Sanctions against Russia will worsen its already poor economic prospects

Elina Ribakova is a Non-Resident Fellow at Bruegel and she is also Deputy Chief Economist at the Institute of International Finance

The sanctions imposed on Russia by the United States, the European Union and other countries that are against Russia’s war on Ukraine have started damaging its economy and will erode it further in the long term. But Russia is the world’s ninth-largest economy and a critical supplier of energy and other raw materials, so any belief that sanctions alone would immediately bring Russia down and stop the war was misplaced.

Russia’s economy has done better than expected relative to spring 2022 expectations. Russia’s GDP has contracted by about 2 percent1 compared to an expected 8.5 percent2. This is mainly due to the strong post-COVID-19 recovery, outsized export earnings as Europe’s dependence on Russian energy declined only slowly and oil and commodity prices soared, and Russia’s ability to partially rebuild value chains (Free Russia Foundation, 2023).

However, over the medium-term, Russia will continue to suffer from weak potential growth. Sanctions alone might not defeat Russia, but they have targeted high-tech inputs, including for the military, and seek to erode Russia’s potential growth.

Sanctions will deepen the pre-existing fault lines in Russia’s outlook of chronic underinvestment, poor productivity growth and labour shortages. Countries opposing Russia’s war on Ukraine should keep up the pressure.

The Russian economy entered 2022 on the back of strong post-COVID recovery and high commodity prices, but it contracted later because of sanctions

Russia’s economy contracted by 2.1 percent in 20223. Before the full-scale invasion of Ukraine, Russia had been expected to grow by 2.5 percent to 3.5 percent in 20224. Government spending and, to an extent, publicly supported fixed investment (albeit likely somewhat overstated by official statistics5) played a crucial role in supporting the Russian economy in 2022. Private sector investment growth in 2022 was also strong, despite rising economic uncertainty and falling corporate profits6.

In the face of sanctions, Russia’s economy held up initially because of: (1) an extraordinary windfall from rising oil and commodity prices, (2) the Fortress Russia strategy – the policy of excessive reserve accumulation to insulate Russia’s economy from external shocks – following the 2014 sanctions (Ribakova et al 2020), (3) the skillful policy response (Lowery et al 2022), and (4) Russia’s ability to partially rebuild its supply chains (Free Russia Foundation, 2023).

Russia experienced a significant positive terms-of-trade shock in 2022 (Figure 1). As a result, its current account surplus was in excess of $230 billion in 2022, an all-time high, and almost double the 2021 record ($122 billion). Furthermore, capital outflows did not contribute to pressure on the rouble and the economy because Russia imposed capital controls in response to sanctions.

Figure 1. Russia’s current account surplus reached an all-time high in 2022 after oil prices spiked

As a result of higher oil prices, Russia’s oil exports (redirected to China, India, Turkey and other friendly countries) increased by $35 billion in March-December 2022 compared to the same period in 2021 (Babina et al 2023). While export volumes contracted immediately post-invasion, they recovered by the summer. For the year as a whole, the volume of oil and oil product exports reduced only marginally.

Russia experienced an extraordinary energy windfall as oil and gas revenues increased 28 percent from 2021 (Demertzis et al 2022)7. Even so, the non-oil and gas deficit – total deficit minus oil and gas revenues, a measure of fiscal stance for commodity exporters – increased by nearly 3 percentage points of GDP to 8.9 percent, as oil and gas revenues were insufficient to cover the 26 percent spending increase8, including military, defence and anti-sanctions measures, and a 10 percent indexation of pensions and social spending.

Russia used nearly $50 billion from its sovereign wealth fund, the National Wealth Fund (NWF), to cover the budget deficit and support struggling companies as domestic and external debt markets shut down in the post-invasion period9. Of the remaining $150 billion in the NWF, about 45 percent is not liquid and cannot be easily used for the budget.

In addition to using NWF funds, the Ministry of Finance issued a record 3 trillion roubles ($44 billion) in domestic debt, mainly at floating interest rates. Russian banks are essentially the only remaining buyers and now hold about 10 percent of their assets in Russian government paper (KSE, 2023).

The Fortress Russia strategy and the skilful policy response also helped to protect the economy initially in 2022. Russia’s economy has faced repeated balance-of-payments shocks since 2008.

In response, President Vladimir Putin has increasingly demanded greater professionalism10 and a crisis-ready attitude from his government technocrats and corporates. After losing over $200 billion in reserves11 on an ultimately futile attempt to defend the rouble in 2008, Russia decided to move toward a more flexible exchange rate and inflation targeting, starting in 2012.

Following the oil price collapse and financial sanctions in 2014-15, Russia accelerated the move toward inflation targeting and cleaned up its banking system. Meanwhile, following draconian spending cuts, the finance ministry implemented in 2016 a fiscal rule setting aside in a special reserve fund energy revenues generated from oil prices above $40 per barrel.

Despite the success of the Fortress Russia strategy, excessive focus on reserve accumulation and, correspondingly, an overly tight macroeconomic policy mix also caused economic growth to decelerate to a potential of only 1.5 percent to 2 percent by 2022.

Russia’s export windfalls allowed its companies to rebuild their value chains severed by sanctions, export controls and self-sanctioning (Free Russia Foundation, 2023)12. China, Hong Kong, Turkey and selected countries in the Commonwealth of Independent States (CIS) and Middle East and North Africa regions have stepped in to provide Russia with goods it could no longer acquire from the coalition of countries against the war.

Sanctions will deepen the pre-existing fault lines in Russia’s outlook of chronic underinvestment, poor productivity growth and labour shortages

The outlook for 2023 is more challenging

Export earnings are expected to fade in 2023 and dwindling revenues will likely be directed toward the war effort and suppression of domestic opposition (Prokopenko, 2023), reducing resources to support its economy.

Some growth may occur in the first quarter of 202313, because of increased fiscal spending starting in late 2022. In addition, according to Rosstat data, private investment has slowed, consumer spending has recovered somewhat, but consumers are cautiously moving more of their savings into short-term deposits and cash, following the autumn mobilisation of Russians to fight in Ukraine14.

Current account inflows will likely decline further, mainly because of the EU embargo and G7 oil price cap on purchases of crude oil and petroleum products. Europe is now also moving away from Russian natural gas faster than most had anticipated (Fries, 2022).

Though Russia’s overall current account surplus reached an all-time high in 2022, it fell from $77.2 billion in the second quarter of 2022 to $37.5 billion in the fourth quarter of 2022, and further to $18.6 billion in the first quarter of 202315.

The Ministry of Finance reported a fiscal deficit of 2.4 trillion roubles (about $30 billion) in the first quarter of 2023, which is 80 percent above the 2023 target, as oil and gas revenues fell by 45 percent year-over-year, while war-related spending increased sharply.

This is following the historically high deficit of 4 trillion roubles (about $57 billion) in December 2022. The Ministry of Finance said that some of the 2023Q1 deficit was incurred in order to reduce the typical backloading of expenditures. Still, it is hard to believe that Russia will reach in 2023 the budget deficit target of only 2 percent of GDP.

Russia’s long-term potential growth, already poor, will be further undermined by sanctions

Sanctions are no doubt aggravating Russia’s existing chronic underinvestment, demographic challenges and low productivity, going back well before 2022. The outlook for Russia’s potential growth has been gloomy since well before the war started and sanctions were imposed (Prokopenko, 2022).

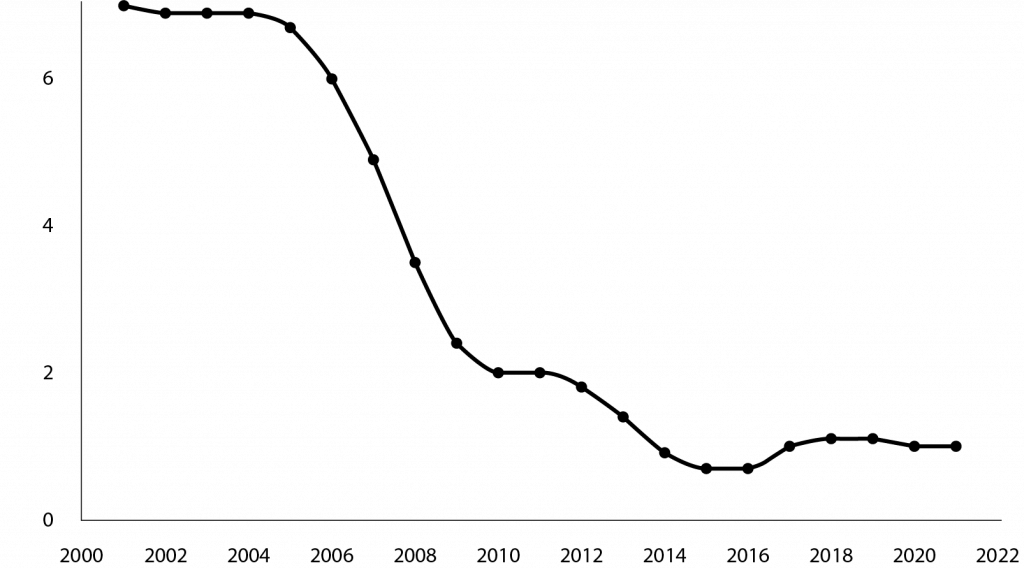

Figure 2 shows a continuous decline in potential growth, to around 1 percent before 2022. From 2000 to 2010, Russia integrated rapidly into global markets amid increased commodity prices. But growth failed to recover in the years following the global financial crisis. It fell by half after the 2014 sanctions imposed when Russia seized control of Crimea.

Figure 2. Russia’s economy was already in decline before the Ukraine invasion and Western sanctions

Except for oil and gas extraction, services and agricultural and chemical production, Russia has been suffering from chronic underinvestment, particularly over the last decade (see red bars in Figure 3).

Figure 3. Russia has suffered from chronic underinvestment since the global financial crisis

Little progress has been made in modernising and diversifying industries as the reach of the state has extended further into economic sectors considered strategic. Russia’s bias toward government programmes supporting state champions has led to dominance in every sector by state-owned enterprises and further dependence on energy exports.

The COVID-19 pandemic highlighted Russia’s most recent failed government-managed reform in healthcare. Export controls will continue, undermining the ability to diversify, particularly in non-energy export-oriented industries16.

While only around 6 percent of foreign companies have left Russia, and roughly 40 percent are in the process of leaving in response to the war and Russia’s crackdown on dissent17, most have scaled back operations and will continue to come under pressure to disengage from Russia18. All these factors will weigh further on already poor productivity growth.

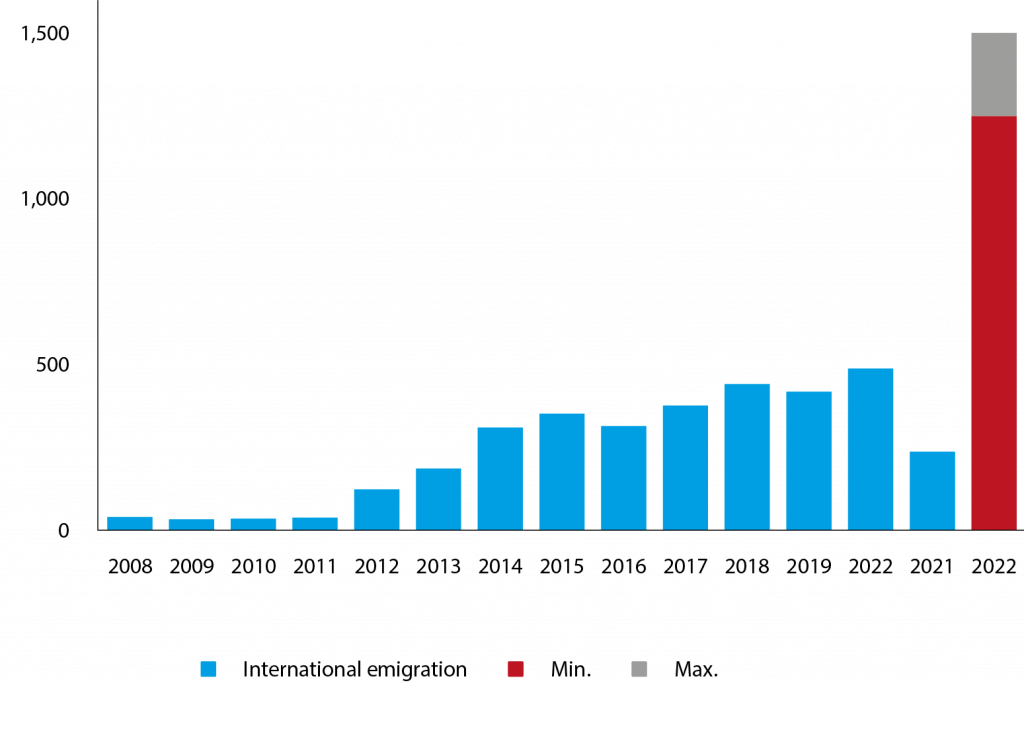

The massive mobilisation for the war effort is limiting labour supply, generating concerns about inflation at the Bank of Russia. Unemployment was down to 3.7 percent by end-2022 (4.3 percent in end-2021). Emigration has reached a historic high, with about 1.3 million persons leaving in 2022 alone (Figure 4).

Even before Russia’s invasion of Ukraine, younger and higher-educated people in Russia were looking for opportunities abroad; with the war and mobilisation, the trend has accelerated. The situation is particularly dire among information technology specialists, forcing Russia’s government to move from pleading and threatening to providing subsidised mortgages to get them to stay19.

Figure 4. The war has sent Russian emigration to historic highs

In conclusion, Russia’s economic challenges will only worsen as the war continues with no end in sight. But the countries against the war cannot afford to ease up on their pressure.

Endnotes

1. Though GDP estimates do not tell the whole story. High-frequency indicators point to inconsistencies in the national accounts; see Schmith and Sakhno (2023).

2. The IMF in April 2022 forecasted an 8.5 percent contraction.

3. See https://rosstat.gov.ru/storage/mediabank/55_07-04-2023.html.

4. See https://www.bofit.fi/en/monitoring/forecasts-for-Russia-and-China/latest-forecast-for-russia/.

5. Imports of equipment and machinery relative to investment spending appear to have diverged from their typical correlation, possibly because of difficulties in rebuilding value chains, but nevertheless casting doubt on the magnitude of the investment growth.

6. See https://rosstat.gov.ru/storage/mediabank/34_10-03-2023.html.

7. Including a one-off tax on Gazprom of 1.2 trillion roubles in the last quarter of 2022.

8. See https://www.cbr.ru/eng/press/event/?id=14670.

10. See https://www.youtube.com/watch?v=zgoZMsWQ69o&t=768s.

11. Between July 2008 and end of January 2009.

12. In the Russian sanctions context, self-sanctioning refers to companies choosing, though not being forced legally, to curb their operations in/with Russia.

13. The International Monetary Fund’s 2023 World Economic Outlook forecasts +0.7 percent growth for 2023.

14. See https://www.cbr.ru/eng/press/pr/?file=17032023_133000Key_Eng.htm.

15. See https://www.cbr.ru/eng/statistics/macro_itm/svs/bop-eval/.

16. See http://www.cbr.ru/Content/Document/File/144420/analytic_note_20230130_dip.pdf.

17. See https://leave-russia.org/uk.

18. See for example, Marton Eder, ‘Raiffeisen Eyes Russia Unit Sale or Spinoff Amid Pressure’, Bloomberg, 30 March 2023, https://www.bloomberg.com/news/articles/2023-03-30/raiffeisen-eyes-russia-unit-sale-or-spinoff-amid-pressure-to-act.

19. See http://government.ru/news/47650/.

References

Babina, T, B Hilgenstock, O Itskhoki, M Mironov and E Ribakova (2023) ‘Assessing the Impact of International Sanctions on Russian Oil Exports’, Discussion Paper DP17957, Centre for Economic Policy Research.

Demertzis, M, B Hilgenstock, B McWilliams, E Ribakova and S Tagliapietra (2022) ‘How have sanctions impacted Russia?’ Policy Contribution 18/2022, Bruegel.

Free Russia Foundation (2023) Effectiveness of U.S. Sanctions Targeting Russian Companies and Individuals.

Fries, S (2022) ‘Is the Russia-Europe energy bind about to unravel?’ Realtime Economics, 28 April, Peterson Institute for International Economics.

KSE (2023) ‘KSE Institute Russia Chartbook BOP and Budget Under Pressure’, KSE Institute.

Lowery, C, E Ribakova, B Hilgenstock and G Meisels (2022) ‘Russia Sanctions: Adapting to a Moving Target’, White Paper, June, Institute of International Finance

Prokopenko, A (2022) ‘The Cost of War: Russian Economy Faces a Decade of Regress’, Carnegie Politika, 19 December.

Prokopenko, A (2023) ‘Does a Record Budget Deficit Herald the Collapse of the Russian Economy?’ Carnegie Politika, 10 February.

Ribakova, E, B Hilgenstock, G Meisels and S Gringel (2020) ‘Market interventions: the case of U.S. sanctions on Russia’, White Paper, March, Institute of International Finance.

Schmith, A and H Sakhno (2023) ‘The recession in Russia deepens: Evidence from an alternative tracker of domestic economic activity’, VOXEU, 14 February.

This article was originally published on Bruegel.