Geoeconomic fragmentation and financial performance

Alessandro D’Orazio is a PhD candidate in Statistics at the University of Rome ‘La Sapienza’, Fabrizio Ferriani is Deputy Head of International Financial Markets and Commodity Division at the Bank of Italy, and Andrea Gazzani is a Senior Economist at the Bank of Italy

How do economic and financial interdependencies among countries and firms respond when seismic geopolitical shifts disrupt the rule-based international order? This question has gained prominence in policy debates as the advantages accrued over decades of economic integration are threatened by escalating tensions, leading to a reversal of international relations.

This phenomenon, labelled as geoeconomic fragmentation (Aiyar and Ilyina 2023), has been accelerating in recent years. Events such as Brexit, trade disputes between the US and China, trade flow restrictions associated with the COVID-19 pandemic, and, more dramatically, Russia’s invasion of Ukraine and the Israeli-Palestinian conflict, have all contributed to this trend.

As of now, the analysis on the impacts of geoeconomic fragmentation has mainly focused on how the deterioration of international relations can impact international trade and highly interconnected global value chains (eg. Campos et al 2023, Attinasi et al 2023). Concerns of geoeconomic fragmentation in commodity markets have intensified since the start of Russia’s invasion of Ukraine (eg. IMF 2023a, Emiliozzi et al 2024, Albrizio et al 2023).

Conversely, the study of the financial impacts of geopolitical tensions has been more limited so far, with most analyses focusing on cross-border capital flows (especially foreign direct investment), asset prices and investors’ risk aversion at the aggregate level (IMF 2023b, Feng et al 2023, Aiyar et al 2024).

In a recent study (D’Orazio et al 2024), we present evidence on the financial impacts of geoeconomic fragmentation from a firm-level perspective. Our study covers the period 2010-2022 and relies on a large sample of non-financial corporations included in the Eurostoxx 600 and the S&P500 equity indexes.

A novel firm-level measure of exposure to geopolitical risk

We propose a novel firm-level measure of exposure to geopolitical risk combining detailed information on the geographic distribution of corporate revenues with country-specific assessments of geopolitical risk to create a revenue-weighted geopolitical risk indicator.

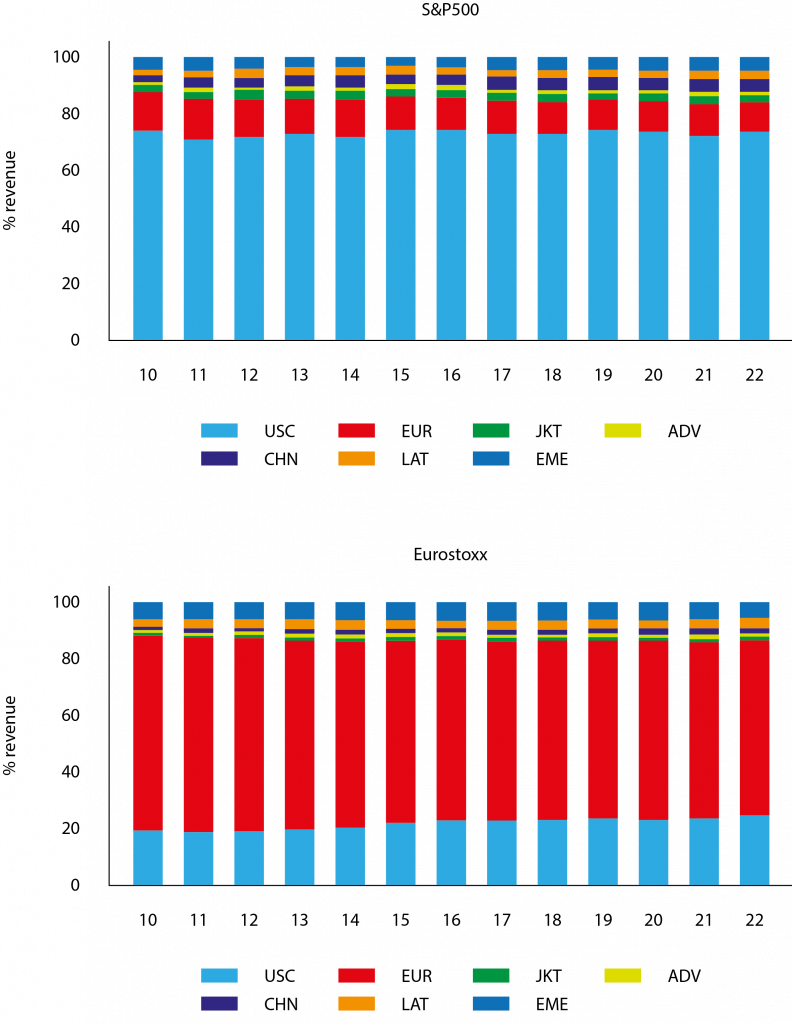

Data on the geographical breakdown of corporate revenues are retrieved from explanatory notes to the official financial statements and is used to identify the ultimate origin of firms’ business risk, specifically the location where firms generate their revenues. Figure 1 displays the geographical breakdown of corporate revenues (using macro-aggregates for readability).

Not surprisingly, the largest share of revenues originates from the geographical area where firms are listed: approximately 72% of revenues are generated in the US and Canada for S&P500 firms, compared to an average of 64% of revenues generated in Europe for Eurostoxx companies. In both regions, revenue generated in China hovers around 3%.

Figure 1. Geographical breakdown of corporate revenues: S&P500 vs. Eurostoxx

Note: Acronyms are as follows: United States and Canada (USC), Europe (EUR), Japan, South Korea and Taiwan (JKT), other advanced economies (ADV), China (CHN), Latin America (LAT), other emerging markets (EME). Our elaborations from Orbis-Bureau van Dijk database.

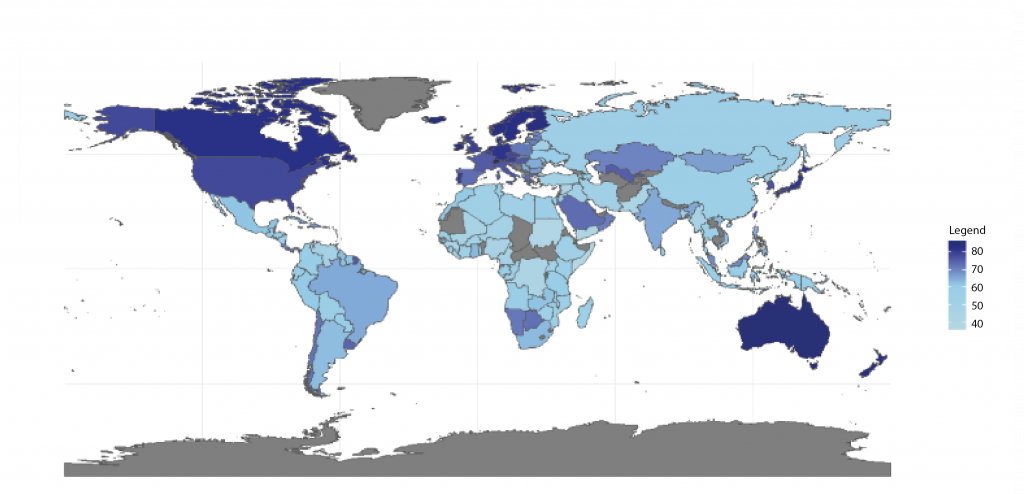

Data on country geopolitical risk relies on the yearly assessment of political risk developed by the International Country Risk Guide (ICRG). The political risk rating ranges from 0 to 100, with higher scores associated with lower risk levels, and it covers the assessment of geopolitical risk across twelve dimensions: government stability, socioeconomic conditions, investment profile, internal conflict, external conflict, corruption, military in politics, religious tensions, law and order, ethnic tensions, democratic accountability, and bureaucracy quality.

Global average risk score is moderately declining over time (ie. geopolitical risk increases) and exhibits high variability across countries, with the political risk score ranging between approximately 30 and 90 points out of 100.

Figure 2 presents the risk ranking based on the ICRG 2022 assessment: lower geopolitical scores are generally associated with advanced economies (Western countries, Japan, Australia, South Korea), while most emerging economies exhibit higher geopolitical risk.

Figure 2. Country-level measure of geopolitical risk

Note: The plot displays countries’ geopolitical risk in 2022. Data are from ICRG, higher values correspond to lower risk levels; grey countries have no available score.

We multiply the shares of firm revenues originating in each national market by the corresponding value of the country-specific ICRG index to obtain a revenue-weighted measure of firms’ exposure to geopolitical risk (Gprisk revenue weighted).

We analyse the impact of this measure on several indicators of corporate financial performance, namely the Altman Z-score, which constitutes an inverse proxy of firms’ default probability based on accounting variables, and the price-to-earnings (P/E) ratio, and the Tobin’s Q ratio, reflecting investors’ assessment of firms’ profitability and market value.

As global tensions continue unabated, the financial consequences of fragmentation for firms may intensify, amplifying macro-financial turbulence

The impact of geopolitical risk exposure on firms’ financial performance

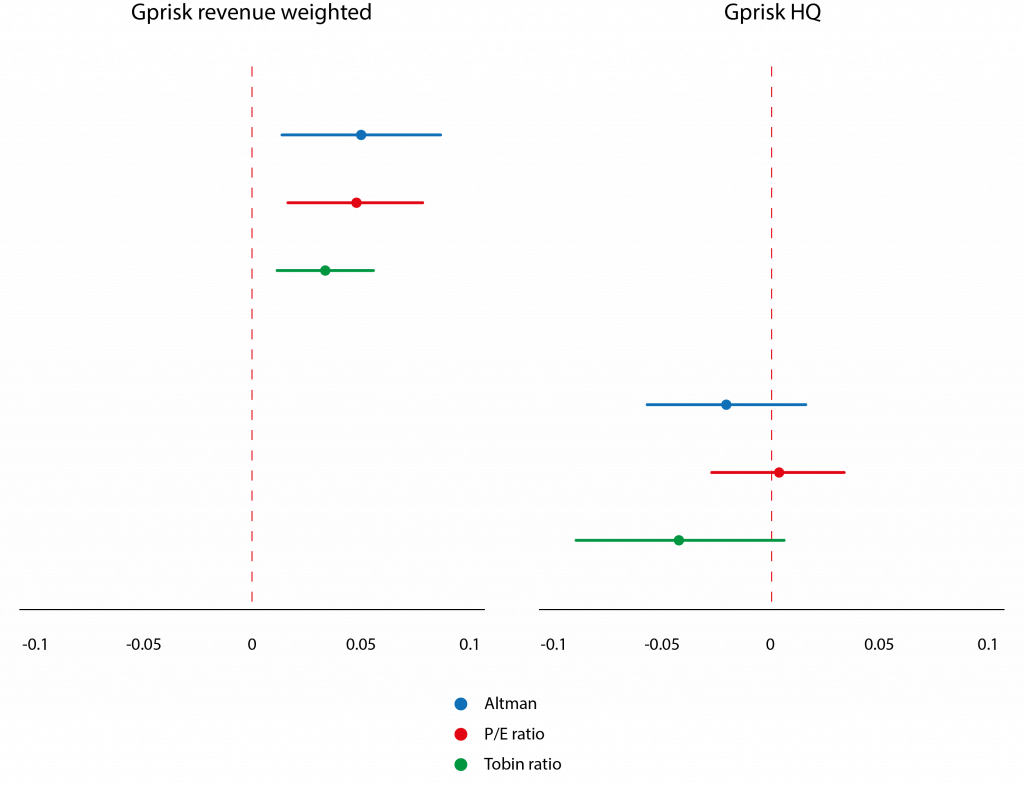

Firms’ revenue exposure to markets characterised by high geopolitical risk impacts corporate viability and this is also reflected in lower investors’ valuations. Figure 3 graphically presents our results, including, for comparative purposes, the effects of a naïve and less sophisticated measure of firm geopolitical risk based on firms’ headquarters (Gprisk HQ).

The two measures can imply very distinct assessments of corporate exposure to geopolitical risk. For instance, consider two firms headquartered in the US – one generating all revenues from the local market and another with half revenues from the US and half from China.

The geopolitical risk based on the headquarters’ exposure is identical for both firms, amounting to 79, according to the ICRG scores in 2022. In contrast, the assessment based on revenue exposure is 79, for the former firm with no foreign revenues, but only 68 for the latter firm with more diversified revenues.

In economic terms, a one standard deviation increase in our revenue-weighted geopolitical risk measure, ie. an improvement in terms of risk exposure, results in a roughly 0.5 standard deviations increase in corporate viability (Z-score), 4.7% increase for the P/E ratio, and 3.3% increase in the case of the Tobin Q ratio.

Conversely our estimates show that, this relationship is muted when examining geopolitical risk based on firms’ headquarters. This result squares with the graphical evidence reported in Figure 2 and stems from S&P 500 and Eurostoxx firms being headquartered in countries with generally lower geopolitical risk.

However, it is noteworthy that even relatively modest shares of revenue exposure to markets with higher geopolitical risks (roughly 12-15% on average across time) have substantial financial effects.

Figure 3. Impact of exposure to geopolitical risk on firms’ financial performance

Note: Gprisk revenue weighted (left panel) combines corporate revenue distribution with geopolitical risk across countries, Gprisk HQ (right panel) is based on geopolitical risk of firms’ headquarters.

These results should be interpreted as conservative estimates of the actual effect, as our revenue geographical breakdown pertains to revenues originating from the sale of final goods and services and does not account for other forms of cross-country linkages (e.g. intermediate output trades) arising from a firm exposure to sourcing from different countries.

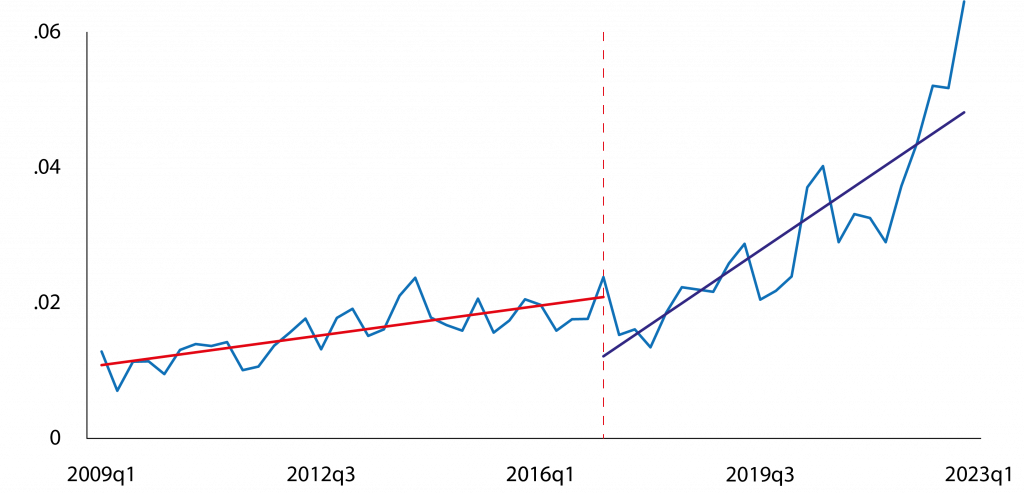

Figure 4. Dynamics of fragmentation index

Note: Fragmentation index measures the average number of sentences, per thousand earnings calls, that mention at least one of the following keywords: deglobalization, reshoring, onshoring, nearshoring, friend-shoring, localization, regionalization. Data are obtained from NL analytics and are based on the methodology described in Hassan et al (2019).

In an additional exercise, we investigate whether the recent upswing in geopolitical tensions has led to more significant repercussions on the viability and valuations of firms (see Figure 4 for a fragmentation index obtained from corporate earnings calls). We find that the financial impact of geopolitical risk has increased since 2017.

During this period, concerns regarding geoeconomic fragmentation began to be more prominently reflected in firms’ risk assessments, amid escalating trade tensions and heightened protectionist rhetoric.

Conclusions

We introduce a novel revenue-weighted geopolitical risk index at the firm level and observe that geopolitical risk substantially affects firms’ default probability and market valuations, with a notable escalation in the impacts since 2017.

The absence of statistical significance regarding geopolitical risks associated with firms’ headquarters emphasises the importance of accessing accurate microdata to precisely measure the real-financial interdependencies of geoeconomic fragmentation (Borin et al 2024).

As global tensions continue unabated, the financial consequences of fragmentation for firms may intensify, amplifying macro-financial turbulence. This could manifest in crossborder effects, including capital shifts away from exposed firms, reduced asset valuations, and heightened market volatility.

References

Aiyar, S and A Ilyina (2023), “Geo-economic fragmentation and the world economy”, VoxEU.org, 27 March.

Aiyar, S, D Malacrino and AF Presbitero (2024), “Investing in friends: The role of geopolitical alignment in fdi flows”, European Journal of Political Economy.

Albrizio, S, J Bluedorn, C Koch, A Pescatori and M Stuermer (2023), “Sectoral Shocks and the Role of Market Integration: The Case of Natural Gas”, AEA Papers and Proceedings 113: 43-46.

Attinasi, MG, L Boeckelmann and B Meunier (2023), “The economic costs of supply chain decoupling”, ECB Working Paper.

Borin, A, G Cariola, E Gentili, A Linarello, M Mancini, T Padellini, L Panon and E Sette (2024), “Inputs in geopolitical distress: A risk assessment based on micro data”, VoxEU.org, 28 January.

Campos, RG, J Estefanía-Flores, D Furceri and J Timini (2023), “Geopolitical fragmentation and trade”, VoxEU.org, 31 July.

D’Orazio, A, F Fabrizio and A Gazzani (2024), “Geoeconomic fragmentation and firms’ financial performance”, SSRN Working paper.

Emiliozzi, S, F Fabrizio and A Gazzani (2024), “The European Energy Crisis and the Consequences for the Global Natural Gas Market”, VoxEU.org, 11 January.

Feng, C, L Han, S Vigne and Y Xu (2023), “Geopolitical risk and the dynamics of international capital flows”, Journal of International Financial Markets, Institutions and Money 82.

Hassan, TA, S Hollander, L Van Lent and A Tahoun (2019), “Firm-level political risk: Measurement and effects”, The Quarterly Journal of Economics 134(4): 2135-2202.

IMF (2023a), “Fragmentation and Commodity Markets: Vulnerabilities and Risks”, World Economic Outlook, October.

IMF (2023b), Geopolitics and Financial Fragmentation: Implications for Macro-Financial Stability, Global Financial Stability Report, April.

Authors’ note: This column does not necessarily reflect the view of the Bank of Italy, the European Central Bank, or the European System of Central Banks. This article was originally published on VoxEU.org.