Making industrial policy work

Conor McCaffrey is a Research Assistant and Niclas Poitiers a Research Fellow, at Bruegel

The transition from cars powered by the internal combustion engine to vehicles powered by electric batteries implies a fundamental shift in the types of skills required by the automotive industry. However, the industry faces significant problems in finding suitable workers.

Surveys show that the lack of skilled labour is seen by firms as a problem of similar magnitude to high energy costs. Against the background a general skills shortage in the European Union, the shortage of skilled labour represents a major impediment to the development of a European battery industry.

The European Battery Alliance Academy is the main component of the EU’s strategy for tackling this problem. It develops training courses and materials to assist local training providers and serves as a blueprint for skills policies in other industries. However, given the scale of the challenge, it represents more a symbolic than a substantive answer to the challenge.

More should be done. The limited powers of the EU in labour market policies hold up a union-wide solution. In the short term, the training programmes developed by the European Battery Alliance Academy1 could more explicitly target demographics that are underserved by private training providers. In the medium term, the EU should rethink its labour market competences in order to develop a social pillar to underpin the European green transition.

1 Introduction

Industrial policy2 is back. Though the European Union has limited powers in relation to industry3, recent years have been marked by a shift towards targeted EU support for specific industries4. The European Chips Act (Regulation (EU) 2023/1781) and the proposed EU Net Zero Industry Act (NZIA) are the two most prominent examples of this change, with the range of measures introduced or planned including regulatory changes, public funding through national state aid and trade defence measures (see for example Kleimann et al 2023; Tagliapietra et al 2023; Poitiers and Weil, 2022a).

However, this shift has largely overlooked one of the primary production factors: labour. While the United States explicitly framed its Inflation Reduction Act (IRA) as a worker-centric industrial policy5, and the EU has also highlighted the importance of skilled workers in its industrial policy communications, the skills-relevant parts of these policy packages have arguably been underdeveloped.

This discrepancy is especially apparent in the lithium-ion battery industry, which manufactures the rechargeable batteries used to power electric vehicles (EVs). The automotive industry is one of the largest sectors in the EU, responsible for 10 percent of manufacturing employment6.

The shift from internal combustion engines (ICE) to electrification of the European automotive fleet necessitates massive investments and a fundamental shift in production technology. This implies stranded assets, in terms of both intellectual property and production facilities, but also in terms of skills.

Companies will not be able to capitalise on the ICE technology they developed in the past and workers who specialise in this technology will also find fewer opportunities to benefit from their skills. As part of its broader attempts to foster a domestic battery industry, the EU has put forward policies to develop the required skills, which are often put forward as a template for skills policies in other clean-tech industries.

However, as we discuss in this paper, despite the widely recognised importance of skills for industrial policy and the significant role that availability of skilled workers plays in investment decisions, the EU is yet to find a convincing strategy in this area.

Given their importance, making skills a more substantive pillar of EU industrial policy should be a priority. In this paper, we look at EU skills policies in the battery industry as an example for how skills policy in the EU currently works and how it could be improved. The European Battery Alliance Academy (EBA Academy) is the primary tool7.

It provides a cost-effective instrument aimed at addressing the expected skills shortage in this growing sector. However, more funding and care should be put, in particular, into targeting those workers who might not find training through private sector programmes.

Overall, we recommend that the role of the EU in skills policy be rethought, to establish a more direct link between EU green policies and labour-market opportunities.

2 Workers and industrial policy

The relationship between industrial policy and labour markets can be seen from two perspectives: whether interventions can create jobs (treating employment as an output) or whether they can facilitate access to skilled labour (treating it as an input). These two perspectives are not mutually exclusive.

For instance, a skills shortage may occur in the short term before the growth of a targeted sector generates further employment. The EU’s proposed Net Zero Industry Act walks a line between these two positions by emphasising that growing clean-tech industries in the EU “requires significant additional skilled workers which implies important investment needs in re-skilling and upskilling” but this also “has a great potential for quality job creation” (European Commission, 2023a, p.32).

However, assessing the relative importance and potential of the labour market as an input and output for industrial policy is important in framing the debate and determining policy priorities.

2.1 The labour market as an output?

In some cases, an increase in employment in the targeted industries has been framed as one of the primary objectives of industrial policy. Perhaps the biggest proponent of this framing has been US President Joe Biden, who has stressed repeatedly that one of the main goals of his green industrial policy is to revitalise the manufacturing sector and create jobs8.

Similar ambitions have been voiced by EU leaders, with Internal Market Commissioner Thierry Breton arguing that European industrial policy is needed to build a manufacturing base and create jobs for Europeans9.

However, the results of policies enacted thus far, as well as forecasts for future growth, cast doubt on the ability of industrial policy to act as an engine for job creation. Despite much fanfare, the 170,000 new jobs announced in the year following the passage of the US IRA failed to equal even an average month’s net employment gains over the same period10.

Bistline et al (2023) forecast only limited employment gains, and even the study cited by the White House to advertise the IRA projected only 150,000 new manufacturing jobs by 2030 (Foster et al 2023). A literature survey by Cameron et al (2020) suggested that the net employment gains in the EU by 2050 from the green transition (the key aim of some EU industrial policies) will be positive but small.

For the battery sector, estimates vary but tend to suggest that the shift away from ICE automotives to EVs will have a net negative impact on employment in the European automotive value chain up until 204011. This includes new jobs associated with the growth of the nascent lithium-ion battery sector.

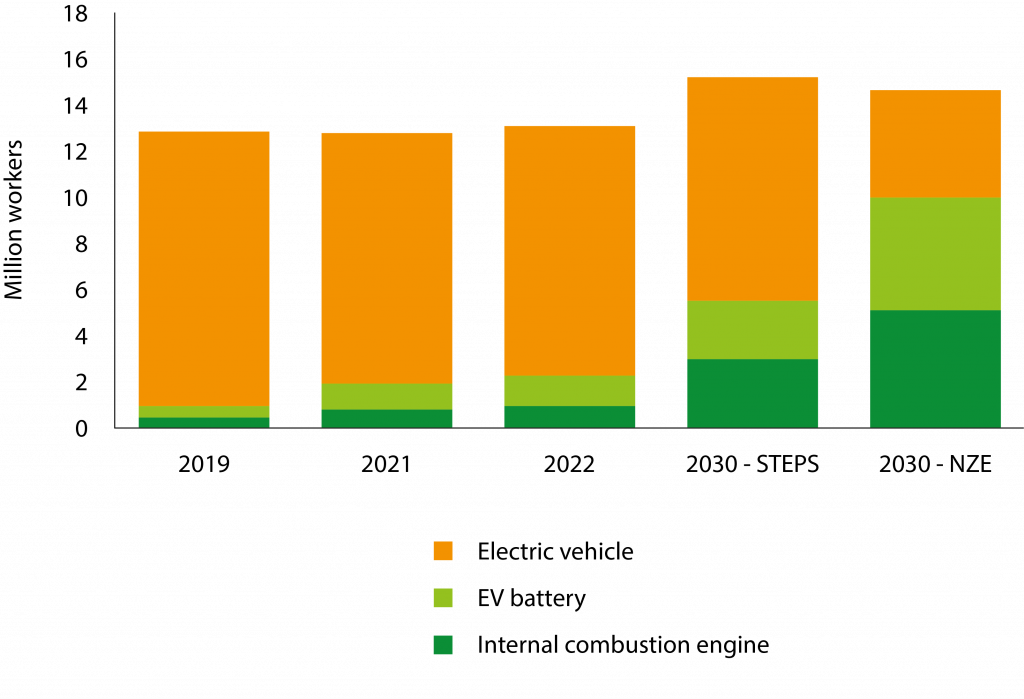

Within this sector, batteries will become increasingly important as a share of employment: the International Energy Agency has estimated that, in a scenario of policies introduced to reach net zero emissions by 2050, EV and battery manufacturing jobs would make up over two-thirds of global automotive sector employment by 2050, up from just 8 percent in 2022 (IEA, 2023, Figure 1).

In other words, while expanding the European battery sector might fail to generate net employment growth across the automotive value chain, it could serve to mitigate the job losses expected from a decline in the ICE sector.

Figure 1. Estimated global employment in the automotive manufacturing sector

Note: Electric vehicles include workers in battery supply chains. STEPS = IEA Stated Policies Scenario; NZE = IEA Net Zero Emissions by 2050 Scenario.

Source: Bruegel based on IEA (2023).

Given that the impact of the green transition on labour markets is expected to be uneven across various groups and locations (Vandeplas et al 2022), well-targeted green industrial policies could be used to avoid the negative local labour-market outcomes associated with previous energy transitions12.

However, from a macroeconomic perspective, the net employment benefits of industrial policy to the EU appear to be negligible. Therefore, from a European perspective, the focus should be on the labour market as an input for industrial policy.

2.2 A shortage of skilled workers

The ongoing skilled-worker shortage workers across the EU makes the need for skills-based policies as part of a European industrial policy more apparent.

Along with inflation and excessive burdens on firms, European Commission President Ursula von der Leyen has identified labour and skills shortages as one of the three major economic challenges for European businesses13. Former European Central Bank President and former Italian Prime Minister Mario Draghi has also pointed to a lack of skilled workers as a main weakness in the EU14. Firm-level surveys support these claims.

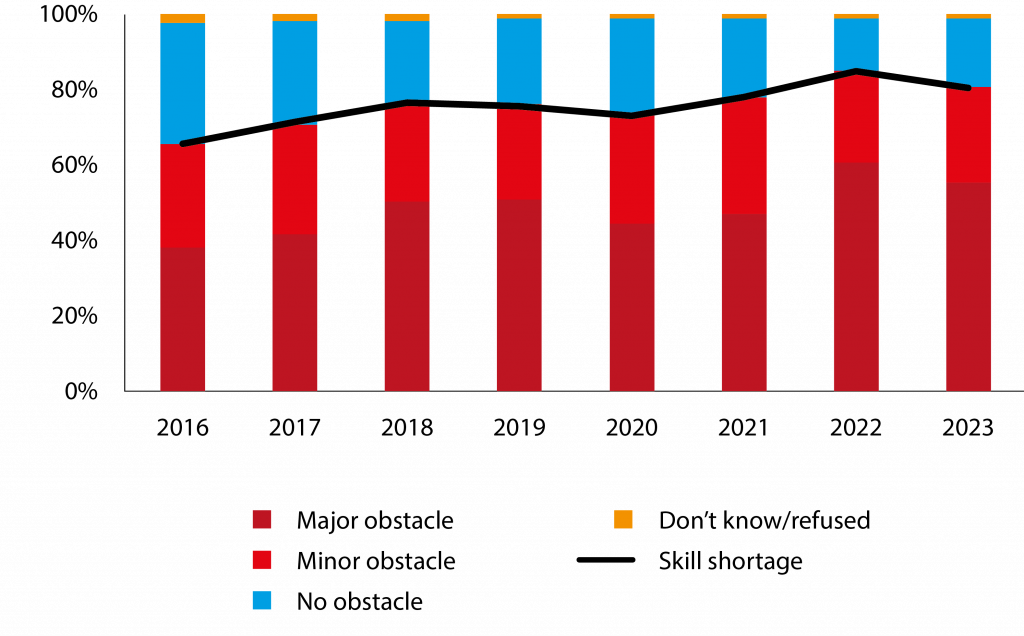

Over 80 percent of EU firms report that a lack of skilled workers represents either a major or minor obstacle to investment (Figure 2), with numbers broadly consistent across countries and economic sectors (EIB, 2023).

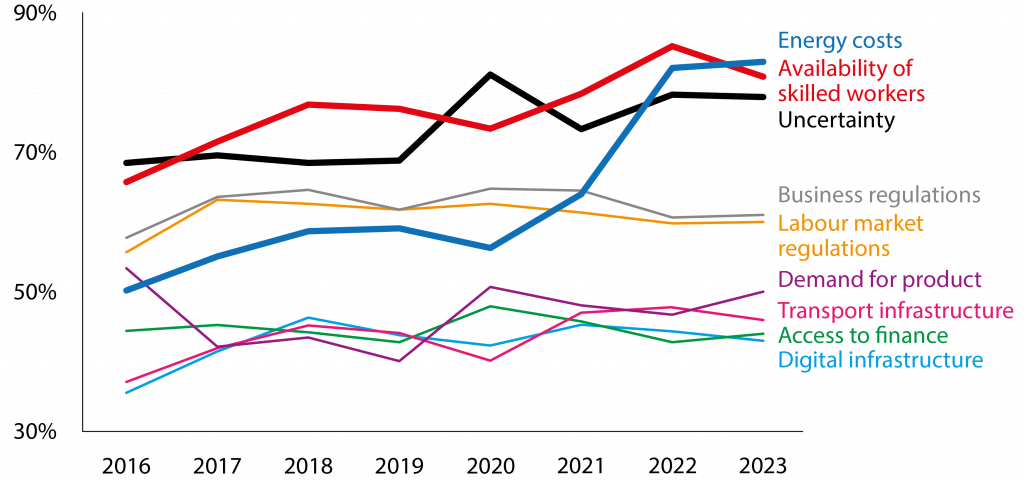

The share of companies reporting that this has been an obstacle rose from 65 percent in 2015 to over 80 percent in 2022, and the share of those identifying it as a major obstacle has risen strongly. When juxtaposed with other potential deterrents to investment, a lack of availability of skilled workers has ranked as one of the top two factors each year since the survey began (Figure 3).

According to the European Central Bank, labour, which encompasses associated costs, skills and shortages, was the most cited factor when firms were asked which factors would motivate shifts of production or operations out of the EU (Attinasi et al 2023).

Figure 2. The impact of a lack of skilled workers on European firms’ investment decisions

Note: Answers to “Thinking about your investment activities, to what extent is availability of staff with the right skills an obstacle? Is it a major obstacle, a minor obstacle or not an obstacle at all?”. Skill shortage is the sum of those answering major obstacle or minor obstacle. The year refers to the survey year, with the reference year the previous calendar year.

Source: Bruegel based on European Investment Bank Investment Surveys.

Figure 3. Obstacles to EU firms’ investment decisions

Note: Answers to “Thinking about your investment activities, to what extent is an obstacle? Is it a major obstacle, a minor obstacle or not an obstacle at all?”. Values reported are the sum of those answering major obstacle or minor obstacle for the given factor. The year refers to the survey year, with the reference year the previous calendar year.

Source: Bruegel based on European Investment Bank Investment Surveys.

Data from the November 2023 Eurobarometer survey on skill shortages further reinforces this point (Eurobarometer, 2023a). More than half (54 percent) of small and medium-sized enterprises (SMEs) and 72 percent of large companies (250 employees or more) across the EU reported that finding employees with the right skills was among their most serious problems; it was by far the most cited challenge, consistent across both countries and industrial sectors.

Both SMEs (38 percent) and large firms (41 percent) were most likely to answer that workers with vocational training were the most difficult to recruit, with more highly qualified workers apparently relatively less scarce15.

National reports stress the same message. For instance, the German Economic Institute reported a shortage of 600,000 workers across the German economy in 202216. According to the Association of German Chambers of Industry and Commerce, as of November 2023, half of German firms faced labour shortages, with almost 2 million jobs unfilled across the economy17.

Similarly, in its European Semester 2023 country report, the European Commission blamed labour shortages in key industries in France for creating “bottlenecks in the transition to a net zero-economy” (European Commission, 2023b, p.15).

Box 1. Skills shortages versus labour shortages

Even if skill levels are excellent, it cannot compensate for a shortage of workers themselves. Part of the documented shortfall in skilled workers across Europe is a consequence of a very tight labour market in general, with both the employment and job vacancy rates (74.6 percent and 2.9 percent respectively) reaching all-time highs/lows in 2022 (European Commission, 2022b). When asked for the reasons behind the aforementioned labour shortage, the two dominant answers from SMEs were that applicants were insufficiently skilled or experienced (54 percent) but also that there were not enough applicants of any skill level (56 percent) (Eurobarometer 2023a).

Without wider measures to address labour supply in general, up- or re-skilling measures alone will not be enough to solve the widespread skilled labour shortages in the EU, especially considering that the

ageing population will lead to a smaller EU labour force (European Commission, 2023d). However, given that industrial policy is intended to support selected industries, we focus on the challenge of equipping the particular workforce with the skills it needs, notwithstanding the wider challenge facing the EU.

2.3 Battery sector

In the burgeoning battery sector, and indeed the clean-technology sector in general, the problem of skilled-labour shortage that we have documented seems to be even stronger.

While granular data is limited, available indicators suggest that the sectors critical to the green transition are experiencing growing labour shortages (European Commission, 2023c). As far back as 2018, the Strategic Action Plan on Batteries published by the European Commission identified a skills gap in the battery sector (European Commission, 2018)18.

In 2023, the Commission (2018, p.15) described the transport and storage (ie. batteries) sector as “already experiencing persistent labour shortages.” The same theme has been emphasised repeatedly by stakeholders in interviews. For instance, the CEO of Northvolt, one of the few large European battery producers, described in February 2023 labour issues as “probably the number one limiting factor” in their production19.

The largest labour demand in this industry is for vocationally trained workers, with approximately 85 percent of roles requiring this level of education and no more (Stolfa, 2023). This is also the level of education for which firms report having by far the greatest difficulties in recruiting (Eurobarometer, 2023a).

Just under half (49 percent) of SMEs operating in the mobility-automotive-transport industrial sector reported that they faced difficulties recruiting workers with vocational qualifications, more than double the share that reported the next most common education level of worker shortage20. This shortage in vocational roles is common across the clean-energy industry (IEA, 2023).

In the battery value chain, approximately 90 percent of the jobs created will be downstream, eg. in areas including electric vehicle manufacturing, installation and repairs (for a detailed breakdown of job positions in the downstream component see EIT InnoEnergy, 2023); see Box 2 for a description of the battery value chain).

The Commission often cites an estimate of 800,000 workers in need of up- or re-skilling across the battery value chain by 202521. More interesting than the estimated figures22 is the breakdown along the value chain, with approximately 90 percent of the estimated skill shortage in the downstream component (Fraunhofer Institute, 2021). The industry will require more mechanics and technicians than electrochemists, for example, and training programmes should be designed to reflect this.

This also highlights another uncomfortable reality for the sector: the EU is currently facing a severe shortage in relevant blue-collar positions, including motor vehicle mechanics and repairers, electrical engineering technicians and electrical mechanics and fitters (IEA, 2023). EU firms identified in particular technicians as a role in which there are shortages (Eurobarometer, 2023).

This also represents a challenge for policy measures as the less-educated and less-skilled workers who would be expected to fill these rolls have historically been less likely to undergo training (European Commission 2023d; Güner and Nurski, 2023).

Given the importance that companies, and especially SMEs, put on the shortage of available skilled workers, current policy responses are not satisfactory

Box 2. The lithium-ion battery value chain

The value chain of lithium-ion batteries can be divided into three broad categories: upstream, battery production and downstream.

Upstream encompasses the mining, processing and refining of raw materials; the workforce ranges from supply chain analysts to mining engineers23. Battery production entails firstly cell-component manufacturing, eg. the production of the cathode and anode materials that make up batteries, and then pack production (producing the cells before assembling the pack). The roles and skills needed for this stage include compliance managers, process engineers and calibration technicians. Finally, the downstream component captures applications, mainly in electromobility but also in stationary storage applications, such as storage of power produced from renewable sources24, as well as second life (ie. recycling, which is becoming increasingly important because of regulatory changes and shortages of raw materials25). This is the part of the value chain that is expected to see the most demand for workers, for roles including automotive engineers and installation technicians. Some profiles, such as researchers and logistics managers, are required along the entire supply chain (for a detailed discussion, see IEA, 2022).

Except for some raw material mining, China dominates the global battery value chain26. Production is also highly concentrated among a small number of firms. Rather than focusing on comparative advantage and therefore a particular segment of production, the European Battery Alliance defines its mission as “to ensure an unbroken value chain in Europe”27. For this to be achieved, workers will be required at each of the stages outlined above.

Such challenges are not unique to the EU. Economies all over the world and specialising in different parts of the battery value chain have encountered similar problems. From extracting raw materials in the Democratic Republic of Congo or Australia, to battery production in South Korea, the US or Japan28, firms grapple with the challenges of finding skilled labour.

In the battery sector, this has led to the development of a global race for talent29. Furthermore, it is not only with other countries that the European battery sector must compete for skilled workers, but also with other growing European industries including the solar30 and semiconductor31 sectors, which require similar skill profiles and are facing workforce challenges of their own.

While claims of labour scarcity can seem over-hyped, with the reasonable assumption that the jobs will be filled if the pay is high enough, the impacts can be concrete. For instance, a lack of skilled labour was cited by TSMC as the reason for a delay in opening a semiconductor plant in Arizona in August 202332. Attempts to grow and support this sector via industrial policy should therefore take this challenge seriously.

3 Policy responses

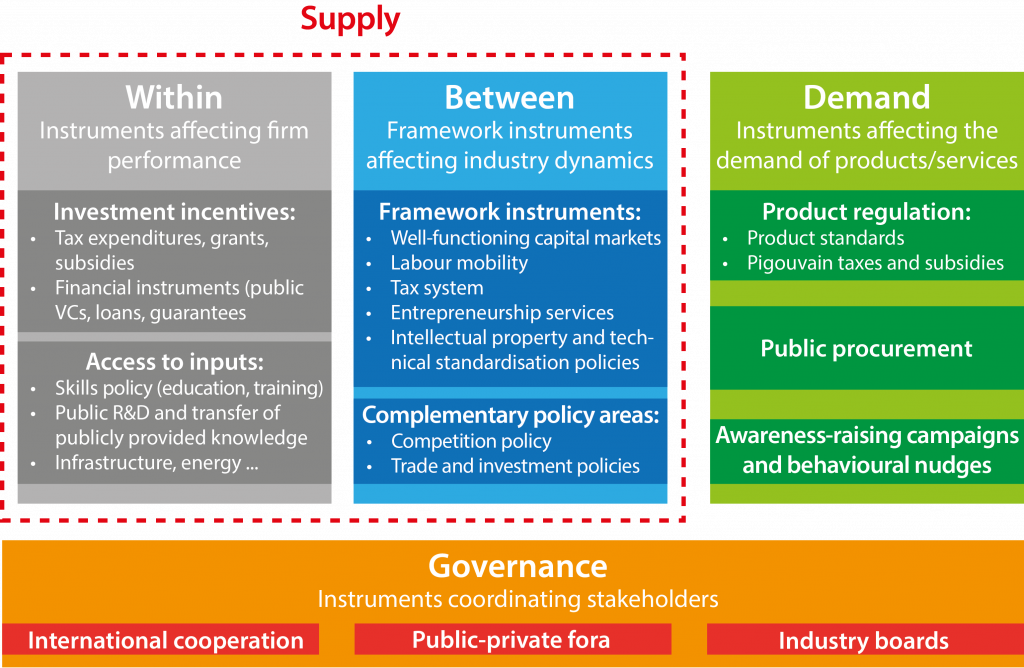

Before discussing the instruments put forward by the EU, it is useful to look at a theoretical framework appropriate for their assessment. In their taxonomy of instruments of industrial policy33, Criscuolo et al (2022a) categorised policies as demand-side, supply-side or governance instruments (Figure 4).

On the supply-side, production-focused instruments, a further distinction is made between ‘within’ instruments, the policies that shape firms’ internal efficiency, and ‘between’ instruments, which instead shape the dynamics between firms.

Figure 4. Categories of industrial policy instruments

Note: The policies listed in each category above are examples, not an exhaustive collection.

Source: Criscuolo et al (2022a).

Labour-market instruments fall into both categories of supply-side instruments: policies that increase general access to skills are considered ‘within’ instruments, while those that affect the allocation and movement of workers between firms are considered ‘between’ instruments.

The new wave of industrial policy has consisted more of the former than the latter, with efforts made to counter skilled-worker shortages across various sectors. Such measures have historically been found to improve growth and productivity, and act as important complements to investment incentives (Criscuolo et al 2022b).

For instance, Hanlon (2020) found that the development and maintenance of a pool of skilled workers played an important role in the British shipbuilding industry’s maintenance of a dominance advantage over its North American rivals in the decades leading up to the First World War.

These skills-focused instruments have always formed important, if often overlooked, parts of industrial policy. In Singapore in the 1970s, the government established training institutes and business schools and also liberalised immigration to help supply the managers, engineers and technicians needed for the rapid industrial change the country was undergoing (Yeo, 2016).

Towards the end of the same decade, universities in Ireland provided one-year courses and expanded technical programmes to train electrical engineers to match increased demand arising from industrial agreements (Cherif and Hasanov, 2016). A polytechnic institute was created in the 1990s to train workers in Guanajuato, Mexico, as part of a multi-faceted strategy to attract automotive manufacturers (Cherif and Hasanov, 2016).

Labour-market instruments remain important facets of industrial policy. In their quantification of industrial policy measures across nine OECD countries, Criscuolo et al (2023) found large variations between countries. For instance, the share of industrial policy grants and tax expenditures in 2021 that went to jobs and skills measures ranged from 35 percent in France to less than 1 percent in Israel.

Policymakers in EU countries have put forward a range of measures to address skilled-labour shortages as part of the post-COVID-19 wave of green industrial policies. In Sweden, one of the European leaders in this sector, the 2020 national strategy to develop a competitive battery industry identified provision of access to a skilled workforce as a key area for partnership between government and industry (Fossil Free Sweden, 2020).

The Swedish national research and innovation institute has provided training programmes for workers along the battery chain34, while regional authorities have worked with firms and universities to align training and education with industry needs35.

France36 and Germany37 have each launched battery training schools to address skills shortages, with France also increasing funding for training in clean-tech sectors38 and Germany reforming immigration laws to attract more foreign workers39.

Beyond the battery sector exclusively, Slovakia, Finland, Denmark, Spain and Malta have all introduced various measures to enhance the skills needed for the green transition (European Commission, 2023d). Fourteen EU countries included in their post-COVID-19 Recovery and Resilience Plans measures targeting green skills and jobs, together amounting to approximately €1.5 billion, or roughly 0.25 percent, of total RRF expenditure40.

These efforts have not been limited to the EU. In the US, access to some industrial policy funding has been made conditional on firms implementing labour measures, including apprenticeships for the IRA41 and childcare in the Science and Chips Act42. The Biden Administration has also increased funding for apprenticeships and training programmes to improve the supply of advanced manufacturing workers and to support the policies enacted43.

The skills shortage we have documented has prompted a reaction at the EU level. Beyond industrial policy, various measures have been enacted to try to ease the constraint, notwithstanding limited EU powers in this area. The five-year European Skills Agenda launched in 2020 set out 12 actions to improve skill levels across the EU44.

For instance, the Pact for Skills, the first flagship action enacted under this Skills Agenda, has mobilised over 1,000 stakeholders (including firms, social partners, national authorities and training institutes) across 14 different industrial ecosystems to cooperate on up- and re-skilling needs (European Commission, 2022)45.

Efforts have also been made under the Agenda to improve the recognition of skills and qualifications issued in other EU countries. 2023 was designated the European Year of Skills, with many events and initiatives organised to highlight training and employment opportunities. In November 2023, the European Commission also issued a Skills and Talent Mobility package, which includes proposed measures to ease hiring from non-EU countries and proposes higher targets for inter-EU training mobility46.

Regarding financing, the state-aid exemption threshold for skill measures was raised in March 2023 from €2 million to €3 million, increasing the ability of national governments to support training schemes47. Various EU budgetary programmes included in the 2021-2027 Multiannual Financial Framework – the EU’s budget – including the European Social Fund Plus and Just Transition Mechanism, contain resources earmarked to support green skills (European Commission, 2023f), though precise details on their allocation are difficult to quantify.

While none of these measures is likely to significantly reduce the skills shortage in Europe, they do show that the Commission is at least aware of this challenge and is making efforts to address it. This also holds true in its approach to industrial policy.

The European Chips Act includes measures to support the development of ‘competence centres’, with the intention of boosting access to internships and apprenticeships. Work on a European Chips Skills Academy, supported by €4 million of Horizon+ funding, is in progress to solve skilled-worker shortages in the semiconductor sector48.

Addressing the skills shortage in green technologies also formed one of the pillars of both the Green Deal Industrial Plan (European Commission, 2023a) and the proposed NZIA. The Commission has placed the onus of solving these skills constraints on proposed ‘net zero industry academies’ for the respective clean-tech sectors. These are to be modelled on the European Battery Alliance (EBA) Academy (European Commission, 2023e), which we discuss next.

3.1 Skills measures in the battery sector

When it was established in late 2017, the European Battery Alliance (EBA) – an industrial alliance bringing together stakeholders across the battery value chain – identified development of a skilled workforce as one of the priority actions facing the industry49.

As a result, the need to develop a highly skilled workforce across the value chain was included in the Commission’s 2018 Strategic Action Plan on Batteries (European Commission, 2018), and the need to address this skill shortage has been consistently raised at the annual high-level meeting of the EBA50. The EBA Academy was launched in 2022 for this purpose.

Directed by EIT InnoEnergy and supported with €10 million of seed funding from REACT-EU, the EBA Academy is designed to support the training efforts of national and regional authorities to address this skills bottleneck. It has three main purposes: identifying future skill needs; designing and providing training corresponding to these needs; and issuing certifications to accredit the training provided.

Despite claims in the Green Deal Industrial Plan that the EBA Academy “will train, reskill and upskill approximately 800,000 workers by 2025” (European Commission, 2023e, p.16), the target in the proposed NZIA is for the academy to upskill 100,000 workers by 2025, with the hope that other workers will benefit indirectly (eg. from ‘train-the-trainers’ initiatives).

Complementing previous work by the Alliance for Batteries Technology, Training and Skills (ALBATTS, an EU-funded four-year project launched in 2019)51, the first pillar of the EBA Academy is to identify the job roles that both are and will be in demand across the value chain.

A range of methods is used for this purpose, including analysing online job postings and engaging with stakeholders and experts. To date, over 600 unique roles and profiles have been identified (EIT InnoEnergy, 2023). The various skills, and the level of expertise in those skills, that each role requires are established and documented in a report known as a ‘skills compass’.

For instance, a quality technician would be required to be an expert in ‘quality assurance processes’, while also having a much more limited awareness of ‘environmental health and safety’ (EIT InnoEnergy, 2023).

Once these required skills have been identified, the Academy then produces training material to correspond to these needs. These training packages span both the educational qualification spectrum (ie. from Masters’ programmes to short-term vocational training material)52 and the value chain. The Academy then works with firms and local training providers (eg. community training centres, universities or national battery schools, as in France) in EU countries to deliver the training to workers53.

There is a wide variety in the courses offered: some are hands-on and intended to be delivered on-site by experts, with others designed to be accessed online and completed asynchronously.

Finally, the EBA Academy issues certifications to graduates detailing the training that has been received, so that it can be recognised by firms across the European battery sector. At the time of writing, exam-based and Europass-compatible54 certification was available for three courses55, with work ongoing to expand this to six other courses.

As of December 2023, approximately 50,000 workers and 90 ‘trainers’ (out of targets of 100,000 and 100 by 2025 respectively) had received training through the Academy56. The average age of participants was 34, with men making up 50.5 percent of learners. Memoranda of Understanding had been signed with 11 governments to avail of this support, with courses provided in 10 languages.

Associated language costs have proved to be a significant burden for the Academy, given the frequent modification and updating of the courses on offer.

4 Policy lessons

Access to skills is a bottleneck in developing a European EV supply chain. Given the rapid expansion of a sector directly linked to the decarbonisation of transport, coupled with the current overreliance on China for supply, public intervention to facilitate this shift is justified.

However, the role of EU-level policy to provide a public good in this regard is not straightforward. Education and labour markets are national responsibilities, and local and state governments are often better equipped than the EU to provide training programmes that fit the specific requirements of local labour markets. The EBA Academy provides some returns to scale by developing training programmes that will be useful in many locations.

However, it also exemplifies the current lack of EU investment in skills. Compared with the €6.1 billion in subsidies in the two battery Important Projects of Common European Interest57 and hundred million euro state-aid packages that can be expected as part of the Temporary Crisis Transition Framework (TCTF58), the €10 million in seed funding over three years to support the labour needs looks rather meek.

Nevertheless, there is a political case for the EU to act to provide support for reskilling the workforce. The decarbonisation plans that necessitate phasing out ICE vehicles were developed and implemented at the EU level. The EU will thus likely be seen as at least partly responsible for job losses that occur during the transition.

At the same time, the EU is greenlighting billions in subsidies for capital investment in the sector. Without a plan to also support labour, such a policy would rightly be perceived as lopsided. Given the importance that both large companies and SMEs give to the skills shortage, a more involved EU skills strategy would also signal that these concerns are taken seriously at the highest political level.

This is especially important considering that 70 percent of SMEs think that the EU is not doing much to help companies like theirs tackle skill shortages (Eurobarometer, 2023b).

Making subsidies conditional on labour-market measures, as done in the US under the IRA and the Chips and Science Act, might not be the first option for the EU. Given the limited labour market effect that is expected from the IRA (section 2.1), this represents mostly a symbolic act that will benefit only a small number of workers (Poitiers, 2023).

In the EU, where labour-market instruments with general coverage are available and protection of labour rights is more stringent in general, there would be less justification for such measures.

Furthermore, the constitution of labour markets is a national competence and linking EU industrial policy to changes in the governance of labour relations in EU countries would require support from the member states.

Beyond skill shortages directly, two challenges should be considered when designing EU labour policies that support the battery industry. The first corresponds to demographics. Because of demographic change, the EU working-age population decreased by 2.6 percent between 2009 and 2022, and is expected to fall by about the same amount between 2022 and 2030, and by 6.8 percent in total between 2022 and 2040 (European Commission, 2023c).

Simultaneously, the green transition is expected to lead to a shift in demand for labour. As discussed above, certain job profiles will be more in demand, while demand for others will decrease. Older workers with skills profiles linked to a decrease in employment opportunities might not find it worthwhile investing in new skills without public support.

The economic incentives to invest into reskilling are much lower for older workers and their employers, which have a shorter prospective return on such investments than for younger workers, meaning that there may be a particular role for policy in addressing this issue.

Given these demographic challenges, the EU should also target for roles in the battery sector young people who are not in education, employment or training (11.7 percent of young people in 2022; European Commission, 2023c) and women (who in Germany make up just 24 percent of the battery-production sector; Arnold-Triangeli et al 2023).

While the measures announced under the Skills and Talent Mobility Package in November 2023 may help to facilitate the hiring of workers from outside the EU, the global race for talent in this sector means that the EU should not rely on immigration to ease this skills shortage.

The second challenge concerns the location of jobs. Given the limited geographical mobility of workers, and the potential mismatch between the regions dependent on the automotive industry for jobs and the location of new battery production plants, localised negative labour market shocks will pose a challenge and have the potential to undermine political support for the green transition (see Cameron et al 2020, for a breakdown of regions particularly at risk).

A successful industrial policy should help reskill older workers and mitigate the negative effects of the green transition on local communities, while making it easier for workers to move for new employment or training opportunities.

The EU has taken some initial steps into this direction. The TCTF links the eligibility of clean-tech manufacturing projects for subsidies to those projects benefitting poor regions in the EU (Tagliapietra et al 2023).

While such a link is not explicit in the IPCEIs, countries including France and Germany have used industrial subsidies to incentivise the location of battery factories in poorer regions such as Eastern Germany59 or Northern France60.

Given the dual constraint of limited EU competence in both industrial policy and skills, the EBA Academy is a useful EU instrument to complement national policies. Its ability to address the identified skills shortage seems limited at best, but it is a relative cost-effective instrument that does appear to provide a useful resource to training providers across the EU.

However, there are a few areas for improvement. Based on the average learner age reported previously, the EBA Academy seems to mainly reach younger workers, and is not well equipped to target specific labour markets and demographics that might be underserved by private training providers.

While the burden of this may rest more on local or national authorities, more focus should be placed on targeting older or financially constrained workers, who otherwise may not be able or willing to take up the courses offered.

The EBA also needs a stronger profile and should engage more with SMEs, which will become more important players in the battery sector (eg. once EV repairs and maintenance become more widespread) and of which 65 percent are unaware of EU skills policies (Eurobarometer 2023b). Work should continue on expanding the credentials provided, as this is recognition of training is crucial for both firms and learners.

Finally, there is a risk that the different clean-tech skills programmes will directly compete against each other, and a strategy should be devised to identify synergies and avoid such competition. This should be feasible now that the solar, hydrogen and battery skills institutes are all under the same umbrella of the InnoEnergy Skills Institute.

More generally, the social and labour aspects of EU industrial policy should be rethought and given more prominence. The EBA and the Just Transition Fund provide early steps in this regard, but the current lack of competences at the EU limits what can be done. This is regrettable, as it limits the EU’s ability to form a well-balanced industrial policy.

5 Conclusions

Despite the significance of skilled-labour shortages as a bottleneck in the development of a European battery supply chain, an ambitious policy response at EU level is lacking. The EBA Academy, which provides training solutions, is the headline EU skills initiative to tackle this bottleneck. While it receives relatively little funding, the EBA Academy is a potentially valuable and low-cost tool. However, it could be improved by more explicitly targeting those workers who might not receive training without public support.

Given the importance that companies, and especially SMEs, put on the shortage of available skilled workers, current policy responses are not satisfactory. While we argue that labour markets should be mostly considered as an input and not an output in industrial policy, there are political benefits in linking EU green policy with skill policies. Therefore, we argue for EU member states to allow the EU to get more involved in skill policies.

Endnotes

1. The academy was rebranded in early 2023 to become the storage component of the wider InnoEnergy Skills Institute. For clarity and ease, we refer to it as the EBA Academy in this paper.

2. Defined by Juhász et al (2023, p.4) as “government policies that explicitly target the transformation of the structure of economic activity in pursuit of some public goal”.

3. As defined in Article 6 of the TFEU, the EU only has competence “to carry out actions to support, coordinate or supplement the actions of the member states” in the area of industry.

4. While an ‘EU industrial strategy’ had been on the Council of the EU agenda since at least 2017, this refers more generally to improving the performance of European firms and strengthening the single market, not to establishing domestic manufacturing bases in certain sectors. A timeline of the Council’s position on industrial policy.

5. See The White House, ‘Fact sheet: President Biden Takes Historic Step to Advance Worker Empowerment, Rights, and High Labor Standards Globally’, 16 November 2023.

6. Source: ACEA ‘Employment trends in the EU automotive sector’, 22 September 2023.

7. The academy was rebranded in early 2023 to become the storage component of the wider InnoEnergy Skills Institute. For clarity and ease, we refer to it as the EBA Academy in this paper.

8. See for instance The White House, ‘Remarks by President Biden on the Inflation Reduction Act and Bidenomics’, 15 August 2023.

9. As detailed in his September 2023 remarks at the Bruegel Annual Meetings.

10. Niclas Poitiers, ‘The manufacturing jobs boom that isn’t’, First glance, Bruegel, 29 August 2023.

11. The European Association of Automotive Suppliers estimated that 275,000 jobs will be lost on aggregate across the EU, EFTA and the UK between 2020 and 2040 (CLEPA, 2021); Boston Consulting Group (Kuhlmann et al 2021) put net European losses at 50,000 by 2030.

12. Diluiso et al (2021) detailed that 130 of the coal transitions between 1860 and 2020 included in their literature analysis were associated with negative labour market outcomes (higher unemployment and job losses). Only five were linked with positive outcomes.

13. See ‘2023 State of the Union Address by President von der Leyen’, 13 September 2023.

14. Henry Foy and Martin Arnold, ‘Mario Draghi delivers downbeat outlook for EU economic growth’, Financial Times, 8 November 2023.

15. The next highest responses were secondary education for large firms (22 percent), and no level in specific for SMEs (20 percent), meaning that the share of both large and small companies that answered vocational level was almost double that of the next answer.

16. Nick Alipour, ‘Germany’s skilled labour shortage puts vital industries at risk’, Euractiv, 30 November 2023 (updated: 1 December 2023).

17. Reuters, ‘Half of German companies face labour shortages despite economic stagnation – survey’, 29 November 2023.

18. This action plan was heavily informed by the European Battery Alliance, which identified building a skilled labour force as one of the key actions required to develop a European battery sector.

19. Richard Milne, ‘Northvolt: the Swedish start-up charging Europe’s battery ambitions’, Financial Times, 14 March 2023. For more stakeholders pointing to the skills shortage as a significant issue for the European battery sector, see EIT InnoEnergy, ‘TÜV SÜD and EIT InnoEnergy launch partnership to combat skills shortage in battery sector’, 21 October 2022.

20. ‘No particular education level’ at 20 percent.

21. See for instance the 2023 Green Deal Industrial Plan (European Commission, 2023e)

22. The estimates appear to be based on a report by the Fraunhofer Institute (2021) and seem to outweigh the estimates detailed previously.

23. Each stage in the value chain requires a huge range of jobs, with those listed here merely a sample. For a more complete list of roles along the value chain, see EIT InnoEnergy (2023).

24. For a more comprehensive discussion of stationary storage applications see https://www.ise.fraunhofer.de/en/key-topics/stationary-battery-storage.html.

25. For a more detailed discussion on the growth of battery recycling see McKinsey, ‘Battery recycling takes the driver’s seat’, 13 March 2023.

26. The IEA does not report data for the geographical location of the second-life industry.

27. See European Battery Alliance.

28. Bacary Dabo, ‘Africa: The DRC Faces a Skills Shortage in its Quest to Manufacture Electric Vehicle Batteries in the Congo’, allAfrica, 25 November 2021; Benchmark Source, ‘What does Australia’s labour shortage mean for lithium expansions?’ 21 June 2021; Byun Hye-jin, ‘Why Korean battery makers’ mass hiring still ‘not enough’ for tech race’, The Korea Herald, 19 September 2023; Steve LeVine, ‘The Electric: The Next Hurdle for a U.S. Battery Industry: Talent’, The Information, 25 September 2022; Ryohtaroh Satoh, ‘Japan to teach teenagers to make EV batteries amid labor shortage’, Nikkei Asia, 29 June 2023.

29. See European Battery Alliance webinar of 12 April 2022 for a stakeholder discussion on the international race for talent.

30. Benoit Ribeaud, ‘Workforce dilemma casts long shadow’, PV Magazine, 23 November 2023.

31. Pieter Haeck, ‘Chip manufacturers scramble to staff their European factories’, Politico, 18 September 2023.

32. Michael Sainato, ‘“They would not listen to us”: inside Arizona’s troubled chip plant’, The Guardian, 28 August 2023.

33. Which Criscuolo et al (2022a, p.14) broadly defined as interventions used “to structurally improve the performance of the domestic business sector”.

34. RISE, ‘Battery training and courses in batteries’, undated.

35. See https://skelleftea.se/platsen/eng/business/stories-eng/2021-11-22-skellefteas-success-a-national-affair and Stolfa (2023) for details on the work done by the Skelleftea municipality to attract Northvolt.

36. See Verkor press release of 30 August 2022, ‘Verkor and 11 partners launch the École de la Batterie’.

37. Evertiq, ‘Germany is looking to combat the shortage of workers’, 10 October 2022.

38. See Loi n° 2023-973 du 23 octobre 2023 relative à l’industrie verte, https://www.legifrance.gouv.fr/dossierlegislatif/JORFDOLE000047551965/.

39. Nick Alipour, ‘Germany’s skilled labour shortage puts vital industries at risk’, Euractiv, 30 November 2023.

40. Figures as of August 2023, so may not reflect final allocations. Countries included are Greece, Spain, France, Croatia, Portugal, Slovenia, Ireland, Estonia, Lithuania, Romania, the Netherlands, Cyprus, Finland and Denmark; see European Commission (2023f).

41. Apprenticeship USA, ‘Inflation Reduction Act Apprenticeship Resources’.

42. See The White House, ‘ICYMI: Experts Agree: Chips Manufacturing and National Security Bolstered by Childcare’.

43. For more details, see The White House, ‘Factsheet: To Launch Investing in America Tour, the Biden-Harris Administration Kicks off Sprint to Catalyze Workforce Development Efforts for Advanced Manufacturing Jobs and Careers’, 6 October 2023.

44. See European Commission news of 1 July 2020, ‘Commission presents European Skills Agenda for sustainable competitiveness, social fairness and resilience’.

45. The European Commission (2022) estimated that, as a result of the Pact, by the end of 2022 almost 2 million individuals were “reached by upskilling and/or reskilling efforts”, over 15,000 training programmes were updated or developed, and almost €160 million was invested in upskilling and reskilling. However, without a counterfactual it is difficult to determine the actual impact of this initiative.

46. See European Commission press release of 15 November 2023, ‘Commission proposes new measures on skills and talent to help address critical labour shortages’.

47. See See European Commission press release of 9 March 2023, ‘State aid: Commission amends General Block Exemption rules to further facilitate and speed up green and digital transition’.

48. A European Chips Skills Academy to solve skilled-worker shortages in the semiconductor sector is also in progress and is supported by the Erasmus+ programme; see Nick Flaherty, ‘Semi launches €4m European Chip Skills Academy’, EE News Europe, 14 April 2023.

49. See European Battery Alliance.

50. For the 2023 takeaways, see ‘7th High-Level Meeting of the European Battery Alliance, main takeaways by the Chair Maroš Šefčovič and the Council Presidency’, undated.

51. For an in-depth account of all the EU policy measures, introduced to support the battery sector, including those centred around skills, see ECA (2023).

52. Based on our conversations, the greatest demand is for short-term training.

53. The Academy is designed to be self-sustaining, and as such does not provide its content for free. It enters into commercial arrangements with LTPs, who can then charge learners for the training provided. In some instances, this training can be subsidised by local authorities or other relevant organisations.

54. The Europass profile is an online portal that allows workers to document their education, training and experiences. See https://europa.eu/europass/en/stakeholders/education-and-training.

55. Fundamentals on Batteries, Battery Storage Basics and Battery Management Systems.

56. Data from an internal EIT InnoEnergy report shared with Bruegel.

57. IPCEIs are state aid exemptions granted by the Commission in order to support major cross-border innovation and infrastructure projects, including the industrial deployment of innovative technologies. They have been used to support large battery, hydrogen and chip projects (for an overview, see Poitiers and Weil, 2022b). For the battery sector, see the Commission’s overview on approved IPCEIs.

58. The temporary loosening of state aid rules to support clean-tech industries, announced in March 2023; see European Commission, ‘Temporary Crisis and Transition Framework’.

59. Guy Chazan and Joe Miller, ‘The surprising revival of eastern Germany’, Financial Times, 28 June 2022.

60. Reuters, ‘France inaugurates first of four gigafactories in the north’, 30 May 2023.

References

Arnold-Triangeli, L, N Birner, A Busch-Heizmann, D Johnsen, P Kelterborn, M Maschke and C Sprung (2023) Spotlight on talents in the German battery industry: How companies can secure their demand by promoting diversity, II/2023 Study.

Attinasi, MG, D Ioannou, L Lebastard and R Morris (2023) ‘Global production and supply chain risks: insights from a survey of leading companies’, ECB Economic Bulletin 7/2023, European Central Bank.

Bistline, J, NR Mehrotra and C Wolfram (2023) ‘Economic Implications of the Climate Provisions of the Inflation Reduction Act’, BPEA Conference Drafts, The Brookings Institution, 30-31 March.

Cameron, A, G Claeys, C Midões and S Tagliapietra (2020) A Just Transition Fund – How the EU budget can best assist in the necessary transition from fossil fuels to sustainable energy, Study for the European Parliament BUDG Committee.

Cherif, R and F Hasanov (2016) ‘Soaring of the Gulf Falcons: Diversification in the GCC Oil Exporters in Seven Propositions’, in R Cherif, F Hasanov and M Zhu (eds) Breaking the Oil Spell: The Gulf Falcons’ Path to Diversification, International Monetary Fund

Criscuolo, C, L Díaz, L Guillouet, G Lalanne, C van de Put, C Weder and H Zazon Deutsch (2023) ‘Quantifying industrial strategies across nine OECD countries’, OECD Science, Technology and Industry Policy Paper No. 150.

Criscuolo, C, N Gonne, K Kitazawa and G Lalanne (2022a) ‘An industrial policy framework for OECD countries: Old debates, new perspectives’, OECD Science, Technology and Industry Policy Paper No. 127.

Criscuolo, C, N Gonne, K Kitazawa and G Lalanne (2022b) ‘Are industrial policy instruments effective? A review of the evidence in OECD countries’, OECD Science, Technology and Industry Policy Paper No. 128.

Diluiso, F, P Walk, N Manych, N Cerutti, V Chipiga, A Workman … K Song (2021) ‘Coal transitions— part 1: a systematic map and review of case study learnings from regional, national, and local coal phase-out experiences’, Environmental Research Letters 16(11).

EIT InnoEnergy (2023) ‘Powering the Transition to Net Zero Economies: A report on the talent and skills the Battery Industry will need’, InnoEnergy Skills Institute Insights.

CLEPA (2021) Electric Vehicle Transition Impact Assessment Report 2020–2040: A quantitative forecast of employment trends at automotive suppliers in Europe, European Association of Automotive Suppliers

European Commission (2018) ‘Strategic Action Plan on Batteries’, COM(2018) 293 Annex 2.

European Commission (2022) Pact for Skills Annual Report 2022.

European Commission (2023a) ‘Proposal on establishing a framework of measures for strengthening Europe’s net-zero technology products manufacturing ecosystem (Net Zero Industry Act)’, COM(2023) 161.

European Commission (2023b) ‘2023 Country Report – France’, SWD(2023) 610.

European Commission (2023c) Employment and Social Developments in Europe: Addressing labour shortages and skills gaps in the EU, Annual Review, DG EMPL.

European Commission (2023d) ‘2024 European Semester: Proposal for a Joint Employment Report’, COM(2023) 904.

European Commission (2023e) ‘A Green Deal Industrial Plan for the Net-Zero Age’, COM(2023) 62.

European Commission (2023f) ‘Communication on the revision of the Strategic Energy Technology (SET) Plan’, COM(2023) 634.

ECA (2023) ‘The EU’s industrial policy on batteries: New strategic impetus needed’, Special report, 16 March, European Court of Auditors.

European Investment Bank (2023) EIB Investment Survey 2023.

Eurobarometer (2023a) ‘Flash Eurobarometer 537: SMEs and skills shortages’.

Eurobarometer (2023b) ‘Flash Eurobarometer 529: European Year of Skills: Skills shortages, recruitment and retention strategies in small and medium-sized enterprises’, May.

Fossil Free Sweden (2020) Strategy for fossil free competitiveness; Sustainable battery value chain.

Foster, D, A Maranville and SF Savitz (2023) ‘Jobs, Emissions, and Economic Growth—What the Inflation Reduction Act Means for Working Families’, Policy Paper, Energy Futures Initiative, January.

Fraunhofer Institute (2021) Future Expert Needs in the Battery Sector, EIT RawMaterials, March.

Güner, D and L Nurski (2023) ‘Understanding barriers and resistance to training in the European Union’, Bruegel Blog, 16 January.

Hanlon, WW (2020) ‘The persistent effect of temporary input cost advantages in shipbuilding, 1850 to 1911’, Journal of the European Economic Association 18(6): 3173- 3209/

IEA (2022) Global Supply Chains of EV Batteries, International Energy Agency.

IEA (2023) World Energy Employment 2023, International Energy Agency.

Juhász, R, NJ Lane and D Rodrik (2023) ‘The new economics of industrial policy’, NBER Working Paper 31538, National Bureau of Economic Research.

Kuhlmann, K, D Küpper, M Schmidt, K Were, R Strack and P Kolo (2021) Is E-mobility a Green Boost for European Automotive Jobs? Boston Consulting Group.

Kleimann, D, N Poitiers, A Sapir, S Tagliapietra, N Véron, R Veugelers and J Zettelmeyer (2023) ‘How Europe should answer the US Inflation Reduction Act’, Policy Contribution 04/2023, Bruegel.

Poitiers, N and P Weil (2022a) ‘Is the EU Chips Act the right approach?’ Bruegel Blog, 2 June.

Poitiers, N and P Weil (2022b) ‘Opaque and ill-defined: the problems with Europe’s IPCEI subsidy framework’, Bruegel Blog, 26 January.

Stolfa, J (2023) ‘Overview of the skills and competence needs of the European battery sector’, presentation, 9 February, Alliance for Batteries Technology, Training and Skills project.

Tagliapietra, S, R Veugelers and J Zettelmeyer (2023) ‘Rebooting the European Union’s Net Zero Industry Act’, Policy Brief 06/2023, Bruegel.

Vandeplas, A, I Vanyolos, M Vigani and L Vogel (2022) ‘The Possible Implications of the Green Transition for the EU Labour Market’, European Economy Discussion Paper 176, European Commission, December.

Yeo, P (2016) ‘Going Beyond Comparative Advantage: How Singapore Did It’, in R Cherif, F Hasanov and M Zhu (eds) Breaking the Oil Spell: The Gulf Falcons’ Path to Diversification, International Monetary Fund.

This paper was produced within the project Future of Work and Inclusive Growth in Europe with the financial support of the Mastercard Center for Inclusive Growth. This article is based on the Bruegel Working Paper 01/2024.