How to de-risk

Jean Pisani-Ferry is a Senior Fellow at Bruegel, Beatrice Weder di Mauro is President of the Centre for Economic Policy Research, and Jeromin Zettelmeyer is Director of Bruegel

Executive summary

Pandemic-related supply disruptions, the energy crisis provoked by Russia’s invasion of Ukraine and economic coercion by China have put economic security high on the European Union policy agenda. The question is how exactly the EU should ‘de-risk’ its external economic relationships without foregoing the benefits of trade. The standard answer is that it should identify product-level trade dependencies, mainly on the import side, and reduce them, mainly through diversification of suppliers, while otherwise maintaining maximum trade integration.

This Policy Brief argues that this answer falls short. First, product-level dependencies cannot be identified reliably even with sophisticated analysis and data. As a result, both ‘missed dependencies’ and ‘false positives’ are inevitable. Second, external shocks and coercion could be propagated through exports, productive assets held abroad and financial channels as much as through imports.

The analysis has five main implications:

1. Import de-risking should focus on a few product categories for which the costs of supply interruptions would be unquestionably large. This reduces false positives.

2. De-risking and/or buffers to deal with exports and financial coercion require more attention.

3. De-risking must be complemented by raising resilience against all shocks, whatever their origin. This requires a deeper and broader European single market.

4. De-risking and resilience must be complemented by deterrence.

5. A sufficiently high probability of chronic trade conflict – or one very large conflict – may justify reducing overall integration with a large trading partner, on both the export and import sides.

EU economic security policies have been right to emphasise the reduction of import dependence on chips and critical raw materials, and the creation of a powerful legal instrument to deter coercion (the Anti-Coercion Instrument). In most other respects, there is room for improvement.

1 Introduction

Over a period of just fifteen years, Europe has been confronted with a financial shock that originated in the United States, a pandemic shock that originated in China but could have come from anywhere, and an energy shock provoked by Russia’s invasion of Ukraine. These events have prompted a re-examination of efficiency/security trade-offs that arise as a result of international integration, and particularly as a result of specialisation in international trade and the vulnerabilities of global supply chains.

Economists and policymakers have long worried about similar trade-offs. At the most fundamental level, such trade-offs arise from the standard tension between growth and economic crises: higher growth is often accompanied by greater instability. For example, regulation of financial and product markets may prevent or mitigate financial or environmental hazards at the cost of dampening entry and growth of firms. Similarly, in open economies, trade and financial integration may be good for growth, but can expose economies to imported shocks.

The most recent set of concerns – as exemplified, for example, by a series of European Commission (2021, 2022) papers and an associated legislative agenda (see section 4, and McCaffrey and Poitiers, 2024) – differs from these standard preoccupations in two respects.

First, economic risks relate increasingly not just to crises or shocks, but to deliberate economic coercion by foreign governments or even non-governmental entities (such as criminal groups). This is probably the reason why the term ‘security’ – as opposed to ‘stability’ or ‘resilience’ – has become popular to describe the mitigation of economic, rather than just national security threats (we discuss the difference in section 2).

One reason to be concerned with economic coercion is that China, an increasingly powerful and authoritarian country, has been applying coercion regularly in response to political actions by trade partners (for example, Australia’s call for investigations into the origin of the COVID-19 pandemic and Lithuania’s decision to let Taiwan open a representative office in Vilnius1).

But the concern is not just about China: the policies of President Trump between 2017 and 2020 showed that even one’s closest ally can be tempted to leverage its market power and its control of the technical and financial infrastructures of globalisation. The possibility of a second Trump term is now prompting a reflection on the need for Europe to prepare for such a risk (Gonzales Laya et al 2024).

Second, recent concerns have focused mostly on trade-related rather than financial vulnerabilities. This reflects the fact that trade-related vulnerabilities have become more prominent as a result of specialisation and the vulnerability of global supply chains that maximise efficiency, but at the cost of creating hidden fragilities.

But the prominence of trade concerns may also reflect a rather myopic reasoning, as the last two or three external shocks that Europe (and, to a lesser extent, the US) has suffered have been trade-related: supply chain disruptions related to COVID-19 and energy price shocks following the Russian invasion of Ukraine.

In line with this concern, we focus mostly on trade-related external economic security. This should not be taken to imply that Europe does not need to worry about financial security. But unlike trade-related security, financial risks continue to be mostly of the financial-stability variety, linked to shocks and financial vulnerabilities rather than coercion. To the extent that financial coercion is a serious concern, it is linked to one main potential source: the United States if President Trump returns (see section 2). In contrast, trade-related external security risks are ubiquitous.

In this Policy Brief we seek to answer two critical questions. First, how should trade-related vulnerabilities be identified, and what trade relationships make Europe particularly vulnerable to shocks and coercion? Second, how can these vulnerabilities be reduced while minimising the costs of ‘de-risking’ and reducing the chances of unintended consequences? Four such potential costs come to mind:

-Foregoing some of the gains from trade specialisation and trade openness. This could weigh on European growth and competitiveness, which depend on export specialisation and on importing raw materials and intermediate inputs more cheaply than they could be produced at home (if at all). It could also make it harder to attain emission reduction objectives, by raising the cost of the transition to renewable energy sources. In turn, this could exacerbate social and political divisions related to climate action.

-Becoming more vulnerable to domestic shocks including natural disasters, epidemics and home-grown financial crises – and more generally, to any shock whose consequences would be mitigated by international trade and/or capital flows.

-Damaging international cooperation. This could include European Union cooperation with China on vital matters of common interest, such as climate-change mitigation, as well as respect for the rules of the multilateral trading system. Notwithstanding the damage that the World Trade Organization has suffered over the last decade, these rules continue to be largely respected (Mavroidis and Sapir, 2024). An aggressive ‘de-risking’ of European trade relationships through trade policy tools and subsidies could trigger protectionist reactions from trading partners, particularly if measures violate WTO rules. It could also become an excuse for protectionists in the EU, who might use economic-security arguments to further special interests.

-Damaging cohesion within the EU. EU countries differ in their trade structures and their dependence on specific export and import markets. As a result, attempts to de-risk trade may have net benefits for some and net costs for others. If de-risking becomes a source of division, it may be counterproductive, as internal divisions in the EU are partly what an adversary – whether China, Russia or President Trump – might try to exploit (and indeed, divisions are what these three powers have tried to exploit in the past).

The remainder of this paper summarises as best we can the answers to these questions, drawing on a set of papers collected in Pisani-Ferry et al (2024). Section 2 defines what we mean by economic security, and what risks we should be worrying about. Section 3 discusses how these risks should be addressed in principle. What trade relationships require de-risking? Section 4 discusses the instruments. How can protection be built that preserves the benefits of trade? A concluding section summarises the main lessons.

2 Defining risks to economic security

As noted by Bown (2024), economic security remains an emerging concept. At its most abstract level, it can be defined as both preventing bad economic outcomes and making sure that should risks materialise, the damage they cause is minimised. Societies care both about raising expected welfare and about reducing its volatility. Economic security is concerned with the latter.

Defined in this broad way, economic security has been a standard concern of policymakers for centuries – and not just of economic policymakers, since economic harm can be inflicted by ‘non-economic’ shocks, including political disruption and wars. The use of state intervention to address these concerns, including industrial policy and trade policy, is similarly nothing new (Kelly and O’Rourke, 2024).

The question, then, is how the concept of ‘economic security’ differs from those of ‘economic crisis prevention’ or ‘national security’. To the extent that the perceived nature of the risk and risk propagation has changed, it is important to understand how it has changed, to avoid duplication, and to prevent overreaction to perceived new risks when the old risks and risk propagation channels might still be there.

Economists concerned with crisis prevention and mitigation typically focus on risks and vulnerabilities related to the financial system or the structure of production. For example, credit cycles can expose countries to financial crises, which are propagated internationally. Dependence on commodity exports or imports exposes economies to swings in international prices and to disruption to domestic production that relies on commodity imports.

Military and security experts worry about a different type of threat: harm that is inflicted purposely by outside actors, normally nation states, but also terrorist or criminal organisations. Murphy and Topel (2013) widened the definition of national security to include all ‘substantial threats’ to the safety and welfare of a nation’s citizens, eg. including national catastrophes and public health threats.

Defined this broadly, national security would include preparedness and mitigation against any harmful acts conducted by foreign governments or non-governmental organisations with military or non-military means, including economic sanctions, and threats related to physical and information infrastructure.

The recent usage of the term ‘economic security’ is at the intersection of non-financial economic crises and national security in the broad sense defined by Murphy and Topel2. Specifically, it focuses on harm inflicted through international economic relationships – and particularly trade relationships – whether these reflect exogenous shocks (such as COVID-19-related trade disruption) or deliberate actions by foreign governments or non-governmental organisations (Bown, 2024; McCaffrey and Poitiers, 2024; European Commission, 2021, 2022).

These risks are particularly relevant today because of the combination of economic integration through trade and FDI, specialisation, long supply chains and actors willing to engage in coercion through these channels.

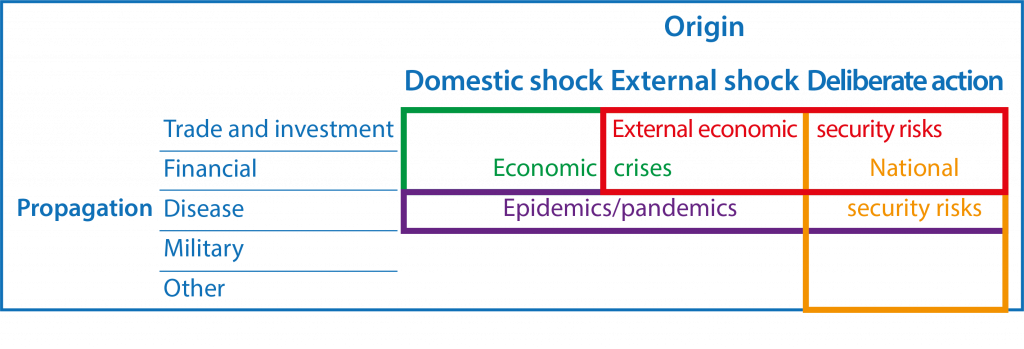

It is in this sense that the term ‘economic security’ will be used in the remainder of this paper. In this definition, achieving economic security involves the prevention and mitigation of:

-Disruption to critical imports, whether accidental or deliberate;

-Economic coercion through restrictions or boycotts on specific exports, along the lines of actions taken by China against Australia; or through pressures on foreign companies even when they produce locally (for example, threats of depriving them from access to the domestic market, restrictions on profit repatriation, or expropriation);

-A broad disruption of global trade at a scale with macroeconomic impact, for example, as a result of geopolitical conflict leading to economic sanctions or a protracted tariff war with a major trading partner. Events that could trigger such scenarios include a Chinese attack on Taiwan, or the re-election of President Trump triggering a sharp deterioration of the political relationship between the US and the EU.

It is important to emphasise that this a narrow – perhaps inappropriately narrow – definition of economic security, for two reasons. First, it disregards the possibility of economic disruptions as a result of domestic shocks, which historically have been a major source of economic crises (Table 1).

Hence, a better term for the type of economic-security risks we discuss would be ‘external economic security’. This terminology reminds us that there could be trade-offs not just between economic security and economic growth, but also between external economic security and security from domestic shocks. International integration may increase exposure to the former but offers protection against the latter.

Table 1. Varieties of welfare threats and propagation mechanisms

Note: The columns in Table 1 define the origin of a bad event – an exogenous shock originating at home or abroad (production disruption, natural catastrophe, transportation or infrastructure disruption, confidence shock) or a deliberate action by a foreign government or a non-governmental entity. The rows define the propagation channel: economic activity related to trade or finance, disease, military action or other (for example, through IT infrastructure).

Source: Bruegel.

Second, the narrow definition largely ignores external economic security risks through financial channels. However, international finance – including the international payments system and the confiscation of financial assets located in foreign jurisdictions – is an obvious instrument of economic coercion and economic sanctions, as shown by G7 sanctions against Russia since its full-scale invasion of Ukraine.

The main reason why financial risks do not feature prominently in the recent literature on European economic security is that Europe is much less likely to be on the receiving end of such sanctions, given the control exerted by the US and its allies over international finance.

But this could rapidly change if President Trump is re-elected in the United States and decides to use financial coercion against Europe for whatever reason (for example, to force Europe to align its foreign or commercial policies with those of the United States, as was the case when the US threatened EU firms with ‘secondary sanctions’ for violating US-imposed sanctions on Iran).

A broader analysis of European economic security should take into account such financial economic risks and how to mitigate them. For now, the remainder of this paper focuses on trade and investment-related risks.

These are particularly relevant for the relationship with China, but could also become relevant in the event of a return of President Trump and a revival of US tariffs against Europe, whether imposed for mercantilist or political reasons.

3 What to de-risk

Firms have incentives to avoid becoming dependent on one or a small number of suppliers or customers, particularly when those suppliers or customers are vulnerable to high risks outside their control, including politically motivated interference.

Yet, as Mejean and Rousseaux (2024) have pointed out, the firms’ private interest in security may not be enough to take care of the collective EU security interest. Firms often fail to realise the extent to which suppliers or customers are themselves subject to risks, simply because they do not know the entire value chain.

Firms also do not internalise the potential costs of supplier or customer dependency on the entire value chain, and ultimately the welfare of citizens. If a supplier relationship represents a critical link in that chain, the social costs of that link failing may far exceed the private costs to the firm. This argument, which is broadly consistent with the evidence presented by Bown (2024), can justify policy-led de-risking.

But what areas of trade require de-risking? How can policymakers tell when trade dependencies are excessive, in the sense that the economic security risks of trade outweigh its benefits, both for efficiency and growth and as protection against domestic disruption? The ideal way to answer this question would be through a firm-level model of trade and supply relationships, both across borders and within the EU.

The model would ‘know’ who trades with whom, how specific inputs enter each stage of production, and to whom firms sell. It would also have information about the ease of switching suppliers if a supplier fails or sharply raises its prices. Such a model could be used to stress test European economies in relation to specific supply chain or customer risks.

Where large effects are found, it would be used to identify trading relationships worth de-risking. Unfortunately, such a model does not exist and may never exist because of data limitations. We are therefore constrained by the available information and should make the best of it.

3.1 Critical goods and the risk of import disruption

Suppose we were mainly interested in risks related to import disruption. This would be the case if exports are either well diversified or go mainly to countries that one would not consider to be major sources of shocks.

In that case, the following approach might be a close substitute for the perfect model. Using the most disaggregated data possible, one should identify products for which:

1. A large share of EU consumption relies on imported inputs;

2. Foreign supply of these goods is highly concentrated;

3. Finding alternative suppliers in the event of a disruption is difficult, and

4. Disruption to supply would have high economic costs. Unlike criterion 3, this criterion reflects the substitutability of products in either consumption or production, as opposed to the substitutability of supplier relationships.

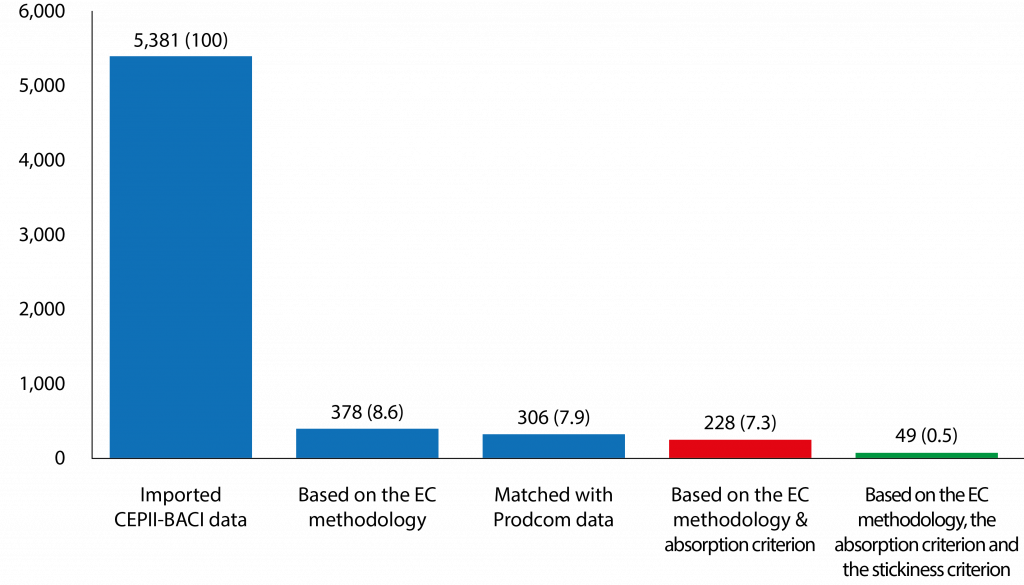

Products that meet all four criteria would be prime candidates for de-risking. This approach, which builds on work undertaken by the European Commission (2021), approximately describes the approach taken in Mejean and Rousseaux (2024). Their main innovation relative to the work of the Commission and other authors is step 3, which they implement by eliminating products for which ‘relationship stickiness’ – the typical duration of firm-supplier relationships – drops below a specific threshold.

For example, if the stickiness threshold is set at the sample median, the number of products for which the EU should consider itself import-dependent drops from 378 to just 105, and to just 49 if the 75 percent least relationship-sticky products are eliminated (Figure 1). Focusing only on upstream intermediate products – for which an export ban would affect many supply chains and hence have high economic costs – would reduce the list further, to just 21 products. For 12 of these, the main supplier is China.

Figure 1. Number of products for which the EU is import dependent

Note: The figure shows the numbers of products for which the EU is import-dependent according to various methodologies, starting with that of the European Commission (2021) (second blue bar) and adding the criteria proposed by Mejean and Rousseaux, based on the ratio of imports over domestic absorption (red bar) and the degree of product stickiness (green bar). Numbers in brackets refer to percentage of value of EU imports.

Source: Mejean and Rousseaux (2024).

To these, Mejean and Rousseaux (2024) suggested adding a small number of ‘critical goods’ that, if insufficiently supplied, ‘can result in human losses and other severe non-economic consequences’. These would include between two and 19 pharmaceutical products, depending on where the substitutability cut-off is set, as well as inputs to the green transition.

Interestingly, most of these inputs – including most critical raw materials, which have been among the main justifications for the drive to de-risk imports, particularly from China – currently fail one or several of Mejean’s and Rousseaux’s dependency tests.

While highly relationship-sticky, batteries and their components, hydrogen technologies, rare earth metals and solar panels fail the concentration test, and most components of solar panels fail both the concentration test and the relationship-stickiness test.

Yet, Mejean and Rousseaux urged caution with respect to these products, on the grounds that demand for them is developing so fast that the structure of EU imports during 2015-2019, on which concentration indices and import needs are based, may be a poor proxy for trade dependencies in the future.

Mejean and Rousseaux’s work represents the most exhaustive analysis so far to identify dependencies on the basis of ranking critical imports with respect to concentration and relationship substitutability, and deciding on thresholds above or below which concentration is deemed too high or substitutability too low. Precisely because it is more thorough and comprehensive than previous attempts in this literature, Mejean and Rousseaux (2024) illustrates the intrinsic limitations of this approach.

-We have so far no systematic way of telling which imports are genuinely critical. Focusing on upstream products and pharmaceuticals may miss other products (such as computer chips), the accidental scarcity of which would cause large economic or non-economic losses. Meanwhile, some upstream products and pharmaceuticals might not be critical if they can be substituted by other products. The European Commission’s (2021) approach of designating whole ‘ecosystems’ (sectors, such as health, energy, digital, electronics and aerospace) as critical, seems even more problematic, both because many products in these sectors are not in fact critical and because products outside these sectors that may well be critical could be missed (for example, most of Mejean and Rousseaux’s upstream products).

-As both Mejean and Rousseaux (2024) and Bown (2024) emphasised, data limitations imply that import dependence measures do not reflect indirect exposure. If the EU has an import exposure to a country that is itself import dependent on China for this product (or an important intermediate input), then direct import dependence on China might significantly understate total import dependence.

-The final lists can be very sensitive to how the cut-offs are set, which is somewhat arbitrary. For example, whether relationship substitutability thresholds are set at the twenty-fifth, fiftieth or seventy-fifth percentile adds or subtracts large shares of products from the sample.

-Supplier relationships in normal times tend to be relatively long (25 and 19 months, respectively, for the seventy-fifth and fiftieth percentiles in Mejean and Rousseaux’s sample). This implies that unless replacement duration is significantly shorter in a crisis, an import interruption could be very damaging even for products that are relatively non-relationship-sticky in normal times. But the impact of a forced interruption on the replacement period could go both ways. Firms seeking to replace suppliers under duress would have incentives to do so much faster than in normal times. However, finding new suppliers when many other firms are trying to do so could take longer and/or result in price jumps for scarce supplies, which could be very damaging.

Economic risks relate increasingly not just to crises or shocks, but to deliberate economic coercion by foreign governments

3.2 Risk from export disruptions and from decoupling

Another problem is that an approach focused on reducing dependence on critical imports does not consider disruptions to exports, which could equally have a macroeconomic impact if they were highly concentrated in any one destination country.

For example, 20 percent of EU exports got to the US, 13 percent to the United Kingdom and 9 percent to China; while 41 percent of UK exports go to the EU, 21 percent to the US and 5 percent to China. Furthermore, just as import dependency numbers ignore indirect exposures, so do export shares. For example, direct UK export dependency to China is only 5 percent, but the UK’s indirect exposure via the EU alone could be larger if UK products are part of the value chains of goods ultimately destined for the Chinese market.

While demand shocks via exports are a standard risk of trade integration, geopolitical conflict can take this risk to an entirely new level. First, hitting the exports of specific industries through import bans, high tariffs or social-media campaigns can be a form of geopolitical coercion. As reported by Bown (2024) and McCaffrey and Poitiers (2024), there are numerous examples of Chinese coercion of this type.

This type of coercion is typically not macroeconomically critical, but may seek to exploit the lobbying power of groups that are hurt, as well as internal divisions (in the case of the EU, this may include divisions across member states). Second, deliberate economic sanctions can of course have a much greater impact than swings in export demand triggered by normal economic fluctuations, or even than an economic crisis in a trading partner.

Baqaee et al (2024) simulated the impact of a decoupling from China in a trade model with 43 countries and 56 sectors, in the form of a complete stop in trade between a ‘Friends’ bloc comprising the G7 countries, Spain, the Netherlands and an artificial country comprising the rest of the EU, and a ‘Rivals’ bloc including China and Russia, on the assumption that trade continues both within these blocs and with the rest of the world.

As might be expected, the short-term effects are substantial, with German output calculated to decline by 3-5 percent of GDP. At the same time, the simulations suggest that the cost of a complete decoupling from China would be relatively low if done slowly over time: around 1.25 percent of GDP for Germany and Japan, while the US and the remaining European countries would suffer in the range of 0.47 percent to 0.69 percent of GDP.

The intuition behind this result is that the welfare costs of an end to trade integration between China and the ‘Friends’ group are mitigated by the fact that the Friends continue to trade with each other and with the ‘Neutrals’, and that these groups are sufficiently large and diverse to preserve most of the gains from trade.

3.3 Putting it all together

Combining the insights of Baqaee et al (2024) and Mejean and Rousseaux (2024) with the assumption that external economic risks include not only exogenous shocks to trade but also coercion, and possibly a wider trade disruption involving China, leads to the following conclusions.

First, there is a strong case for de-risking concentrated exposures to critical imports, by either diversifying supply or making preparations to mitigate disruption. However, identifying such products turns out to be very difficult, mainly because it is hard to assess the criticality of products, ie. the welfare losses inflicted by a shortage or price spike. While we know that some products are critical – chips, energy, some pharmaceuticals, some minerals and some upstream inputs – we do not know what other products are critical.

A good way to start is by de-risking the products known to be critical. Because we don’t know how long it would take to find new suppliers in a crisis, or how price sensitive these imports might be to a loss of the main supply source, products known to be critical should be de-risked even if their relationship stickiness in normal times is fairly low.

The identification of such products obviously needs to take into account the costs as well as the benefits of de-risking. Take the example of solar panels and their components, often cited as a prime de-risking candidate because of their importance in the green transition and China’s overwhelming global market share (63 percent, according to Mejean and Rousseaux, 2024).

However, the short-term economic costs to the EU of a complete stop in solar panel imports from China would be tiny (hitting mostly installation services, while leaving the solar capacity unchanged). Unlike imported gas from Russia, disruption to solar panel imports from China would have no direct impact on the energy supply, although it would affect the increase in installed energy capacity and would raise the cost of replacing panels that become obsolete.

Hence, the main benefit of de-risking Chinese solar panel imports would be insuring against a (possible) disruption to the energy transition to renewables, which could sharply raise solar-panel prices. This needs to be weighed against the certain price impact of a decision to diversify away from Chinese solar imports and purchase panels from more expensive sources, which will slow the green transition.

Second, the de-risking of trade dependencies cannot be the only layer of protection against import disruption, because it will never be possible to identify and de-risk all critical products. Beyond trade de-risking, it is hence essential to strengthen the resilience of European economies against import shocks, whatever their source. This is an argument for a better-functioning and more flexible single market, and for the broadening of international trade relationships through free-trade agreements with friendly countries.

Third, it is important to de-risk export dependencies as well as import dependencies. For specific products, this could be done in three ways: by deterring coercion (as the EU’s new anti-coercion instrument, discussed in the next section, attempts to do); by offering EU producers incentives to diversify export destinations, particularly to reduce concentrated exposures to China; and through insurance mechanisms that reduce ex post the impact of export disruptions to specific products.

The latter must of be designed in a way that avoids moral hazard, ie. does not encourage concentrated exposures ex ante. We return to possible instruments for export diversification and ex-post protection in the next section.

Fourth, there is a role for deterring coercion, rather than just reducing vulnerability to it. This is because de-risking of export and import dependencies will never be complete – and should not be complete, given that de-risking needs to be weighed against the benefits of trade specialisation and continuation of trade with China and other countries that may use coercion.

Fifth, there is the question of whether the EU should reduce its overall trade integration with China to soften the blow of sudden trade disruption triggered by a geopolitical confrontation. According to Baqaee et al (2024), the cost of a gradual reduction in trade integration with China would be small for most EU countries, even if trade integration is reduced all the way to zero.

Even for Germany, where the cost of complete decoupling from China would not be small, the cost of a partial reduction of trade integration – for example, reducing export and import shares by one third – would be small if pursued gradually. On this basis, policy measures to encourage a pre-emptive reduction in trade integration would be justified if all three of the following conditions are met:

1. The probability of a very costly sudden trade disruption is considered to be sufficiently high, and

2. Firm-level diversification of trade is not, by itself, sufficient to engineer this pre-emptive de-risking;

3. Targeted (ie. firm- or sector-level) export diversification efforts do not have a substantial impact in terms of reducing aggregate import dependency.

There is significant uncertainty around each of these points. With regard to points two and three, Bown (2024) found that trade diversion triggered by US tariffs on China and Chinese retaliation has further increased EU trade integration with China. With fresh US legislation directed against Chinese imports, such as the Inflation Reduction Act, this effect might continue.

At the same time, the combination of a heightened sense of the risks created by concentrated exposure to China and the structural slowing of the Chinese economy might push in the other direction. Furthermore, targeted de-risking efforts may have an aggregate impact, particularly if they reduce concentrated exposures to China in major sectors for the EU economy, such as the car industry.

Finally, it is important to highlight two trade-related economic-security concerns that are the intellectual cousins of the risks identified and quantified by Baqaee et al (2024) and Mejean and Rousseaux (2024), but are not directly discussed in those papers.

The first is the obvious risk, already mentioned in section 2, of a broad disruption to European trade with the United States in the event of a return of Donald Trump to the US presidency3. Given the much larger share of US imports and exports in European trade, this could hit Europe even harder than a disruption to trade with China.

While Baqaee et al (2024) did not directly simulate such a shock, this is suggested by their ‘EU autarky’ scenario, which has substantial costs even in the long run, ie. even when phased-in slowly (a permanent consumption loss of 9 percent of GDP). It follows that de-risking the trade relationship with the US by reducing trade integration might makes sense only if an even more catastrophic sudden decoupling from the US is viewed as likely.

However, a disruption to trade with the US would likely take the form of a (limited) tariff war rather than a trade embargo. This argues against a pre-emptive reduction in trade with the US. Instead, the EU must be politically prepared to fight a trade war with the US, if and when a returning President Trump decides to start such a war.

A second related concern is that exposures to China and other countries that might engage in coercion against EU firms could take the form of asset expropriation – in particular, expropriation of production sites. By removing an important source of foreign revenue and profits, this could impact EU firms in much the same way as an import prohibition.

However, the risk would show up ex ante in the form of a concentration of profit sources, rather than concentrated exports, and the remedy could involve diversification of production sites and profit centres, rather than diversification of exports, as along with increases in capital buffers.

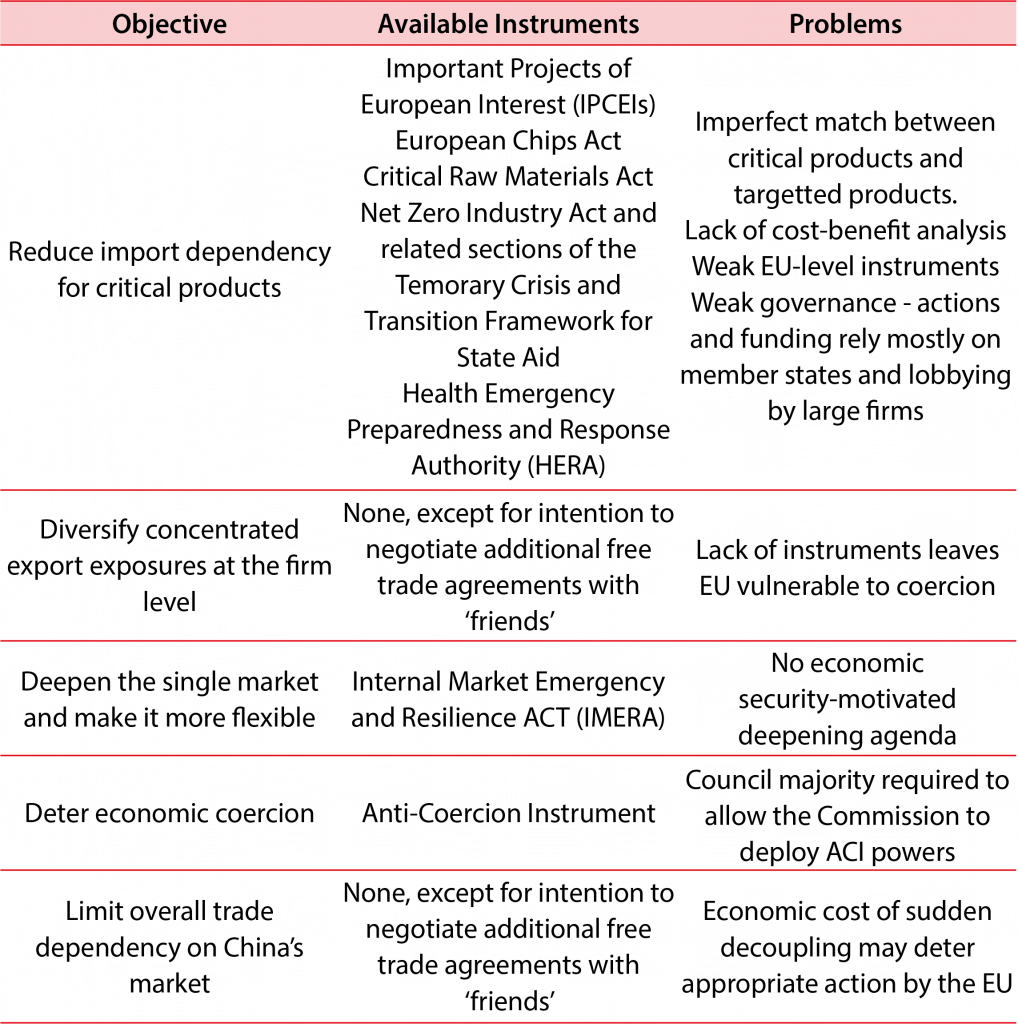

Summing up, our analysis results in five main calls for European policy action:

1. Reduce import dependency for critical products;

2. Diversify foreign revenue sources and/or strengthen firm resilience against potential disruption to foreign demand, asset expropriations or payment controls impeding profit repatriation;

3. Deepen the EU single market and make it more flexible;

4. Deter economic coercion of any kind, whether through imports or exports, or through other means such as expropriation;

5. Possibly, limit overall trade dependency (and particularly export dependency) on China, at the aggregate level.

Achieving these objectives requires policies that are effective, that balance costs and benefits, and that minimise risks of unintended consequences. We next examine what such policy might look like concretely, starting with those the European Commission has already started implementing.

4 How to de-risk

As the outbreak of COVID-19 revealed dangerous vulnerabilities and called for a reassessment of the EU’s international economic relations, rising pressure from the US under the Trump presidency and the increasingly aggressive behaviour of the Chinese government focused the attention of European policymakers on the threat of economic coercion and prompted a redefinition of the toolkit with which they could respond.

The EU took a series of major initiatives to strengthen its economic resilience and to equip itself to better counter malicious behaviour by economic partners (Box 1).

Box 1. Additions to the European external economic security policy toolkit

The EU has adopted or is discussing a series of new initiatives, which complement standard trade defence instruments4 (anti-dumping or anti-subsidy duties consistent with the World Trade Organisation Agreement on Subsidies and Countervailing Measures, for which the EU has developed procedures that are in the process of being strengthened):

The Foreign Subsidies Regulation5 (FSR, in force since July 2023) introduced new tools to tackle foreign subsidies that cause distortions and undermine the level playing field in the areas of mergers and acquisitions and procurement (see Anderson, 2020).

The European Chips Act6 (in force since September 2023) is intended to bolster Europe’s competitiveness and resilience in the semiconductor sector by supporting large-scale manufacturing projects via somewhat more permissible subsidy rules compared to a conventional Important Projects of Common European Interest (IPCEIs, investment projects involving crossborder collaboration and state aid from several EU countries). It also entails measures aimed at mapping and monitoring the semiconductor supply chain to assess ex-ante risks of potential import disruption but also and envisions broader powers for the Commission to act in a crisis, including as common purchasing body (see Poitiers and Weil, 2022).

The Net Zero Industry Act (NZIA)7 and related parts of the Temporary Crisis and Transition Framework8 (TCTF) are intended to strengthen the European ecosystem of clean-tech manufacturing. The NZIA includes measures intended to accelerate permitting, while the TCTF allows member states to provide subsidies to clean tech manufacturing projects which can match subsidies of third countries under certain conditions (see Tagliapietra et al 2023).

The Critical Raw Materials Act9 (CRMA) aims to tackle the issue of highly concentrated imports of certain raw materials that are of strategic importance. It seeks to boost domestic mining, refining and recycling of such raw materials through accelerated permitting procedures as well as measures related supply chain monitoring, stockpiling and improving the recyclability of CRMs (see Le Mouel and Poitiers, 2023).

The Health Emergency Preparedness and Response Authority (HERA)10 that was launched in September 2021 has as part of its mission to improve the resilience and availability of medical supplies. It aims to achieve this mission by identifying key supply chain bottlenecks and addressing them through measures such as coordinated stockpiling and joint procurement.

The Anti-Coercion Instrument (ACI, in force since December 2023) is intended to provide to the EU a wide range of possible countermeasures when a third country exercises coercion. It gives the EU extensive powers to deploy countermeasures in response to an act of foreign coercion, including the imposition of tariffs, restrictions on trade, services and intellectual property rights, and restrictions on access to foreign direct investment and public procurement.

The Internal Market Emergency and Resilience Act11 (IMERA, formerly Single Market Emergency Instrument, on which agreement was reached between the Parliament and the Council in February 2024) aims at ensuring continued access to critical goods and services. Although primarily intended to respond to COVID-type emergencies, it also covers disruptions to the single market triggered by conflicts, such as the war in Ukraine.

Commission initiatives on inward and outward investment screening and the coordination of export controls were proposed in January 2024. The coordination mechanism for inbound investment screening is in place since 2020, but it mainly commits member states to put an investment screening into place. The 2024 economic security package includes an update of this scheme, but remains vague on the prospect of outbound investment screening.

Limitations notwithstanding, the EU has assembled an impressive package that expresses a change of attitude. Considerable effort has gone into addressing critical import dependencies, giving the European Commission powers to deter coercion (the Anti-Coercion Instrument, application of which must be triggered by a majority in the Council), and preventing a breakdown of the single market in an emergency (Internal Market Emergency and Resilience Act, IMERA). However, these efforts fall well short of meeting the policy objectives listed at the end of section 3.

First, and most obviously, export dependencies have been largely neglected. Aside from the intention to negotiate additional trade agreements with friendly nations, there is no instrument to encourage export diversification and/or reduce concentrated export dependence on China.

Second, instruments to address import dependencies remain imperfect and incomplete:

-While the European Chips Act, Critical Raw Materials Act (CRMA) and Health Emergency Preparedness and Response Authority have plausible economic-security justifications, the Net Zero Industry Act covers a broad swathe of goods that mostly fail to meet the definition of critical good proposed in section 312. Many other goods that might be critical, such as the upstream products with high import concentration identified by Mejean and Rousseaux (2024), remain outside the scope of any of these acts. There is no framework for identifying goods that may be genuinely critical, but are not part of any of the four identified product categories.

-EU-level instruments to reduce dependency on these goods are for the most part weak. EU-level funding for industrial policy directed at expanding EU capacity is small (Chips Act) or non-existent (CRMA). Trade policy instruments rely mainly on increasing market or investment access for EU companies via new or expanded trade agreements.

-The main channel through which these acts operate is by giving EU countries greater leeway to subsidise investment in the areas covered by these acts. While this may lead to occasional successes (investment in a critical area that would otherwise not have happened), there is no governance structure to ensure that critical dependencies are reduced in a timely way. Furthermore, the approach mostly benefits EU countries that have the fiscal resources to provide large subsidies, and large incumbents, which have the clout and scale to lobby for subsidies and participate in IPCEI consortia.

Third, the Commission has so far missed the opportunity to rally members states behind the push to increase resilience by deepening the single market. This would help the EU resist external shocks and coercion – whatever the source and the channel – by allowing faster re-direction of trade and supply.

Banking and capital markets union would raise economic security both by funding new productive capacity and by improving automatic risk-sharing, better risk sharing across intra-EU borders would in turn make the EU more cohesive, and would make it harder to exploit internal divisions.

Table 2. Economic security objectives and available instruments

Source: Bruegel.

A more systematic attempt to strengthen economic security could involve the following elements.

1. A process for identifying and regularly reviewing critical import dependencies, based on the criteria developed in section 2, and better data (Mejean and Rousseaux, 2024; Bown, 2024). Better data may require more systematic due diligence on the part of European firms in relation to their supply chains, from an economic-security perspective.

2. Stronger governance and better funding for a competition-friendly EU-level industrial policy. This could involve:

i. An institution similar to the US Advanced Research Projects Agencies (ARPA) to develop technology in areas that are identified as critical (Tagliapietra et al 2023; Pinkus et al 2024).

ii. Where the technology exists already, allocation of production or investment subsidies through auctions (along the lines of auction mechanisms that are currently used to tender renewable energy capacity).

These mechanisms would not necessarily require large funding. US ARPA budgets are relatively modest (in the single digit billon range), while the auction process could be co-funded by EU countries, along the lines of the ‘Auctions as a Service’ concept proposed by the European Commission in relation to climate goals (European Commission, 2023).

3. The use of WTO-consistent trade instruments to incentivise import and export diversification. These could include:

i. On the import side: countervailing duties, justified by the presence of a foreign subsidy, that are focused on an area in which there is a critical import dependency on the country that is responsible for the subsidy;

ii. On the export side, a duty levied on EU exports to countries for which export exposure is considered excessive. The latter could be politically difficult, but would be fully consistent with WTO rules13.

4. As an alternative to export taxes, requiring exporters that are highly dependent on a specific export destination to buy publicly provided political risk insurance that would defray the costs of ex-post public support in the event of coercion (and would discourage exports to the destination in question).

5. Incentivising European firms that are highly dependent on production and profits in foreign jurisdictions to diversify production, structure their operations or hold capital to enable them to survive an expropriation (or controls that impede profit repatriation).

6. To further increase the deterrence value of the ACI, allowing the Commission to trigger retaliation under the ACI without requiring confirmation by a majority of member states.

7. Preparing for economic coercion through financial channels rather than just trade channels. While European firms have not recently been at the receiving end of such coercion, this may change if Donald Trump returns to the White House.

8. Invigorating the single market for economic security rather than just for efficiency reasons.

Endnotes

1. See, for example, The Economist, ‘China punishes Australia for promoting an inquiry into covid-19’, 21 May 2020; and Andy Bounds, ‘Lithuania complains of trade ‘sanctions’ by China after Taiwan dispute’, Financial Times, 3 December 2021.

2. The European Commission (2023) uses a definition which also includes “risks related to physical and cyber security of critical infrastructure” and “risks related to technology security and technology leakage”. We would classify this as part of national security (within the ‘other’ category in Table 1) rather than economic security.

3. Trump has announced that he would implement a 10 percent across-the-board tariff. This would affect EU exports significantly, in addition to US importers. See Charlie Savage, Jonathan Swan and Maggie Haberman, ‘A New Tax on Imports and a Split From China: Trump’s 2025 Trade Agenda’, New York Times, 26 December 2023.

4. See European Commission, ‘Trade defence’, undated.

5. See European Commission, ‘The Foreign Subsidies Regulation in a nutshell’, undated.

6. See European Commission, ‘European Chips Act’, undated.

7. See European Commission, ‘Net-Zero Industry Act’, undated.

8. See European Commission, ‘Temporary Crisis and Transition Framework’, undated.

9. See European Commission, ‘Critical Raw Materials Act’, undated.

10. See European Commission, ‘Health Emergency Preparedness and Response (HERA)’, undated.

11. Final compromise text agreed in February 2024 available at https://data.consilium.europa.eu/doc/document/ST-6336-2024-INIT/en/pdf.

12. Namely, photovoltaic and solar thermal, onshore wind and offshore renewables, batteries and storage, heat pumps and geothermal energy, electrolysers and fuel cells, sustainable biogas and biomethane, carbon capture and storage (CCS) and grid technologies.

13. Article XI of the 1994 General Agreement on Tariffs and Trade prohibits quantitative export restrictions (with certain exceptions) but permits “duties, taxes or other charges”. See https://www.wto.org/english/res_e/publications_e/ai17_e/gatt1994_art11_oth.pdf.

References

Anderson, J (2020) ‘Not all foreign investment is welcome in Europe’, Bruegel Blog, 10 November.

Baqaee, DJ Hinz, B Moll, M Schularick, FA Teti, J Wanner and S Yang (2024) ‘What if? The Effects of a Hard Decoupling from China on the German Economy’, chapter 4 in J Pisani-Ferry, B Weder Di Mauro and J Zettelmeyer (eds) Paris Report 2: Europe’s Economic Security, CEPR Press.

Bown, C (2024) ‘Trade policy, industrial policy, and the economic security of the European Union’, chapter 5 in J Pisani-Ferry, B Weder Di Mauro and J Zettelmeyer (eds) Paris Report 2: Europe’s Economic Security, CEPR Press.

European Commission (2021) ‘Strategic dependencies and capacities’, SWD(2021) 352 final.

European Commission (2022) ‘EU strategic dependencies and capacities: second stage of in-depth reviews’, SWD(2022) 41 final.

European Commission (2023) ‘Auctions-as-a-Service for Member States, Concept Note’, Directorate-General Climate Action.

González Laya, A, C Grand, K Pisarska, N Tocci and G Wolff (2024) ‘Trump-Proofing Europe: How the Continent Can Prepare for American Abandonment’.

Kelly, M and KH O’Rourke (2024) ‘Industrial policy in the shadow of conflict: Lessons from the past’, chapter 2 in J Pisani-Ferry, B Weder Di Mauro and J Zettelmeyer (eds) Paris Report 2: Europe’s Economic Security, CEPR Press.

Le Mouel, M and N Poitiers (2023) ‘Why Europe’s critical raw materials strategy has to be international’, Analysis, 5 April, Bruegel.

Mavroidis, P and A Sapir (2024) Key New Factors likely to shape the new EU Trade agenda in the next term, study for the European Parliament International Trade Committee.

McCaffrey, C and NF Poitiers (2024) ‘Instruments of economic security’, chapter 5 in J Pisani-Ferry, B Weder Di Mauro and J Zettelmeyer (eds) Paris Report 2: Europe’s Economic Security, CEPR Press.

Mejean, I and P Rousseaux (2024) ‘Identifying European trade dependencies’, chapter 3 in J Pisani-Ferry, B Weder Di Mauro and J Zettelmeyer (eds) Paris Report 2: Europe’s Economic Security, CEPR Press.

Murphy, KM and RH Topel (2013) ‘Some Basic Economics of National Security’, American Economic Review 103(3): 508–11

Pinkus, D, J Pisani-Ferry, S Tagliapietra, R Veugelers, G Zachmann and J Zettelmeyer (2024) Coordination for EU competitiveness, study for the European Parliament Economic and Monetary Affairs Committee.

Pisani-Ferry, J, B Weder di Mauro and J Zettelmeyer (eds) (2024) Paris Report 2: Europe’s Economic Security, CEPR Press.

Poitiers, N and P Weil (2022) ‘Is the EU Chips Act the right approach?’ Bruegel Blog, 2 June.

Tagliapietra, S, R Veugelers and J Zettelmeyer (2023) ‘Rebooting the European Union’s Net Zero Industry Act’, Policy Brief 15/2023, Bruegel.

This Policy Brief is based on chapter 1 of Pisani-Ferry et al (2024). We thank Chad Bown, Julian Hinz, Morgan Kelly, Conor McCaffrey, Isabelle Mejean, Kevin O’Rourke, Pierre Rousseaux and Moritz Schularick, as well as Shekar Aiyar, Alicia García-Herrero, Petros Mavroidis, Francesco Papadia, André Sapir, Fiona Scott Morton, Nicolas Véron, Lennard Welslau and Guntram Wolff for helpful discussions and comments. We are particularly grateful to Niclas Poitiers for his contribution to the survey of EU economic security instruments that appears in section 4 of this paper. This article is based on a Bruegel Policy Brief Issue no07/24 | May 2024.