Carbon pricing and inflation

Daniel Santabárbara is Head of the Advanced and Systemic Economies Unit, and Marta Suárez-Varela a Senior Economist, at the Bank of Spain

Not only climate change but also its mitigation policies may affect business cycles and inflation dynamics. Among the policy measures to mitigate climate change, carbon pricing is seen as one of the most efficient economic instruments for reducing greenhouse gas emissions (Hepburn et al 2020).

In fact, in recent decades the number of carbon pricing initiatives and their coverage in terms of emissions have risen significantly. In 2024, 24% of global emissions are covered, with the most ambitious initiatives implemented in OECD countries (World Bank 2024).

The realisation that climate change and mitigation policies may reshape policy formulation has prompted the need for a better understanding of their consequences for economic policy.

Monetary policy is not an exception. Both climate change and the transition to a low-carbon economy could impinge on the fulfilment of central banks’ price stability mandates and the conduct of monetary policy.

Indeed, in the context of its review of monetary policy strategy, the ECB has committed to incorporate climate change considerations into the design of monetary policy (ECB 2021).

In a recent study (Santabárbara and Suárez-Varela 2022), we contribute to the ongoing debate on the choice of the optimal carbon pricing instrument (Parry et al 2022, Nakov and Thomas 2023) by analysing the impact of carbon pricing on consumer prices volatility. Inflation volatility is crucial for monetary policy, as it complicates the communication and the conduct of the monetary policy.

In addition, sectoral price shocks linked to carbon pricing risk affecting inflation expectations, possibly triggering second-round effects (Batten et al 2020). Furthermore, research has shown that inflation volatility can intensify the impact of supply shocks on consumer prices.

This is because in periods of heightened inflation volatility, the payoffs of swiftly responding to inflation developments may be more significant, thus boosting the incentives for firms to enhance their pricing flexibility (Arndt and Enders 2024).

Finally, significant inflation volatility may lead to economic uncertainty affecting agents’ investment and consumption decisions and growth (Judson and Orphanides 1999).

The links between carbon pricing schemes and price volatility

The presumed impact on inflation volatility of the two main types of carbon pricing initiatives – emissions trading systems (ETSs) and carbon taxes – can be different. Under an ETS, a cap is first set on pollution, and then a volume of emissions allowances is issued compatible with that cap and allowing companies to trade with them and determine a market-clearing price, which could be potentially rather volatile.

Conversely, under carbon tax schemes, policymakers directly set a price on emissions, letting the market determine the amount of pollution consistent with that price. Thus, carbon prices tend to be relatively stable as long as their tax rates and bases do not change frequently.

All in all, while carbon taxes deliver relatively stable carbon prices, ETSs have been found to lead to substantial carbon price volatility. Higher volatility of carbon prices could be transmitted into producer and consumer prices – especially of those goods and services related to those sectors under the coverage of carbon pricing – and thus increase inflation volatility.

Given these dynamics, how might these differences between carbon taxes and an ETS influence volatility in consumer price inflation? Might the effects be different for headline, energy, and core inflation? Are there some underlying mechanisms and factors that contribute to observed heterogeneous effects of carbon pricing on consumer price volatility?

To answer these questions, we use panel local projections following Jordà (2005) on a comprehensive dataset including information on carbon pricing from the Carbon Pricing Dashboard (World Bank 2024) for OECD economies between 2000 and 2020.

Our sample shows substantial variability both across countries and time, with initiatives of different types – ETSs and carbon taxes – implemented in a number of countries and at different points in time (see Figure 1). Those initiatives are also heterogeneous in terms of their coverage and price for carbon.

Our results contribute to the ongoing debate regarding the choice of the optimal carbon pricing instrument by shedding light on novel side effects associated with ETS initiatives compared to carbon taxes

Figure 1. Timeline of carbon pricing initiatives in OECD countries

Source: Authors’ own elaboration based on World Bank Carbon Pricing Dashboard.

The impact of carbon pricing schemes on inflation volatility

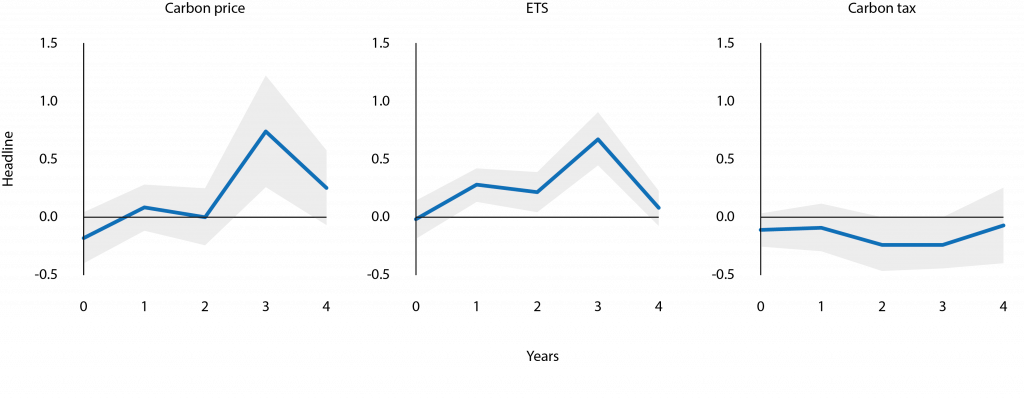

Our baseline results presented in Figure 2 depict the effects of a rise in effective carbon prices on consumer price inflation volatility without further differentiating by types, and considering the ETS and carbon tax types separately.

Overall, at a first look, an increase in the effective carbon price does not seem related to increased volatility of headline inflation (see left-hand side panel). However, when distinguishing between an ETS and carbon taxes, a different pattern emerges. While an increase in ETS effective prices induces a rise in the volatility of inflation after one year, carbon tax rates do not seem to have a significant impact (see centre and right panels).

Figure 2. Impulse responses of headline inflation volatility to shocks in carbon prices

Notes: The solid blue lines describe the dynamic impulse responses to an increase in the effective carbon price by $40 with 30% emission coverage. The grey area delimits 95% confidence bands. All responses are estimated by local projections including country fixed effects and controlling for GDP per capita, Population, Trade openness, Primary exporter, Capital flows, Commodity prices: Energy inflation, agriculture inflation and Metals & Minerals inflation, and CPI inflation. Standard errors are heteroskedasticity robust and clustered by country.

Source: Santabárbara and Suárez-Varela (2022).

In a second step, we investigate the channels by which carbon pricing systems affect inflation volatility, analysing the differential impact on the energy component of CPI and the degree of pass-through to the volatility of core inflation (see Figure 3).

The estimates reveal that only schemes of the ETS type push up the volatility of the energy and core components of inflation, while no impact is found in the case of carbon taxes. ETS schemes show the highest impact on the volatility of inflation for the case of energy CPI, which should be expected given that energy-related goods are the ones that are targeted by carbon pricing initiatives and ETSs induce volatility in carbon prices.

The volatility of core inflation is also affected with some delay by the rise in effective carbon prices of those jurisdictions with an ETS, suggesting lagged indirect effects of ETS schemes on inflation volatility.

Figure 3. Impulse responses of energy and core inflation volatility to shocks in emissions trading system prices and carbon tax rates

Notes: The solid blue lines describe the dynamic impulse responses to an increase in the effective carbon price by $40 with 30% emission coverage. The grey area delimits 95% confidence bands. All responses are estimated by local projections including country fixed effects and controlling for GDP per capita, Population, Trade openness, Primary exporter, Capital flows, Commodity prices: Energy inflation, agriculture inflation and Metals & Minerals inflation, and CPI inflation. Standard errors are heteroskedasticity robust and clustered by country.

Source: Santabárbara and Suárez-Varela (2022).

Finally, we explore several factors that could drive the differences between an ETS and carbon taxes. For instance, electricity producers are typically covered by an ETS, while carbon taxes tend to exclude the electricity sector. Our findings indicate that the increased volatility observed in cap-and-trade schemes is primarily due to higher fluctuations in carbon prices, rather than differences in the sectoral coverage in comparison with carbon taxes.

Furthermore, we identify several factors contributing to the heterogeneous impacts of carbon pricing initiatives across jurisdictions. For example, countries with higher weight in high-polluting sectors (as measured by the share of value added attributable to those sectors) experience more volatile energy CPI inflation.

Interestingly, under an ETS, a higher share of free emission allowances allocated to each country tends to reduce inflation volatility. This could be because larger free allowances reduce the effective costs incurred by producers and, thus, their incentives to adjust prices.

Concluding remarks

These results also have important implications for policy. The literature has found that carbon pricing schemes are generally associated with a transitory effect on the level of inflation (Moessner 2022, Konradt and Weder di Mauro 2023, Känzig 2023, Konradt and Känzig 2023).

Therefore, credible monetary policy authorities would generally ’look through’ this effect, as it shares the features of a temporary negative supply-side shock (Batten et al 2020).

However, as ETS schemes are found to affect inflation volatility, those relative price shocks could further complicate the conduct of monetary policy, as the central bank’s signal-extraction problem becomes more challenging. Therefore, central banks should closely monitor these effects.

Additionally, our results contribute to the ongoing debate regarding the choice of the optimal carbon pricing instrument by shedding light on novel side effects associated with ETS initiatives compared to carbon taxes.

References

Arndt, S and Z Enders (2024), “How inflation volatility matters for the pass-through of supply shocks to consumer prices”, VoxEU.org, 25 January.

Batten, S, R Sowerbutts and M Tanaka (2020), “Climate Change: Macroeconomic impact and implications for monetary policy”, in T Walker, D Gramlich, M Bitar, P Fardnia (eds.), Ecological, Societal, and Technological Risks and the Financial Sector, Palgrave MacMillan.

European Central Bank (2021), “Climate change and monetary policy in the euro area”, ECB strategy review.

Hepburn, C, J Stiglitz and N Stern (2020), “Carbon Pricing”, European Economic Review 127 (Special Issue).

Jordà, O (2005), “Estimation and inference of impulse responses by local projections”, American Economic Review 95.

Judson, R and A Orphanides (1999), “Inflation, volatility and growth”, International Finance 2.

Känzig, D (2023), “Climate policy and economic inequality”, VoxEU.org, 25 June.

Konradt, M and D Känzig (2023), “The economic effects of carbon pricing”, VoxEU.org, 12 August.

Konradt, M and B Weder di Mauro (2023), “Carbon taxation and greenflation: Evidence from Europe and Canada”, Journal of the European Economic Association.

Moessner, R (2022), “Effects of carbon pricing on inflation”, CESifo Working Paper.

Nakov, A and C Thomas (2023), “Climate-conscious monetary policy”, Banco de España Working Paper 2334.

Parry, I, K Zhunussova and S Black (2022), “How to design carbon pricing schemes”, VoxEU.org, 22 July.

Santabárbara, D and M Suárez-Varela (2022), “Carbon pricing and inflation volatility”, Banco de España Working Paper 2231.

World Bank (2024), State and trends of carbon pricing 2024.

This article was originally published on VoxEU.org.