Britain’s road to Brexit

Patrick Minford is Professor of Applied Economics at Cardiff University

In this article I evaluate the progress being made in the Brexit agenda. This has always been one of long-term reform, involving trade with the EU and the rest of the world, as well as the restoration of UK-based regulation.

Free trade: the official assessment misunderstands the gains from international trade agreements

Britain has just signed a highly significant trade agreement with nearly a dozen Asian countries – the Comprehensive and Progressive Agreement for Trade Partnership, the CPTPP; call it the Trans-Pacific Partnership, TPP, agreement for short.

According to the Department of Trade’s official assessment the TPP will add 0.08% to UK GDP in the long run, which has been derided by Remainer opinion as negligible compared with the supposed loss of GDP due to lower EU trade, set at 4% of GDP by the Office of Budget Responsibility, a government-funded budgetary watchdog.

These official estimates are flawed by two key mistakes. First, they are based on so-called ‘gravity’ models which assume that trade effects of trade liberalisation fall off the higher the distance of a trade partner. Second, they assume that trade barriers with the EU must be raised by Brexit in spite of the Trade and Cooperation Agreement, TCA, with the EU whose aim is precisely to eliminate trade barriers between the UK and the EU.

Start with the second; it takes time first for negotiations on numerous details to be concluded, as the long discussions on implementing the Northern Ireland Protocol of the TCA illustrate. It also takes time for people and businesses to adapt to the new border processes. But as the recent agreement on the Protocol show, they eventually succeed.

It is reasonable to assume that other details will similarly be sorted out over time; hence we should assume the TCA achieves its long run objective of removing trade barriers with the EU, in which case there will be no long run EU trade effects.

Now turn to the first issue of the gains from wider trade agreements, found to be minimal by the official model used. In our trade modelling work at Cardiff University, we have repeatedly tested the ‘gravity’ model on different countries’ data and found it to be widely rejected.

The reason is that while of course ‘gravity’ (ie. distance and size) does affect the extent of trade by itself, the effects of trade liberalisation and other changes over time have rather similar effects on all trade and they work by bringing down national prices into line with world competition; a model along these lines is generally consistent with the data.

The ‘gravity’ model that says they have limited price effects and disproportionately affect nearer and larger trade partners is generally rejected by the data.

How the gravity model fails in tests of its ability to mirror long term trade trends

Many followers of economic debate think that a good test of a theory is its ability to forecast future events. But it turns out that forecasting well is a bad test of a model; many poor models forecast well, and many good models forecast badly.

Forecasts in other words have little to do with how well a model understands the underlying causal processes at work, which is what we care about. Models that are based on exploiting lagged indicators usually do better than good causal models, and all forecasts are upset by big shocks that are unforecastable, reducing forecasting ability all round and making forecast success largely a matter of luck. This criticism also applies to ‘likelihood ratio’ testing which is based on models’ capacity to forecast past data accurately.

Instead, a reliable way of testing models is to ask if they can mimic the behaviour of real-world data. This behaviour is produced by the unknown true model, so the closer a model can get to producing similar behaviour, the greater its claim to be the true model.

This test of a model is known as ‘indirect inference’ testing; in this method the data behaviour is described accurately by some past relationships found in the data, and the proposed causal model is simulated to see if it implies relationships close to this- and so is ‘indirectly’ similar rather than ‘directly’ forecasting data.

In repeated ’Monte Carlo’ experiments using mocked-up data from supposed true models we have found that these indirect inference tests are extremely powerful in rejecting false models, whether of the macro economy or of trade.

In recent work at Cardiff we have asked whether a model of world trade including all the major countries or country blocs of policy interest – the US, the EU, China, the UK, and the rest of the world – can mimic these countries’ behaviour in trade and output.

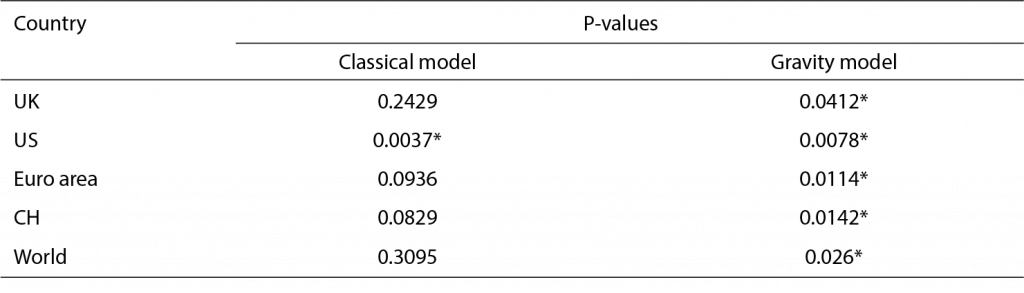

We have a ‘classical’ and a ‘gravity’ version of the model. The results are striking – as the table below of the probabilities of each model for each country and the world as a whole show rather strikingly. What can be seen is that the gravity model probability falls in all cases below the 5% cut-off level (ie. 0.05), while the Classical model generally has a probability well above this level.

Table 1. Test results of the full world global model

Note: P-value * indicates a rejection of the model at 5% significance level.

Source: Minford, P, Dong, X, Xu, Y (2021)’ Testing competing world trade models against the facts of world trade’, Cardiff Economics working paper E 2021/20.

The only exception is the US whose individual facts are not well fitted by either model. Nevertheless, the Classical model fits the world as a whole very well. It also fits UK trade facts particularly well.

You might ask why so many economists adhere to gravity models in commenting on Brexit. The answer seems to be that these models do quite well in mimicking short term macro behaviour, in effect behaving like business cycle macro models, which frequently use the same gravity assumption that trade in different countries’ goods compete imperfectly.

But while this assumption works well for the short run, in the long run it breaks down as competition irons out differences between products. We know that in the short run Brexit is bound to cause disruption, but the whole point of Brexit, as we have seen, is to improve long run performance – in the process ironing out the EU trade disruption through the improving TCA.

This testing failure of the gravity model, as we have just seen, applies strongly to UK trade in particular (as found some time ago in earlier work of ours).

The TPP countries currently account for about 6% of our trade in goods- largely food and manufactures. But the key point totally missed in the official assessment is that our importers will now have a barrier-free source of these goods for them to access if they need to and our exporters will have their markets to sell to; this via competition will reduce our import and export prices on these goods to world levels.

This in turn impacts on our consumer choices and our production structure. Eliminating the trade barriers to these goods that we inherited from the EU- which are estimated to average about 20% – would according to our detailed model of UK trade and the economy increase UK GDP in the long run by around 6% – a big gain, very many times the official estimate – and lower consumer prices by 12%.

This is the ‘static’ benefit, assuming trade does not grow, as of course it will, given that Asia is a fast-growing part of the world economy.

A natural reaction to this estimate will be that, just as the official one was far too small, this one is extravagantly large. It is certainly true that it is based on a long-term assessment, not the short-term gravity models used by Remainers.

It also assumes that in the long term there is free trade within this Pacific bloc which is the aim of the TPP; the initial agreement is hedged about with quota restrictions on the amount that can be freely traded but these should be eventually phased out as markets develop and confidence expands that they are not disrupting them; UK businesses will be incentivised to accept easier import access by the reciprocal access for their exports.

One of the major objectives of Brexit is to replace the EU’s intrusive precautionary principle with the pragmatic common law principles under which experimentation is permitted to enable vigorous innovation

Furthermore, the TPP is due to expand as new members join; those interested include S Korea, Thailand, several Latin American economies and both Taiwan and China. The US could also return to being a member. As it expands the TPP will reinforce these competitive effects on our economy.

The gravity models used to condemn Brexit are short term in focus, not much different from the ‘macroeconomic’ models we use for analysing the business cycle. Hence, they put much emphasis on the short-term EU trade disruption due to the mere fact of creating a new border, which in time with the TCA and WTO rules on ‘seamless’ borders should disappear; and they do not factor in the long-term effects of lowering the large EU barriers against non-EU trade.

It is these that loom large in the classical trade model that properly explains long term trade/economy movements. Unfortunately, commentators generally look for quick results from policy changes that can only work well in the long term. Brexit was always about the long-term economic gains from self-government and not about quick wins.

Our estimate is aimed at this long-term situation; it is large relative to the short-term and it will take a long time. But Rome was not built in a day, nor will post-Brexit Britain emerge blinking successfully from transitional problems in just a few years.

How this free trade agenda leads to a full Brexit with EU irrelevance.

Because of the short-term focus of the current Whitehall consensus gravity model, it is not well understood just what radical implications this free trade has for our future relations with the EU.

As we have seen in the long-term free trade implies equalisation of our home prices with world prices, which in turn means that we would export to the EU at these very same prices and would only import from the EU goods that were priced at the same competitive level.

This means that any threats by the EU to levy tariff or other trade barriers on UK goods in the course of any future negotiations on the TCA and any proposed new UK regulations, would be entirely empty. The reason is simple enough; UK export prices to the EU would be unaffected, as for example should they fall, UK goods would be diverted to other world markets at the full world price.

Hence any EU trade barriers would simply raise the prices paid for UK goods by EU consumers. Should EU sales suffer as a result, then more goods would be sold elsewhere at world prices.

Similarly, if the UK were to raise barriers against EU imports in retaliation against any such EU barriers, it would not affect UK prices of these imports as they would have to compete with world imports to be sold at all. As a result, EU sellers’ prices would be reduced. If as a result they supplied less imports, these would be replaced by imports from elsewhere.

It follows that the TCA itself would become irrelevant, dominated as our trade with the EU would now be by the prices prevailing in the world at large. Furthermore, the EU would get most welfare from UK trade free of barriers as this would keep down the prices of UK goods to its consumers and keep up the prices of its UK exports to world prices.

Hence, we would expect that our relations with the EU would default to barrier-free trade. As for UK regulations, the UK would be entirely free to set them as it suited it best, free of EU trade threats.

Progress in restoring UK-based regulation

It can be seen from this trade analysis that the UK will be unrestricted in its ability to restore UK-based regulation once free trade around the world is created. Meanwhile there has been progress on this front on the ground.

The Retained EU Law Bill currently going through Parliament mandates the sunsetting of all remaining EU regulations by the end of 2023; while this target date has now been abandoned as too ambitious, it is reasonable to assume the sunsetting process will be completed in the next year or so.

Most significantly in any case, existing regulations by now are all the responsibility of UK regulators, under the direct control of Parliament. This will ensure that UK regulation is done by new UK processes supervised by UK law and regulators in consultation with UK industrial interests. The sunset deadline forces these bodies to work urgently to find optimal UK replacements.

One of the major objectives of Brexit is to replace the EU’s intrusive precautionary principle with the pragmatic common law principles under which experimentation is permitted to enable vigorous innovation. As long as EU regulations are left in place by default, their replacement is delayed by bureaucratic inertia. As nature abhors a vacuum, so the abolition of remaining EU regulations should stimulate the necessary consultations to produce new UK-based regulation.

Conclusions

What this all implies is that the Brexit agenda is indeed being rolled out, contrary to much Remainer vilification, and is set to bring material long term benefits to the UK economy as this continues, besides ensuring that Brexit is fully completed.

Meanwhile EU trade will continue to bounce back in the short run as the government continues to negotiate the necessary details to achieve the TCA’s aim of free trade with the EU. With Brexit now well on track, it is important that our Civil Service establishment gets behind it and does not minimise its significance.

We should add that those wanting Brexit to succeed in the long run should not be afraid of an agenda for improving the TCA and relations with the EU, fearful of making concessions over short run issues. What our analysis here shows is that in the long run, once free trade truly prevails, the UK will be entirely free to set its own trade and regulative policies, regardless of EU pressures.