Carbon leakage and international cooperation

Christofer Schroeder is an Economist Graduate Programme Participant in the Directorate General Economics, Livio Stracca is the Deputy Director General Financial Stability, both at the European Central Bank

Carbon dioxide (CO2) emissions are a key driver of climate change and a major threat to lives and livelihoods. As the environment is a global good, emissions reductions benefit the planet as a whole, regardless of where the reductions occur. Governments, therefore, have an incentive to free-ride on the environmental policies of others, foregoing the costs while reaping the benefits in terms of mitigating climate change.

Although this collective dimension is well recognised (eg. Snower 2022), governments around the world have largely introduced unilateral policies aimed at reducing emissions or slowing their growth.

Among the menu of unilateral policy options available, carbon taxes are generally regarded as particularly efficient (Metcalf 2019, Nordhaus 1977) and potentially less regressive (Levinson 2018). Indeed, carbon taxes have been found to exert a significant negative impact on domestic emissions (Andersson 2019, Bustamante and Zucchi 2023, Metcalf 2019), though evidence of their macroeconomic impact is less clear (Känzig and Konradt 2023, Metcalf and Stock 2020).

Carbon leakage

A common concern with carbon taxes is the potential for ‘carbon leakage’ – shifts in the production of emissions away from regions in which they are taxed. This undermines the effectiveness of such policies, even abstracting from the fact that their introduction suffers from a free-rider problem. Indeed, initiatives such as the EU’s Carbon Border Adjustment Mechanism (CBAM), which will come into force in 2026, aim precisely at preventing this problem.

While carbon leakage is an established theoretical channel (see Copeland et al 2022 for a detailed discussion), the empirical evidence is mixed. Böning et al (2023) find that the EU’s Emissions Trading System (ETS) has led to carbon leakage, while Aichele and Felbermayr (2015) provide evidence of carbon leakage from the Kyoto Protocol.

Indeed, aggregate data show that emissions in many advanced economies have been declining since the early 2000s while rising in many developing economies (Plumer 2017). The extent to which these patterns are explained by carbon leakage, however, remains unclear.

In this column, we summarise new empirical evidence of carbon leakage, drawing on our recent research estimating the impact of carbon taxes on emissions, using annual country data from the Global Carbon Project (Schroeder and Stracca 2023). Our findings suggest that carbon taxes do indeed lead to carbon leakage, particularly for countries that are more open to trade.

Importantly, our study distinguishes between two different measures of emissions at the national level: territorial emissions (or the emissions emitted within a country’s borders) and consumption emissions (or the emissions emitted anywhere in the world to satisfy a country’s domestic demand)1.

Nationally determined policies will have a meaningful impact on reducing global emissions only if they are accompanied by mechanisms that eliminate carbon leakage

The difference between the two measures of emissions are net imported emissions. Within this framework, carbon leakage can be observed when a carbon tax leads to a reduction in territorial emissions that is offset by an increase in net imported emissions. Together, these leave consumption emissions less impacted or unchanged.

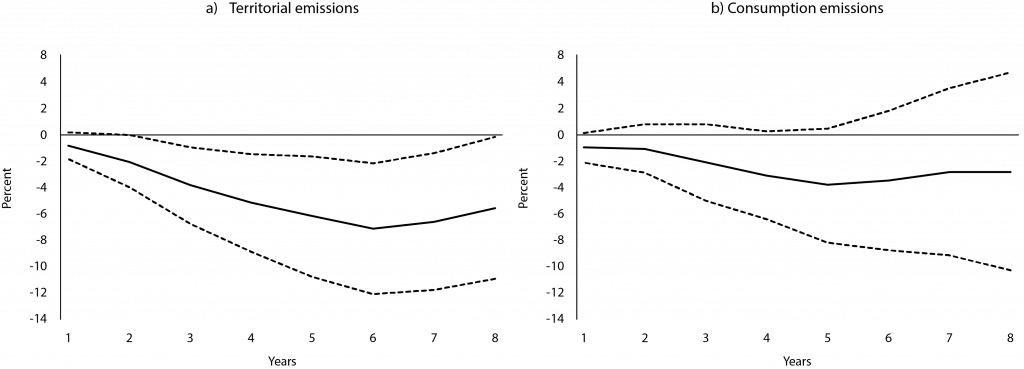

Our estimates show that carbon taxation has a negative, cumulative impact on territorial emissions over time, which is good, but no impact on consumption emissions, which may imply that their overall effect is limited if implemented in isolation (note that in our paper we do not directly measure the effects of taxes on emissions in other countries).

The results plotted in panel A show that carbon taxes significantly reduce territorial emissions starting around three years after implementation. Consumption emissions, on the other hand, are estimated to fall by less than territorial emissions; these estimates are not statistically significant, as shown in panel B. Together, these results offer evidence of carbon leakage from carbon taxes.

Figure 1. Dynamic effects of carbon taxation on emissions

Notes: This figure plots impulse response functions capturing the dynamic cumulative effects of carbon tax implementation on territorial (panel a) and consumption (panel b) emissions based on local projections of annual data. The dashed lines represent 90% confidence intervals surrounding the point estimates of the dynamic impacts plotted by the solid lines.

The role of international trade

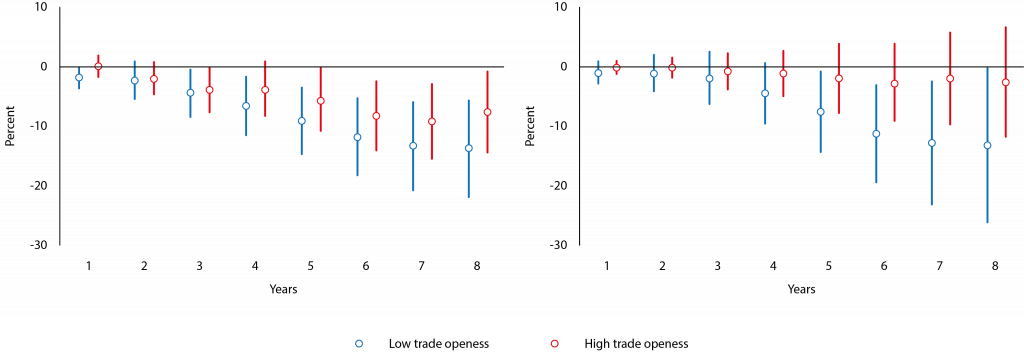

Carbon leakage across international borders implies that trade acts as a conduit for emissions. That is, countries more open to trade may be more susceptible to carbon leakage than countries less open to trade. Indeed, we find evidence of this outcome.

The results in Figure 2 show that the patterns in Figure 1 are driven by countries that are more open to trade. In particular, carbon taxes significantly reduce territorial emissions over time, regardless of a country’s openness to trade, as shown in panel A. The impacts on consumption emissions differ, however, as shown in panel B.

Countries that are more open to trade see no significant impact of carbon taxation on consumption emissions, while countries that are less open to trade see a significant reduction. These results suggest that openness to trade is a key country characteristic enabling carbon leakage.

Figure 2. Dynamic effects of carbon taxation on emissions by openness to trade

Notes: This figure plots impulse response functions capturing the dynamic cumulative effects of carbon tax implementation on territorial (panel a) and consumption (panel b) emissions by countries’ level of trade openness. The blue circles plot point estimates of the effect for countries with low openness to trade. The red squares plot point estimates of the effect for countries with high openness to trade. High openness to trade countries are defined as those with above median openness to trade in a particular year. Both series of estimates are surrounded by 90% confidence intervals represented by the solid lines of the same colour.

Our findings have important implications for the design of policies aimed at mitigating emissions, which are not limited to carbon taxes but can also involve green subsidies and other instruments. Nationally determined policies will have a meaningful impact on reducing global emissions only if they are accompanied by mechanisms that eliminate carbon leakage.

‘Climate clubs’ or CBAMs, for instance, can help reduce the incentive to offshore the production of emissions, despite their administrative challenges (Dominioni and Esty 2022). Our findings are in line with a broad literature emphasising the importance of international cooperation and coordination in implementing the policies needed for reducing emissions to meet the goals set out in the Paris Agreement (Ferrari et al 2023).

Endnote

1. We draw on data on territorial and consumption emissions from the Global Carbon Project (GCP). See https://www.globalcarbonproject.org and Andrew and Peters (2021) for detailed accounts of the data. In practice, the GCP estimates consumption emissions by adjusting territorial emissions with estimates of net emissions transfers via international trade. Net emissions transfers are estimated via environmentally extended input-output analysis (EEIOA).

References

Aichele, R and G Felbermayr (2015), “Kyoto and Carbon Leakage: An Empirical Analysis of the Carbon Content of Bilateral Trade”, Review of Economics and Statistics 97(1): 104–15.

Andersson, JJ (2019), “Carbon Taxes and CO2 Emissions: Sweden as a Case Study”, American Economic Journal: Economic Policy 11(4): 1–30.

Andrew, R and G Peters (2021), The Global Carbon Project’s fossil CO2 emissions dataset: 2021 release.

Böning, J, V di Nino and T Folger (2023), “The EU must stop carbon leakage at the border to become climate neutral”, VoxEU.org, 8 August.

Bustamante, MC and F Zucchi (2023), “Carbon trade-offs: How firms respond to emissions controls”, VoxEU.org, 5 August.

Copeland, BR, JS Shapiro and MS Taylor (2022), “Globalization and the Environment”, Handbook of International Economics, vol. 5, 61–146.

Dominioni, G and DC Esty (2022), “Designing an effective border carbon adjustment mechanism”, VoxEU.org, 22 April.

Ferrari Minesso, M and MS Pagliari (2023), “No country is an island: International cooperation and climate change”, Journal of International Economics 145, 103816.

Känzig, D and M Konradt (2023), “The economic effects of carbon pricing”, VoxEU.org, 12 August.

Levinson, A (2018), “A carbon tax would be less regressive than energy efficiency standards”, VoxEU.org, 5 July.

Metcalf, GE (2019), “On the Economics of a Carbon Tax for the United States”, Brookings Papers on Economic Activity 2019(1), 405–84.

Metcalf, GE and JH Stock (2020), “Measuring the Macroeconomic Impact of Carbon Taxes”, AEA Papers and Proceedings 110: 101–6.

Nordhaus, WD (1977), “Economic Growth and Climate: The Carbon Dioxide Problem”, American Economic Review 67(1): 341–46.

Plumer, B (2017), “A closer look at how rich countries ‘outsource’ their CO2 emissions to poorer ones”, Vox.com, 18 April.

Schroeder C and L Stracca (2023), “Pollution Havens? Carbon taxes, globalization, and the geography of emissions”, ECB Working Paper No. 2862.

Snower, D (2022), “A fresh approach to climate action”, VoxEU.org, 15 November.

Authors’ note: This column should not be reported as representing the views of the ECB. The views expressed are those of the authors and do not necessarily reflect those of the ECB. We thank Massimo Ferrari Minesso, Irene Heemskerk, Mario Morelli, and Agnieszka Trzcinska for useful comments. This article was originally published on VoxEU.org.