Carbon trade-offs: how firms respond to emissions controls

Maria Cecilia Bustamante is Associate Professor of Finance at the University of Maryland, and Francesca Zucchi is a Senior Economist at the European Central Bank

Given that regulatory efforts to control carbon emissions are intensifying around the world, understanding the incentives that carbon pricing creates for firms is paramount. This column presents a framework showing that whilst carbon pricing mechanisms curtail firms’ carbon emissions, as it becomes costlier to comply, these mechanisms also tilt polluting firms’ investment mix towards short-term abatement and away from green innovation. Subsidies for innovation can partly offset this shift and, overall, can boost firms’ green investment.

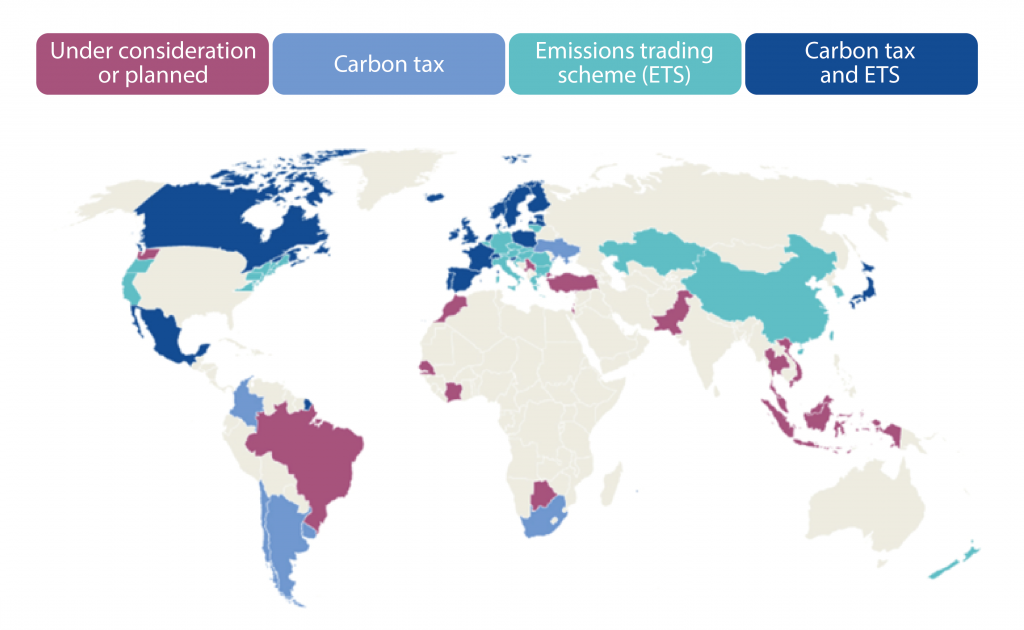

To limit global warming, several countries around the world have adopted carbon pricing mechanisms (or are considering doing so). As shown in Figure 1, regulators rely on two carbon pricing mechanisms: emissions trading systems and carbon taxes (or a combination of the two).

Under emissions trading systems, carbon credits give firms the right to release a set volume of emissions into the atmosphere (generated through their production processes). These credits are also tradeable, which means firms with a shortage of credits can buy them, and firms with an excess of credits can sell them.

In contrast, under carbon tax systems, a central authority sets a predetermined price that emitters pay for a set volume of emissions. A common feature of carbon pricing mechanisms is that they impose additional costs on businesses.

As a result, every tonne of carbon dioxide produced through industrial processes needs to be paid for, either by surrendering carbon credits (which are costly) or by paying a tax on it.

Figure 1. Carbon pricing around the world

Notes: The map illustrates the adoption of carbon pricing mechanisms around the world. The boundaries and other information shown do not imply on the part of the IMF any judgement on the legal status of any territory or any endorsement or acceptance of such territories.

Sources: World Bank Group, IMF staff calculations and national sources, July 2022.

Given that regulatory efforts to control carbon emissions are intensifying around the world, understanding the incentives that carbon pricing creates for firms is paramount. Intuitively, by making pollution costly, carbon pricing mechanisms should provide incentives for firms to reduce their carbon footprint.

However, a key question is how firms attain this goal. The answer is indeed not obvious, as firms can have various options at their disposal to limit their carbon footprint; for instance, they can cut their output or engage in green investment with various horizon and cost profiles.

To answer this question, in a recent paper (Bustamante and Zucchi 2023) we have constructed a theoretical framework to investigate the incentives that carbon pricing creates for firms and how they should therefore best respond.

We study the three most prevalent regulatory frameworks: laissez-faire (or no regulation), emissions trading systems and carbon tax systems. We assume that firms choose the mix of policies that maximises shareholder value.

First, they can adjust their scale of production, which directly determines their gross carbon emissions. Second, firms can engage in green investments, which are intended to make industrial processes cleaner. Third, under emissions trading systems, they can optimally manage and trade carbon credits. As a result of this dynamic problem, firms’ net emissions depend on the choices they make, and vary over time.

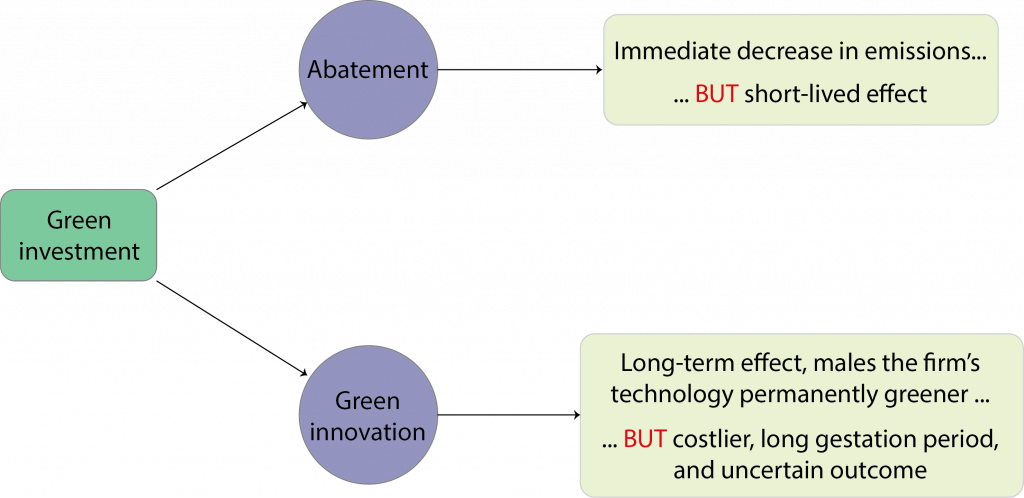

Figure 2. Green investment types

Note: The diagram shows the different types of green investment that a firm can undertake along with the associated benefits and downsides, as described in Bustamante and Zucchi (2023).

As a novel distinction, our framework acknowledges that green investment projects feature different characteristics. Two green investment projects at opposite extremes of the spectrum can be considered, as illustrated in Figure 2: abatement and green innovation.

At one extreme, abatement projects are aimed at offsetting some of the firms’ emissions. That is, firms generate emissions through their production processes and abatement projects have the effect of ‘cleaning up’ some of these emissions. Planting trees or carbon capture and storage are just some examples. While immediately reducing firms’ net emissions, abatement projects do not result in structural technological change.

At the other extreme, green innovation fosters the transition to novel, more sustainable technologies and has a long-lasting effect – it makes a firm’s technology permanently less polluting1. Pioneering inventions which accelerate the phasing-out of fossil fuels are a key example. While having a long-term impact on sustainability, green innovation is costlier than abatement, has a long gestation period, and has an uncertain outcome2.

The control of carbon emissions by regulators poses a new challenge in the corporate world, namely maximising shareholder value by developing an optimal carbon management policy

How do firms respond to carbon pricing?

A first insight of our analysis is that carbon pricing effectively leads to a reduction in firms’ net carbon emissions compared with laissez-faire, which is consistent with the available evidence (See, for instance, Fowlie et al 2012, Martin et al 2016).

This happens for two reasons. First, firms produce less compared with laissez-faire, as carbon pricing makes them internalise the externalities associated with their industrial processes. Second, firms engage in green investment.

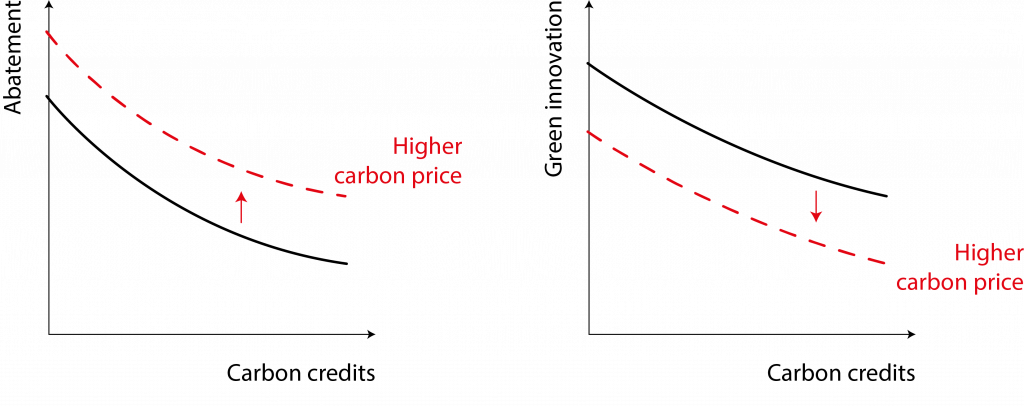

Moreover, our analysis reveals that carbon pricing affects firms’ green investment mix. As it becomes costlier to comply, polluting firms tilt their green investment mix towards short-term abatement and away from green innovation, as illustrated in Figure 3.

The reason is that abatement effectively and immediately reduces a firm’s expected cost of carbon regulation, whereas green innovation has a delayed and uncertain outcome. That is, by engaging more in abatement, firms decrease their net emissions with immediate effect – thus, they reduce their need to buy credits under emissions trading systems, or they lower their tax liability under carbon tax systems.

Shifting to abatement, however, can slow down the transition to greener technologies. Our analysis shows that this shift can be (at least partly) offset by complementing carbon pricing with subsidies for green innovation. Such subsidies not only spur greater engagement in green investment, but also tilt the mix in favour of green innovation.

Figure 3. Carbon pricing and the green investment mix

Notes: The diagram shows how the different types of green investment (abatement and green innovation) respond to an increase in the carbon price, as described in Bustamante and Zucchi (2023). If the carbon price increases – meaning that it becomes costlier to comply – polluting firms increase their investment in abatement and decrease their investment in green innovation. The figures also show that firms’ engagement in green investment decreases as their balances of carbon credits increase.

In the specific case of emissions trading systems, our model also warns that firms holding larger balances of carbon credits are less committed to curbing their emissions (consistent with the empirical evidence in De Jonghe et al 2020).

The reason is that firms adopt precautionary policies to minimise their need to buy carbon credits and incur the ensuing costs. This precautionary need is especially strong when firms have low balances of carbon credits. In those instances, firms optimally cut production to reduce their consumption of credits and, additionally, increase their green investment.

Conversely, a large balance of carbon credits reduces this precautionary need. Thus, firms increase production and reduce their engagement in green investment, leading to higher emissions overall. Our model then suggests that limiting the distribution of free carbon credits can make firms more committed to green investment.

Lastly, our model suggests that carbon regulation does not necessarily decrease shareholder value. Despite the long-standing perception of a conflict of interests between businesses and environmental regulators, a growing body of empirical literature documents that the effects of climate regulation vary across firms (eg. Bolton et al 2023, Trinks and Hille 2023).

Our paper provides theoretical grounds for this evidence. In fact, the sale of carbon credits as well as subsidies for green firms can effectively increase valuations if firms are sufficiently committed to reducing their carbon footprint.

Conclusion

The control of carbon emissions by regulators poses a new challenge in the corporate world, namely maximising shareholder value by developing an optimal carbon management policy. We show precisely how firms should optimally manage carbon emissions through their scale of production, green investments of various types, and the management of carbon credits.

Our analysis suggests that carbon pricing mechanisms curtail firms’ carbon emissions but, as it becomes costlier to comply, these mechanisms also tilt polluting firms’ investment mix towards short-term abatement and away from green innovation.

Subsidies for innovation can partly offset this shift and, overall, can boost firms’ green investment. Our model also shows that, under emissions trading systems, firms with large balances of carbon credits are less committed to reducing emissions, which provides an argument in support of limiting the allocation of free carbon credits. Overall, we conclude that carbon regulation does not necessarily decrease shareholder value.

Endnotes

1. Green innovation is viewed as necessary to limit global warming to the Paris Agreement’s targets, as noted by Aghion et al (2022), among others. A seminal contribution studying endogenous green innovation is Acemoglu et al (2012).

2. De Haas and Popov (2023) document how these characteristics make green innovation hard to finance.

References

Acemoglu, D, P Aghion, L Bursztyn and D Hemous, D (2012), “The Environment and Directed Technical Change”, American Economic Review 102(1): 131-166.

Aghion, P, L Boneva, J Breckenfelder, L Laeven, C Olovsson, A Popov and E Rancoita (2022), “Financial Markets and Green Innovation”, ECB Working Paper No 2686.

Bolton, P, A Lam and M Muûls (2023), “Do Carbon Prices Affect Stock Prices?”, mimeo.

Bustamante, C and F Zucchi (2023), “Dynamic Carbon Emission Management”, ECB Working Paper forthcoming.

De Haas, R and A Popov (2023), “Finance and Green Growth”, The Economic Journal 133(650): 637-668.

De Jonghe, O, K Mulier, and G Schepens (2020), “Going Green by Putting a Price on Pollution: Firm-level Evidence from the EU”, mimeo.

Fowlie, M, SP Holland and ET Mansur (2012), “What Do Emissions Markets Deliver and to Whom? Evidence from Southern California’s NOx Trading Program”, American Economic Review 102(2): 965-993.

Martin, R, M Muûls and UJ Wagner (2016), “The Impact of the European Union Emissions Trading Scheme on Regulated Firms: What is the Evidence after Ten Years?”, Review of Environmental Economics and Policy 10(1):129-148.

Trinks, A and E Hille (2023), “Carbon Costs Hardly Harm Firms”, VoxEU.org, 9 May.

Authors’ note: This column first appeared as a Research Bulletin of the European Central Bank. The authors gratefully acknowledge the comments from Gareth Budden, Alexandra Buist, and Alexander Popov. The views expressed here are those of the author and do not necessarily represent the views of the European Central Bank or the Eurosystem. This article was originally published on VoxEU.org.