A story of tailwinds and headwinds

Agustín Carstens is the General Manager at the Bank for International Settlements

Introduction

My remarks will reflect on aggregate supply’s importance for macroeconomic stabilisation. We are used to viewing the economy mainly through the lens of aggregate demand, with supply assumed to adjust smoothly in the background. But we need a more balanced approach. Signs of fragility in supply have been ignored for too long.

Recent events have shown the dangers of doing this. Reinvigorating productivity growth and enhancing the flexibility and resilience of supply will have to play a larger role in policy debates going forward. Let me elaborate on these thoughts.

An era of supply tailwinds

In the three decades leading up to the pandemic, four criss-crossing tailwinds made aggregate supply highly responsive to shifts in aggregate demand: a relatively stable geopolitical environment, technological advances, globalisation and favourable demographics.

A relatively stable global political landscape arose around the broad consensus that free markets and cooperation would support economic growth. At an international level, this helped forge trade agreements that drew more countries into global production networks.

At a domestic level, it helped strengthen market forces through privatising state enterprises, deregulating labour, product and financial markets, and legal improvements, including more secure property rights.

Liberalised and globalised markets, in turn, disciplined policymaking, as they made it harder to deviate from prudent approaches and helped spread best practices, such as inflation targeting.

At the same time, technological advances pushed down costs, made time and physical distance less of a constraint on economic activity and thus provided the basis for a lift in global productivity1.

Intertwined with these political and technological developments, globalisation expanded the world production frontier. Globalisation in goods and factor markets gave firms access to a larger consumer base, a wider pool of resources, access to international know-how and chances for specialisation.

Financial globalisation alleviated constraints. As a result, more productive capacity was brought online and opportunities for efficiency gains and cost reductions were exploited on a global scale.

Meanwhile, demographic trends were favourable. The working age share of the global population grew rapidly from 1970 onwards. In advanced economies, baby boomers injected a large cohort of workers into the job market from the 1980s. And trade brought the previously untapped young workforces of emerging market economies into the global labour pool.

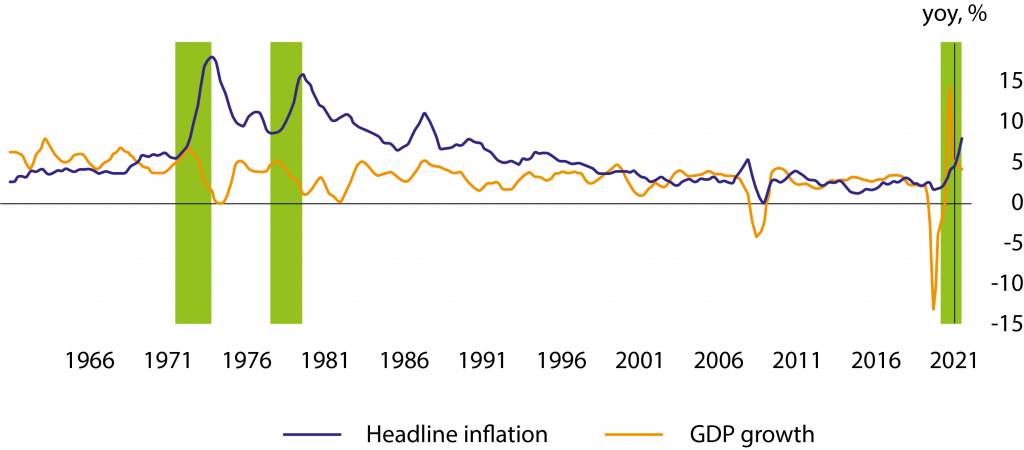

These tailwinds fostered growth alongside low inflation in several ways (Figure 1). A key one was by loosening the link between domestic economic activity and inflation (Forbes (2019)).

Access to cheaper production locations drove inflation down. More contestable domestic markets and sharper international competition weakened the pricing power of firms and bargaining power of workers. And because countries – especially advanced economies – could more easily tap global resources, domestic supply constraints became less binding.

As a result, Phillips curves flattened (Borio (2017))2 and global – rather than domestic – slack increasingly became the key driver of inflation (Borio and Filardo (2007), Boissay et al (2021)).

At the same time, the tailwinds also made supply more responsive to changes in demand. Producers could easily access a network of worldwide suppliers. This allowed them to take advantage of the best available prices. After disruptions, supply would generally adjust quickly to new demand patterns.

The sooner policymakers recognise the need for a reset and commit to sustainable growth strategies focused on revitalising the supply side, the stronger and more resilient the global economy will be

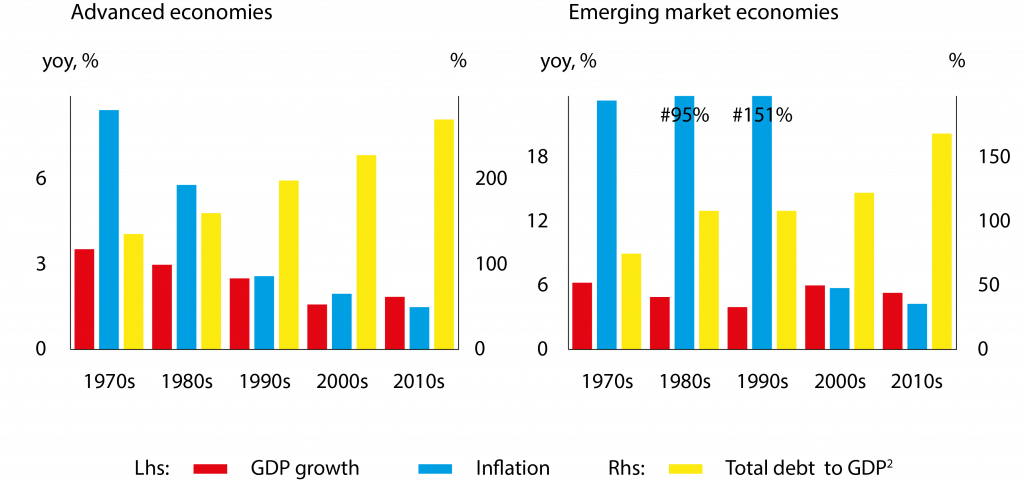

Figure 1. Mostly solid growth and low inflation characterised much of the decades before COVID-19

Notes: Weighted averages based on GDP and PPP exchange rates across 10 advanced economies (AU, CA, DK, EA, GB, JP, NO, NZ, SE and US) and 11 emerging market economies (CL, CO, IN, KR, MX, MY, PH, SG, TH, TR and ZA). Green shaded areas represent persistent inflation periods, where the cumulative rise in inflation was above 5.5 percentage points.

Sources: OECD; World Bank; Global Financial Data; national data; BIS.

A build-up of fragilities

The supply tailwinds produced a business cycle distinct from that seen in the post-war period. With inflation low and stable, monetary policy had less need to tighten during expansions than in the past. And in recessions, central banks were usually in a position where they could provide forceful stimulus, confident that inflation would remain under control.

Fiscal policy also had more leeway, as nominal and real interest rates fell to their lowest levels since records began. But, even though macroeconomic conditions remained benign, fault lines emerged.

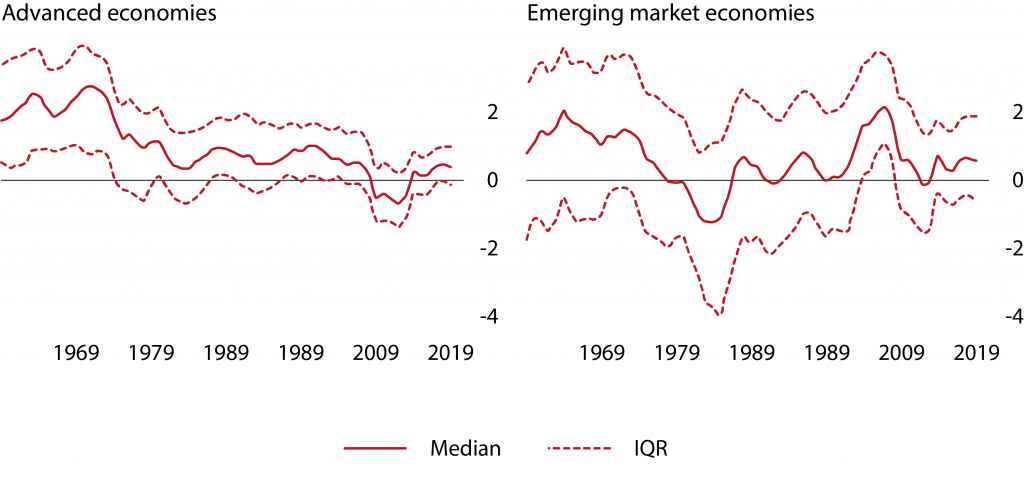

Low productivity growth was a key warning sign. In advanced economies, it plunged during the Great Financial Crisis (GFC) and never fully recovered, part of a longer decline going back at least to the late 1990s (Figure 2). In emerging market economies, the productivity boost from integration into global networks and structural reforms proved to be fleeting. The post-GFC slowdown has been the steepest and most prolonged of the past three decades.

In retrospect, some slowdown in productivity growth was probably inevitable. Liberalising reforms that improve the quality of institutions3 can deliver rapid productivity gains. But these naturally slow as countries exploit them and approach the productivity frontier. Incremental improvements in institutional quality become harder to achieve.

Figure 2. Productivity growth has been difficult to keep up (in per cent)

Notes: Five-year moving averages of median and interquartile ranges of year-on-year changes in total factor productivity at constant national prices. Advanced economies: AT, AU, BE, CA, CH, CY, DE, DK, ES, FI, FR, GB, GR, IE, IS, IT, JP, LU, MT, NL, NO, NZ, PT, SE and US; emerging market economies: AR, BR, CL, CN, CO, CZ, EE, EG, HK, HR, HU, ID, IL, IN, KR, LT, LV, MA, MX, MY, PE, PH, PL, PY, RO, RU, SA, SG, SI, SK, TH, TN, TR, UA, UY and ZA; where data are available.

Sources: Penn World Table, version 10.0; BIS.

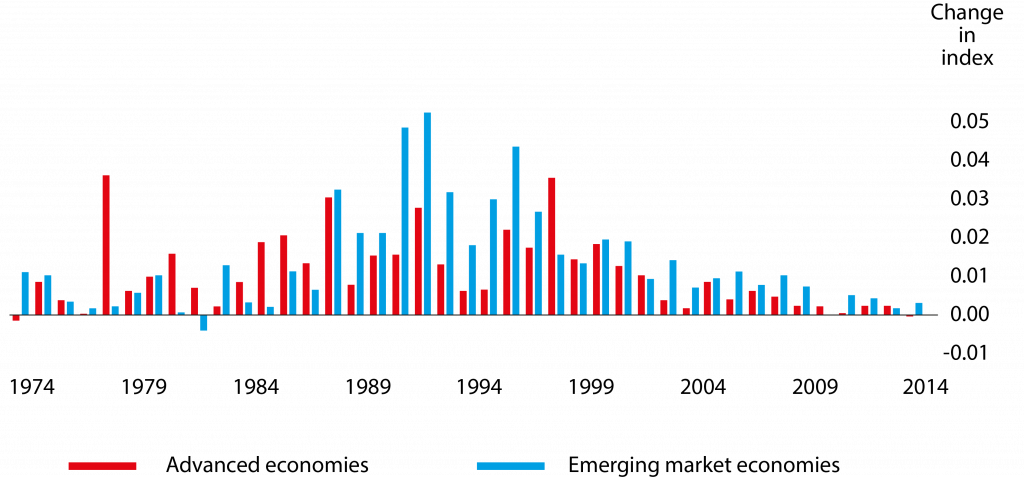

That said, there is no hiding the fact that the growth-enhancing structural reform drive prevalent during the 1990s and early 2000s slowed significantly in many countries (Figure 3). There are many possible explanations for this. Vested interests resist changes. And, as the benefits of structural reforms accrue only in the longer term, they usually rank low in governments’ priority lists.

Paradoxically, the supply side tailwinds may also have played a role. Plentiful global supply and low inflation concealed the costs of low productivity. In consequence, governments lost the appetite for technically difficult – and often politically unpopular – structural reforms. The can was kicked down the road4.

Figure 3: Structural reforms largely stalled in the 2000s

Notes: Change in average reform index computed as the arithmetic average of indicators capturing liberalisations in five areas: domestic finance (regulation and supervision), external finance (capital account openness), trade (tariffs), product market (network industries) and labour market (job protection legislation). The index ranges from 0 to 1, with higher scores indicating greater liberalisation.

Sources: IMF, BIS.

Missing the lift that robust productivity growth could have provided, economies had to rely on other sources of growth. Expanding financial systems provided an impetus, at least until the GFC – when the engine of growth fuelled by debt and driven by demand sputtered.

Crucially, this was not neutral for potential growth, as indicated by the break in productivity patterns I mentioned earlier. And fiscal and monetary policies were increasingly called upon to sustain output. Although obscured by acceptable growth, the constraints were increasingly visible, even before the pandemic.

Economies were becoming fragile as private and sovereign debt levels reached historical highs (Figure 4) and inequality rose. The room for policy manoeuvre was eroding, with policymakers forced to do ever more to bring economies back to trend after each downturn5.

Nonetheless, with supply side tailwinds still lending support, increased reliance on demand management did not lead to higher inflation. Indeed, in many parts of the world, the key challenge for central banks on the eve of the pandemic was to bring inflation back up to target. The winds were about to change, however.

A rude awakening

The pandemic and the war in Ukraine have been a rude awakening both in an economic and humanitarian sense. To be sure, both were exceptional shocks that arose from exogenous causes.

But they painfully revealed that the supply side could only be stretched so far. This made demand side policy responses far harder to calibrate. I draw several lessons from this experience.

First, to fight the pandemic it was decided to bring the global economy intentionally to an immediate standstill in mid-air. But turning on and off supply is not like turning on and off demand. With the benefit of hindsight, it was perhaps naïve to expect that it would be possible to easily reignite the growth engine, quickly recover speed and again fly smoothly. We now know better.

Figure 4: Debt levels climbed as inflation came down

Notes: Decade average of respective variables where regional aggregates are computed as weighted averages based on GDP and PPP exchange rates. Advanced economies: AU, CA, CH, DK, EA, GB, JP, NO, NZ, SE and US; emerging market economies: AR, BR, CL, CN, CO, CZ, HK, HU, ID, IN, KR, MX, MY, PE, PH, PL, RU, SG, TH, TR, TW and ZA; where data are available. 2. Sum of public and non-financial private sector debt.

Sources: IMF; World Bank; Global Financial Data; national data; BIS.

The second lesson is that we cannot take the availability of aggregate supply for granted. The global supply networks that adjusted smoothly to changes in aggregate demand turned out to be far less resilient than we thought. Seemingly robust supply chains broke down in the face of disruptions to a few key production inputs.

The final lesson is the sensitivity of inflation to supply constraints. Policymakers had grown accustomed to decades of ample supply, and, with no experience in calibrating stimulus to restart an engine that had been intentionally switched off, reached for their familiar demand side tools. These had boosted growth in the past, without stoking inflation. The consequences for inflation when supply could no longer keep up caught many of us off guard.

As tailwinds turn into headwinds

Looking further out, a key challenge I see is that even if the specific supply disruptions caused by the pandemic and the war fade, the importance of supply side factors for inflation is likely to remain high.

This is because the global economy seems to be on the cusp of a historic change as many of the aggregate supply tailwinds that have kept a lid on inflation look set to turn into headwinds. If so, the recent pickup in inflationary pressures may prove to be more persistent. Let me consider three of the forces I noted earlier: geopolitics, globalisation and demographics.

Even before the war in Ukraine, the political environment had been growing tense and less friendly to the principle of international cooperation. This backlash reflects, in part, the course globalisation has taken: the perceived uneven distribution of benefits within and across countries and discontent with local and global governance mechanisms.

Greater inequality has given rise to populism, which has threatened the rules-based international trade and finance system, and more broadly democratic norms and institutions, including independent central banks (Goodhart and Lastra (2018), Borio (2019)). Thus, it is not surprising that globalisation has been losing steam.

Other, more structural, factors have also weighed on global trade integration. As emerging market economies converge to their richer trade counterparts, comparative advantage on the basis of wages narrows.

Advances in robotics and information and communications technology (ICT) that decrease the relative importance of labour in production processes could also favour local production and discourage global goods trade6.

Recent developments could accelerate this trend further. The pandemic revealed the fragility of global supply chains that prioritised cost reduction above all else. The war in Ukraine has rattled commodity markets and threatened energy and food security. It has also accelerated the realignment of geopolitical alliances.

As a result, access to global production networks and international financial markets can no longer be taken for granted. A reconfiguration of global value chains could well follow. Some of these developments may be warranted. But we should not imagine that they will be costless.

Meanwhile, demographic tailwinds are set to reverse, and labour may not be as abundant as it used to be. The baby boomers are retiring. The pandemic may leave a persistent imprint on both the quantity and quality of workers.

Labour force participation rates remain below pre-pandemic levels in many countries, signalling a potential shift in attitudes towards work. Lost schooling and disruptions to regular healthcare services during the pandemic could scar human capital. International labour mobility also faces increasing obstacles.

Moreover, even as these tailwinds turn into headwinds, new headwinds are emerging. In particular, the threat of climate change calls for an unprecedented policy-induced reallocation of resources. And it will only intensify war-induced food and energy bottlenecks.

Increasing extreme weather events and an interconnected global food supply system raise the risk of disruptions and higher, more volatile prices, not to mention human costs7.

Expectations of a shift away from fossil fuels have deterred investment (Meyer (2022)), threatening energy shortages before clean energy options can catch up to meet demand. This pushes up inflation.

Policies to deliver the lift needed and avoid the stall

This new and more hostile supply environment has sobering implications for economic policy. We may be approaching what in aviation is called a ‘coffin corner’, the delicate spot when an aircraft slows to below its stall speed and cannot generate enough lift to maintain its altitude.

It takes skilled piloting to get the aircraft back to a safer, stable place. Continuing to rely primarily on aggregate demand tools to boost growth in this environment could increase the danger, as higher and harder-to-control inflation could result.

So what needs to be done? Getting the economy back to a durable path starts with a reset to macroeconomic policymaking. As demand side policies cannot substitute for supply tailwinds, we need to be realistic about what these policies can deliver and more keenly aware of the associated costs.

When economic disturbances come from supply as well as demand, the ‘divine coincidence’ breaks down. In this environment, central banks cannot hope to smooth out all economic air pockets, and must instead focus first and foremost on keeping inflation low and stable (BIS (2022)). Monetary policy needs to meet the urgent challenge of dealing with the current inflation threat.

Fiscal policy should also be aware of tighter limits on what demand management policies can deliver. In a world of unforgiving supply, what fiscal stimulus adds to demand may need to be taken away by monetary policy tightening.

Scarce fiscal resources should instead be used to tackle supply constraints head on, including those imposed by climate change, ageing populations and infrastructure, through growth-friendly actions and support for broad structural reforms. Such a focus on reinvigorating growth through the supply side could also create scope to rebuild fiscal buffers.

The aim should be to create a dynamic, nimble environment encouraging innovation, enhancing resilience and supporting the required institutional, technological and ecological transitions.

Policymakers should focus on fostering investment in healthcare to better protect human capital. They should also promote investment in climate-friendly industries and all types of infrastructure, including digital. Priority areas of action should involve competition, labour and education policies to provide and sustain the much-needed innovative impetus.

At the same time, reaping the benefits of technological innovation requires a favourable regulatory and legal environment. Efforts to make the financial system more balanced yet more innovative go hand in hand with reforms on the real side.

Sustaining international cooperation in the face of rising protectionist and populist impulses will also be important. One solution could be to promote a ‘better’ and more sustainable form of globalisation, rather than scaling back trade integration in a major way8. This would strike a balance between resilience, sustainability and efficiency9.

We can achieve it by giving businesses incentives to set up shorter or more diversified supply chains when the social benefit exceeds the private cost, and by leveraging new technologies to monitor and stress-test systems.

These new arrangements would also have to recognise the redistributive implications of integration and offer concrete remedies, taking to heart the lessons that not all members of society have benefited from globalised trade and finance.

Let me conclude. As any pilot will tell you, when the warning lights flash, there is a premium on timely and decisive action. The sooner policymakers recognise the need for a reset and commit to sustainable growth strategies focused on revitalising the supply side, the stronger and more resilient the global economy will be.

If we manage to do that, new tailwinds may well develop, with substantial benefits for both growth and price stability.

Endnotes

1. Intermodal standardised freight containers, introduced in the 1950s and widely adopted over the subsequent decades, drastically lowered shipping costs and boosted international trade (Bernhofen et al (2016)). In the meantime, the information and communication technology (ICT) revolution made it easier for firms to operate on a global scale (Baldwin (2016)), while improving production processes and opening up new business opportunities.

2. Globalisation also affected inflation through commodity prices. The increased importance of emerging market economies and their higher demand for raw materials meant that global commodity prices became more tightly linked to growth in emerging market economies – particularly in China. Given more volatile growth in these economies, this development contributed to sharper commodity price swings. As a result, global commodity price movements came to explain a larger share of the variance in inflation. See Forbes (2019) for more on this effect.

3. These institutions include the rule of law, property rights, competition and human capital. The importance of each factor may vary across countries. For instance, in emerging market economies rule of law and property rights are key to the development of a stable financial system for intermediating domestic savings and to making the most of foreign capital to benefit supply, not least through diffusion of know-how. For advanced economies, competition, labour market and education policies are instrumental to remain on the knowledge frontier and ensure that gains from global integration and technological advances are distributed evenly.

4. Meanwhile, the productivity-enhancing promise of many technological developments – particularly in the information and communications technology (ICT) sphere – has not been realised. Indeed, many new technologies such as big data and artificial intelligence seem to have favoured incumbents and further encouraged concentration, limiting the spread of productivity across the economy. Other explanations for the puzzling discrepancy between rapid ICT innovation and slow aggregate productivity growth include the arguments that the economic benefits of these new technologies are overblown, that productivity is mismeasured or that the gains will take time to emerge given the necessary investment for adoption, including training of current and prospective workers to acquire the skills needed for the digital workplace. See Mihet and Philippon (2019) for a detailed discussion.

5. Aggressive monetary policy easing could create conditions that make it necessary to maintain extraordinary accommodation. One possibility is the potential link between monetary policy and the natural interest rate, eg. due to the former’s effect on debt (Mian et al (2021)) or because the act of policy easing leads the public to believe that the natural interest rate has declined and save more as a result (Rungcharoenkitkul and Winkler (2021)).

6. Conversely, technological advances could facilitate an increase in trade in services and intangibles. Such a shift away from tangibles to intangibles has already taken place in several economies and could explain some of the productivity slowdown. Bailey (2022) shows that, between 2000 and 2007 in six advanced economies, intangible-intensive industries had a more pronounced slowdown in productivity growth than tangible-intensive industries did.

7. The global food system involves production, transport, processing, packaging, storage and retail. It feeds the great majority of the world population and supports the livelihoods of over 1 billion people (Mbow et al (2019)).

8. For views on what such forms of globalisation could look like, see Rodrik (2011) and Wolf (2019).

9. For a discussion of the importance of resilience in promoting macroeconomic stability, see Brunnermeier (2021).

References

Bailey, A (2022): “The economic landscape: structural change, global R* and the missing-investment puzzle”, speech at the Official Monetary and Financial Institutions Forum, 12 July.

Baldwin, R (2016): The great convergence: information technology and the new globalisation, Harvard University Press.

Bank for International Settlements (BIS) (2022): Annual Economic Report 2022, June.

Bernhofen, D M, Z El-Sahli and R Kneller (2016): “Estimating the effects of the container revolution on world trade”, Journal of International Economics, vol 98, pp 36–50.

Boissay, F, E Kohlscheen, R Moessner and D Rees (2021): “Labour markets and inflation in the wake of the pandemic”, BIS Bulletin, no 47.

Borio, C (2017): “Through the looking glass”, OMFIF City Lecture, London, 22 September.

Borio, C (2019): “Central banking in challenging times”, speech at the SUERF Annual Lecture Conference on “Populism, economic policies and central banking”, SUERF/BAFFI CAREFIN Centre Conference, Milan, 8 November.

Borio, C and A Filardo (2007): “Globalisation and inflation: new cross-country evidence on the global determinants of domestic inflation”, BIS Working Papers, no 227.

Brunnermeier, M (2021): The resilient society, Endeavor Literary Press.

Forbes, K (2019): “Has globalisation changed the inflation process?”, BIS Working Papers, no 791.

Goodhart, C and R Lastra (2018): “Populism and central bank independence”, Open Economies Review, vol 29, pp 49–68.

Mbow, C, C Rosenzweig, L G Barioni, T G Benton, M Herrero, M Krishnapillai, E Liwenga, P Pradhan, M G Rivera-Ferre, T Sapkota, F N Tubiello and Y Xu (2019): “Food security”, in P R Shukla, J Skea, E Calvo Buendia, V Masson-Delmotte, H-O Pörtner, D C Roberts, P Zhai, R Slade, S Connors, R van Diemen, M Ferrat, E Haughey, S Luz, S Neogi, M Pathak, J Petzold, J Portugal Pereira, P Vyas, E Huntley, K Kissick, M Belkacemi and J Malley (eds), Climate change and land: an IPCC special report on climate change, desertification, land degradation, sustainable land management, food security, and greenhouse gas fluxes in terrestrial ecosystems.

Meyer, R (2022): “The world is half-prepared for a different energy future”, The Atlantic, 5 January.

Mian, A, L Straub and A Sufi (2021): “Indebted demand”, The Quarterly Journal of Economics, vol 136, no 4, pp 2234–307.

Mihet, R and T Philippon (2019): “The economics of big data and artificial intelligence”, in J Choi and B Ozkan (eds), Disruptive innovation in business and finance in the digital world (International Finance Review, vol 20), Emerald Publishing Limited, pp 29–43.

Rodrik, D (2011): The globalisation paradox: democracy and the future of the world economy, W Norton.

Rungcharoenkitkul, P and F Winkler (2021): “The natural rate of interest through a hall of mirrors”, BIS Working Papers, no 974.

Wolf, M (2019): “The case for sane globalism remains strong”, Financial Times, 16 July.

This article is based on a speech delivered at the Jackson Hole Economic Symposium, 26 August 2022.