The role of competition in the transition to climate neutrality

Georg Zachmann is a Senior Fellow at Bruegel

Summary

The transition to climate neutrality requires the reallocation of production factors from polluting activities to non-polluting activities. The main push for this reallocation will come from governmental decarbonisation targets that are translated into stringent climate policy tools, such as carbon pricing and emissions standards. But the complex process of recombining production factors will require the coordination of millions of individuals and firms. The efficiency of this recombination process will be a main driver of the cost of the transition.

Based on a consistent analytical framework, I argue that much more political attention should be paid to the markets and regulators that guide the re-allocation of production factors, to bring them in line with a carbon-neutral economy at the best service of European consumers. Three main issues should be considered:

1. The transition will change the role and efficiency of markets in allocating resources;

2. Competitive markets can make the transition more efficient;

3. In some areas, a too-narrow focus on competition can be detrimental, and needs to be discussed.

To improve the institutions for resource allocation in the transition, policymakers should revisit three levels of intervention: 1) competition rules and enforcement should be adjusted to meet the new challenges of the transition; 2) efficient markets that are central to a climate-neutral economy – such as for electricity, emission rights or circular logistics – need to be properly designed; 3) the advantages and disadvantages of more direct state control in specific sectors should be revisited in light of the challenges of the transition.

In summary, policymakers need to get away from simplistic state-or-market narratives. The focus should be on developing politically feasible frameworks for leveraging the benefits of competition for efficient resource allocation in the transition.

Institutions should not focus solely on static efficiency, but must forcefully encourage investments in new systems and innovation. The role of institutions that determine resource allocation in the transition is an underappreciated but crucial area for future research and policy action.

1. Introduction

1.1. Markets are important for the transition

Decarbonisation implies a massive re-allocation of resources in our economy. Companies need to change how they produce and sometimes what they produce – occasionally retiring carbon-intensive assets before the end of their economic lifetimes.

Consumers need to reduce their carbon footprint by replacing carbon-intensive by carbon-neutral consumption, which implies buying the appliances that allow them to do so. Workers and capital need to move from brown to green sectors. And the massive transition1 must happen very quickly.

The transition is also likely to be bumpy. It remains undetermined what will be the most economic technologies, the most efficient systems, the best mix of reduced demand versus more carbon-neutral supplies, and the optimal share of domestic versus imported clean fuels.

Those issues are highly interdependent. Mistakes could be made and their consequences significant. Individual projects might fail completely. Specific technology solutions might cost twice as much as alternatives. Complete systems might be dozens of percent more expensive than others2.

And when constraints on production factors (land, specific capital and labour) are binding – which they will likely be – any misallocation will either slow down the transition and/or remove these production factors from other needs. If that becomes too expensive, climate policy might fail.

The transition thus needs mechanisms to ensure reasonably efficient resource allocation in a dynamic interconnected system characterised by uncertainty. Markets are a very powerful tool to coordinate the production, consumption, investment and innovation decisions of billions of individuals and millions of firms, and thus to enable a high level of consumption given the available production factors.

Markets can deal with explicit constraints, such as emissions limits in cap-and-trade mechanisms, and monetise trade-offs, such as competition for land used for solar panels or food. They are good at determining robust answers to multidimensional questions (what is the best combination of storage and flexible electricity generation?).

They are innovative in finding new solutions (such as smartphones), facilitate optimal resource allocation across borders and are much better than governments in cancelling wasteful projects.

1.2. Unregulated markets will not efficiently allocate resources

Free markets may be the most efficient mechanisms at allocating resources, but they can also fail to allocate resources optimally, and this is very relevant to decarbonisation:

i. If unregulated, companies tend to discharge too much pollution as they do not face the full societal costs (environmental externalities3);

ii. Companies tend to underinvest in developing new technologies that can be reproduced by others which did not spend money on research and development (innovation spillovers);

iii. Private investors would not be able to monetise investments in bicycle lanes or re-wetting moorlands by charging individual beneficiaries (public goods);

iv. The more electric vehicle owners use a specific charging system, the more corresponding charging stations break-even (network effects4);

v. Consumers buy cheaper but more energy-intensive appliances as they care more about the price than the long-term cost (such hyperbolic discounting is a form of behavioural bias);

vi. Landlords have less incentive to improve the energy efficiency of apartments rented to tenants than of their own apartment (such split incentives are a form of coordination problem);

vii. Banks do not know whether borrowers will be willing/able to pay back energy-efficiency loans – and hence ask for higher interest rates (information asymmetries);

viii. Companies that face too little competition might provide less of their product to increase market prices and hence earn higher revenues (market power);

ix. Companies and consumers might not believe that governments will implement announced stringent climate policies, such as rising carbon prices, leading them to inefficiently delay investments in low-emission production, infrastructure and appliances (time inconsistency).

As misallocations could be particularly costly in the dynamic process of a whole-economy transition (see section 2), a sound institutional framework to minimise such market failures is crucial.

1.3. Market rules will shape the efficiency of the transition

Policies that address these market failures can drastically improve resource allocation. The Tinbergen Rule (‘one instrument per policy target’, for example carbon pricing for the environmental externality, or innovation policy for the innovation externality) is a very important first principle for establishing the policy architecture.

But market failures are often complex. Policies to address them face practical limitations, such as the inability to enforce competition policy abroad, or imperfect information on the cost structures of incumbents, and can hence only act as partial solutions.

Moreover, policies to address one market failure might have side-effects. Trade-offs emerge. For example, patents boost innovation at the cost of temporary market power (OECD, 2004). Accordingly, concrete policy design needs to address these complexities in a way that provides a framework for markets to allocate resources as efficiently as possible.

1.4. Paper structure

In this paper we discuss how competitive markets will have to change to support efficient resource allocation in the dynamic and uncertain transition to a decarbonised economy. In the next section, we discuss transition-related challenges to competitive markets that policy should address.

In the third section, areas where more competition can unleash market forces will be discussed. In section four, we review areas where policymakers might want to balance a too-narrow focus on competition against other policy goals, including environmental benefits.

We conclude with recommendations primarily on the role of competition authorities (though not explicitly discussing the very important issue of state aid5).

2. Challenges for efficient resource allocation in the transition

The transition will affect disproportionately those economic activities that are prone to very clear market failures: the transition will require more innovation, new networks and platforms and more coordination on new systems. The transition itself might amplify the detrimental effects of some of the market failures described above.

Moreover, to overcome such barriers, governments might want to resort to policies that put effectiveness before efficiency, for example by prioritising meeting targets over cost-minimisation. But this might create new competition issues during the transition.

For example, the need for energy and material efficiency might require more coordination in some areas than current market structures can provide. Consequently, new market structures with very limited numbers of potential competitors might emerge.

The transition will recalibrate the roles of major economic players. In general, a speedy transition will require more coordination of actions over different time periods. The state will likely take a stronger role in organising the emergence of a sustainable economic system.

But companies will also want to coordinate more. In the following, we describe transition-related trends that reduce the potential of competition to allocate resources efficiently.

2.1. Increasing role of networks and platforms

A sustainable economy will have to be more resource-efficient than today. Corresponding efficiency gains can come from aggressively exploiting economies of scale and scope. Digitisation/digitalisation promises to super-charge the efficiency-potential in many sectors.

The result is that in a number of areas, a role is emerging for centralised platforms or networks to coordinate economic behaviour, with the ability to extract significant rents.

Four examples illustrate this:

First, resource use can be reduced substantially6 in a circular economy in which products that lose some of the use-value for consumers (an old smartphone for example) are transferred to that economic actor that can generate most value from reusing, repairing, repurposing or recycling it. It is easily conceivable that large online retailers that maintain several integrated networks, including customer and supplier bases, logistics and payments, would be best positioned to master this challenge, reinforcing the virtually incontestable position of such firms.

Second, in the electricity system of the future, passive users could turn into prosumers who reduce the cost of the electricity system by supplying, consuming, producing or storing electricity based on real-time system information. Again, several overlapping networks (standardised appliances, power lines, data networks, information aggregation and payments/billing) would be required to run efficiently a system with a massive number of distributed energy resources. For several years, big players in some of these networks have been trying to position themselves in this market, hoping to benefit from the value that can be created by managing these systems.

A third example is integrated energy solutions for big consumers like a university or groups of consumers like a neighbourhood or even a town or city, for which different heat, electricity and gas networks can be co-optimised with the locally available supply, storage and design of the demand.

Finally, multimodal mobility services that reduce the need for individual vehicles and empty runs work better the more mobility providers are co-optimised; consumers might prefer to use one software tool that deals with planning, buying the service and paying for it.

The better complex multi-actor systems can be designed and coordinated, the less expensive the infrastructure, energy and resources required for the transition will be. Single companies that can coordinate many economic actors, most notably through digital platforms, can operate more efficiently the bigger they are.

As a result, the same efficiency gains that will help with the transition might result in sectors characterised by reduced competition. Some of the current platform-economy incumbents are potentially well positioned to extend their market power to potentially very significant new services. The promise of excessively high rents in the longer term might create a welcome competitive race in the short term7.

However, as seen with smart grids, such a competition for a new market can also lead to an unproductive paralysis in which different players that each possess essential infrastructure try to secure a central position in new value chains, making it difficult to quickly find good compromises on standards and systems.

Consequently, economic policy will have to strike the balance between ensuring that the most productive systems are speedily selected, and that economic actors have incentives to invest in the necessary complementary infrastructure, and making sure that the regulatory framework allows the new systems to be efficiently used and developed.

2.2. Downscaling of ‘brown’ systems

The downscaling of fossil-fuel related economic activities and the exit of players from shrinking markets could lead to increasing market concentration in the whole market – when the number of players decreases faster than the volume – or the disintegration of some markets, leading to highly concentrated market segments (for example if connections between market segments become unprofitable and are abandoned).

One example is the natural gas wholesale market. It has already been seen how decreasing gas exploration in the EU resulted in increasing market shares of Russian gas in Europe.

If at some point in the transition natural gas pipelines that connect market areas are decommissioned or converted into hydrogen pipelines, the internal natural gas market might disintegrate and the dominance of gas suppliers will increase in the disconnected natural gas market areas.

Another challenge is that uncoordinated disconnection of users from incumbent gas distribution networks has negative spillovers for the remaining users as the fixed cost of the distribution system then falls on a smaller pool of users.

As it will be mainly more affluent households that can afford to invest in electric heat-pumps, poorer households in particular could be confronted with increasing gas distribution tariffs. If left to the market, this might trigger a chaotic ‘doom loop’ of cascading disconnections, which would be clearly less efficient than a planned decommissioning of distribution networks8.

2.3. Reduction in international competition

Import competition can substantially reduce the market power of domestic firms (or at least render markets contestable)9. In recent years, trade policy has become increasingly an area of international climate policy. The most tangible example is the carbon border adjustment mechanism (CBAM), proposed by the European Commission in the Fit for 55 package10.

The CBAM is intended to prevent carbon leakage by requiring EU importers of certain carbon-intensive products to buy an amount of allowances proportional to their products’ carbon content, with the carbon content either established individually based on a verification procedure that might be difficult for smaller importers, or based on default values that, if too high, might make importers worse off than most domestic companies11.

In some of the quite highly concentrated sectors covered by CBAM, there could be significant reductions in the competitive pressure from imports (Baccianti and Schenker 2022)12. The increasing market power of EU companies might translate into increasing mark-ups or lower quality13.

Moreover, CBAM is controversial and could lead trade partners to retaliate, at worst leading to a trade war14. This might further break up international markets, increasing market concentration in many sectors in a way that reinforces the market power of local companies.

Finally, rising fuel costs from the transition to low-carbon fuels and the need to invest in low-carbon ships might cause international transportation costs to increase. This might make imports more expensive and hence increase the local market power of domestic companies.

2.4. Public interventions risk inefficient favouring of incumbents

The transition will require massive government intervention to overcome some of the market failures listed in section 1. But governments are not omniscient, efficient or necessarily benevolent.

Bureaucracies and policymaking have their own failings that systematically prevent stops them achieving efficient results15, 16.

Government resource allocation, such as through R&D budgets, and administrative decisions, such as on market rules, follow different dynamics than market/price/competition-based resource allocation.

Politicians compete for voters and campaign funding, bureaucracies compete for power, and decision- makers compete for careers. These incentives are often more aligned with the interests of incumbents/insiders (‘regulatory capture’), than with those of the general public, who might benefit from fairer treatment of new entrants.

Accordingly, administrations are, for example, worse than companies at stopping projects/policies that turn out inefficient, which is a problem in a transition with a lot of uncertainty. Administrations also set standards and market rules that tacitly form barriers against technological change. Rules to protect specific rights in a status-quo market might become so complex that only large players can safely navigate them.

Because government decisions shape the structures of competition in markets that will be crucial for efficient resource allocation in the transition, preventing an undue bias in favour of incumbents goes way beyond the role of competition authorities and courts.

Europe’s long-term competitiveness will benefit if it finds ways to strengthen the voice of proponents of new business models, technologies and market entrants in the political/administrative process.

2.5. National transition policies might undermine the internal market

EU countries differ in their preferences for policy tools, market rules, standards, and infrastructure and innovation projects. The transition will require major new policies in many sectors.

While some areas are harmonised through EU-wide rules, tools and programmes, much of the heavy-lifting will come from member state policies. This provides room for targeting policy to national circumstances and allows testing of different solutions, which at best can result in mutate-and-select-evolution of the fittest policy proposals.

But national policies also carry the risk of increasing market fragmentation in the EU. Decarbonisation policies such as the deployment of renewables through national feed-in tariff systems can result in clear cases of resource misallocation in the EU (Abrell et al 2020).

Aggressive uncoordinated national support programmes for industry decarbonisation and hydrogen deployment also run the risk of highly inefficient allocation of resources.

2.6. Strategic behaviour in emerging certificate markets

The carbon market is crucial for decarbonisation. The EU emissions trading system is characterised by the presence of a relatively limited number of important players that compete in the same commodity markets, including electricity, steel and cement.

The structure of these markets implies that higher carbon prices can be largely passed through to consumers (European Commission, 2016), and some companies obtain significant volumes of allowances for free. This structure might make it profitable for individual companies or colluding entities to manipulate the carbon price, for example by buying up more allowances than a company in perfect competition would do, in order to increase the price of their products and hence their profits17.

Given this tail-wag-the-dog market, close monitoring is needed and it would be beneficial to increase the number of players – for example by extending carbon trading to cover more sectors – or reduce the volumes of free allowances. Measures to reduce competition, such as CBAM (see above), meanwhile, would be detrimental for competition.

Economic policy will have to strike the balance between ensuring that the most productive systems are speedily selected, and that economic actors have incentives to invest in the necessary complementary infrastructure, and making sure that the regulatory framework allows the new systems to be efficiently used and developed

2.7. Risk of ‘green-washing’ anti-competitive arrangements

There are good reasons for competition policy to permit arrangements that improve the coordination of companies during the transition (section 4). But there is a risk that companies will seek such arrangements primarily to reduce competition.

One challenging area is green alliances of companies. Such alliances agree environmental standards among each other – and jointly promote corresponding labels. They are clearly anti-competitive if they do not allow other companies that meet their same standards to join.

But also if they are open to all companies, by letting the insiders establish the standards, they essentially coordinate the speed of efficiency improvements in the industry – and competition policy needs to watch very carefully whether this on balance increases the ambition.

2.8. Summary

The examples described illustrate that the transition will profoundly change the allocative outcomes of market competition. In most cases, neither direct public management nor full laissez-faire competition will lead to satisfactory results.

To ensure efficient resource allocation, policy must, early on, re-adjust the institutional framework. The optimal points of intervention will differ case-by-case, and interventions might need to adjust dynamically over time.

Relatively light-handed intervention to protect virtuous competition can be done by adjusting competition authority toolkits. For example, market definitions can be revised when investigating declining brown sectors, rules should be clarified on the evaluation of green efficiencies to prevent green-washing, and state-of-the-art market monitoring (eg. in certificate markets) should be put in place. These adjustments would go a long way to prevent abuses of market power that threaten efficient resource allocation.

The politically but also technically most challenging intervention is designing efficient markets. Well- designed markets with robust regulatory oversight will often be the only realistic option for benefiting from the efficiencies of markets, without falling for the inefficiencies from rising market power, especially in network/platform sectors.

This is not made easier by the fact that market design is a continuous process that is at constant risk of being taken over by incumbents, and that suffers from different preferences in different EU countries.

Finally, the costs and benefits of direct state control in essential pieces of infrastructure need to be evaluated on a case-by-case basis. It might be that the benefits of being able to design a functioning market around directly state-controlled infrastructure exceed the inefficiencies of public-sector management of the infrastructure segment of the value chain.

This shows that it will be impossible to develop one single institutional framework to facilitate efficient resource allocation in a dynamic transition process. Quite the reverse: a complex mix of institutions and instruments will be needed to approach the efficiency frontier.

3. Competition can make the transition more efficient

The transition can be defined as a recombination of production factors into products and services that increase utility for consumers, while generating much less or no greenhouse gases.

Market mechanisms are well placed to play a significant role in determining efficient combinations quickly. In this section, we show with examples that competition will be important in allowing markets to pursue this role.

3.1. Competition pushes innovation which is crucial in the transition

Innovation is crucial for efficient decarbonisation. Previous cost-degressions for wind and solar power generation facilitated more aggressive global decarbonisation targets – such as the carbon-neutrality pledge in the Paris Agreement.

Future innovations are already priced-in in the large-scale economic models that underpin European climate targets. The cost of offshore wind turbines, for example, is expected to fall by one third by 2050 according to the assumptions used for the European Commission’s impact assessment that justified EU climate neutrality by 2050.

While basic research into completely new technologies such as nuclear fusion is almost entirely provided by governments, much of the resources that go into translating this research into new products are provided by companies18.

Competition is thus a strong incentive for innovation activity. Having better production processes, products or services is a mayor way for a company under pressure of competition to maintain extraordinary profits. By investing in innovation, companies can achieve/defend this ability.

Competition creates a positive incentive to innovate while punishing companies that do not innovate, as successful innovation by a competitor will have adverse impacts on the non-innovative companies’ ability to charge high margins.

Finally, the competitive success of companies depends on their targeting of resources to innovation activities in the commercially most promising areas, and on their ability to take resources away from innovation activities that cease to look promising. In the transition, shifting resources from a multitude of ‘brown’ to green innovation projects will be crucial.

But the literature indicates that market structure impacts innovation in a complex way19. While more competition increases the incentives for innovation, it can also reduce the means to do so.

One major finding that there is less innovation in sectors with an extreme intensity of competition is possibly explained by the argument that neck-and-neck competition decreases the free cash flow of companies to fund innovation activities (Aghion et al 2005).

In sectors that do not easily support multiple providers, such as electricity transmission and distribution, railroads or logistics, incumbents do very little R&D (Popp et al 2020). But innovation might still occur in the non-oligopolistic segments of the value chain, and contestability through more modular technologies (wind and solar versus large complex power plants) can be related to more innovation.

The structure of competition impacts both the speed and direction of innovation. While larger incumbents are suited to developing incremental innovations, small new firms are better at developing radical innovation (D’Estea et al 2011; Christensen and Bower, 1996; Hamilton and Singh, 1992; Henderson, 1993).

In the absence of market incentives for innovation, regulation or public ownership can try to mimic them20. But while this is an improvement over purely cost-based regulation (without any innovation incentives), it might often result in incumbents optimising to meet the demands of the regulator/mechanism, rather than meeting the future needs of consumers.

As innovation is so crucial for an efficient transition, policymakers, including competition authorities, should put a high value on protecting and encouraging competition in green sectors in the many cases where it is good for innovation.

The European Commission has demonstrated such encouragement. In the 2018 merger between Bayer and Monsanto21, the Commission found significant R&D overlaps, including in green products. The Commission cleared the merger on the condition that the parties divested certain activities to ensure adequate continuation of R&D in these activities.

3.2. Competition for ‘green quality’ contributes to the transition

Consumers often care about purchasing sustainably, and are willing to pay for it (Volpin, 2020)22. Consuming more sustainable products thus increases consumer welfare.

An overwhelming majority of Europeans (94 percent) say that protecting the environment is important to them personally, and a third believe that changing consumption patterns is the most effective way of tackling environmental problems (Eurobarometer, 2017).

Other studies confirm that consumers’ attitudes and beliefs reflect an intention to consume more sustainable products (see Annex for a discussion on the literature on consumer preference for green products). This is a strong motivation for companies to distinguish themselves from competitors by offering more sustainable products.

Competition for sustainability is hence a driver for innovation and a speedier transition, and policy should encourage it.

Under current competition policy practices, environmental protection is not treated as a standalone non-economic goal to be defended in the way that, say, market integration is23. Nor has environmental protection justified derogation from competition rules24.

Where the European Commission has taken environmental concerns into account, it has been as an element of consumer welfare25 and, more specifically, as a mark of the ‘quality’ of products. ‘Quality’ is a key aspect of competition under EU law. When firms compete on quality, any agreement or behaviour that artificially weakens quality may be subject to a prohibition.

In the context of mergers, for example, the European Commission (2013) states that “competitive harm caused by a reduction of quality [is] on an equal footing with an increase of prices, or a reduction of output, choice of goods and services.”

In 2017, the Commission blocked the proposed takeover of Aer Lingus by the low-cost airline Ryanair on the basis that the merged entity would impose lower service quality at equal prices26.

Agreements or behaviour that undermine sustainability to the detriment of consumers may be deemed anti-competitive and treated with the same severity as those that raise prices. If sustainability is a quality that consumers care about, then a merger that would allow the phasing out of a sustainable line or product could be blocked for this reason.

Similarly, competition authorities may prohibit or punish agreements between companies or conduct by dominant firms that limit green quality (under Articles 101(1) and 102 of the Treaty on the Functioning of the EU, respectively).

The Commission is in fact at time of writing investigating an agreement under which car manufacturers allegedly colluded to limit the development and roll-out of technology to reduce pollutants in emissions from cars27.

So undercutting of sustainability as a result of mergers, acquisitions and abuse of market dominance can already be sanctioned by competition authorities by referring to the negative impact on ‘green quality’.

But it becomes very difficult for competition authorities if lower sustainability needs to be balanced against potential cost benefits for consumers in the same case.

Moreover, competition policy is focused on the impacts on current and possibly potential consumers, but not on externalities cases have on all living (let alone future) citizens.

3.3. Competition between institutions helps identify more efficient and resilient solutions

Virtuous competition can emerge not only between companies, but also between technology systems, regulatory systems, countries and institutions (Petersmann and Steinbach, 2020). Particularly in the European context, allowing some differentiation between member state approaches might enable a faster and more resilient transition, if differentiation is not used to protect suboptimal solutions.

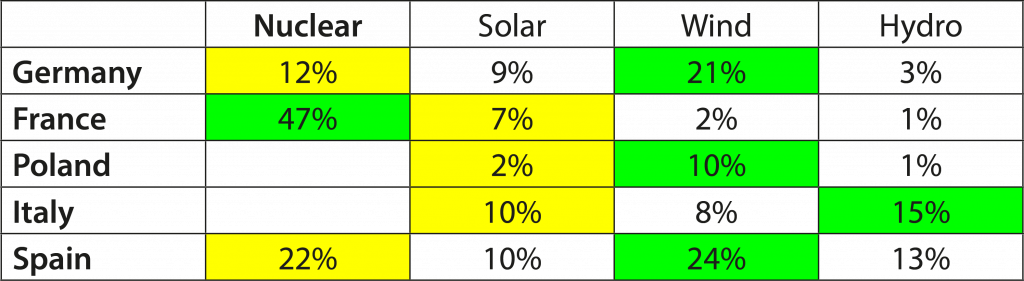

Different energy mixes in EU countries enhance mutation and selection of the best technologies based on geographical and pre-settled conditions. Having a wide energy portfolio fosters competition and permits complementarity among technologies, lowering the price of energy and increasing supply resilience.

A high degree of freedom in technology adoption by EU countries has resulted in a very diverse assortment of energy technologies in the EU, which was complemented by the emergence of a bandwagon effect by pioneer countries dragging others to adopt effective technologies.

For example, the successful early adoption of solar photovoltaics in Germany was a strong market signal for southern countries such as Italy and Spain to invest in the technology. Italy is now the second producer of solar energy (after Germany) with 20.5 gigawatts of installed capacity, amounting to about 8 percent of its electricity production, while Spain was both the EU’s and Europe’s largest solar market in 2019, after adding an estimated 4.7 GW in a single year (Schmela et al 2019).

Therefore, the French government’s commitment to spend €1 billion on small modular reactors, known as SMRs, and other technologies such as atomic waste recycling, might increase the portfolio of available low-emission technologies28.

Similarly, the German National Hydrogen Strategy29, and its required network of international partnerships to guarantee supply of green hydrogen, represents an opportunity to assess the real potential of the technology for the foreseeable future.

Having EU countries bet on distinct technologies could turn out to be a winning strategy. It could lead to a more resilient portfolio of sometimes complementary solutions, and might allow the EU to maintain its technological advantage in low-carbon energy sources.

Table 1. Share of first (green) and second (yellow)-most important source of zero-carbon electricity consumption in the five most populous EU countries 2021

Source: Entso-E.

Competition might emerge not only between technological solutions for the transition, but also between the policies and rules to bring about the transition. Different regulatory/policy approaches among EU countries have improved the common understanding and selection of the most effective policies for the roll out of low-carbon technologies.

For instance, regulatory convergence is now emerging around the auctioning of feed-in premiums as the most common policy framework for incentivising the adoption of renewable energy sources. This is the standard price-setting mechanism in Czechia, Denmark, Germany, Italy, the Netherlands, Estonia, Finland, Slovenia, Slovakia and Spain30.

Given the massive uncertainty and complexity of the choices, trying different technologies, systems and regulations might be more likely to result in the emergence of efficient solutions.

But, at some point, eliminating ineffective solutions will increase overall efficiency. Unleashing the power of the internal market by removing regulatory and infrastructure bottlenecks and cancelling support for inferior solutions can speed up this process31.

For example, a more integrated energy market at the EU level would not only increase the degree of competition energy providers are exposed to, but would also guarantee greater benefits from investments in successful technologies.

In fact, increasing the potential customer base of energy companies makes risk-taking more appealing because the returns on fruitful investments will be higher. This is particularly important in a sector with high upfront costs in R&D and subsequently in infrastructure.

Therefore, a broad conclusion could be that allowing heterogeneity in emerging regulations/systems can be very helpful in developing a resilient portfolio of solutions. However, at some point these solutions need to be exposed to competition with each other to determine the most efficient role for each.

In the European context, this approach bring two risks: to avoid costly mistakes in terms of backing ultimately unsuccessful approaches, countries might 1) prefer to wait and see and try to converge on the most conventional approach, and 2) they might try to protect their suboptimal solutions from true competition.

This might be rectified partly by engineering some risk-pooling between countries in order to allow them to take on the risk that mistakes will be made.

3.4. Testing disruptive ideas can require exemptions from regulations that discriminate against new entrants

An efficient transition will require not only massive investments in available low-carbon alternatives, but also the emergence of new business models and new technologies.

This might allow new market players with different backgrounds to bring new ideas and different capabilities to old sectors that are dominated by incumbents. Start-ups might contribute disruptive ideas that enable more efficient transition pathways.

Economic activities in mature sectors are regulated by a complex web of rules to address a wide array of societal concerns (including privacy concerns, environmental protection, construction safety, social protection and energy security).

The rules were co-created between societal actors and incumbents. In many cases, the arrangements imply that incumbents address some externality in return for protection against too much competition. For example, the complexity and bureaucracy of some regulations are a de-facto barrier to entry into specific business activities.

For an efficient transition, the challenge will be to find the right balance between protecting legitimate societal concerns and allowing new dynamism in mature sectors. The emphasis should thus be on finding ways to remove barriers that discriminate needlessly against new entrants which are testing disruptive ideas and contesting incumbents.

4. Areas where a too-narrow focus on competition needs to be discussed

Focusing solely on defending competition might, in the presence of strong market failures, aggravate misallocations. In this section, we discuss cases in which public intervention in competition might improve resource allocation during the transition.

4.1. Some green innovation might justify temporary competition derogations

Because innovation is so crucial in the transition, the wider competition framework should be calibrated to make good use of the entrepreneurial innovation machine. But prioritising more and better innovation over lower mark-ups in competition policy is easier said than done32.

This is best illustrated by the century-old academic debate on whether patents are a good tool to balance competition and innovation. While economists have learnt a lot about the dimensions and drivers of the trade-off in terms of the cost of patent protection and impact on innovation33, there is still no consensus on an efficient toolbox (Scotchmer, 1991, 2004; OECD, 2004; Dosi et al 2006; Boldrin and Levine, 2008; Henry and Stigliz, 2010; Haskel and Westlake, 2018).

A more recent question relates to the innovation-competition trade-off when assessing the desirability of acquisitions of small innovators by incumbents. In some cases, these might be ‘killer acquisitions’ that destroy potential innovative disruptors.

In other cases, it might be the best way to quickly scale up a new solution or to encourage entrepreneurs to innovate in the first place. Hence, if acquisition by an incumbent helps to scale-up green solutions rapidly, the environmental benefits might be worth safeguarding.

Another example of the competition/green-innovation trade-off is innovation cooperation between companies. The incentives to invest in innovation might be sub-optimal for companies in complex value chains.

It is much easier for a company to justify investment in a marginal improvement to its current contribution to the existing system (say a combustion engine cylinder) than in a more sustainable new system (electromobility).

In the transition, such cases are not unimportant. As noted by IEA (2020), “low-carbon electricity systems are characterized by increasingly complex interactions of different technologies with different functions in order to ensure reliable supply at all times,” placing a premium on collaborative research between different partners, stretching well beyond partners in the energy field.

While there is scant evidence on the role of collaborative research in the energy sector, the work that does exist suggests government intervention can facilitate collaboration34.

EU initiatives such as the Fuel Cells and Hydrogen Joint Undertaking or the Battery Alliance offer the participating companies some shield against competition authorities’ claims of anticompetitive collusion.

These examples show that the competition/innovation trade-off is particularly complex and getting it right is particularly rewarding. In fact, there is little discussion in the academic literature about whether it is possible and desirable to discriminate in the innovation-competition trade-off between societally useful (‘green’) and detrimental (‘brown’) innovation.

Nevertheless, it is clear that an over-strong focus on static efficiency is suboptimal. Competition policymakers should in general emphasise dynamic effects more – which depending on the case can imply either a more permissive or more restrictive stance.

4.2. Investment in new systems might require cooperation between potential competitors

The transition will require the quick deployment of new productive systems, in the circular economy or multimodal transport, for example. Coordination by companies to develop new sustainable systems will be necessary in the innovation stage, and also when coordinating investments in emerging systems to overcome chicken-and-egg problems.

Current coordination structures might go a long way in allowing the coordination/synchronisation of significant capital investment, but it should not be excluded that in specific cases more exclusive forms of cooperation will be required to enable investments in new systems.

One illustrative example of the high capital-specificity of new system investments is the complementarity of a hydrogen-based steel-plant, a hydrogen transmission system, and electrolysers. None of the three elements are useful without the others.

Each player in one part of the value chain might have an incentive to look for more economic partners once the system is established, but no partner would invest if it were worried that the other partners might switch once the system is running.

Hence, the investment might only go ahead if partners sign watertight long-term exclusive cooperation agreements, or even form an exclusive joint venture. Sector regulation and competition policy need to provide a framework to encourage such systems to emerge, with the proviso that they are eventually opened up to competition after companies manage to recover their capital costs.

In this, and other cases of investment in new systems, temporary exemptions should be considered to rules that were developed to protect competition in mature sectors.

4.3. Some ‘green efficiencies’ might trump competition concerns

Competition policy already has tools to protect ‘green competition’, by treating green as a quality (see section 3). But consumers do not always demand sustainable products35.

In such cases, competition does not drive green progress – firms have little incentive to invest in costly clean-ups. Worse still, in markets where consumers care primarily about prices, firms may have little choice but to adopt the dirtiest production processes.

There might thus be cases when reducing competition (eg. through mergers and acquisitions) might have positive environmental effects. For example, a merger of an emerging company with a clean technology and an incumbent with a dirty technology could allow the clean technology company to develop faster based on the incumbent company’s infrastructure.

Competition authorities might therefore have to rule on behaviours that are good for the environment but otherwise anti-competitive36. EU competition policy is asymmetric in its analysis of harmful and beneficial effects.

Beneficial effects, or ‘efficiencies’, are typically only considered in the second stage of a two-step process, while harmful effects are considered in the first step. In the first step, the European Commission assesses whether the agreement, merger or behaviour restrains competition.

If the action raises competition concerns then, in a second step, the Commission examines potential efficiencies. The burden of proof is on the companies to show that the improvements offset the anti-competitive restrictions – the so-called efficiency defence.

In practice however, efficiency arguments are largely ignored, the Commission having set demanding requirements which are rarely met in practice.

Competition authorities must identify if a merger between and clean-tech company and an incumbent ‘dirty’ tech company is a killer acquisition to destroy a new green competitor, an acquisition that primarily aims to consolidate market shares, or an acquisition that will serve the faster deployment of the environmental technologies developed by the emerging company.

As the future business model of the merged company (brown or green) is unknown to the competition authority, this might be resolved partly by attaching conditions and obligations to such an acquisition. In our example, this might be a specified share of clean technology sales in the overall sales of the new company.

4.4. Global market imperfections might require protection for European companies

Some countries, notably China and Russia, seek to ensure that in some sectors their companies do not compete or do even collaborate on foreign markets (Monopolkommission, 2020, p.18). They also do not give foreign companies full access to their markets (Monopolkommission, 2020, p.15).

Moreover, countries like China provide implicit or explicit subsidies to certain companies in international competition (Monopolkommission, 2020).

This can lead to foreign companies operating in Europe securing larger markets, greater scale efficiencies, higher profits and hence more funds for further expansion. This might result in European companies facing an unfair disadvantage in sectors that are crucial for the transition.

And as the transition will alter the determinants of competitiveness in many industries (eg increasing demand for specific skills, capital or low cost renewables), countries that manage to establish agglomeration effects in new industries most effectively might benefit from such industrial policy for a long time.

A much quoted, but also disputed example is the active Chinese support for its photovoltaic panel industry (Goron, 2018). It has been argued that the subsidised Chinese industry has killed off its European competitors through dumping.

As a remedy, there are calls for national champions to be supported in the EU to level the playing field. Most prominently, the creation of Airbus and the proposed Alstom/Siemens merger were justified on the basis that they would strengthen European companies in international competition for aviation/rail-technology37.

In fact, Motta and Peitz (2019) pointed out that EU merger control can allow the formation of European champions if companies can show that efficiency gains (synergies and complementarities) outweigh anti-competitive effects in terms of higher prices and less choice in the short term, and less investment, innovation and quality in the long term.

“But in the Siemens/Alstom case, there is no public information that points to such synergies, and the European Commission stated that the parties have not substantiated any such efficiency claims”, Motta and Peitz (2019) added.

But how should the EU then react to unfair market practices by foreign companies? In crossborder trade, European undertakings are already protected by anti-dumping and anti-subsidy instruments.

However, such measures – as in the case of Chinese solar panels – are complicated by internal divisions inside the EU, the threat of retaliation and their focus on narrow product categories (Goron, 2018).

The first-best approach would be for EU’s competition authorities to continue to build partnerships with foreign antitrust institutions, preferably in the context of trade agreements, which have chapters on competition policy38.

But this long-term approach will be continuously challenged by incentives to deviate. As an alternative to solving unfair global competition challenges by resorting to the inefficiencies of national champions, Motta and Peitz (2019) proposed “preventive intervention – such as excluding from tenders non-EU firms suspected of engaging in such behaviour – or with having to resort to anti-dumping provisions.”

The sustainability dimension will further complicate the already almost insoluble issue of ensuring a sufficiently level playing field between companies from different economic systems.

4.5. Resolving uncertainty about competition law treatment might promote investment

An efficient transition will likely be characterised by the development of new business models and new company ecosystems with new networks of contractual regulations between companies (see section 3.4).

Regulatory and competition agencies will require time and experience to identify which of those are helpful or innocent, and which might substantially reduce competition. This might create substantial uncertainty on the part of companies and hence might delay the transition.

In principle, temporary and targeted deviations from rules that protect competition in mature sectors should be allowed if those rules would have unduly complicated the emergence of new systems. Such regulatory holidays could act as innovation incentives similar to patents and could be compatible with later regulation, thereby preventing long-run monopolistic exploitation (Choi, 2011).

Gans and King (2003) set out conditions under which access holidays can increase investment incentives for innovative infrastructure. Simulations by Nitsche and Wiethaus (2011) confirmed increased investment incentives.

However, there are two commitment issues for regulatory holidays: first, that regulation will actually come at the stipulated date (or incident); second, that regulation will not come before that date. However, breaking the latter commitment and installing regulation may itself take time, meaning the commitment period is implicitly assured.

This potentially long lag will have to be traded off against the danger that the firm building the new market may gain a long-lasting first-mover advantage (Briglauer, 2014).

5. Making competition fruitful for the transition

We have provided examples of how the transition will affect the ability of markets to allocate resources efficiently, and how competition policy can help but also obstruct efficient resource allocation in the transition.

From this, it should be quite clear that policy frameworks will need to be adjusted to ensure economic actors have the right incentives to efficiently reallocate resources in line with the transition. It is most important to address the environmental externality directly and effectively through carbon pricing.

But the multitude of overlapping market and government failures implies that a carbon price alone will not be enough for an efficient transition.

In the following we discuss which shifts in policy frameworks would be effective in guiding resource allocation in the transition, from the least intrusive to the most intrusive.

5.1. Adjusting competition rules and enforcement

Competition rules are devised primarily to address the strategic behaviour of companies with market power that results in inefficient allocation of resources.

The EU Treaty gives EU competition authorities39 the power to prohibit cartels, to punish or prevent abusive practices by powerful firms, and to block mergers that threaten to significantly reduce competition40. But competition policy tools interact with other externalities.

In the course of their work, competition authorities may find that some ostensibly anti-competitive practices have environmental benefits. An industry-wide agreement to phase out energy-intensive washing-machines may restrict competition, for example, but lead to reduced carbon emissions.

Conversely, competition authorities may find some industrial actions acceptable on pure competition grounds, but alarming for environmental reasons. They could, for instance, be called to rule on an acquisition by a dirty incumbent that wants to delay greening its production process by eliminating a competitor that exerts little competitive pressure but has green potential.

A common misconception is that the EU competition framework is directed solely towards maximising the welfare of consumers defined in terms of allocative efficiency41 and measured through prices.

According to this understanding, competition enforcers would be bound to making the decision that secures the lowest price (or highest quantity) for consumers, regardless of non-price concerns such as the environment42.

But as the EU Court of Justice has made clear that “the competition rules were aimed at protecting not only the interests of competitors or of consumers, but also the structure of the market and, in so doing, competition as such.”43.

Non-economic factors may and have been relevant to competition decisions, most notably the integration of national markets into a single European market44.

More generally, and as noted by the legal scholar Giorgio Monti (2007), “to date no competition authority has deployed competition law in accordance with one unchanging set of aims – the goals of antitrust vary over time; even at the same time, the law can be pursuing different, even mutually contradictory, goals.”

Issues of law are at the sole discretion of the EU courts (the General Court and the EU Court of Justice), which enjoy full judicial review (Ibáñez Colomo, 2018).

So where does environmental protection stand? Can EU competition enforcers pursue sustainability as one of their legitimate aims? As Kingston (2012) and others45 have argued, from a legal standpoint the answer is yes.

The Treaty on the Functioning of the European Union (TFEU) states: “the Union shall ensure consistency between its policies and activities, taking all of its objectives into account” (Article 7 TFEU).

Environmental protection has featured prominently among the EU’s policies since long before the European Green Deal. Article 11 TFEU says that “environmental protection requirements must be integrated into the definition and implementation of the Union’s policies and activities, in particular with a view to promoting sustainable development.”

The question therefore is not so much whether but how competition policy can serve the EU’s environmental goals.

Protect competition

The main task of competition policy is to protect competition in both green and non-green sectors. In general, this will remain the most important task for competition policy, which will help make best use of the resources needed for a socially viable transition.

Sharpen existing tools to take into account sustainability in competition decisions

As we have argued, competition enforcement and sustainability are not opposing aims, but they interact strongly on a case-by-case basis, sometimes in a complementary way, sometimes not.

Considering the environmental performance of products and services as a quality and assessing whether a competition case might lead to reduced quality will mean taking into account sustainability concerns.

Accepting ‘efficiency defence’ arguments in competition cases, in particular when there are clear benefits in terms of resource use, is another element of a sustainability-friendly competition policy.

But marginal sustainability gains should not provide carte blanche for companies to engage in anticompetitive behaviour at the detriment of all-economy resource allocation. Hence, the assessment will remain an exercise in the weighting of the arguments – with more visibility of the sustainability effects.

On other important elements of competition policy enforcement, such as market definition46 (eg. are green acquisition targets in the same sector as the brown acquirer?) or the test applied for the anticompetitive effects of mergers (eg. in complex emerging value chains), the effects in terms of efficient resource allocation in the transition should be assessed and monitored.

But before competition authorities are asked to consider such effects in their decisions, a better theoretical understanding is needed.

Legal certainty

As the transition must be fast, waiting for legal clarity on new business models and corporations might take too much time. Existing law provides various instruments at European and national level to ensure legal certainty in cases of uncertainty over new arrangements.

At European level, these instruments include:

~‘No infringement’ decisions pursuant to Article 10 of Council Regulation (EC) No 1/2003, by which the European Commission can decide that Article 101 TFEU and/ or Article 102 TFEU does not apply to certain commercial practices if the “Community public interest […] so requires”, and

~Informal guidance letters that the European Commission can publish in the case of novel questions in individual cases.

Competition authorities should consider using these tools more for cases in which some tight coordination is needed for a limited period of time and a credible vision of a competitive market after this phase is provided.

Sector inquiry on new sectors

Some sectors that are extremely relevant for the transition, including electricity, circular economy sectors and shared mobility, are developing or changing fast and developing new forms of interaction between companies.

This is much needed, but also carries risk in terms of monopolisation that might become a problem at later stages of the transition. To provide guidance (some metrics for critical concentration levels or undue practices) but also comfort to innocent developments, sector inquiries and/or benchmarking analysis should be conducted as per Article 17 of Regulation (EC) No 1/2003.

Improve competition authority capacity

The expected changes in economic organisation during the transition – in particular the increasing role of networks, systems and platforms – will require substantial legal and economics expertise in order to reach robust and speedy analysis and decisions. Accordingly, it will be important to strengthen the capacity of competition authorities in these complex areas47.

5.2. Designing markets

Many of the sectors relevant for the transition have characteristics (network effects, scale and scope economies, platform effects, high capital specificity) that imply that unregulated markets either under-invest in socially desirable capital (eg. back-up capacities) or that market concentration makes resource allocation inefficient.

To produce efficient results, market rules need to be put in place that give market actors incentives that are aligned with maximising citizens’ welfare. This is easier said than done, as the decade-long series of reforms of the electricity market design has shown. But there is no way to benefit from the power of competition in the internal market in these sectors other than designing robust markets.

As each network/platform technology creates different challenges to be addressed by regulators and competition authorities, and each industry presents specific problems, this is not the place to provide specific recommendations. Some more generic recommendations can be given however to illustrate some of the trade-offs:

1) New vs. old sectors: It might make sense to discriminate between emerging sectors where chicken-and-egg issues require strong coordination of investments, and more mature sectors. But again, any exemption to infrastructure access or unbundling rules48 should be subject to clear sunset dates and a plan for how competition will be eventually protected.

2) National vs. European market designs: There is a trade-off between using the efficiency of the internal market and enabling effective national climate policies. This will remain a tension throughout the transition. This trade-off is better addressed through well-balanced initial policy design than by leaving it to state aid rules and their interpretation49. One solution is policies that tolerate periods of national support whilst pushing convergence to the first-best outcome of European integration.

3) Regulating access to new networks or not: Network and platform rules are important elements for new smart solutions in energy and mobility. Opening new networks to competitors might discourage investments, while not opening them might prevent virtuous competition. It is crucial that rules do not allow an incontestable position to emerge. For network rules, the UK’s Furman Review (Furman et al 2019) recommended measures including inter-operability50 and data openness as part of a regulatory framework that shapes the market.

4) System vs. company competition: In industries with competing networks (electric vs. hydrogen vehicles; district vs. individual electric heating; ride-sharing vs. public transport), having several systems compete (some even government driven) while trying to ensure that this system competition is based on merit rather than incumbent market power, might initially be enough competition. When one system prevails, however, it might become relevant to determine access conditions/interfaces, and to require unbundling.

5) Policy experimentation51: temporarily giving differentiated permissive rules in specific geographical areas (eg. not enforcing unbundling of hydrogen networks in Catalonia), when this serves to test a credible hypothesis on why this could be a useful approach, and closely monitoring the effects, might be a way to learn more quickly what works and what does not.

This illustrates how multifaceted and complex, but also path-prescribing, market design questions will be. But unregulated/unmonitored self-organisation risks running into problems, and companies might hence in anticipated obedience not try promising ideas at all.

Accordingly, EU countries and the EU will need to invest political capital in determining the playing field for competition in these sectors, which are so crucial for decarbonisation.

5.3. Direct state control

The economics in some sectors make it very difficult to engineer virtuous competition between companies, even with sophisticated market rules. Moreover, it is difficult to design markets so they produce the distributional results and resource allocation that are desired politically.

As the assessment on the balance of imperfections of markets, trust in indirect tools to address them and the imperfections of direct public management differ between countries and change over time, there are very different levels in EU countries of state ownership in some sectors, and also clear ups and downs in these shares over time.

Different developments in the energy sector, which remained state-controlled in France and went from liberalisation in the 1990s in Germany to some re-nationalisation in the 2010s, is a striking example.

And state control in specific sectors is not binary. It can range from (i) very light touch provision of company coordinating services, such as EU industrial alliances, that actually even shield companies against certain policies, (ii) via medium-level interventions such as strong regulation of the activities of private companies through specific agencies, public-private partnerships and minority shareholdings, to (iii) very heavy-handed direct control through majority shareholding in essential companies (eg. platforms or network providers), or even complete value chains (electricity and rail sectors in several EU countries).

Again, the optimal balance will be case-specific as countries and sectors differ markedly – and this is not the place to provide a comprehensive list of specific recommendations. However, a few selected considerations illustrate the complexity of the trade-offs:

~Public-body coordination: One approach would be to allow governments to take some temporary coordination role (as for example tried with EU industrial alliances) – but very often those protect incumbents.

~Regulation: Since a regulatory agency can never be completely independent of political influences, its mandate can shift from providing a solution to market failures to becoming an instrument for the protection of incumbents. Regulation can thus become a barrier against technological change and can create inefficient path dependence and reduce dynamic competition. Moreover, domestic regulatory initiatives in a context in which services are often supra-national in scope, are unlikely to lead to efficient outcomes.

~Public financing: providing public financing especially thorough public banks in ways that enable additional efficient investments in sustainable projects, requires this financing to be used to overcome well-defined market failures. Hence public finance might be less useful in reasonably competitive segments with limited externalities (eg mature renewables).

~State control: Direct control over decisions (‘build X nuclear power plants by 20XX!’) can be an advantage in speeding up the transition, but public companies’ incentives are often less-well aligned with minimising resource misallocation.

~Fiscal rules: If public budgets are credit-constrained by fiscal rules, direct forms of state control (through public companies) might be more difficult.

The balance of the advantages and disadvantages of different forms of state control is a never-ending policy discussion. But the role of competition in the transition cannot be discussed without noting that the need for an efficient transition will require a reassessment of arguments.

This discussion has clearly started in practice in specific cases (eg. re-nationalisation of energy networks in Germany), but it requires a more comprehensive framework.

6. Conclusion

Competition and carbon pricing remain key for an efficient transition

Markets will play a central role in the EU’s transition to carbon neutrality. Efficiency of resource allocation between sectors is crucial to chart a least-cost route to net zero.

Products, services and underlying sectors will undergo abrupt and significant reshaping. The challenge for policy is to adapt dynamically to evolving circumstances, creating the framework to ensure effective allocation of labour and capital.

On balance, the urgency of the climate transition does not alter the broad principle that free markets are good for achieving efficient resource allocation. Competition must continue to be supported, particularly with the goal of spurring innovation.

This should take place within an underlying framework of progressively more ambitious carbon pricing, which remains the most effective tool for addressing the principal market failure – that of mispriced carbon emissions.

Efficient allocation in the transition will require well-designed markets

However, carbon pricing alone will not efficiently allocate resources because of a number of further externalities, or market failures. There are therefore compelling cases for public intervention to improve resource allocation.

The main challenge will be designing markets for new network industries, including hydrogen, smart grids, the circular economy and multi-modal transport. In all these areas there are efficiency gains to be had from economies of scale and/or scope.

A careful balance needs to be struck between allowing coordination of competitors in a sector in order to develop new integrated systems, and potentially even permitting a certain degree of market power to encourage them to make initial investments, while proving longer-term robust protection against abuse of this power.

Policy framework should focus on enabling innovation

As Europe peers over the precipice of rapid energy-system change, it is not clear whether all member states will move in the same direction in terms of technology and policy choices.

Moving together would provide valuable efficiency gains, but diverging paths would permit greater adherence to national political preferences and, importantly, could offer valuable experimentation on what technologies and policies work well, and which don’t.

In this and other cases there are trade-offs between pushing for innovation outcomes and sacrificing short-term (sometimes green) gains. The benefits of providing innovative green solutions to the rest of the world means we take the view that in cases of conflict, policy should err on the side of innovation.

Running through the veins of policy must remain the mantra of ‘allowing failure’. A large body of literature in the Schumpeterian tradition finds empirical evidence for positive effects of exit or firm turnover on growth (Comin and Mulani, 2005; Aghion and Howitt, 2006; Fogel et al 2006).

While companies are very good at stopping failing projects, politicians are less so. Failure should not only be tolerated but expected.

A discussion is needed on how to ensure efficient resource allocation in the transition

Economic models that assume perfect market outcomes and flawless government decisions already demonstrate that the low-carbon transition implies substantial challenges for jobs, growth and welfare.

If on top of this, an inappropriate institutional framework leads to very inefficient resource allocation, the corresponding cost might make the transition politically unmanageable.

As the EU and its members are now committed to ambitious climate targets and the necessary changes in production and consumption become clearer, it is high time to discuss which fundamental reforms are needed to ensure that the institutional framework that guides resource allocation in the transition is up to challenge.

There are no easy answers on how to organise sectors so that they use the benefits from competition, while minimising detrimental rent-seeking behaviour. But, an efficient transition will, depending on the sector require revised competition rules, redesigned markets and recalibrated roles for the state and the private sector.

Annex. Consumer preference for green

For competition authorities, actual consumption behaviour matters more than intentions. Analyses (and most notably market definitions), are based largely on past consumption data, ie. revealed preferences.

This includes data from the market under study, or, if such data does not exist (for instance because the market does not exist), econometric techniques can help estimate consumers’ preferences based on information gleaned from other markets (eg. the travel cost method).

When revealed preferences can neither be observed nor estimated, competition authorities conduct surveys to gauge consumers’ intended behaviour in hypothetical markets, ie. their stated preferences. But even there, survey questions and choice situations are designed to elicit consumption decisions as if they were in real markets (Lianos, 2018).

So, are consumers’ green intentions reflected in their actual purchase choices? On aggregate, yes. A French study estimated that 44 percent of consumers are “significantly engaged” in sustainable consumption (l’ObSoCo, 2020). This group of consumers is composed of three sociological types for whom environmental considerations largely guide consumption and lifestyle choices52.

Overall, French consumers give themselves 6.7 out of 10 when asked to grade the extent to which they consider the environmental impact of their shopping choices (l’ObSoCo, 2020). Climate Neutral Group (2018) found that 50% of respondents to a Dutch survey indicated that they purchase climate-neutral products53. In Italy, 26 percent of families purchase at least one organic product (which is generally less carbon-intensive) per week (ITC, 2019).

The trend is also positive. In the Netherlands, sustainable food accounted for 14 percent of all food purchases in 2019, up from 6 percent in 201354. In 2018, 21.5 million Italian families (81 percent) purchased at least one organic product, a 5 percent increase from just a year before.

A survey of retailers in the five largest EU markets finds that 85 percent increased their sales of sustainable products in the five years leading up to 2019 (ITC, 2019)55. The great majority (92 percent) of these surveyed retailers expected sales of sustainable products to increase in the next five years, with around three-quarters of these companies expecting the growth to exceed 10 percent (ITC, 2019). French young adults are much more environmentally conscious than previous generations (l’ObSoCo, 2020).

There are however signs of polarisation, and of possible entrenchment. The share of Germans that declare themselves fully willing to pay more for green products has increased in the last five years, from 6 percent to 8 percent. But so has the share declaring themselves not at all willing to pay more for green products (from 14 percent to 15 percent)56.

The l’ObSoCo study found that in France, values and political affiliation are the most important predictor of sustainable consumption; not classic demographic characteristics (eg income, education, location). Given the tendency of people to cluster around values, those that care more about sustainability will find themselves comforted by their choices, while those uninterested in sustainability will be subject to little pressure to change.

Such polarisation gives a political dimension to competition decisions that prioritise one group over another, raising questions of legitimacy on the part of unelected competition officials (see section 4).

And while most consumers care about sustainability, they care even more about price. The l’ObSoCo study found that sustainability considerations do not ultimately drive purchase decisions. Price is much more important.

Sustainability trails behind price and other features that directly benefit consumers such as taste, performance and aesthetic quality. Price is one of the three most important factors when choosing which food products to buy for 62 percent of respondents.

Environmental consideration makes it to the top three for only 29 percent of those surveyed. The different is even more significant for non-food products (71 percent and 25 percent).

Similarly, in the Netherlands, a survey found that environmental impact is a deciding purchasing factor for only 6 percent of respondents57. Only 8 percent of surveyed Germans declared themselves fully willing to pay more for green products58.

Endnotes

1. Throughout, the term ‘transition’ refers to the process of transition to a climate-neutral economy.

2. Benchmarking is very difficult because it is very hard to control for all the idiosyncrasies of different systems. In the energy sector, with its quickly changing regulatory and market conditions, there are abundant examples of projects that completely failed: eg. German coal plants (Moorburg, Datteln) that were built but never entered into operation; the Montalto di Castro, Stendal and other nuclear power plant projects that were abandoned. Moreover, some large energy projects turn out to be unprofitable, such as the big third generation reactor projects in Finland and Flamanville, which had huge cost overruns.

3. This environmental externality is not restricted to greenhouse gases. Concepts such as ‘natural capital’ try to introduce environmental factors better into economic analysis. See for example https://www.ons.gov.uk/economy/environmentalaccounts/methodologies/naturalcapital.

4. Desruelle et al (1996) argued that the complementarities between different components of systems lead to a form of network effects.

5. For a comprehensive analysis see https://ec.europa.eu/competition-policy/system/files/2021-06/kd0521173enn_EEAG_revision_2021_0.pdf.

6. For an estimate, see PACE (2021).

7. This would be competition for ownership of the infrastructure (‘for the market’ competition), rather than actually between competing construction projects (‘in the market’ competition).

8. If using heat-pumps is cheaper for affluent households than connecting to district heating, similar effects might also arise there.

9 See https://voxeu.org/article/us-firms-market-power-has-declined-due-import-competition

10. See https://ec.europa.eu/commission/presscorner/detail/en/IP_21_3541

11. “Average emission intensity of the 10 per cent worst performing EU installations for that type of goods” https://ec.europa.eu/info/sites/default/files/carbon_border_adjustment_mechanism_0.pdf p.67.

12. European Commission (2016, p.156) showed how concentrated markets in steel, cement and refineries in the EU are.

13. On the other hand, if CBAM is used to reduce the free allocation of allowances, the corresponding distortions of international competition might make the international division of labour more efficient.

14. To minimise this risk, the EU wants to set up a CBAM system that is compatible with the rules of the World Trade Organisation.

15. This is often forgotten in modelling exercises that expect efficient government policies.

16. They, for example, make unavoidable mistakes, such as supporting the development of technologies that do not perform, like companies, but they are often worse at stopping them.

17. This depends on the ability of companies to pass through the carbon cost to product prices, which is relatively high in ETS sectors.