Is de-dollarisation happening?

Barry Eichengreen is the George C Pardee and Helen N Pardee Professor of Economics and Political Science at the University of California, Berkeley

There has been much discussion recently on the prospect of the US dollar losing its global dominance. Among the factors behind the decline are the need for central banks to intervene in foreign exchange markets and changes in interest rates, but there is little evidence of an effect of sanctions. The majority of the shift away from the dollar has been towards non-traditional reserve currencies.

“De-dollarization is real and is happening fast”, began a recent widely shared video post. “Dollar share went from 73% (2001) to 55% in (2020). Went from 55% to 47% since sanctions launched on Russia, now de-dollarizing at 10x faster than the previous two decades.” This video attracted the attention of no less a personage than Elon Musk, who tweeted “If you weaponize currency enough times, other countries will stop using it.”

This question is not new, as readers of VoxEU will be aware (eg. Wyplosz 2020). Answering it requires sober analysis, starting with the facts. The dollar’s share of allocated foreign exchange reserves in 2022 Q4 was 58.4%, not 47%, according to the IMF’s latest Currency Composition of Official Foreign Exchange Reserves (COFER) database. This was virtually unchanged from 58.5% in 2021 Q4, the latest COFER reading prior to G7 financial sanctions on Russia.

Sceptics object that these data are distorted by exchange rate changes. The dollar strengthened through the first three quarters of 2022, which could have pushed up the value of dollar reserves and the currency’s share in reserve portfolios.

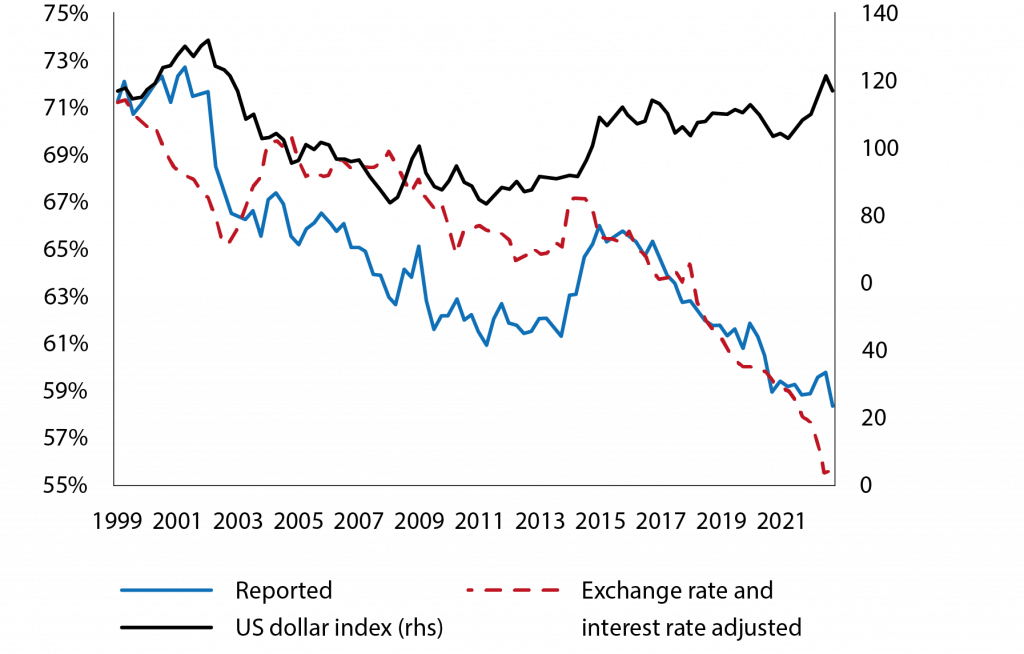

But central banks rebalance their reserve portfolios in response to exchange rate changes, which limits the impact of valuations on shares. Figure 1 therefore compares reported COFER shares with exchange rate-adjusted shares.

A decline in the dollar’s share is evident in the exchange rate-adjusted data, from 59% in 2021 Q4 to 57% Q2022 Q4. But a decline is not a collapse. As Figure 1 shows, the dollar’s share of allocated reserves, exchange-rate adjusted, has been falling by 6/10ths of a percentage point a year, on average, since 1999. The 2 percentage-point drop from 2021 Q4 to 2022 Q4 is three times this large. But equally large drops have occurred before, in 2002, 2005, 2010, and 2015, to cite some examples.

Figure 1. US dollar share of global foreign exchange reserves and the US dollar index, 1999-2022 (in percent; index Jan-2006=100)

Source: Arslanalp et al (2022, updated).

Among the factors underlying these drops in dollar shares is the need for central banks to intervene in foreign exchange markets. The dollar being the most liquid intervention unit, it is widely used when central banks enter the market to purchase their currencies. Hence the decline in dollar reserves.

A prominent instance was 2015, when China, the single largest holder of US dollar reserves, experienced capital outflows and saw the need to intervene. It is no coincidence that the decline in the dollar share of reserves in 2022 coincided with exchange rate weakness in emerging markets.

Another mechanism that could generate movements in the dollar share is changes in interest rates, since these affect the market value of bonds, and reserve data are reported to COFER in market value. Because most foreign reserves are held in interest rate-sensitive assets, one might observe a fall in the dollar share if interest rates on dollar bonds rise more sharply than those on bonds denominated in other currencies.

Total return indices on government bonds with a maturity of zero to five years can be used to measure the contribution of interest rates in each jurisdiction. Total return indices capture not just interest payments but also capital gains accruing on a bond portfolio due to movements in interest rates.

The zero-to-five-year range captures the bulk of holdings of US Treasury bonds by official investors, according to Treasury International Capital (TIC) data. Figure 1 again shows that the dollar’s share of allocated reserves, now both exchange-rate and interest-rate adjusted, has been on a gradual downward path. To repeat, however, a gradual downward path is not a collapse.

Might financial sanctions play a role in this gradual, ongoing diversification away from the dollar on the part of central banks? Arslanalp et al (2022) examined the role of financial sanctions on the currency composition of reserve portfolios using publicly available data for 80 central banks. They found no evidence of an effect of sanctions on dollar shares.

This is not surprising, in that sanctions imposed by the US have frequently been coordinated with other countries, including countries issuing the other leading reserve and international currencies. As a result, the euro, British pound, and Japanese yen have not constituted safe havens for governments and central banks concerned about ‘weaponisation of the dollar’.

Two directions in which central banks seeking a safe haven from sanctions might diversify is towards gold and towards non-traditional reserve currencies. A number of emerging market central banks have been raising the share of their reserves held in the form of gold. That movement accelerated in 2022, which saw the largest net purchases of gold by central banks of any 21st century year.

The majority of the shift away from the dollar has been towards non-traditional reserve currencies such as the South Korean won, Norwegian krone, Canadian dollar, Australian dollar, and Singapore dollar

Arslanalp et al (2023) analyse the impact of past financial sanctions on the share of official reserves held in gold for 180 countries. They find a statistically significant effect of sanctions in the current or two immediately preceding years on the gold share of reserves. But the quantitative effect is small – a country targeted by multilateral sanctions raises the share of gold in its reserves by roughly 4 percentage points.

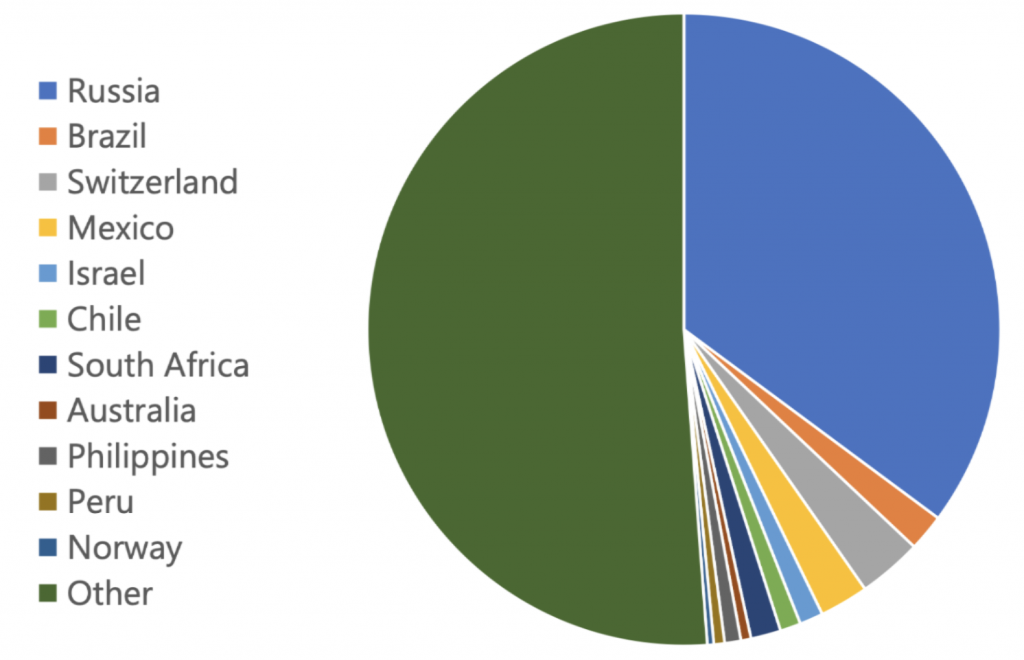

Another conceivable direction of reserve diversification in response to recent financial sanctions is toward the Chinese renminbi, since China has not participated in sanctions against Russia. Figure 2 shows new estimates of the national distribution of renminbi reserve holdings, updated to the end of 2022. The Bank of Russia holds nearly a third of all renminbi reserves reported by central banks around the world.

It has not been possible to update figures for Russia’s renminbi reserves, since the Bank of Russia has not reported reserve composition since the end of 2021. But with most of the bank’s other currency reserves having been frozen since early 2022, one would not expect significant changes in reserve composition since that time.

Figure 2. Countries holding Chinese renminbi in reserves (as a share of total RMB holdings, end-2022)

Note: The chart shows identified countries that hold US$1 billion or more of RMB in reserve assets. Data for the Philippines, Russia, and South Africa are for Dec 2021, Dec 2021 and Mar 2022, respectively.

Source: IMF COFER, IMF Reserve Data Teample, and central bank annual reports.

COFER data for 2022 Q4 place renminbi reserves at 2.7% of the allocated world total. Remove Russia’s share on the grounds that the country faces exceptional financial and geopolitical circumstances, and the renminbi’s share falls to roughly 1.6%. This relatively small share is not consistent with assertions that other central banks have been shifting bigtime towards China’s currency.

As Zhang (2023) has shown, China’s internationally traded assets and liabilities are just 4% of global totals. There are still not enough Chinese assets and liabilities to constitute serious alternatives to dollars, in other words.

Another perspective derives from the work of Gopinath and Stein (2021), who emphasise self-reinforcing complementarities between the different functions of international currencies. Central banks hold dollar reserves, the authors argue, because banks in their national jurisdiction borrow and lend dollars, and because domestic firms make and accept crossborder payments in dollars.

Crossborder use of the renminbi for global payments remains small, on the order of 2% of total crossborder transactions (Perez-Saiz and Zhang 2023). Evidently, the complementarities supporting a continued global role for the dollar do not provide comparable support for the renminbi. Research on the use of currencies for trade invoicing and crossborder payments suggests continued dominance for the US dollar and, to an extent also, the euro (Boz et al 2020).

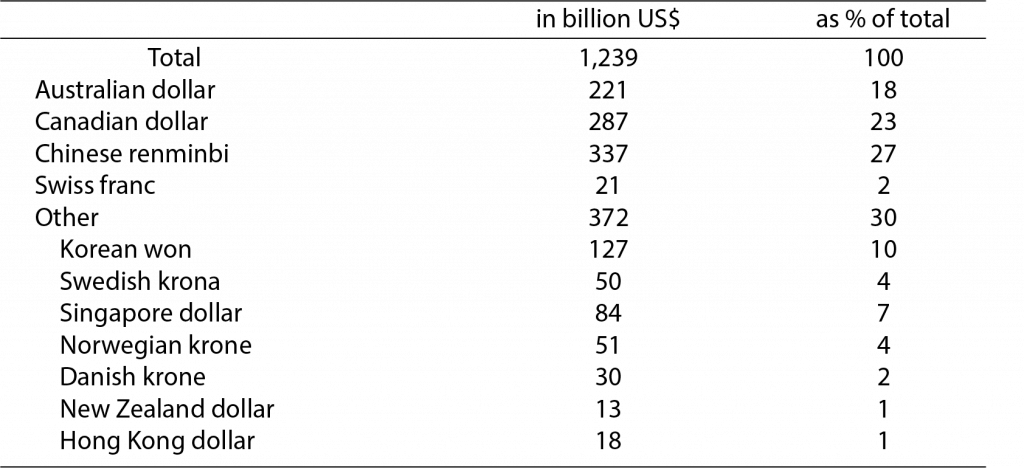

So where, if not towards the renminbi, have central banks been rebalancing their reserve portfolios? The majority of the shift away from the dollar has been towards non-traditional reserve currencies such as the South Korean won, Norwegian krone, Canadian dollar, Australian dollar, and Singapore dollar. Table 1 shows updated data on the shares of these non-traditional reserve currencies (including the renminbi) in global reserves.

Table 1. Non-traditional currencies in allocated reserves, end-2021

Note: The size of ‘other’ currencies is estimated based on Arslanalp and Tsuda (2014).

Source: IMF, COFER and CPIS.

In part, the shift toward non-traditional currencies reflected the fact that they offered relatively attractive risk/return profiles in a period when interest rates on traditional reserve currencies were near zero or, in some cases, negative.

Now that interest rates have, in most cases, moved strongly back into positive territory, it is worth pondering whether this trend towards non-traditional reserve currencies will continue or, to the contrary, whether traditional units such as the dollar, now bearing positive yields, will regain favour.

To paraphrase a quip popularly attributed to Mark Twain, one might say that reports of the dollar’s demise have been greatly exaggerated.

References

Arslanalp, S, B Eichengreen and C Simpson-Bell (2022), “The Stealth Erosion of Dollar Dominance and the Rise of Nontraditional Reserve Currencies,” Journal of International Economics 138.

Arslanalp, S, B Eichengreen and C Simpson-Bell (2023), “Gold as International Reserves: A Barbarous Relic No More?” IMF Working Paper 2023/014.

Boz, E et al (2020), “Patterns in Invoicing Currency in Global Trade,” IMF Working Paper no.20/126.

Gopinath, G and J Stein (2021), “Banking Trade, and the Making of a Dominant Currency,” Quarterly Journal of Economics 136.

Perez-Saiz, H and L Zhang (2023), “Renminbi Usage in Cross-Border Payments: Regional Patterns and the Role of Swap Lines and Offshore Clearing Banks,” IMF Working Paper 2023/077.

Wyplosz, C (2020), “And the Dollar reigns supreme,” VoxEU.org, 20 January.

Zhang, L (2023), “Capital Account Liberalization and China’s Financial Integration,” M-RCBG Associate Working Paper no.196, Kennedy School of Government, Harvard University.

This article was originally published on VoxEU.org.