Reforming British economic policy

Patrick Minford is Professor of Applied Economics at Cardiff University

Economic policy in Britain is at a crossroads. The change of leader creates an opportunity to reform inherited policies which I argue in this article are set to create economic disaster. Fortunately, Liz Truss is pledged to grasp this opportunity, very much in the way I will argue is needed.

The current outlook under scheduled policies

Under current policies the UK economy was drifting into a bad economic future in which the gradual defeat of inflation by higher interest rates and reversing commodity prices would be marred by a nasty recession and substantially lower growth in the long term.

Policy on taxes and the budget were scheduled to deliver rising corporate tax rates and have already raised tax rates on wages (via higher National Insurance Contributions, NICs, and via higher income tax rates as inflation pushes people up the tax scale).

According to much modern work on incentives to innovate and so stimulate productivity, growth depends on an environment where entrepreneurial incentives are high and so tax rates and regulative barriers are low – modern thinking on ‘endogenous growth’.

In our models of UK growth, the raising of corporation tax to 25% will lower growth by about 2.5% pa; on top of that the rise in NICs lowers competitiveness and also depresses output. In our baseline forecast without all this growth is projected at 2%. Reducing it by this much implies actual decline.

The rise in taxes was intended to strengthen the public finances and bring down the debt ratio. Ironically by destroying growth it does the opposite. My Cardiff research team has projected long-term debt according to the effects of these taxes on growth and so on tax revenues net of benefits, where spending is kept on its present trajectory1.

The result is that the debt ratio spirals upward, reaching 125% by 2035. What this illustrates is the Treasury’s intellectual error in neglecting the effect of its policies on growth.

In principle, if uncorrected, it could react to this evolving scenario by raising taxes even further to restore the finances. But this would worsen matters further, creating a ‘doom loop’ in which events and policies interact to destroy both the economy and the finances.

As for inflation, if this continuing recession were to cause a sharp loosening of monetary policy in a forlorn attempt to restore growth, we could also face a worsening inflation outlook. What we see is that the policy orthodoxy enshrined in the Treasury’s policies as planned by the previous government would have been likely to produce very poor economic prospects for the UK economy. This is what needs to change.

How to change the approach – moving to long-term rules

The pity of all this self-harm in taxation is that it is entirely unnecessary, an ‘unforced error’, inflicted by the UK Treasury failure to understand the role of debt management.

This Treasury view has been that debt contracted during COVID should now be repaid as soon as possible, as a priority, and hence that any new spending must be met from new taxes. However, this view is quite wrong and at variance with welfare-maximising debt policy.

The reason is not rocket science. To maximise welfare, tax rates should be set to maximise growth over the long run. This means, because higher tax rates reduce growth, they should be kept constant at the lowest rate the government can afford over the long term, which means equal to long run expected spending.

This in turn is equal to long run spending on goods and services plus debt interest. As for short term fluctuations in spending and debt interest these should be paid for by borrowing which consequently ‘smooths’ out the need for tax rises – much like households or businesses use borrowing to allow them to keep their consumption or investment spending constant.

It is incomprehensible that the Treasury threw over this basic economics. A more forceful Chancellor than Rishi Sunak, who has proclaimed that he is a ’low tax supporter’, would have overruled officials on this.

Instead, he gave way to Treasury insistence on ‘balancing the books’ short term with tax rises. Boris Johnson went along with this, in spite of strong opposition from his backbenches. As a result he and his Chancellor threatened to kill off economic growth just when post-COVID and post-Brexit we most need it to boost confidence in the economy’s future.

There are those who are uncomfortable with a public debt ratio to GDP well above the 50% or so to which we became accustomed before the financial crisis and COVID. Of course, over the long term such a ratio must be brought down to the comfort zone.

But the way to do this is not to sabotage growth but to allow growth gradually to bring it down over time by raising revenue and lowering the need for benefits.

In our baseline forecast my Cardiff team show, using our model of the economy, that leaving our growth rate at a trend rate of 2%, achievable without the sabotage created by scheduled tax rises, the debt ratio steadily falls to around 50% by 2035. It does so in the time-honoured fashion, in which growth raises net tax revenues steadily.

This Treasury idea that borrowing is a bad thing goes back a long way, especially in Conservative circles after all the battles over the tough 1981 budget under Mrs Thatcher.

But the world has changed radically since then. Inflation then reached 25%, today it has been close to or at 2% for most of the last three decades. Unions, mighty then, are today weak and controlled by tough union laws.

In 1981, the government controlled both debt and money and markets were afraid it had lost control of both; to bring inflation down it had to convince them with that tough budget.

Post-Brexit and post-COVID there are major challenges for government policy; the recovery needs to be sustained, and policies must be put in place for solid long-term growth and levelling-up

Today the Bank controls money; its current tightening will bring inflation down which allows the government freedom to use the budget to support the economy.

Finally interest rates today, the cost of borrowing, are close to zero, whereas in 1981 they were well into double digits. Real interest rates today are negative, which means the Treasury is actually being paid to borrow. The Treasury has resisted all advice to reissue as much debt as possible at today’s negative real rates; why look such a gift horse in the mouth?

Government borrowing today should optimally support the real economy by keeping taxes down, growing output and productivity and tempering wage costs. Furthermore, it should aim to go further and actually cut taxes, not merely cancel the planned and recent increases, to boost growth further. I discuss this further below in the next section.

The Treasury likes to parade its scepticism that the tax and regulative environment is crucial to growth; for it, growth is ‘exogenous’, and falls or not like manna from heaven.

There is strong evidence that a free market approach to cutting taxes and regulation on entrepreneurs has been successful here in the decades since 1970, confirming that UK growth has indeed been ‘endogenous’ – ie. policy-dependent – once you allow for all the shocks that have buffeted the economy over the period.

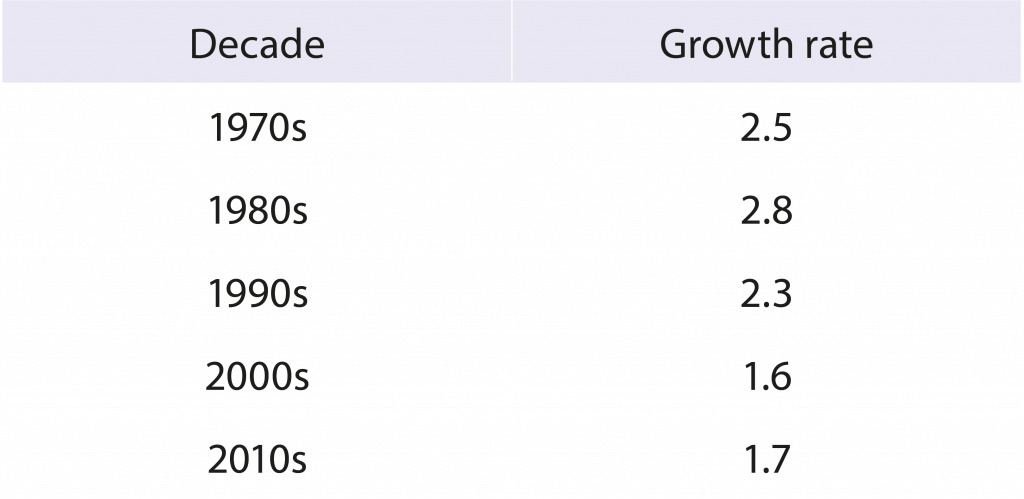

We have estimated and tested a full regional model of the economy in which growth due to all relevant factors depends on tax and regulation; it matches the UK economy’s behaviour well- the table of decadal growth below suggests why: growth surged in the 1980s as the Thatcher reforms took hold.

As one side implication, it finds that the North responds more to a policy of cutting tax and regulation than the South-see next section for more details. Hence it provides strong evidential support for a policy of not merely keeping taxes down but actually cutting them further.

Table 1. UK growth by decades (eg. 1970s=Q1 1970 to Q1 1980)

Source: Fed of St Louis databank, FRED.

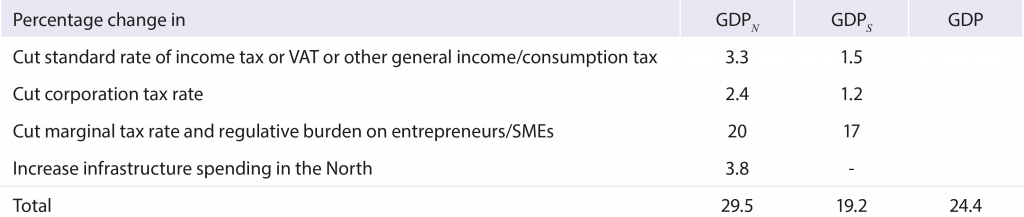

Table 2. A fiscal stimulus package costing £100 billion pa.

Notes: 1. Representing a weighted average tax cut across all income of about 15%. 2. On public services and infrastructure.

A longer-term programme for stimulating growth

The economy is now recovering from the pandemic, after the collapse of 2021 and the resulting run-up in public debt to pay for the emergency. Post-Brexit and post-COVID there are major challenges for government policy; the recovery needs to be sustained, and policies must be put in place for solid long-term growth and levelling-up.

This policy formulation requires the government to take a long-term view, as we have seen, and not to panic in the face of short-term pressures.

What this implies is that having reversed the scheduled tax rises, we need to do more to stimulate growth further. It is generally agreed that our inherited EU regulation needs urgently to be liberalised and replaced with the environment of the common law where people’s rights are protected by the ordinary criminal law and the civil laws of contract and tort.

With this back in place, the need for bevies of regulators and long complicated regulations forbidding swathes of actions is removed, as recommended in the TIGGR report of the Task Force under Sir Ian Duncan Smith2.

However, in addition we need to reinforce our growth environment with a programme of actual tax cuts, not merely the reversal of scheduled tax rises.

Such policies will also generate ‘levelling-up’ where growth in the North exceeds that in the South- we define the South as consisting of London, the South East and the South West and the ‘North’ as all other regions (with apologies to Wales, the Midlands and the east).

The new Cardiff regional model of the UK is designed to frame the best way for policy to address this agenda. Our work3 produces the policy results shown in Table 3.

Table 3. Effects on growth in Regional Model (% of GDP over next decade) from full policy package of £100 billion pa.

The model is based on well-known and well-tried ideas of supply-side channels through which targeted tax cuts and regulative reform raise entrepreneurial incentives to innovate as well as creating labour market flexibility and lowering labour costs.

Previous work has shown that these sorts of policy have worked well in the UK to boost the economy in the 1980s and 1990s. Much policy commentary has criticised the government for aiming at ‘levelling-up’ without any strategy for achieving it.

We show here that there is a potential strategy that is feasible without affecting public sector solvency; also that it ‘levels up’ the North without cutting down the South – all boats rise in this strategy.

The policy package we propose below will, according to the Cardiff model, raise growth by 2.4% per annum, that is to 4.4% against the 2% baseline assumption. It will also raise growth in the North faster than that in the South, so achieving levelling-up in a way that raises all boats.

The projections for the public finances under this scenario not surprisingly show that, with this growth trajectory, tax revenues surge, pushing the debt ratio down rapidly, providing spare resources for yet further tax cuts, in a virtuous circle, the mirror-image of the doom loop set up by rising taxes.

How short-term economic management of the economy needs to change

The above ‘Treasury Orthodoxy’ maintains that the restraint of government borrowing is the key priority for the government. Yet in truth public debt is simply another and an important instrument of policy to achieve the overriding aim of a prosperous economy.

To achieve growth, as I have just argued, we need a policy of reducing taxes and improving regulation in a new reform of ‘supply-side’ policy; this will improve business innovation and so productivity growth, and will also promote levelling-up, as the north responds most due to having more spare resources.

To enable it, there has to be government borrowing to finance any temporary excesses of spending over tax revenues as shocks like the business cycle hit the economy.

This ‘tax-smoothing’ function of borrowing merely has to be consistent with the long run constraint that the debt ratio must come down again to a safe level of around 50%, with spending matching tax in the long run.

But short run fiscal rules of the various sorts that have been used from time to time obstruct the vital tax-smoothing function of debt and borrowing. So much we have already seen above. We have also shown that a bold supply-side reform programme that includes tax cuts is entirely consistent with long term public solvency, with the debt ratio coming down steadily to safe long-term levels.

But there is more than such a supply-side agenda to ‘fiscal policy’, in the form of the effects on demand in the economy from the current balance of government spending minus revenue – the ‘fiscal deficit’ for short.

What I also propose is that this should stabilise output, going up when recession threatens and down in booms. At the present time when rising interest rates threaten a recession, this implies fiscal policy should support demand and avert a recession.

Meanwhile monetary policy has the job of controlling inflation, mainly by moving interest rates around but also by directly printing/reducing money through buying/selling market-held bonds.

Currently, with inflation close to double digits, the Bank of England is raising interest rates. It is having to decide continuously how far to raise them to get inflation back down to its 2% target; accordingly we can describe its behaviour as a rule by which money tightening responds to inflation and output.

What my Cardiff research team’s work on modern economies has told us is that the most successful policies for stabilising inflation, output and interest rates are a combination of a fairly tough monetary policy reaction rule and a fiscal policy that stabilises output.

This is because then people and firms know that inflation will not be tolerated, so they act to restrain their wages and prices; but they also know that recession will be avoided so they keep on spending in a way that keeps growth on course.

Finally, because this stops inflation from rising too much and also stops output from slumping, this also keeps interest rates stable – with the Bank not needing to raise them too much when inflation shocks hit and not being pressured to lower them to zero as it did (with bad side-effects on saving and the survival of zombie firms) after the financial crisis.

In other words, using the instrument of fiscal policy side by side with a monetary policy to control inflation ensures a generally stable economy – implying stability in all of inflation, output and interest rates.

This is why it is nonsense to say, as so many orthodox economists today have said, that for fiscal policy to support the economy now is inflationary and pushes up interest rates.

The opposite is true: by reinforcing the Bank’s freedom to get on top of inflation, it contributes to both lower inflation and lower interest rates.

What the orthodoxy asserts is a naïve simplification of the economy’s workings which omits the way private expectations and responses interact with policy rules – this is a key element in modern models of the economy.

What the orthodox see is just the direct effect of fiscal expansion on demand and inflation, and the assumed direct offsetting effect of interest rates needing to be raised by the Bank. However, this leaves out the vital reactions of expectations to the policy rules.

People see that the Bank is now freer to raise interest rates due to the recession being prevented by fiscal policy. This reinforces the Bank’s credibility in the control of inflation, which in turn restrains people’s inflationary reactions and so reduces inflation, without the Bank having to raise rates by more.

It is a bit like the general putting his army with its back to a river knowing the enemy will fear it more and so will fight less enthusiastically.

The failure of the UK Treasury to understand these ideas needs to be remedied by Whitehall reforms. It should not be necessary for ministers to have to import teams of outside advisers to remedy Whitehall failings and resulting obstinacy.

Admittedly the government to date has failed miserably even to have good enough teams of advisers to get policy right, let alone ones capable of remedying Whitehall obstructionism.

As part of the Whitehall reforms, there also needs to be a review of what went wrong in detail in the Bank and Treasury policy processes that permitted double digit inflation to take hold this year; while this is unlikely to recommend changing the Bank’s independent mandate to control monetary policy, there may well be areas where practices can be improved.

This Whitehall situation has occurred before. When Mrs Thatcher embarked on her 1980s monetarism and supply-side reform programme, it was widely opposed and misunderstood by the senior civil service.

To carry it out required a huge effort of Whitehall transformation involving the removal or side-lining of numerous senior officials and the promotion of able junior civil servants who understood and implemented the programme. A similar effort seems to be needed today if the government is to succeed in launching the new reforms that must go forward.

Endnotes

1. These and other projections I refer to here can be found in our latest Quarterly Bulletin at https://www.patrickminford.net/QEB/QEB%202022%20July.pdf

3. Gai, Y, Meenagh, D, and Minford, P (2020) North and South: A Regional Model of the UK, Cardiff Economics Working Papers E2020/14, forthcoming Open Economies Review http://carbsecon.com/wp/E2020_14.pdf