Trump will see arms deliveries to European customers as an important point strengthening the relation between the US and Europe.

Put differently, EDIS could make transatlantic relations more difficult. The real strategic dilemma will be about strengthening domestic capabilities versus buying American to manage a deteriorating transatlantic relationship.

Third, high import shares might be considered a security risk: security of supply might be undermined by geopolitical tensions and the risk of more military conflicts in Asia. Some parts of the military production supply chain (such as smokeless powder, or propellant, production) depend on China.

Yet, ensuring that supply chains are diversified does not necessarily translate into lower import shares. If the worry is China’s role in the supply chain, then it needs to be addressed urgently, but is unlikely to change the import shares of weapons, where the US dominates global markets.

Figure 2. Share of arms (value) transfer deliveries by supplier, 2019

Source: Bruegel based on State Department (2021).

In short, while aiming for higher EU domestic production is warranted given the needs, doing so at the expense of foreign supply would be a severe military-strategic mistake in the short term, as demand far outstrips supply.

In the medium to long terms, EU policymakers need to assess whether strategic industrial policy in the defence sector should really be focused only on the EU or whether it should include partner countries such as the UK and Japan.

The guiding principle should be military strategic capacity, benefits of intellectual property and costs – rather than profits accruing to domestic industry. Indeed, the Ukraine war shows that military procurement and weapon purchases are expensive. Cost efficiency is an aspect that EDIS does not seem to consider, but that Ukraine knows is all too important given the high loss of materiel.

Comparative advantages and the benefits of international division of labour also exist in defence products. Cost differences for military spending (including in terms of procuring products) are substantial across the world and the US and EU are among the most expensive regions (Robertson, 2021). The cost of foreign procurement should therefore be taken into account while managing to avoid security risks.

Europe’s defence strategy needs to carefully explore the trade-offs. A greater domestic share may make sense in products with substantial intellectual property benefits accruing to the economy as a whole. This suggest focussing the domestic share goal on specific high-tech military equipment, rather than mass products.

Money worries

Third, EDIS needs to be bolder on funding. The strategy is open about the current financial limitations of the EU – the proposed €1.5bn for industrial development is obviously not going to make a significant difference for a sector with a €70 billion turnover8.

However, the strategy shies away from pushing forward the debate on joint EU borrowing for military aid to Ukraine. While the regular and long-lasting need to increase defence spending is a structural shift at the end of the 30 years of peace dividend and should not be funded by deficits, the increase in defence purchases to support Ukraine is temporary and can therefore be funded by deficits.

Another aspect is private finance. EDIS cites evidence that SMEs in the defence sector have greater difficulties accessing finance than other SMEs. Yet, it also claims that no European corporate governance regulation requires investors to reduce their investments in the EDTIB – contrary to widely held beliefs.

Practitioners in banks suggest that providing funding to EDTIB does come with reputational costs. It is unclear, how the strategy would address the funding question.

Fourth, more reflection on how to operationalise EDIS is needed. While the plan calls for a reduction in the fragmentation of the EU defence market, it isn’t clear how to get there. Previous initiatives have aimed to increase transparency in European defence markets and enable greater cross-border cooperation: the Defence Procurement Directive and the Intra-Community Transfers Directive from 20099. Previous studies (for example Masson et al, 2015, and Ioannides, 2020) suggest that their effectiveness was limited at best.

Meanwhile, governments have continued to make indiscriminate use of EU Treaty exceptions allowed for arms production10 contrary to European Commission guidance (Marrone and Nones, 2020). In practical terms, a more integrated single market for defence products would help reduce costs with better use of comparative advantages and the ability to increase scale in production.

Yet, this requires trust among member states in the sensitive security area and the overcoming of vested interests entrenched in the nexus of national public procurement offices and defence companies. Joint funding for joint procurement might be a way of overcoming entrenched national resistance, but it would require unanimous endorsement at the highest level as well as substantially increased capacities for procurement, for example with a stronger European Defence Authority. It is thus up to EU leaders to really endorse and support EDIS.

On the whole, the EDIS proposal rightly sets the tone that Europe needs to progress with the development of its defence industry. It includes a number of positive and concrete proposals that could strengthen the sector. In the end, it will be up to member states to decide how they want to develop the sector.

Integrating European defence spending and thereby strengthening economies of scale in production would be a very worthwhile endeavour. The strategy opens the debate but the EU needs to be careful on becoming protectionist at time when it is critically dependent on foreign supplies.

Endnotes

1. In EU terms, a joint communication from the European Commission and the EU High Representative for Foreign Affairs and Security Policy (Commission and High Representative, 2004).

2. EDIS also refers to the unsuccessful European deposit assurance scheme initiative.

3. See Sabine Siebold and Anneli Palmen, ‘Rheinmetall eyes boost in munitions output, HIMARS production in Germany’, Reuters, 29 January 2023; and Konrad Schuller, ‘Der Ukraine geht die Munition aus’, FAZ, 10 February 2024.

4. Miguel Sanches, ‘Pulver verschossen: Warum Munition für die Ukraine fehlt’, Berliner Morgenpost, 9 March 2024.

5. Thomas Gutschker, ‘Jetzt fehlen nur noch die Bestellungen’, FAZ, 19 March 2024.

6. Jack Watling and Nick Reynolds, ‘Russian Military Objectives and Capacity in Ukraine Through 2024’, Commentary, 13 February 2024, RUSI.

7. Katie Bo Lillis, Natasha Bertrand, Oren Liebermann and Haley Britzky, ‘Exclusive: Russia producing three times more artillery shells than US and Europe for Ukraine’, CNN, 11 March 2024.

8. The Guardian, ‘“Mix of aspiration and some concrete measures”, expert says as EU defence industry plan comes under scrutiny’, 5 March 2024.

9. Directives 2009/81/EC and 2009/43/EC.

10. Treaty on the Functioning of the EU Art. 346.

References

Commission and High Representative (2024) ‘A new European Defence Industrial Strategy: Achieving EU readiness through a responsive and resilient European Defence Industry’, JOIN(2024) 10 final, European Commission and the EU High Representative for Foreign Affairs and Security Policy.

Fiott, D (2019) The poison pill: EU defence on US terms? Research Report, EU ISS.

Ioannides, I (2020) EU Defence Package: Defence Procurement and Intra-Community Transfers Directives, Study, European Parliamentary Research Service.

Marrone, A and M Nones (2020) ‘The EU Defence Market Directives: Genesis, Implementation and Way Ahead’, Documenti IAI 20/18, Istituto Affari Internazionali.

Masson, H, K Martin, Y Quéau and J Seniora (2015) The impact of the ‘defence package’ Directives on European defence, study requested by the European Parliament’s Subcommittee on security and defence.

Robertson, P (2021) ‘The Real Military Balance: International Comparisons of Defense Spending’, The Review of Income and Wealth 68(3): 797-818.

State Department (2021) World Military Expenditures and Arms Transfers (WMEAT) 2021 Edition, US Department of State.

This article was originally published on Bruegel.