Taxing the wealthy

Spencer Bastani is Professor of Economics at the Institute for Evaluation of Labour Market and Education Policy, and Daniel Waldenström is Professor of Economics Research at the Institute of Industrial Economics (IFN)

The search for optimal taxation of the wealthy is central to the fiscal policy debate, reflecting broader concerns about inequality, economic growth, and social welfare. Previous studies, including Saez and Stantcheva (2018), Cnossen and Jacobs (2020), Scheuer and Slemrod (2021), Boadway and Pestieau (2021), and Guvenen et al (2023), have explored the benefits and limitations of various tax strategies aimed at reducing wealth inequality.

These studies underscore the delicate balance required in tax-system design to reconcile redistributive goals with economic growth and highlight the complex trade-offs between taxing capital income and wealth.

Comparing wealth and capital taxes to tax the rich

Wealth taxes, which tax the stock of wealth itself, have been studied for their potential to address unrealised capital gains – a significant but often untaxed component of wealth accumulation among the wealthiest individuals.

Capital income taxes, which target investment income such as dividends, interest, and capital gains, are instead advocated for their direct approach to taxing the economic benefits derived from wealth.

In our recent study (Bastani and Waldenström 2023), we compare wealth and capital income taxes to assess their effectiveness in taxing the rich (see also Slemrod and Chen 2023 and Piketty et al 2023). Our analysis reviews theoretical insights, empirical evidence, and practical considerations to examine the conditions under which wealth taxes could be an effective complement to capital income taxes.

Conceptual issues regarding taxing capital income and wealth

The economic literature offers arguments both for and against the taxation of capital and, in particular, the use of capital income or wealth taxes.

A central argument against capital taxation is that it distorts the intertemporal allocation of consumption and physical investment, thereby hampering capital accumulation and possibly long-run growth. Proponents of capital taxes emphasise that they allow for both more and less distortionary redistribution than if labour income alone were taxed, as well as a more effective way of taxing economic rents.

The central theoretical motivation for a wealth tax is to reduce the incompleteness of the tax code when it comes to taxing unrealised capital gains, which can be enormous in advanced economies. A wealth tax would be levied regardless of any voluntary realisations and could thus broaden the overall tax base and enhance redistribution.

However, it is clear that a wealth tax can lead to inefficient or inequitable outcomes precisely because it ignores actual cash flows. A wealth tax becomes difficult for anyone who owns illiquid assets or assets with uncertain valuations that do not generate regular cash flows, such as houses, works of art, and shares in unlisted companies, especially start-ups.

Our analysis reconciles theoretical arguments and past experience with capital income and wealth taxation in the Western world. The previous research literature is not extensive, and most empirical analyses can only examine the short-term reporting effects of these taxes rather than their long-term effects on capital accumulation and economic growth.

The main message is that fair and workable taxation of the rich requires a balance between economic ideals and practical realities

The problematic wealth tax

A first-pass sanity check on the usefulness of capital income and wealth taxes is how widely they are practised among today’s countries. It turns out that capital income taxes account for the vast majority of capital tax revenues, led by the corporate income tax (about half of all capital taxes).

By contrast, wealth taxes are rare and have been abolished in almost all countries that previously used them. The motivations for abolishing wealth taxes are the same everywhere: difficulty of implementation, economic inefficiencies, valuation problems, unequal treatment of different types of assets, and liquidity problems in paying the tax (Bastani and Waldenström 2020a, 2020b, Schmidheiny et al 2019, Brühlhart et al 2022).

The imposition of wealth taxes disproportionately affects owners of closely held businesses, especially in growth sectors, where asset valuations are both large and volatile. The resulting liquidity squeeze during economic downturns often forces the sale of assets or the incurrence of debt, undermining the viability of the wealth tax.

In response to these problems, many countries have attempted to provide valuation discounts or special tax rate schedules for closely held businesses, not infrequently family businesses. But because many of these firms are quite large, the exemptions introduced regressive elements into the tax code that provoked protests from non-exempt, moderately wealthy taxpayers, further undermining political support for the wealth tax.

Evidence from Sweden: the concentration of corporate capital at the top

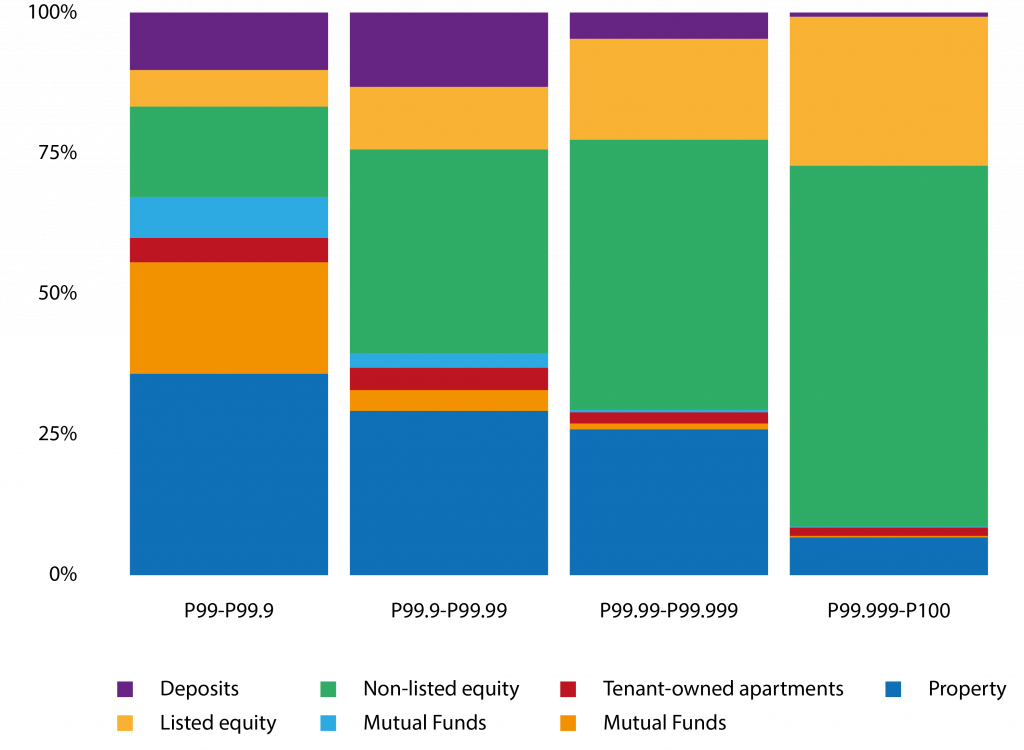

Using Swedish registry data, we examine the wealth composition of the top percentile and the distributive effects of different wealth and capital income tax systems.

Figure 1 provides a detailed look at the composition of wealth within the richest percentile of the household wealth distribution. The results show that the wealth of the rich is predominantly tied up in corporate equity, especially in privately held companies, with other assets such as real estate and financial instruments making up a smaller portion of their portfolios.

This composition underscores the complexity of effectively taxing the rich through wealth taxation without inadvertently affecting the broader economy.

Figure 1. Wealth composition of the rich: the top wealth percentile

Source: Bastani and Waldenström (2023, Figure 2).

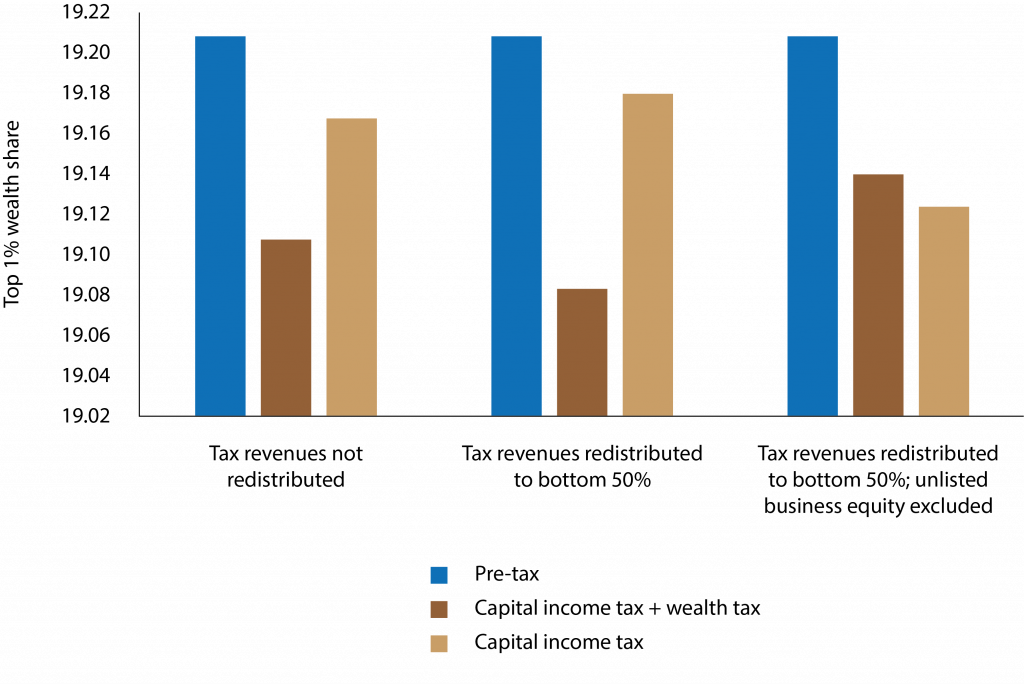

We also simulate the distributional consequences of introducing a 1% wealth tax on household net wealth for the Swedish adult wealth distribution. The wealth tax is added to the current capital income tax, and we compare it to a situation where we instead increase the capital income tax to match the additional revenue generated by the wealth tax. Because we assume no effects on asset prices, saving, or portfolio composition in this simple exercise, the results should be interpreted with caution.

Figure 2 shows the wealth share of the top 1% in three different situations: (1) when tax revenues are not redistributed at all (think of this as the government building statues for the money); (2) revenues are redistributed per capita to everyone in the bottom half of the wealth distribution; and (3) revenues are redistributed as in (2) but the wealth tax base now excludes all assets in unlisted corporations, which has been the going standard in wealth tax regimes.

Adding a wealth tax, in addition to having a revenue-equivalent capital income tax, equalises the distribution regardless of whether the revenue is redistributed progressively or not. However, the results are reversed if unlisted corporate equity is excluded from the tax base.

Figure 2. Distributional impact of wealth composition of the rich: the top wealth percentile

Source: Bastani and Waldenström (2023, Figure 4).

Conclusion: balancing economic ideals with practical realities

Our discussion of wealth and capital income taxation is embedded in a larger discourse on the role of fiscal policy in promoting equitable economic growth.

Through a detailed comparison of wealth and capital income taxes, this column discusses how fiscal instruments can be used to mitigate disparities in wealth accumulation. The main message is that fair and workable taxation of the rich requires a balance between economic ideals and practical realities, an insight that sometimes receives insufficient attention in the current discourse on wealth taxation.

References

Bastani, S, and D Waldenström (2020a), “How should capital be taxed?”, Journal of Economic Surveys 34(4): 812–46.

Bastani, S, and D Waldenström (2020b), “Capital taxation: A survey of the evidence”, VoxEU.org, 2 November.

Bastani, S, and D Waldenström (2023), “Taxing the wealthy: The choice between wealth and capital income taxation”, Oxford Review of Economic Policy 39: 604–16.

Boadway, R, and P Pestieau (2021), “An annual wealth tax: Pros and cons”, FinanzArchiv: European Journal of Public Finance 77(4): 408–29.

Brülhart, M, J Gruber, M Krapf, and K Schmidheiny (2022), “Behavioral responses to wealth taxes: Evidence from Switzerland”, American Economic Journal: Economic Policy 14(4): 111–50.

Cnossen, S, and B Jacobs (eds) (2020), Tax by design for the Netherlands, Oxford University Press.

Güçeri, I, and J Slemrod (2023), “Taxing the rich (more)”, Oxford Review of Economic Policy 39(3): 399–405.

Guvenen, F, K Kambourov, B Kuruscu, S Ocampo, and D Chen (2023), “Use it or lose it: Efficiency and redistributional effects of wealth taxation”, Quarterly Journal of Economics 138(2): 835–94.

Scheuer, F, and J Slemrod (2021), “Taxing our wealth”, Journal of Economic Perspectives 35(1): 207–30.

Slemrod, J, and X Chen (2023), “Are capital gains the Achilles’ heel of taxing the rich?”, Oxford Review of Economic Policy 39(3): 592–603.

Piketty, T, J Saez, and G Zucman (2023), “Rethinking capital and wealth taxation”, Oxford Review of Economic Policy 39(3): 575–91.

Saez, E, and S Stantcheva (2018), “A simpler theory of optimal capital taxation”, Journal of Public Economics 162: 120–42.

Schmidheiny, K, J Gruber, M Krapf, and M Brülhart (2019), “Wealth taxation: The Swiss experience”, VoxEU.org, 23 December.

This article was originally published on VoxEU.org.