The real effects of trade financing by export credit agencies

Poorya Kabir is Assistant Professor of Finance at the National University of Singapore, Adrien Matray is visiting Assistant Professor at Stanford Graduate School Of Business, Karsten Müller is an Assistant Professor of Finance at the National University of Singapore’s Business School, and Chenzi Xu is Assistant Professor Finance at the Graduate School of Business, Stanford University

Exports are often seen as boosting economic growth. But exporting internationally requires upfront financing. Recognising this, around one hundred countries around the world have set up export credit agencies to provide subsidised trade financing to support their country’s exporters. Today, such subsidies are the predominant tool of industrial policy around the world, especially in advanced economies (Juhasz et al 2022).

The rationale behind subsidising export financing is that international trade is complex and involves substantial frictions. For example, exporters need working capital for the period between the production of a product to its final sale. They also face a risk of non-payment from customers in foreign countries after a product is shipped, and these customers may need credit to finance a purchase.

This demand for financing creates a role for intermediaries in supporting exporters, and shocks to these intermediaries can potentially shape trade patterns over long periods of time (Xu 2022).

However, the same frictions limit the pool of institutions able to provide trade financing. As a result, the private market for trade financing is specialised and concentrated (Niepmann and Schmidt-Eisenlohr 2017), which could result in the under-provision of funds.

The role of export credit agencies

Export credit agencies (ECAs) are private or quasi-governmental institutions that act on behalf of national governments to issue insurance and guarantees for financing to exporters. Depending on their mandate, export credit agencies lend directly to exporters or their customers, or provide credit guarantees or insurance to lower the cost of financing of exporters or their customers.

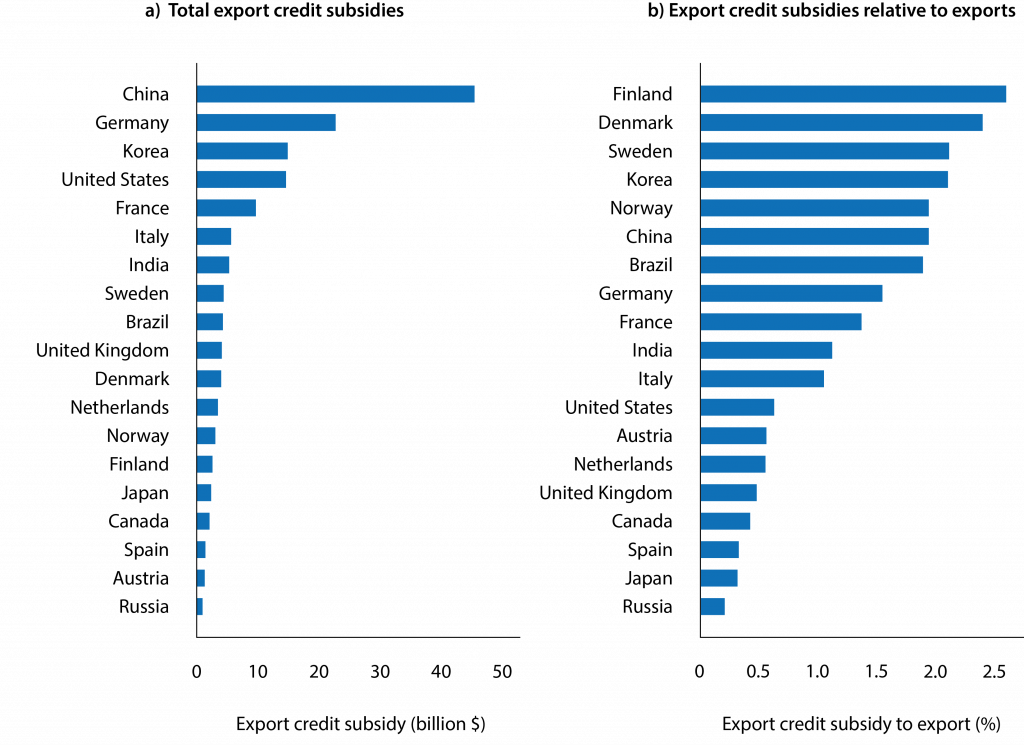

In absolute terms, China, Germany, Korea, and the US spend the most on these programmes. The Scandinavian countries, as well as China and Korea, are among the heaviest users of export credit agency support relative to their exports as we show in panel B of Figure 1.

Figure 1. Export credit subsidies by country

Source: World Bank 2013

There is an ongoing debate about whether such institutions should exist. Proponents argue that these agencies boost firm exports by alleviating a private market failure, which in turn can create jobs and promote economic growth.

Critics argue that they provide support to firms that would have been able to finance their exports regardless, and therefore have no effect on the beneficiary firms’ performance. In this latter view, export credit agencies primarily provide transfers to well-connected firms at the expense of taxpayers, and simply boost beneficiaries’ profits.

In addition to this transfer, agencies might also distort the allocation in the economy by shoring up low-productivity firms. This heightened misallocation would then lower aggregate productivity (eg. Hsieh and Klenow 2009, Bau and Matray 2023).

The US experiment

To better understand the role of export credit agencies, we study the temporary shutdown of the Export-Import Bank of the United States (EXIM) between 2015 and 2019, prompted by a lapse in its charter — a first since the agency’s inception in 1945 – and lack of quorum on its board of directors.

The shutdown resulted in an 80% drop in the volume of EXIM-supported transactions in 2016 compared to 2014. The volume of export credit support provided by EXIM only returned to pre-shutdown levels after the resumption of full operations in December 2019.

We focus our analysis on publicly traded firms over the period 2010-2019, which were among the largest in the economy and had received over 80% of EXIM support prior to the shutdown. These firms were also the ones most likely to be able to access alternative sources of credit and to be the least constrained following EXIM’s shutdown.

In this respect, it is most likely that we find limited real effects for the average firm and potential distortions in the allocation of capital in this sample of firms.

Can governments boost exports by providing targeted trade financing without distorting the allocation of resources? The results in this column, based on the natural experiment of EXIM’s lapse of authorisation, suggests that the answer is yes

The large effect of EXIM’s shutdown

To estimate the effect of EXIM’s shutdown, we obtained detailed loan-level data from EXIM for the period 2010 to 2014 and compare firms that previously benefited from EXIM support with firms that did not. This allows us to tease out the effect of EXIM’s shutdown on a host of outcomes using a standard difference-in-differences estimator.

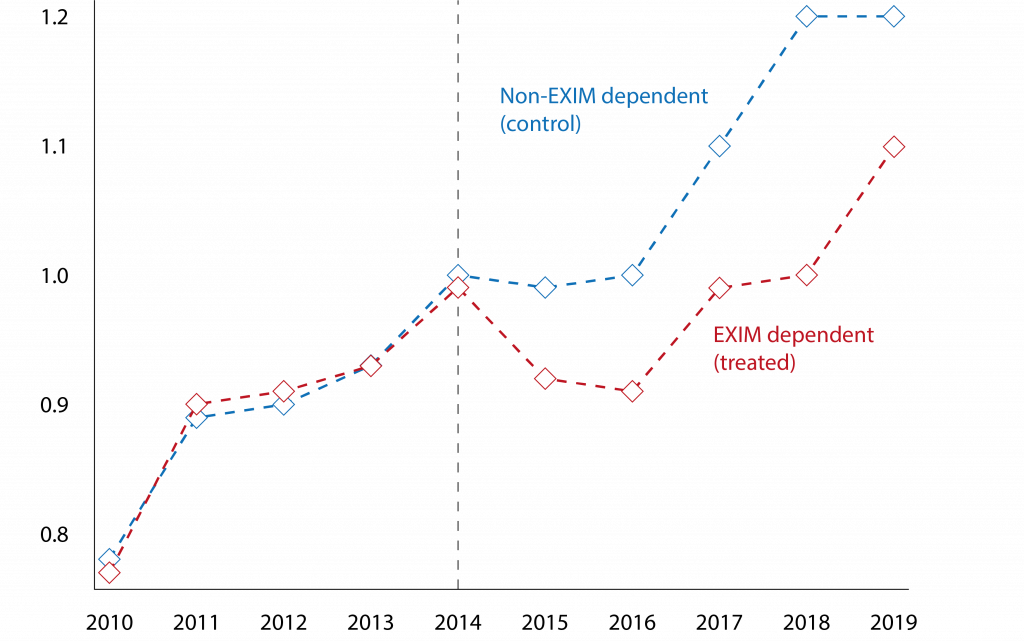

The first conclusion of this analysis is that EXIM-dependent firms experienced a substantial drop in their global sales as we show in Figure 2. This large drop can be explained by a reduction in firm exports, which we are able to measure in several ways, including using proprietary data on the universe of firms’ maritime export transactions.

The large drop in global sales resulted in a permanent reduction in capital and labour but did not affect firms’ average return on assets. The combination of the large drop in global sales, capital, and labour with the lack of an effect on profitability is inconsistent with a view of inefficient ‘capture’ in which EXIM support is a pure transfer to beneficiary firms that allows them to earn higher profits without having real effects.

The combination of the large drop in global sales, capital, and labour with the lack of an effect on profitability challenges the prevailing scepticism about the efficacy of industrial policy, particularly the criticism that such interventions are mere transfers to large, well-connected firms without tangible economic benefits.

So why did firms not compensate for the loss of access to EXIM funding? We show that the loss in global sales is concentrated on firms with higher financial frictions, and that the drop in exports is larger for maritime exports than for other form of exports.

This sensitivity is consistent with the importance of financing frictions in explaining the effect of the EXIM shutdown since maritime exports, which tend to have longer shipment times and therefore higher working capital needs (eg. Ahn et al 2011, Xu 2022). This underscores the unique role that government-backed agencies like EXIM play in filling gaps left by the private sector, even in advanced financial ecosystems.

Figure 2. Evolution of global sales

Did EXIM foster misallocation of capital and export?

The average negative effects of EXIM’s shutdown might be of limited consequence or could even be positive for total output if EXIM initially distorted the competition across US firms in a way that fostered a misallocation of capital.

This would happen if beneficiary firms were simply less productive than other firms, which could make exporting infeasible for these unproductive firms without EXIM credit. If this was widespread, shutting down EXIM could increase overall efficiency.

This argument is one of the classic costs attributed to industrial policies, where the policy is wasteful because it only aids the preservation of low-quality firms.

We provide three pieces of evidence inconsistent with this hypothesis. First, we show that the reduction in global sales and capital accumulation induced by EXIM’s shutdown is concentrated among firms with high exporting opportunities. In particular, we show that EXIM support is stronger for firms in industries that provide goods experiencing larger export growth in the world market.

Second, we rely on ex-ante differences in firms’ marginal revenue products of capital (MRPK) before the shock in order to estimate how misallocation evolves after the reform, in a spirit similar to Bau and Matray (2020, 2023). We find that EXIM’s shutdown led to a drop in global sales and capital that is around five times as large for high MRPK firms (firms above their industry’s median MRPK) relative to low MRPK firms.

The result that the capital response is larger for high MRPK firms implies that the reallocation of capital across firms worsened due to EXIM’s shutdown, which would suggest that a reduction in export credit subsidies increases (not decreases) misallocation.

Third, using aggregate customs data at the product-destination-year level, we show that the EXIM shutdown also impacted total export activity. Industries with a higher reliance on EXIM support saw a reduction in exports relative to others, implying that the firm-level reduction in exports we document aggregate up to industry level.

Therefore, EXIM support creates new exports rather than just reallocating export market share among US firms in favour of firms supported by EXIM.

Conclusion

Can governments boost exports by providing targeted trade financing without distorting the allocation of resources? The results in this column, based on the natural experiment of EXIM’s lapse of authorisation, suggests that the answer is yes.

Although there are a few caveats for interpreting our results, they are broadly inconsistent with a pure rent-seeking explanation. While EXIM-supported firms shrank considerably after the agency’s shutdown, this effect was more (not less) pronounced for firms that were plausibly more productive before the shock and had more promising export opportunities.

We also find no evidence that the profitability of firms cut off from subsidies decreased over and above the reduction in firm size, which is inconsistent with these firms pocketing artificially high rates of profits through subsidies beforehand.

The results of our column speak to a renewed debate on the circumstances in which industrial policy can be successful in supporting the domestic economy (eg. Juhasz 2015, 2018, Juhasz et al 2023a, 2023b). Of course, our study only relies on a single unusual shock—the virtual shutdown of an export credit agency responsible for providing subsidised trade financing to the country’s exporters.

While this setting enables us to credibly estimate the effect of export credit subsidies on domestic firms, it also limits the generalisability of our findings. We hope future work will shed light on the effects of industrial policies in other settings.

Our study speaks to the renewed debate on the circumstances in which industrial policy can be successful in supporting the domestic economy (eg. Juhasz et al 2023a, 2023b). While the results from EXIM’s shutdown period do not conclusively settle the debate, they do provide concrete evidence of the positive impact that well-crafted industrial policies, such as export credit subsidies, can have on both firm-level performance and broader economic outcomes.

It suggests that the maturity of financial markets does not diminish the effectiveness of industrial policy. We hope future work will shed light on the effects of industrial policies in other settings.

References

Ahn, JB, M Amiti and D Weinstein (2011), “Trade Finance and the Great Trade Collapse”, American Economic Review 101(3): 298–302.

Bau, N and A Matray (2020), “Capital market integration can reduce misallocation: Evidence from India”, VoxEU.org, 16 March.

Bau, N and A Matray (2023), “Misallocation and Capital Market Integration: Evidence from India”, Econometrica 91(1): 67-106.

Hsieh, C-T and PJ Klenow (2009), “Misallocation and Manufacturing TFP in China and India”, The Quarterly Journal of Economics 124(4): 1403-1448.

Juhasz, R (2015), “Temporary protection and technology adoption: Evidence from the Napoleonic blockade”, VoxEU.org, 15 January.

Juhasz, R (2018), “Temporary Protection and Technology Adoption: Evidence from the Napoleonic Blockade”, American Economic Review 108(11): 3339-3376.

Juhasz, R, N Lane and D Rodrik (2023a), “The New Economics of Industrial Policy”, NBER Working Paper 31538.

Juhasz, R, N Lane and D Rodrik (2023b), “The new economics of industrial policy”, VoxEU.org, 4 December.

Juhasz, R, N Lane, E Oehlsen and VC Perez (2022), “The Who, What, When, and How of Industrial Policy: A Text-Based Approach”, Technical report, Mimeo.

Kabir, P, A Matray, K Müller and C Xu (2024), “EXIM’s Exit: The Real Effects of Trade Financing by Export Credit Agencies”, CEPR Discussion Paper 18795.

Niepmann, F and T Schmidt-Eisenlohr (2017), “International Trade, Risk and the Role of Banks”, Journal of International Economics 107: 111–126.

Xu, C (2022), “Reshaping Global Trade: The Immediate and Long-Run Effects of Bank Failures”, Quarterly Journal of Economics 137(4): 2107–2161.

This article was originally published on VoxEU.org.