The economic effects of carbon pricing

Diego Känzig is an Assistant Professor at Northwestern University, and Maximilian Konradt is a PhD student at the Geneva Graduate Institute (IHEID)

Carbon pricing policies are increasingly used as a tool to mitigate climate change. While there is mounting evidence on the effectiveness of such policies for emission reductions (eg. Martin et al 2014, Andersson 2019), less is known about their economic effects. In this column, we provide new empirical evidence on the aggregate and regional impacts of carbon pricing, drawing on our recent research on the European experience (Känzig and Konradt 2023).

There are two main climate policy tools in Europe. The cornerstone to combat climate change is the EU Emissions Trading System (EU ETS). However, many European countries have also enacted national carbon taxes to complement the common carbon market.

We assess the dynamic effects of both policies in a unified empirical framework to be able to attribute any potential differences to policy design.

Specifically, we estimate a panel model of European countries and identify the effects of carbon pricing by controlling for global and local macro-financial conditions in addition to country fixed effects, building on the approach by Metcalf and Stock (forthcoming).

For the carbon market, we also employ the high-frequency strategy proposed in Känzig (2023) and find that the two approaches produce comparable results.

Our findings suggest that while both policies have successfully reduced emissions, the economic costs of the European carbon market are larger than for national carbon taxes, leading to a stronger fall in GDP and a sharper rise in unemployment.

To account for the differential effects, we evaluate the role of (1) fiscal policy and revenue recycling, (2) pass-through and sectoral coverage, (3) spillovers and leakage, and (4) monetary policy. We find that all four played a significant role.

Lastly, we study the heterogenous effects of the common carbon market on European countries. Our results imply substantial differences in the economic impacts of a similarly sized carbon shock across European countries, depending on the share of freely allocated emission permits and the degree of market concentration in the power sector.

The effects of Europe’s carbon pricing initiatives

The EU ETS is one of the largest carbon markets in the world and accounts for over 40% of the bloc’s total emissions. It covers the most carbon-intensive sectors, such as the power sector and heavy-emitting industrial sectors.

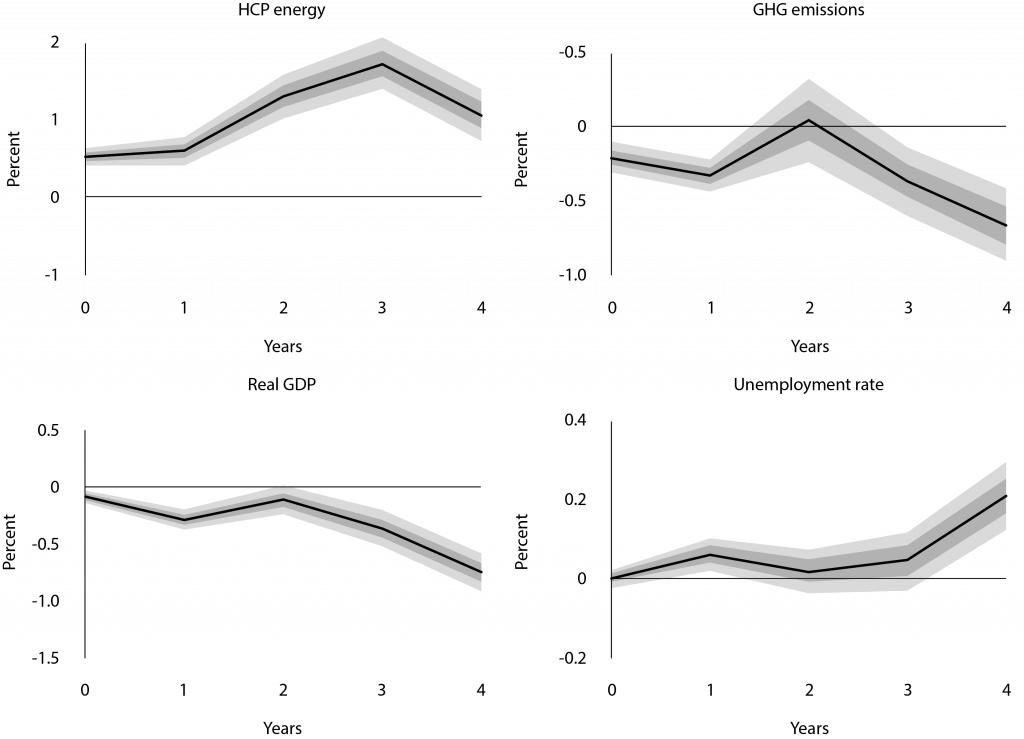

Figure 1 shows the estimated responses to a euro increase in the coverage-weighted carbon price on emissions and the economy. We see that higher carbon prices lead to a significant increase in energy prices and a persistent fall in emissions.

However, this does not come without a cost. Output falls persistently and consumer prices increase, along with a rise in the unemployment rate. These results are broadly consistent with the findings in Känzig (2023), even though the responses are estimated to be somewhat more persistent.

Carbon pricing policies in Europe have been successful at reducing emissions but can come at economic costs that are borne unequally across different regions

Figure 1. The effects of an increase in EU ETS carbon prices

Notes: Impulse responses to an innovation in the ETS carbon price, normalized to increase real coverage-weighted carbon prices by one euro. The solid line is the point estimate and the dark- and light-shaded areas are 68 and 95 per cent confidence bands.

In addition to the EU-wide carbon market, many European countries enacted national carbon taxes to further reduce emissions. These taxes cover sectors and industries that are not part of the emissions trading scheme, such as the transportation and buildings sectors as well as smaller, less energy-intensive industries. Since taxes vary in scope and ambition, we focus on a more homogenous sample of Western and Northern European countries.

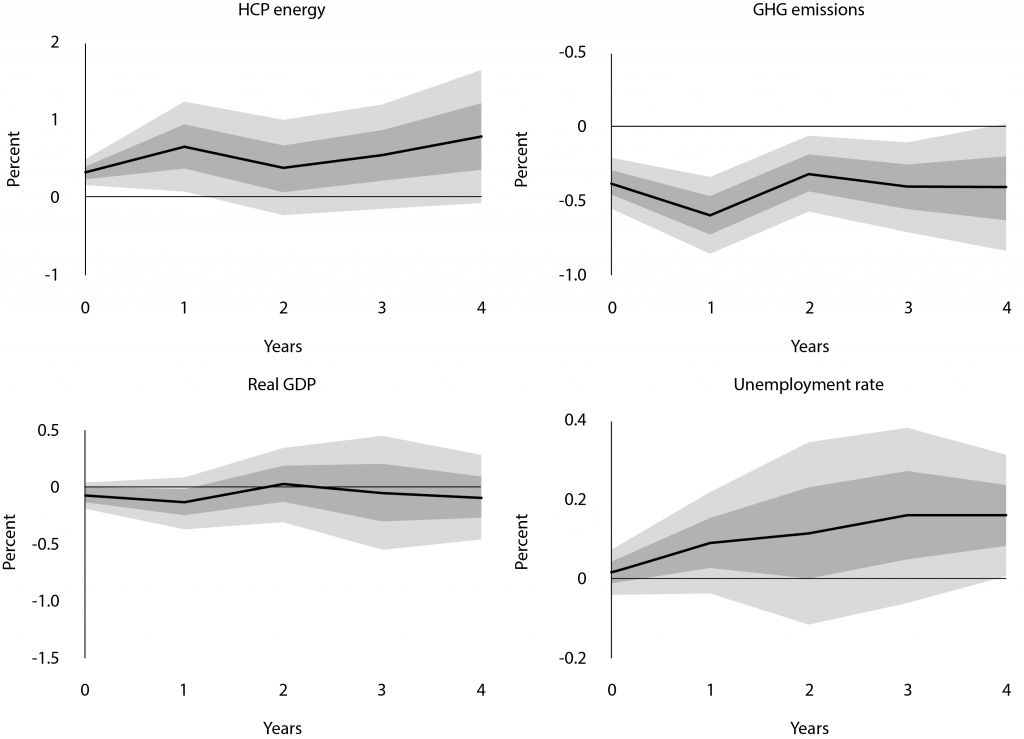

How do the empirical effects compare between the two types of policies? Figure 2 shows a similar fall in emissions following a euro increase in the coverage-weighted carbon tax. The increase in energy prices is more muted, however, and there is little pass-through to overall consumer prices.

Further, we find only modest impacts on GDP, industrial production, or unemployment, corroborating the findings of Metcalf and Stock (forthcoming) and Konradt and Weder di Mauro (2021, forthcoming).

Figure 2. The effects of an increase in European carbon taxes

Notes: Impulse responses to an innovation in European carbon taxes, normalized to increase real coverage-weighted carbon taxes by one euro. The solid line is the point estimate and the dark- and light-shaded areas are 68 and 95 per cent confidence bands.

What explains the different effects?

What can explain the differential economic effects of carbon prices and carbon taxes? We shed light on four factors, which all play a role. First, unlike the EU ETS, national carbon taxes are frequently implemented alongside broader fiscal reforms that potentially cushion some of the burdens for firms and households.

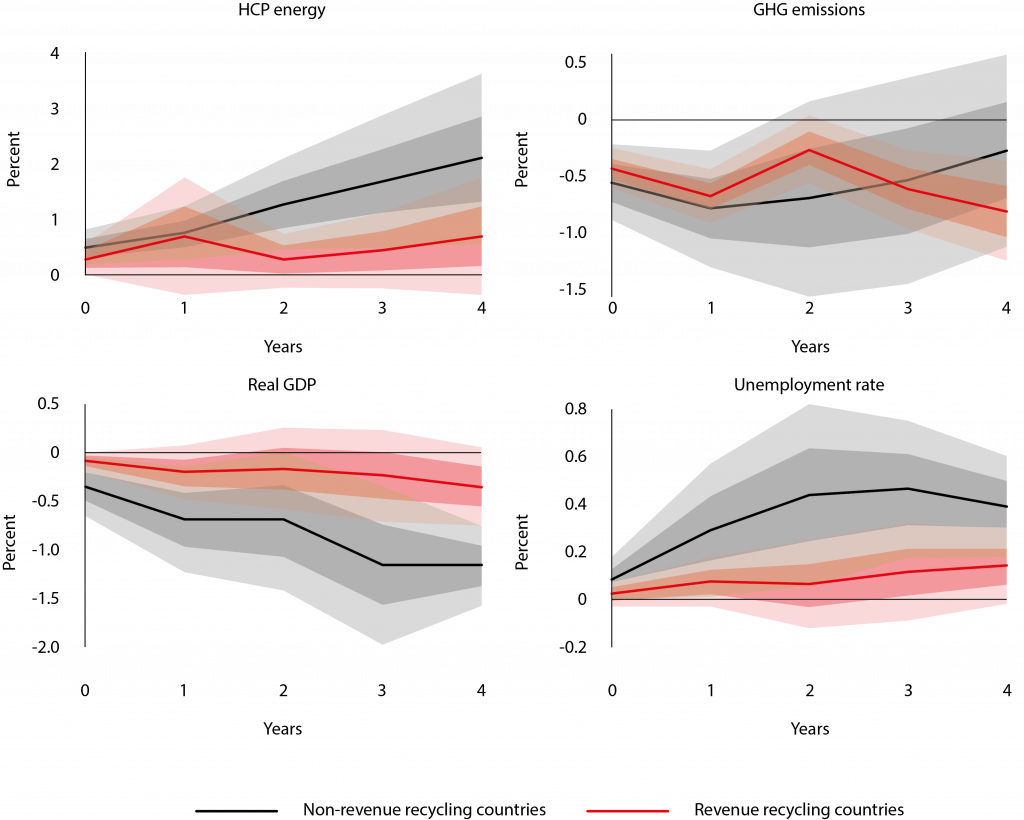

To show this, Figure 3 separately estimates impulse responses for countries that indicated an intention to recycle carbon tax revenues. We see that the adverse economic effects are more pronounced in countries that do not recycle tax revenues, displaying a stronger fall in output and an increase in unemployment.

However, these differential impacts cannot be uniquely attributed to revenue recycling as non-revenue recycling countries also display a somewhat stronger response to energy prices.

Interestingly, the emission responses turn out to be comparable, suggesting that redistributing tax revenues can lower economic costs without compromising emission reductions.

Figure 3. The role of revenue recycling

Notes: Impulse responses to a carbon tax innovation in revenue (red line) and non-revenue recycling (black line) countries. The dark- and light-shaded areas are 68 and 95 per cent confidence bands.

Second, an important distinction between the two carbon pricing initiatives relates to the type of sectors that are covered. Since energy-intensive firms likely pass through a larger fraction of emission costs (Fabra and Reguant 2014), prices could be more affected by the EU ETS, which covers the heaviest emitters.

Indeed, we document a significant response of energy, consumer, and producer prices after an increase in EU ETS prices while the price responses after an equivalent increase in carbon taxes are small and insignificant.

Third, the broader scope of the ETS implies that countries experience simultaneous price changes, limiting the role of potential cushioning effects with unaffected trade partners or carbon leakage to third countries, compared to national carbon taxes. Consistent with this view, we estimate that only ETS prices significantly reduce overall EU emissions.

Lastly, monetary policy could also play a role in accounting for the differential impacts. Carbon policy-induced changes in consumer prices could trigger a policy reaction by the ECB, further reinforcing recessionary effects.

Conversely, one would not expect a monetary response to national carbon taxes, especially given the limited price pressure associated with these policies. Our estimates support this view: while interest rates rise significantly after an increase in ETS prices, the response to a carbon tax increase is estimated around zero and insignificant.

Regional heterogeneity

Although all European countries are faced with common carbon price changes in the ETS, the transmission likely depends on country characteristics.

We focus on the share of freely allocated emission certificates (relative to total emissions) and the degree of market concentration in the power sector as possible transmission channels. The former affects the costs that local firms incur to offset emissions while the latter likely influences the strength of pass-through to energy prices.

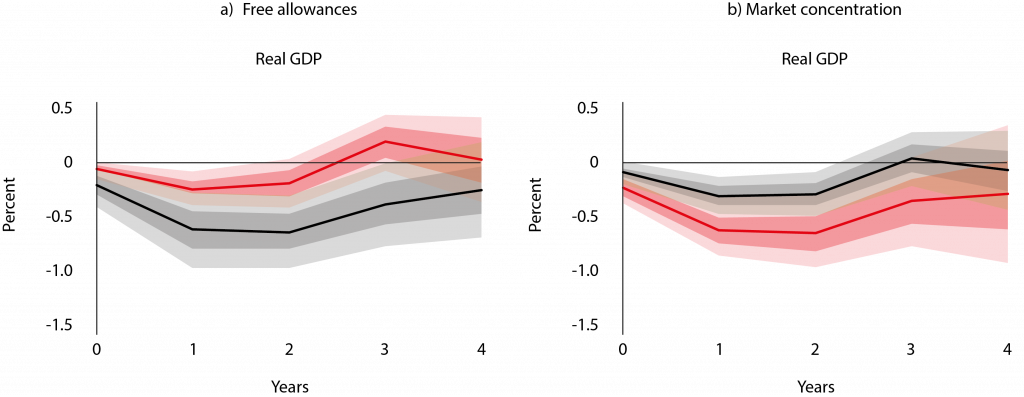

Figure 4 illustrates the effects on output based on the carbon price shocks identified in Känzig (2023), normalized to increase the HICP energy component by one per cent on impact.

We see that a greater share of free allowances substantially dampens the output response (Panel A). Similarly, Panel B shows that higher concentration in energy markets is associated with a stronger negative effect on economic activity, as the energy price response turns out to be more pronounced.

Interestingly, the fact that free allowances were disproportionally allocated to the poorest member countries implies that they are largely insulated from the economic costs associated with carbon pricing. Instead, our findings suggest that countries in the second quartile of the per capita income distribution are most affected by the carbon market.

Figure 4. Regional effects of the EU ETS

Notes: Impulse responses to a carbon price shock at the mean in grey and with one standard deviation higher share of free allowances to total emissions (panel A) and higher concentration in the power sector (panel B) in red. The black/red line is the point estimate and the dark- and light-shaded areas are 68 and 95 per cent confidence bands.

Concluding remarks

Carbon pricing policies in Europe have been successful at reducing emissions but can come at economic costs that are borne unequally across different regions.

Our results from contrasting the EU ETS with national carbon taxes suggest that the recycling of carbon revenues is a key policy tool that can mitigate the potential adverse economic effects of carbon pricing.

However, any complementary fiscal policies should also take the sectoral composition and strength of pass-through into account.

References

Andersson, JJ (2019), “Carbon Taxes and CO2 Emissions: Sweden as a Case Study”, American Economic Journal: Economic Policy 11(4): 1–30.

Fabra, N and M Reguant (2014), “Pass-through of emissions costs in electricity markets”, American Economic Review 104(9): 2872–99.

Känzig, DR, (2023), “The unequal economic consequences of carbon pricing”, NBER Working Paper No. w31221.

Känzig, DR, (2023), “Climate policy and economic inequality”, VoxEU.org, 25 Jun.

Känzig, DR and M Konradt (2023), “Climate Policy and the Economy: Evidence from Europe’s Carbon Pricing Initiatives”, NBER working paper No. w31260.

Konradt, M and BW di Mauro (2021), “Carbon taxation and inflation: Evidence from Europe and Canada”, VoxEU.org, 29 Jul.

Konradt, M and BW di Mauro (forthcoming). “Carbon Taxation and Greenflation: Evidence from Europe and Canada”, Journal of the European Economic Association.

Martin, R, LBD Preux and UJ Wagner (2014), “The impact of a carbon tax on manufacturing: Evidence from microdata”, Journal of Public Economics 117: 1–14.

Metcalf, GE and JH Stock (forthcoming), “The Macroeconomic Impact of Europe’s Carbon Taxes”, American Economic Journal: Macroeconomics.

This article was originally published on VoxEU.org.