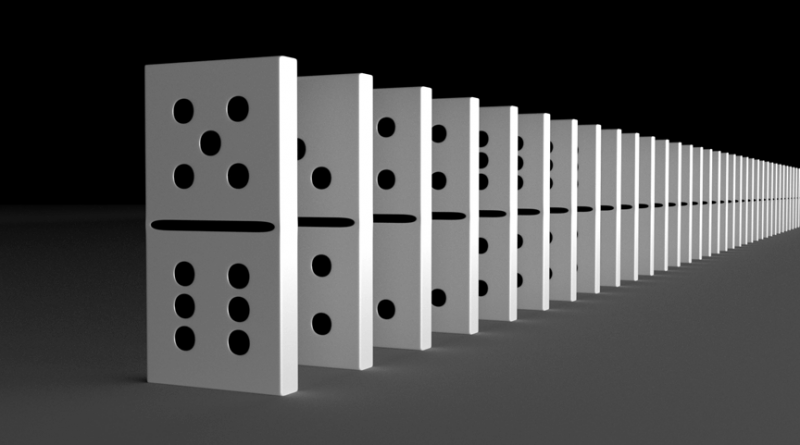

Crypto dominoes

Fabio Panetta is a member of the ECB’s Executive Board

I will discuss cryptoassets and the destiny of digital finance. When I last spoke about crypto finance at Columbia University last April, I likened it to the Wild West and warned about the risks stemming from irrational exuberance among investors, negative externalities and the lack of regulation1.

Crypto markets have since witnessed a number of painful bankruptcies. The crypto dominos are falling, sending shockwaves through the entire crypto universe, including stablecoins and decentralised finance (DeFi)2.

The crash of TerraUSD, then the world’s third-largest stablecoin, and the recent bankruptcy of the leading crypto exchange FTX and 130 affiliated companies each took only a few days to unfold. This is not just a bubble that is bursting. It is like froth: multiple bubbles are bursting one after another.

Investors’ fear of missing out seems to have morphed into a fear of not getting out.

The sell-off is exposing those “swimming naked”3. It has laid bare some unbelievably poor business and governance practices across a number of crypto firms. It has revealed that some investors have been acting carelessly by investing blindly without proper due diligence. And similar to the sub-prime crisis, the crash has uncovered the interconnections and opaque structures within the crypto house of cards.

This is set to dampen enthusiasm in the belief that technology can free finance from scrutiny. The crash has served as a cautionary reminder that finance cannot be trustless and stable at the same time. Trust cannot be replaced by religious faith in an algorithm. It requires transparency, regulatory safeguards and scrutiny.

Does this mean we are witnessing the endgame for crypto? Probably not. People like to gamble. On horse races, football games and many other events. And some investors will continue to gamble by taking speculative positions on cryptoassets.

Today I will argue that the fundamental flaws of cryptoassets mean that they can quickly collapse when irrational exuberance subsides. We should therefore focus on protecting inexperienced investors and preserving the stability of the financial system.

Ensuring that cryptoassets are subject to adequate regulation and taxation is one path to achieving this. Here, we need to move rapidly from debate to decision and then implementation.

But even regulation will not be enough to address the shortcomings of cryptos. To harness the possibilities of digital technologies, we must provide solid foundations for the broader digital finance ecosystem.

This requires a risk-free and dependable digital settlement asset, which only central bank money can provide. And that is why the ECB is working on a digital euro while also considering new technologies for the future of wholesale settlement in central bank money.

Fundamental flaws in crypto finance

The philosophy behind cryptos is that digital technology can replace regulated intermediaries and avoid state ‘intrusion’. In other words, that it is possible to build a trustless but stable financial system based on technology.

This is just an illusion, as was clear from the outset and confirmed by recent developments. In fact, it is precisely the absence of regulation and public scrutiny that blinded investors to the risks involved, leading to the rise and subsequent fall of cryptoassets.

The risks associated with crypto finance stem from three fundamental flaws. I will address each of them in turn.

Unbacked cryptoassets offer no benefits to society

The main structural flaw of unbacked cryptoassets – which form the bulk of the crypto market – is that they do not offer any benefits to society.

Despite consuming a vast amount of human, financial and technological resources, unbacked cryptoassets do not perform any socially or economically useful function. They are not used for retail or wholesale payments – they are just too volatile and inefficient4.

They do not fund consumption or investment. They do not help fuel production. And they play no part in combating climate change. In fact, unbacked cryptoassets often do the exact opposite: they can cause huge amounts of environmental damage5. They are also widely used for criminal and terrorist activities, or to evade taxes6.

As a form of investment, unbacked cryptoassets lack any intrinsic value. They have no underlying claim: there is neither an issuer who is accountable and liable, nor are they backed by collateral. They are notional instruments, created using computing technology, which do not generate financial flows7 or use value for their holders. Therefore, their value cannot be estimated from future income discounted to the present, like for real and financial assets.

Unbacked cryptoassets cannot help to diversify portfolios. Recent developments show that their value does not increase when income becomes more valuable to consumers – such as in periods of high inflation or low growth. Cryptoassets are not digital gold.

Their price changes show increasing correlation with stock markets, with much higher volatility. And recent developments highlight their intrinsic instability: the first Bitcoin exchange-traded fund lost more on its price since its launch than any other that has been issued8.

Many investors have suffered significant losses from the crypto collapse and cannot expect any compensation. There are no insurance schemes. And in several instances, cryptoassets have been shown to offer little protection against IT and cyber risks9.

On the whole, it is difficult to see a justification for the existence of unbacked cryptoassets in the financial landscape. Their combined features mean that they are just speculative assets. Investors buy them with the sole objective of selling them on at a higher price. In fact, they are a gamble disguised as an investment asset.

Millions of investors were lured by an illusory narrative of ever-rising cryptoasset prices – a narrative that was fuelled by extensive news reports and investment advice on social media, highlighting past price increases and features such as artificial scarcity to create the fear of missing out. Many invested without understanding what they were buying10.

Irrational enthusiasm prospered on self-fulfilling expectations11: the textbook definition of a bubble. Like in a Ponzi scheme, such dynamics can only continue so long as a growing number of investors believe that prices will continue to increase. Until the enthusiasm vanishes and the bubble bursts.

The market value of cryptoassets has shrunk from €2.5 trillion at its peak a year ago to less than €1 trillion today. The price of Bitcoin12 has fallen by more than 70% from its peak.

Stablecoins are exposed to runs

The second structural flaw is the purported stability of stablecoins, which the entire crypto ecosystem has relied on to underpin trading in cryptoassets and liquidity provision in DeFi markets13.

Although stablecoins represent only a small part of the cryptoasset market14, crypto trading using Tether, the largest stablecoin, accounts for close to half of all trading on cryptoasset trading platforms (Chart 4)15.

Stablecoins appeal to users because it is claimed that, unlike unbacked cryptos, they provide stability by having their value tied to a portfolio of assets – known as ‘reserve assets’ – against which stablecoin holdings can be redeemed16. Algorithmic stablecoins, meanwhile, aim to match supply and demand to maintain a stable value.

But the recent crypto crash has highlighted that – without sound regulation – stablecoins are stable in name only.

Digital innovation cannot, for example, build stable values on the basis of codes and mechanisms of dependency. This was the key takeaway from the collapse of the algorithmic stablecoin TerraUSD17, which lost its peg to the US dollar in May and has since been trading for less than 10 US cents18.

Tether also temporarily lost its peg amid the ensuing market stress19. This showed that, even for collateralised stablecoins, risks cannot be eliminated easily20. Without public backing21, the risks of contagion and runs are widespread and the liquidation of part of the reserve assets can have procyclical effects and further reduce the value of the remaining reserve assets. These risks are magnified when the composition of the reserve assets is concealed.

Overall, this scramble for stability and the shortcomings of stablecoins underscore the importance of a settlement asset that maintains its value under stressed conditions. In the absence of a risk-free digital anchor, which only digital central bank money can provide, stablecoins represent an overambitious attempt to create a risk-free digital asset backed by risky assets.

Cryptoassets have become the bubble of a generation. It is now obvious to everyone that the promise of easy crypto-money and high returns was a bubble doomed to burst

Crypto markets are highly leveraged and interconnected

The third structural weakness is the fact that crypto markets may have incredibly high leverage and interconnections. This creates strong procyclical effects, given the lack of shock absorption capacity.

Crypto exchanges allow investors to increase exposures by up to 125 times the initial investment. As a result, when shocks hit and deleveraging is needed, they are forced to shed assets, putting strong downward pressure on prices.

These procyclical effects are exacerbated by the pervasive over-collateralisation adopted in DeFi lending to compensate for the risks posed by anonymous borrowers22.

Moreover, funds borrowed in one instance can be reused as collateral in subsequent transactions, allowing investors to build large exposures. Shocks can propagate rapidly across collateral chains and are amplified by positions liquidated automatically using smart contracts.

These are precisely the dynamics we have seen at work in the recent crypto failures, which have sent shockwaves throughout the crypto universe, including in DeFi markets23 used to build leverage24.

The inadequate governance of crypto firms has magnified these structural flaws. Insufficient transparency and disclosure, the lack of investor protection, and weak accounting systems and risk management were blatantly exposed by the implosion of FTX25.

Following this event, cryptoassets may move away from centralised to decentralised exchanges, creating new risks owing to the absence of a central governance body26.

The destiny of digital finance

These fundamental flaws have led many to predict the demise of cryptoassets. But these flaws alone are unlikely to spell the end of cryptos, which will continue to attract investors looking to gamble.

Gambling is perhaps the second oldest profession in the world. It has been traced back to ancient China, Greece and Rome. People have always gambled in different ways: casting lots, rolling dice, betting on animals or playing cards. And in the digital era I expect them to continue gambling by taking speculative positions on cryptoassets.

We therefore need to mitigate the risks, while harnessing the innovative potential of digital finance beyond cryptos. There are two elements to this.

Regulating cryptoassets

The first is to regulate cryptoassets and ensure that they do not benefit from preferential treatment compared with other assets27.

The recent failures of crypto entities do not seem to have had a material impact on the financial sector. But they have highlighted the immense potential for economic and social damage if we leave cryptos unchecked28. And the links between the crypto market and the financial system may become stronger, especially as major tech companies enter the sector.

That is why we now need – urgently – to regulate cryptoassets. It is crucial that the regulatory frameworks currently in the legislative process quickly enter into force and start being implemented so that words can be followed by deeds.

Addressing financial risks

Regulators must walk a tightrope. For one, they need to build guardrails to tackle regulatory gaps and arbitrage. But they also need to avoid legitimising unsound crypto models and refrain from socialising the risks through bailouts29.

Regulatory efforts should primarily be directed at preventing the use of cryptoassets as a way of circumventing financial regulation. The principle of ‘same functions, same risks, same rules’ applies regardless of technology. This should be coupled with measures to ensure that the risks of cryptoassets are clear to all.

Potential buyers should be fully aware of the risks they take when buying cryptos and the services surrounding them30. Gambling activities should be treated as such.

The other task is to shield the mainstream financial system from crypto risks, notably by segregating any crypto-related activities of supervised intermediaries.

The EU’s Regulation on Markets in Crypto-Assets (MiCA) is leading the way in building a comprehensive regulatory framework. MiCA will regulate stablecoins, cryptoassets other than stablecoins, and cryptoasset service providers. It will subject stablecoin issuers of e-money tokens31 and asset-referenced tokens32 to licensing and supervision.

And it will regulate the reserve assets backing stablecoins in order to contain their risks. In turn, the regulation requires that buyers of cryptoassets are informed about the inherent risks involved. It is crucial that the regulation enters into force as soon as possible33.

Looking ahead, the regulation of crypto activities will have to be adapted to the continuous evolution of crypto risks. Given the time needed to design and apply new legislation, it is important to empower regulators, overseers and supervisors to adjust their instruments to keep pace with market and technological developments.

The ECB is not responsible for regulating investment activities. But we are responsible for overseeing European payment systems, and we have already taken action in this field. Our oversight framework for payment instruments, schemes and arrangements – the PISA framework – that was launched last year addresses the risks of stablecoins and other cryptoassets for payment systems.

Since cryptoassets know no borders, their regulatory framework must be global. This requires rapid implementation of the Financial Stability Board’s recommendations to make the regulatory, supervisory and oversight approaches to crypto activities consistent and comprehensive across different countries34.

Swift progress is also needed to finalise the Basel Committee on Banking Supervision’s framework for the prudential treatment of banks’ cryptoasset activities.

Addressing and internalising social risks

Authorities also need to address the significant social costs of cryptoassets, such as tax evasion, illicit activities and their environmental impact35. The use of cryptoassets for money laundering and terrorist financing could be prevented by applying the standards set by the Financial Action Task Force36.

The other task is to ensure that the taxation of cryptoassets is harmonised across jurisdictions and consistent with how other instruments are taxed37.

In Europe, given the negative externalities that crypto activities can generate across multiple member states, the EU should introduce a tax levied on crossborder crypto issuers, investors and service providers. This would generate revenues that can be used to finance EU public goods that counter the negative effects of cryptoassets38.

Such a tax could, for example, address the high energy and environmental costs associated with some crypto-mining and validation activities. This would be in line with the current EU priorities to address climate change and ensure energy security39. Cryptoassets deemed to have an excessive ecological footprint should also be banned40.

Balancing innovation and stability: an anchor for digital finance

But even regulation would not be enough to provide a stable basis for digital finance. The second factor at play here is that, in order to harness the opportunities offered by technological innovation, we need to give digital finance – like other forms of finance – an anchor of stability in the form of a digital risk-free asset.

Only central bank money can provide an anchor of stability

Some commentators are of the view that adequate regulation would allow stablecoins to provide such a risk-free asset. This is a misconception.

Stablecoins invest their reserve assets in market instruments, which inevitably exposes them to several risks: liquidity, credit, counterparty and operational risks. Prudent investment policies can reduce but not eliminate such risks. The riskiness of stablecoins will over time lead to them being traded at variable prices, making them unsuitable as risk-free assets.

Risks could theoretically be eliminated by allowing full-reserve – or narrow – stablecoins to hold their reserve assets entirely in the form of risk-free deposits at the central bank. This would avoid custody and investment risks for stablecoins and underpin their commitment to reimburse coin holders at par value at all times.

But other fundamental problems would then emerge. In fact, this would be tantamount to outsourcing the provision of central bank money. It could even threaten monetary sovereignty if a stablecoin were to largely displace sovereign money. And narrow stablecoins could divert sizeable deposits away from banks, with potential adverse consequences for the financing of the real economy41.

Only central bank money can provide an anchor of stability. The solution is to extend today’s two-tier monetary system into the digital age. This system is built on the complementary roles of central bank money and commercial bank money.

Central bank money is currently available for retail use in only physical form – cash. But the digitalisation of payments is eroding the role of cash and its ability to provide an effective monetary anchor. Central bank digital currencies would instead preserve the use of public money for digital retail payments.

By offering a digital, risk-free common denominator, a central bank digital currency would facilitate convertibility among different forms of private digital money. It would thus preserve the singleness of money and protect monetary sovereignty. The ECB is working on a digital euro precisely for these reasons42.

To preserve its crucial role, public money must also continue to be used as a settlement asset for wholesale financial transactions43.

The Eurosystem currently provides settlement in central bank money for wholesale transactions with its TARGET services. And we are exploring what would happen if new technologies were to be widely adopted by the financial industry. Whether such a scenario will materialise is uncertain, but we must be ready to respond if it does.

Our response may include making central bank money available for wholesale transactions on one or more distributed ledger technology platforms, or creating a bridge between market DLT platforms and existing central bank infrastructures44.

By ensuring that the role of central bank money as the anchor of the payment system is preserved for both retail and wholesale transactions, central banks will safeguard the trust on which private forms of money ultimately depend.

Conclusion

Born in the depths of the global financial crisis, cryptoassets were portrayed as a generational phenomenon, promising to bring about radical change in how we pay, save and invest. Instead, they have become the bubble of a generation. It is now obvious to everyone that the promise of easy crypto-money and high returns was a bubble doomed to burst. It turns out that cryptoassets are not money. Many are just a new way of gambling.

There is an urgent need globally for regulation to protect consumers from the risks of cryptoassets, define minimum requirements for crypto firms’ risk management and corporate governance, and reduce the run and contagion risks of stablecoins. We should also tax cryptoassets according to their social costs.

But regulation will not turn risky instruments into safe money. Instead, a stable digital finance ecosystem requires well-supervised intermediaries and a risk-free and dependable digital settlement asset, which only digital central bank money can provide.

Endnotes

1. Panetta, F (2022), “For a few cryptos more: the Wild West of crypto finance”, speech at Columbia University, New York, 25 April.

2. A complex, interlinked but mostly unregulated crypto ecosystem of miners, wallets, tumblers and exchanges has developed, and a range of ancillary crypto services mimicking traditional financial services have come to the fore in the form of decentralised finance (DeFi). With DeFi it is now possible, for example, to lend, borrow and earn returns when “staking” or “yield farming” cryptoassets.

3. As Warren Buffett famously noted, “only when the tide goes out do you discover who’s been swimming naked”.

4. For example, transactions involving bitcoins are lengthy procedures, and the number of operations that can be completed over a specific period of time is comparatively very limited.

5. For example, producing and trading bitcoin alone wastes huge amounts of energy: the equivalent of the entire annual electricity consumption of a country that has millions of inhabitants, like Belgium. See Cambridge Bitcoin Electricity Consumption Index.

6. Europol notes that the illicit use of cryptoassets is predominantly associated with money laundering purposes, the (online) trade of illicit goods and services, and fraud. See Europol (2021), “Cryptocurrencies: Tracing the evolution of criminal finances”, Europol Spotlight Report series. Chainalysis estimates that the amounts of cryptoassets exchanged for criminal purposes exceeded USD 15 billion in 2021 and notes that criminal activity appears to be more resilient in the face of price declines, with illicit volumes down just 15%, year on year, in the first half of 2022, compared with 36% for legitimate volumes. In the case of hacking, the value stolen was even higher in the first half of 2022 compared to the first half of 2021. See Chainalysis (2022), “Mid-year Crypto Crime Update: Illicit Activity Falls With Rest of Market, With Some Notable Exceptions”, August. Chainalysis estimates are conservative. Europol emphasises that “estimations from Chainalysis are based on their own attribution datasets where transactions are tagged as illicit whenever linked to clearly illicit activities, such as the ones from and to dark web marketplaces and ransomware clusters. It is important to highlight that these figures are affected by a significant intelligence gap related to a lower level of detection of some criminal activities, including frauds and money laundering” (see Europol (2021), op. cit.). Academic research suggests that as much as around 23% of all bitcoin transactions in the period 2009-17 were associated with criminal activities. For more details, see Foley, S, Karlsen, JR and Putniņš, TJ (2019), “Sex, Drugs, and Bitcoin: How much illegal activity is financed through cryptocurrencies?”, Review of Financial Studies, Vol. 32, No 5, May, pp. 1798-1853. Finally, the Financial Action Task Force reports that variations in identified illicit bitcoin transactions from 2016 to 2020 range between 0.6% and 9.9% (relative to the number of transactions); see Financial Action Task Force (2021), “Second 12-Month Review of the Revised FATF Standards on Virtual Assets and Virtual Assets Service Providers”, July.

7. Examples of financial flows are dividends for stocks, coupon payments for bonds, and rental payments for real estate.

8. Johnson, S (2022), “First US bitcoin ETF loses record amount in its initial year”, Financial Times, 26 October.

9. For instance, the hack on the Binance chain initially concerned coins worth USD 570 million and the hack on FTX soon after bankruptcy reached a value of more than USD 300 million; see Shukla, S (2022), “FTX Hacker Emerges as 35th Largest Holder of Token Ether”, Bloomberg, 16 November. There have also been several cases of crypto-asset holders losing all their savings after losing their wallet passwords.

10. A survey showed that one-third of crypto-asset investors know little or nothing about these assets. See Cardify (2021), “All Aboard The Crypto Train: Who Are The Latest Crypto Investors?”, February.

11. Satoshi Nakamoto was in fact open about this when saying the following about bitcoin in 2009: “It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self-fulfilling prophecy.”

12. Bitcoin has generated more greed and enthusiasm among inexperienced investors than any other unbacked cryptoassets.

13. See the section entitled “Stablecoins’ role within the crypto-asset ecosystem” in Adachi, M et al (2022), “Stablecoins’ role in crypto and beyond: functions, risks and policy”, Macroprudential Bulletin, ECB.

14. Less than 10% of the total crypto-asset market at present.

15. In September 2022.

16. These are collateralised stablecoins.

17. Holders could redeem USD 1 of Terra for USD 1 worth of the crypto-asset Luna, which would be issued to meet demand.

18. TerraUSD’s market capitalisation fell from around USD 18 billion to less than USD 2 billion and, as at 30 November 2022, stood at just USD 209 million.

19. The price of Tether came under pressure amid the crypto market stress, with the largest stablecoin temporarily losing its peg on 12 May. Since then, Tether has seen outflows of more than €8 billion, which is equivalent to almost 10% of its market capitalisation.

20. Their liabilities are liquid and redeemable on demand, but their assets are longer term and less liquid.

21. Such as adequate regulation, public insurance and/or access to central bank liquidity.

22. The use of collateral helps align the incentives of the borrower and lender in markets with high asymmetric information. At the same time, the volume of lending is directly influenced by the dynamics of the price of collateral: it would typically increase in booms (when asset prices are high) and decrease in busts (when the value of collateral is lower). See Aramonte, S et al (2022), “DeFi lending: intermediation without information?” BIS Bulletin, No 57, Bank for International Settlements, 14 June.

23. For example: after the crash of the stablecoin TerraUSD in early May, TVL in DeFi fell by almost 40% or €80 billion, with credit and staking protocols suffering the biggest decreases.

24. For instance, FTX and Alameda Research were highly intertwined with the latter reported to have faced severe losses from leveraged positions related to the TerraUSD crash. On 28 November 2022 the crypto lender BlockFi filed for bankruptcy given the close connections to FTX.

25. The new CEO appointed following FTX’s filing for bankruptcy stated in his declaration in support of the bankruptcy petition: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented”.

26. Shukla, S, Kharif, O and Ossinger, J (2022), “Billions of Dollars Flee to Crypto’s Decentralized Roots After FTX Collapse”, Bloomberg, 18 November.

27. See, for instance, Panetta, F (2022), op. cit.

28. For instance, Visa had announced in October 2022 that FTX-branded Visa debit cards would be linked directly to a user’s FTX account to enable card holders to use cryptos to fund purchases at merchants. This agreement with FTX has since been terminated and the debit card programme is being wound down.

29. See Cecchetti, S and Schoenholtz, K (2022), “Let crypto burn”, Financial Times, 17 November. The authors call for not even bringing cryptos under a regulatory framework to avoid the perception of any public support in a stress event, like a run on a crypto provider, such as FTX.

30. See the warning issued jointly by European Supervisory Authorities on the risks of cryptoassets for consumers.

31. E-money tokens aim at stabilising their value by referencing only one official currency.

32. Asset-referenced tokens refer to all other cryptoassets than e-money tokens whose value is backed by assets.

33. Market participants should already take into account prospective requirements, such as consumer risk information or the need for transparent and segregated reserves that can withstand stress.

34. Financial Stability Board (2022), “FSB proposes framework for the international regulation of crypto-asset activities”, press release, 11 October.

35. The social value of cryptoassets may be negative as their opaqueness and lack of scrutiny makes them prone to tax evasion, money laundering, terrorist financing and the circumvention of sanctions, while they consume considerable amounts of energy, especially when relying on proof-of-work. For example, Digiconomist estimates that one Bitcoin transaction (using proof-of-work) has a carbon footprint equivalent to that of 804,367 Visa transactions. Following the recent switch to the proof-of-stake method, Digiconomist estimates the carbon footprint of one Ethereum transaction to be equivalent to that of 22 Visa transactions.

36. Financial Action Task Force (2022), “Targeted Update on Implementation of the FATF Standards on Virtual Assets and Virtual Asset Service Providers”, June.

37. The OECD recently approved a Crypto-Asset Reporting Framework (CARF) which provides for the standardised reporting of tax information on transactions in cryptoassets and could help address the tax aspect.

38. See Panetta, F (2022), “Investing in Europe’s future: The case for a rethink”, speech at Istituto per gli Studi di Politica Internazionale (ISPI), Milan, 11 November.

39. See Panetta, F (2022), “Greener and cheaper: could the transition away from fossil fuels generate a divine coincidence?”, speech at the Italian Banking Association, Rome, 16 November.

40. For now, the nearly final EU Regulation on Markets in Crypto-Assets (MiCA) includes a first step by mandating a follow-up on the environmental impact of proof-of-work.

41. Moreover, lenders might find it more attractive to put their money in stablecoin issuers instead of the overnight repo market, impairing market liquidity and amplifying run risks in times of stress.

42. See Panetta, F (2021), “The present and future of money in the digital age”, lecture at Federcasse’s Lectiones cooperativae, Rome, 10 December.

43. Panetta, F (2022), “Demystifying wholesale central bank digital currency”, speech at the Deutsche Bundesbank’s Symposium on “Payments and Securities Settlement in Europe – today and tomorrow”, Frankfurt am Main, 26 September.

44. Proposed initiatives include DLT-based securities settlement in central bank money.

Annexe 1

Link to slides illustrating the speech can be found here.

I would like to thank Cyril Max Neumann, Patrick Papsdorf and Jean-Francois Jamet for their help in preparing this speech and Alessandro Giovannini, Antonella Pellicani, Pedro Bento Pereira Da Silva, Mirjam Plooij, Anders Ryden, Jürgen Schaaf and Anton Van der Kraaij for their input and comments. This article is based on a keynote speech delivered at the Insight Summit held at the London Business School, December 2022.