Instruments of economic security

Niclas Poitiers is a Research Fellow, and Conor McCaffrey is a Research Analyst, at Bruegel

1 Introduction

Recent years have seen rising concern over the ‘weaponisation of interdependence’, ie. the exploitation of economic links for geopolitical purposes (Farrell and Newman, 2019). There has been a significant shift in the prevailing narrative on both sides of the Atlantic, from seeing economic interdependence as leverage to achieve political liberalisation, to a geopolitical view that sees it as a liability that exposes Western economies to foreign influence1. The relationship between the United States and China has soured and China’s accession to the World Trade Organisation may now be seen as a mistake2.

Meanwhile, Russia’s invasion of Ukraine is portrayed as glaring example of a failed Western strategy of Wandel durch Handel (change through trade). Rather than reducing tensions, economic interdependence instead left some parts of Europe significantly dependent on Russia at the time of the invasion, arguably strengthening Russia’s hand.

However, a strategy of economic decoupling, undoing decades of globalisation and therefore vastly reducing the gains from trade, seems neither feasible nor desirable (Aiyar et al 2023). There is a new consensus among the G7 countries that the ‘de-risking’ of economic relationships with revisionist countries is a more feasible strategy3.

The central idea is to diversify supply chains and build a ‘high fence’ around a ‘small yard’4, to protect vital economic sectors from foreign interference without jeopardising the economic benefits of globalisation. Put simply, the aim of this strategy is to reduce risks without starting all-out trade wars and undermining the rules-based economic order.

Many of the solutions put forward as part of this strategy include significant government intervention. While additional state support in certain areas, in particular for green industries, could have positive outcomes, this approach is not without risks. State support can backfire unless accompanied by strong governance.

This risk is exacerbated in the case of the European Union because the cohesion of its single market is threatened when discipline on state aid given by member states is eroded (Kleimann et al 2023). Therefore, it is important to have a thorough understanding of the problems that ‘economic security’ measures aim to solve, in order to judge the trade-offs involved in the proposed solutions.

To support the development of such an understanding, we attempt to derive a nuanced view of the economic risks that arise from economic interdependence with China in particular5. Based on this view, we assess the appropriateness of EU instruments aimed at improving economic security. We conclude that the EU has made significant steps forward in terms of ex-ante instruments, though many of them need more European coordination to avoid risks for the single market.

However, credible ex-post instruments are lacking. We see the need for a new ex-post instrument that shares the costs from economic coercion and helps countries and firms respond. Such instruments have to be underwritten by member states, and therefore the credibility of any European economic-security instrument depends crucially on a closely coordinated foreign policy.

2 What is economic security?

Despite its prominence in recent debates, the term ‘economic security’ is only vaguely, if at all, defined. The term has been used in varying contexts, and at times has been employed as a catch-all for policies aimed at mitigating all kinds of economic shocks, as well as a wide range of ‘national/physical security’ measures. This conflation of different types of risk can unsurprisingly lead to poorly targeted government interventions.

We employ a narrow definition that is centred around the notion of economic ‘de-risking’ from shocks, and not the use of economic measures to pursue national security objectives. We focus in particular on risks surrounding ‘economic coercion’ – the politically motivated disruption of supply chains and targeting of economic interdependencies.

Examples of such coercion include sanctions and trade embargoes, the weaponisation of energy markets following the Russian invasion of Ukraine, and Chinese economic coercion against Japan, South Korea, Lithuania and Australia.

In these cases, a hostile government targeted vulnerable economic sectors with the aim of inflicting economic and political damage. We assess instruments and strategies that are aimed at mitigating and limiting the risks from such deliberate and targeted economic shocks. It is noteworthy that these types of shock are not only a concern for strategic imports. Recent cases of economic coercion have actually targeted exports more than imports.

While threats to economic security can come from a range of sources, such as climate-related shocks or natural disasters, we focus on improving resilience against economic coercion for two reasons. First, the policy lessons are equally applicable to other supply-chain disruptions. Second, economic coercion includes an additional factor (the behaviour of hostile governments) not present in ‘accidental’ shocks.

This additional factor necessitates additional policy responses to affect other countries’ incentives. As such, policies designed to address threats arising from economic coercion should also address wider risks to economic security.

We also focus on foreign-trade shocks and not domestic shocks, which can have similar implications and are part of some broader definitions of economic security. We are concerned with the interaction between economic outcomes and foreign policy, which is less of a concern with shocks of domestic origin and so the relevant policy instruments differ.

We deliberately abstract from policies that are framed as part of ‘economic security’ (eg. in the European Commission’s Economic Security Strategy; European Commission, 2023a), but are not ‘economic’ in either nature or objective. With the exception of the very rare cases in which technical complexity creates monopolistic power and therefore the potential for future economic coercion6, measures aimed at preventing technology transfers are hard to justify on economic security grounds alone.

While maintaining European technological leadership in certain cutting-edge sectors is clearly desirable, it fails to meet the definition of economic security as articulated here. Other justifications – such as maintaining an edge in dual-use technologies for defence reasons – are thus generally necessary to justify measures that restrict technology transfers.

The distinction between ‘economic’ security risks and national security is important for two reasons. First, economic-efficiency arguments become less important when considering policies with direct national security implications. Economic analysis can help identify the most efficient way to achieve a desired outcome, but cannot ascertain whether a policy is necessary for defence purposes.

Second, separating economic security from national security has legal implications. WTO rules give countries the ability to react to policies that harm their economic interests (eg. with countervailing duties and rebalancing of tariffs) and to call panels to adjudicate on whether rules were broken.

The WTO framework also includes exemptions for measures pertaining national security7. The principle that states can intervene in markets to ensure their national security in ways that would be otherwise prohibited is generally recognised. However, there has been considerable debate about the wide-ranging usage of these exemptions by the United States (see Maruyama and Wolff, 2023).

In several cases, the US has justified policies that arguably primarily have protectionist aims with such national-security exemptions (for a discussion of the role of transatlantic relations see Box 1).

Box 1. Economic security and the transatlantic relationship

While there have been regular trade conflicts between the EU and the US (such as a long running dispute on subsidies for Airbus and Boeing), these were concerned primarily with protectionist measures and support for national champions.

However, during the Trump Administration, new conflicts arose that were framed explicitly around security. While not directly comparable to the current economic security debate relating to Russia and China, certain aspects of the European discourse can be traced back to these origins.

The retreat of the United States from the Iran nuclear deal (the Joint Comprehensive Plan of Action, or JCPOA) was a leading cause of the European desire for a more autonomous foreign policy.

Even though the EU believed it to be in its interest to keep trading with Iran, the US threatened European companies with secondary sanctions if they did so (see Leonard et al 2019). This did not affect European ‘economic security’ per se, but it did advance a discourse on how to harden European trade flows against foreign interference.

In 2018, the Trump Administration put tariffs on EU steel and aluminium exports, justified by national security concerns (Department of Commerce, 2018), launching a transatlantic trade conflict with a vague notion of national security at its centre.

Since President Biden took office, the EU and the US have managed to resolve major trade conflicts. The Airbus-Boeing trade dispute was suspended8, an agreement on transfers of personal data found9 and the trade and technology council established10 with the aim of preventing future conflicts through intergovernmental consultations.

The US tariffs on European steel and aluminum justified by ‘national security’ have been put under a moratorium, though a permanent solution has not yet been reached (Dadush, 2021). There are ongoing efforts to enhance economic security in the G711 and to cooperate on common concerns, such as those surrounding critical raw materials12.

However, should political dynamics change again after the 2024 US presidential election, transatlantic relations could be tested once again and new EU-US trade disputes could arise.

The EU and the US have converged on a shared paradigm of ‘de-risking’, a notion that was first embraced by European Commission President Ursula von der Leyen in March 202313. It is noteworthy that the EU and US have come from opposite directions to arrive at similar strategies.

In the US, the emphasis in ‘economic security’ has primarily been on security, representing a ‘securitisation’ of economic policy. Major economic policies have been announced by National Security Advisor Jake Sullivan, rather than by economic policymakers.

Many actions considered to fall under the umbrella of economic security, such as the US CHIPS and Science Act14 or outbound investment screening15, have been explicitly justified on national-security grounds. This stands in contrast to the European context, with the European Commission hitherto primarily concerned with economic policies and without a strong national-security mandate.

The ‘Geopolitical Commission’ of President von der Leyen16 is trying to use its economic powers to assert itself as a player in foreign policy. Yet its economic-security strategy includes many measures that are not directly related to economic considerations and mirror US policies (European Commission, 2023a).

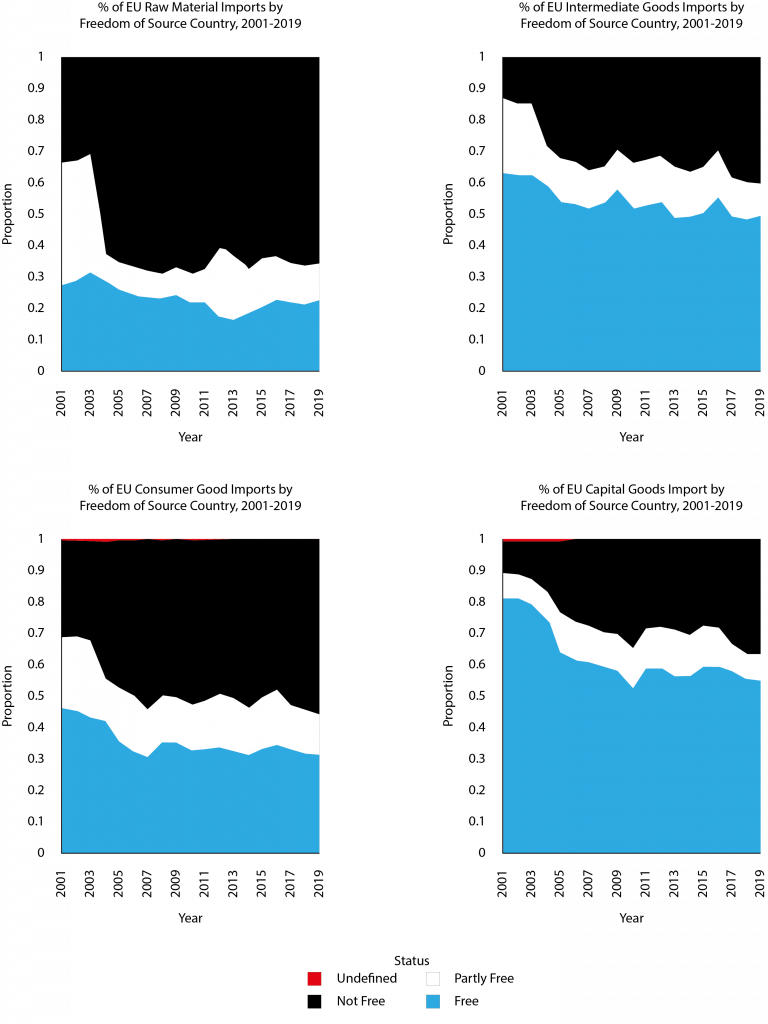

The rise in global geopolitical tensions has coincided with deeper economic integration of EU and non-democratic countries, and an increase in the market concentration of EU imports

3 A brave new world of economic interdependence

The idea of using economic linkages to achieve political goals is by no means new (see Mulder, 2022). Since the end of the Second World War, outright economic sanctions have mostly been used by the US and its allies against emerging-market developing countries (Hufbauer, 2007). Even before the Russian invasion of Ukraine, there was a surge in the number of sanctions imposed by Western countries (Felbermayr et al 2020).

However, while sanctions have historically been mostly used by Western countries, economic coercion is by no means an exclusive to the West. The examples of such measures targeting Western countries range from the oil embargo during the Yom Kippur War in 1973 (Hansen, 2023) to import restrictions on Norwegian salmon by China after the 2014 Nobel Peace Prize for Liu Xiaobo (Harrell et al 2018).

Given the dominance of Western economies in finance and technology, the types of economic linkage targeted by non-Western economies have historically often been access to raw materials. However, recent decades have seen a remarkable shift in the goods that are available for use in economic coercion against the West.

Figure 1 shows the breakdown of the main categories of EU imports by the political systems of source countries, as defined by Freedom House. While raw materials were long primarily imported from non-free countries, as recently as 2001 only 10 percent of imports of intermediate inputs came from such countries. By 2019 this share had increased to almost 40 percent.

Figure 1. EU import sources by political system

Source: Bruegel basted on Eurostat, UNCTAD & Freedom House.

As a result, EU industry imports many more intermediate goods from countries with authoritarian political systems. Intermediate imports are often more specialised and differentiated, limiting their substitutability compared to commodities. This thus represents a new type of risk. Meanwhile, advanced technologies are increasingly dependent on specialised materials as critical inputs, meaning raw materials have also become more susceptible to economic coercion (Le Mouel and Poitiers, 2023).

One additional and often overlooked source of European vulnerability is export dependency. China in particular has become an increasingly important market for Western exports (Figure 6), with approximately 10 percent of German passenger car exports in 2022 going there, for example17.

As will be shown, this means that import bans are also available as a means for China to put political pressure on Western governments. As Baqaee et al (2024) showed, the potential economic costs of sudden trade disruptions with China for a country like Germany are significant (they assess that the effect of a total cessation of trade with China for Germany would be ‘severe but not devastating’).

4 The threat of economic coercion

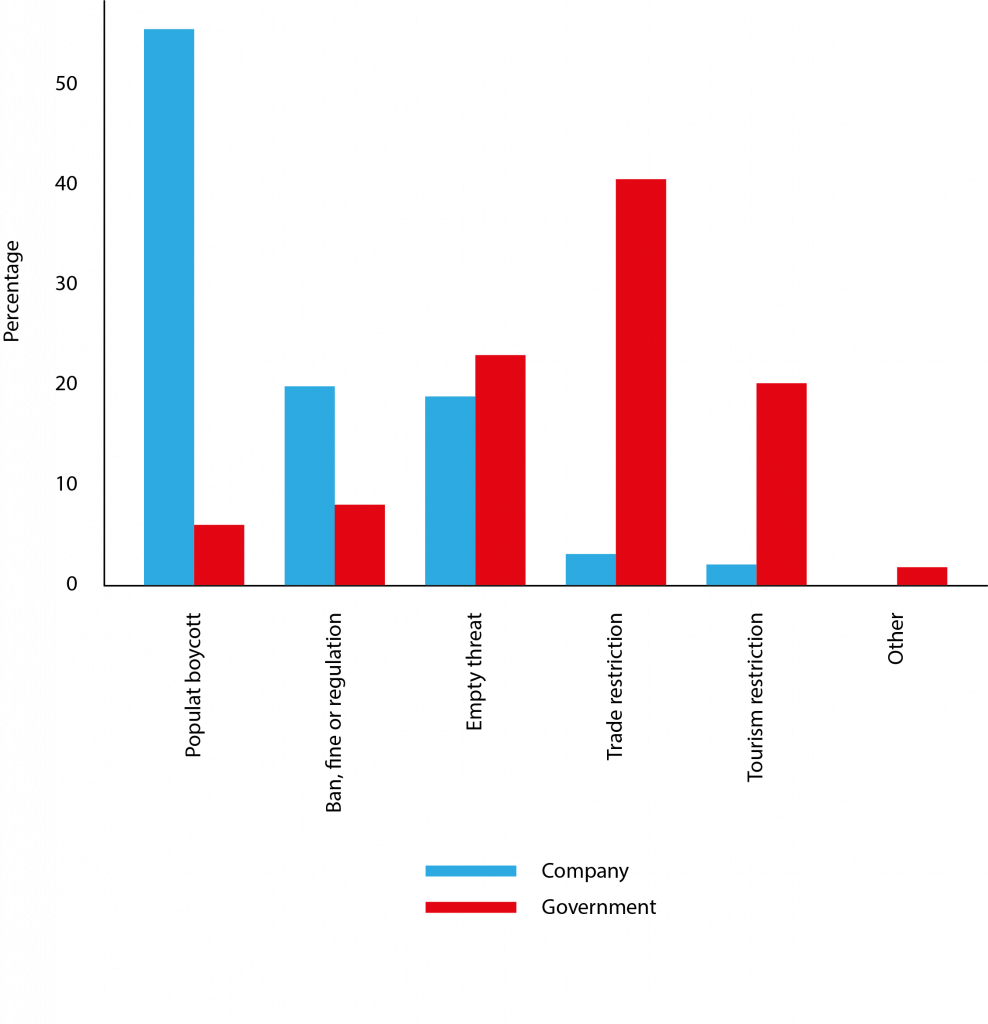

Economic coercion comes in many shapes and forms. Adachi et al (2022) tallied Chinese coercive methods since 2012 (Figure 2). Many measures targeted individual firms, while trade restrictions have been the most common form used to target countries. Within these trade restrictions, import restrictions (China blocking the imports of goods from foreign markets) have been used more often than export restrictions18.

Figure 2. Forms of Chinese economic coercion

Source: Adachi et al (2022).

Unlike Western sanctions that follow formal legal procedures and can be challenged in courts, measures taken by China are often informal. Documentation detailing measures can be difficult to find, and targeted entities might thus find it difficult to challenge measures even when avenues to do so might exist (Hackenbroich et al 2022).

A particularly problematic example is popular boycotts against certain foreign brands, individuals or firms. While sometimes genuine, these movements to encourage firms and consumers to punish certain firms are often stoked by state-controlled media and on social media19. They represent the most common form of economic coercion used by China against firms, and are particularly difficult to attribute to undue state intervention.

The experiences of trade wars and Western sanctions against Russia provide some insights into what types of goods are vulnerable to economic coercion. In episodes such as the China-US trade war that began in 2018, trade diversion has been a major feature, limiting the effects of trade restrictive measures (Fajgelbaum et al 2023).

Similarly, sanction circumvention and alternative sourcing pose major challenges for the effectiveness of Western sanctions against Russia (Babina et al 2023).

The effectiveness of any type of coercive economic measure depends on the market power of a country or coalition. If alternatives are widely available, a targeted economy can easily switch its sources of imports for a product.

Similarly, if alternative export markets exist, a bilateral trade relationship cannot easily be weaponised. This rules out most commodities from being used or targeted effectively for economic coercion, as they have many sources and markets. Even where a high degree of market concentration is found, this does not necessarily imply high monopolistic power.

The contestability of a market also depends on barriers to entry for newcomers. Many of the products for which there is a high degree of market concentration are low-tech products, such as artificial flowers and electric blankets (Mejean and Rousseaux, 2024).

If the dominant producers would limit exports of these products, it would be rather easy for new companies to enter the market. This was the case for rare gases (neon, krypton and xenon), the supply of which was disrupted by the Russian invasion of Ukraine (Georgitzikis and D’Elia, 2022). Their prices spiked after the outbreak of the war, but came down rather quickly as new producers entered the market20.

Furthermore, there might exist close subsitutes that might not be employed presently but could become commercially viable if the supply chain of the incumbent technology is disrupted. Examples of this dynamic have been documented during trade embargoes (Mulder, 2022). However, it can be difficult to assess the feasibility of such substitution before an actual disruption occurs.

An economy can have monopolistic power for several reasons. First, a natural resource might only exist in a few countries, giving them effective control over where the supply goes. Second, infrastructure bottlenecks might create monopolistic power in segregated markets.

This was the case for Russian pipeline gas in the wake of the invasion of Ukraine: a lack of liquified natural gas (LNG) capacity in central Europe allowed Russia to hike prices in European gas markets.

Third, economies of scale or industrial policy can lead to dominance on certain markets, as is the case of China in the solar panel industry (García Herrero et al 2023). Fourth, advanced technological capacities might give monopoly power. An example for this would be ASML in the chip industry (Poitiers and Weil, 2021; Kleinhans and Baisakova, 2020).

The ‘contestability’ of a market is also important. Only if a monopoly market can be maintained over time can it be exploited over extended periods without the risk of losing future markets.

In 2022, there was considerable concern over the supply of certain gases that were primarily produced via a Russian-Ukrainian supply chain. However, alternative sources were brought online relatively quickly, preventing lasting shortages (Darvas et al 2023).

To induce harm that is macroeconomically significant, the impact of a bilateral flow needs to have a material impact on the overall export or import performance of the targeted economy. For certain goods, in the fields of health, defence or clean energy, for instance, disruptions to imports may be highly damaging on have some non-economic outcome, with prominent examples being personal protective equipment and vaccines during the COVID-19 pandemic.

In highly diversified advanced economies such as the EU, the capacity to induce truly significant shocks, either macroeconomic or otherwise, is limited to a very small number of strategic goods. However, in many cases of economic coercion, the harm is market- and industry-specific rather than macroeconomic.

Though few individual products are of such importance that they can affect the economy as a whole, targeted measures can easily harm politically important constituencies, and thus exert political pressure on policymakers.

In the following, we consider two recent cases of economic coercion that illustrate how economic interdependence can be weaponised: the measures taken by China against Australia and Lithuania since 2020.

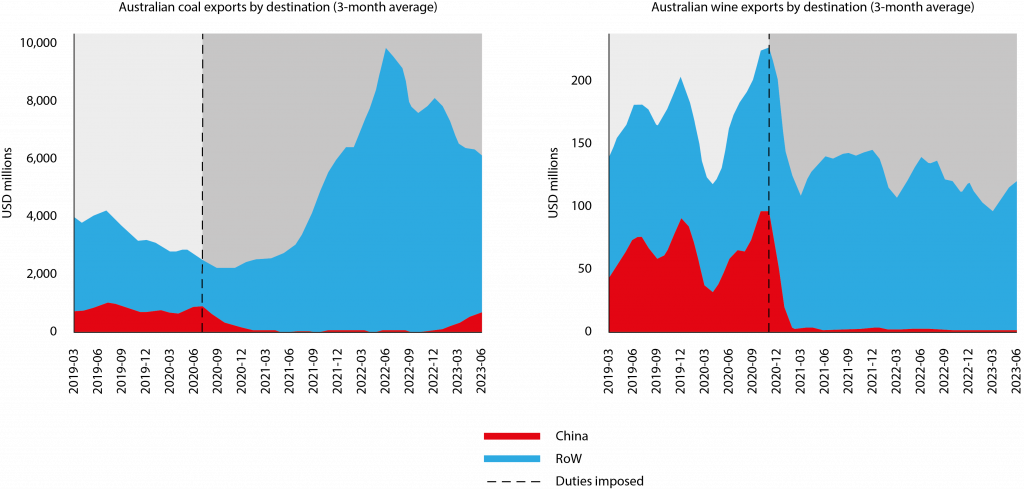

4.1 Australia: a tale of two sectors

In mid-2020, following then-Australian Prime Minister Scott Morrison’s calls to open an investigation into the origins of the COVID-19 pandemic21, China began a campaign of economic coercion against Australia that only began to be eased in early 2023.

It targeted Australian exporters and introduced “discriminatory tariffs on wine and barley” and “informal and WTO-illegal bans on coal, beef, lobster, cotton, wood, nickel and copper concentrates” (Urden 2023a)22. As a result, China’s share of Australian exports fell from its mid-2021 peak of almost 45 percent to less than 30 percent by the end of 202223.

The Australian economy as a whole successfully navigated the coercive measures introduced by China. The value of Australian exports rose between 2020 and the end of 2022, largely driven by energy exports to Asian markets other than China.

There was however important variation in the impacts on the various targeted sectors. For the coal sector, the decline in exports to China was more than offset by higher exports to the rest of the world, in particular to Asian countries that were also indirectly affected by China’s actions (Figure 3, Panel A)24.

Significant export diversification, coupled with high coal prices following the Russian invasion of Ukraine, meant that Australian coal exporters enjoyed surging import revenues over the period of the unofficial embargo.

Figure 3. Chinese economic coercion against Australia

Source: Bruegel based on Australian Bureau of Statistics (left) and UN COMTRADE (right).

This makes for a stark contrast with Australian wine exporters. Because of a 2015 free trade agreement25, Australian wine exporters had been at an advantage in China compared to many other wine-exporting countries, making China an important export destination.

However, following the imposition of countervailing duties as high as 218 percent in late 2020, wine exports to China collapsed from approximately 38 percent of total Australian wine exports in 2019 to zero since 2022. Unlike coal, the industry failed to expand into other markets.

Consequently, monthly Australian wine exports in June 2023 were down over 40 percent from their October 2020 peak. Chinese duties, coupled with a strong harvest, led to a significant oversupply of Australian wine26, depressing prices and adversely impacting the industry27.

The two industries detailed here are representative of the broader range of targeted industries. Some, such as barley, succeeded in diversifying away from Chinese buyers (to Saudi Arabia) and saw their exports grow over the period in question. Lobster and wood exporters on the other hand failed to move into new markets and suffered the same fate as their counterparts in the wine industry (Buckland et al 2023).

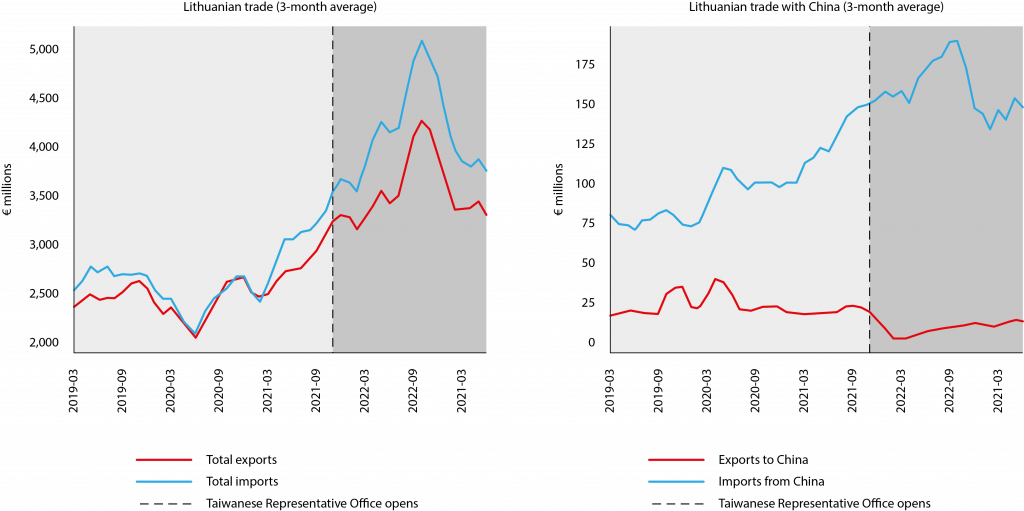

4.2 Lithuania: much ado about nothing?

The trade restrictions introduced by China against Lithuania in 2021 marked the most serious incident of Chinese economic coercion against an EU member.

The relationship between the two countries had been particularly fraught since the formation of a new Lithuanian government in 202028, but broke down entirely in mid-2021 when the Lithuanian authorities announced that they would allow a Taiwanese representative office to be opened in Vilnius29.

After two years of an essential trade ban (detailed below), the Lithuanian government reported in November 2023 that ‘most’ Chinese trade measures had been lifted30.

Given the opacity of China’s actions, it is difficult to disentangle precisely which measures were implemented and when. However, the European Commission (2022) detailed that the original measures enacted included disruption to logistics networks (leading to more expensive and delayed freight deliveries), difficulty obtaining trade credit insurance for imports, and general disruption to supply chains containing Chinese components.

These measures were escalated following the actual opening of the Taiwanese office in November 2021, to go beyond direct trade between the two nations. They also targeted Lithuanian participation in global supply chains, with products from other European countries containing Lithuanian components being threatened with rejection by Chinese customs authorities.

Official import bans on certain products were introduced in 2022, with China relying once again on spurious justifications, such as a ‘lack of documentation’31.

Lithuanian exports to China fell by two-thirds between 2020 and 2022, but imports from China grew by the same amount over the period in question, which reinforces the idea that China most often targets countries’ exports.

Neither Lithuanian total exports nor total imports were significantly impacted, which is unsurprising given that China made up just 1% and 4% of Lithuania’s 2020 exports and imports respectively32.

However, as in the case of Australia, certain sectors were negatively affected by the measures, with two of the three firms claiming assistance under a national support scheme (Box 2) operating in the solar PV industry33.

Figure 4. Lithuanian exports and imports to the world (left) and to China (right), 3-month average in € millions

Source: Bruegel based on Eurostat.

Several observations can be made on the joint experiences of Australia and Lithuania of Chinese economic coercion34. First, exports to China were targeted more strongly than imports. Second, despite significant trade restrictions from one of the world’s largest economies, neither country suffered macroeconomically. Third, targeted industries can emerge unscathed without government intervention, largely through successful diversification.

As Australian coal and barley exports showed, commodities are particularly poor targets for economic coercion as global markets provide alternative buyers. However, it also shows that even if the wider economy can withstand coercion, certain sectors can be strongly impacted.

The markets where Chinese coercion had the greatest effects (wine, lobsters and wood in Australia) are macroeconomically insignificant, yet their targeting affected some constituencies. In other words, the inflicted damage was political rather than macroeconomic.

Box 2. Lithuanian support scheme

In April 2022, the European Commission approved under EU state aid rules a Lithuanian loan scheme designed “to support and facilitate access to finance by companies affected by the exceptional circumstances resulting from China’s discriminatory trade restrictions on Lithuania” (European Commission, 2022). This was approved to last until the end of 2027 or the end of the trade restrictions, whichever came first. However, because of a lack of uptake, the scheme was wound down in 202335.

Administered by INVEGA, the Lithuanian national promotional institution, the scheme was capped at a maximum of €130 million overall, and at €5 million per firm. Access was limited to Lithuanian firms for which the “proportion of either imports from or exports to China represents at least 25% of the beneficiary’s total imports or exports in 2021”, and that were unable to receive financing on the market (which had to be proven by rejections from three financial institutions). The loans had to be used: (i) to source inputs from different sources, (ii) to explore the possibility of entering new markets or (iii) to use “the time to undertake such efforts.”

Estimates at the time of approval were that there were 130 potential beneficiaries, with this expected to increase to up to 500 as Chinese restrictions persisted and grew. However, only three firms, each an SME, made use of the support offered. The total amount of loans granted was €4.22 million, just 3 percent of the maximum amount permitted.

5 Where is the EU exposed to economic coercion?

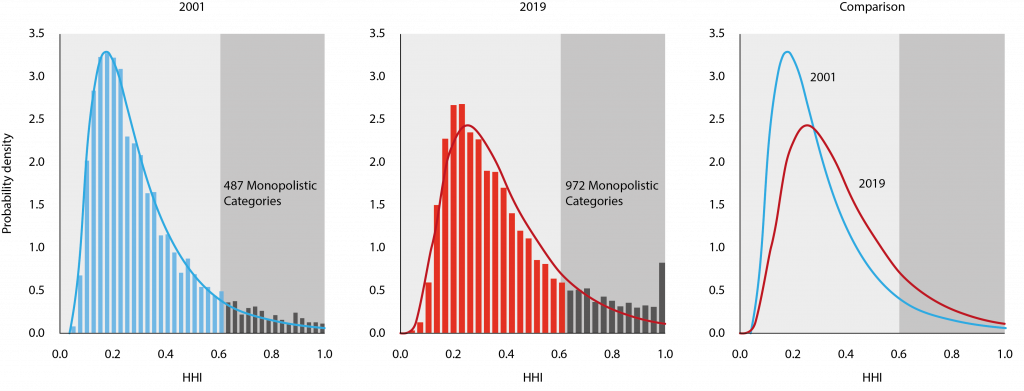

As monopolistic power is a necessity for economic coercion, potential vulnerabilities can be identified by looking at market concentration. The Herfindahl-Hirschman index (HHI) provides an index that measures market concentration. It is used widely not only for assessing competition cases, but also in defining economic security risks (European Commission, 2021a; Jaravel and Mejean, 2021; Welslau and Zachmann, 2023).

The HHI has a value between 0 and 1. The lower the value, the more competitive a market. In competition policy, any market with a value above 0.25 is considered indicative of a high degree of market concentration, and any market with a concentration above 0.6 is considered ‘monopolistic’ (US Department of Justice, 2010).

While these measures might not apply one-to-one to import vulnerabilities, they provide a yardstick of how concentrated import markets are.

Figure 5 plots the distribution of HHI values of EU imports by product category for 2001 and 201936. For easier comparison, estimated distributions for both years are displayed in the right panel. We highlight goods with an HHI above 0.6 as monopolistic and thus problematic.

This is a conservative choice, compared to the threshold values used in other analyses (an HHI of 0.4 in the case of the European Commission). However, this analysis is meant to illustrate the evolution of EU import markets and we abstract from the second stage of import concentration analysis, justifying a more restrictive approach37.

Figure 5. Evolution of concentration of EU imports

Source: Bruegel based on Eurostat.

Between 2001 and 2019, the distribution of EU import market concentration shifted considerably to the right. While in 2001, 487 products had concentrations considered ‘monopolistic’, in 2019, 972 products fell into this category.

Table 1 provides for the EU a breakdown of the types of product that were in highly concentrated markets in both 2001 and 2019. In both periods, most of the products in highly concentrated markets were manufactured goods.

For instance, in 2019, 626 products were manufactured goods, but they accounted for only 11 percent of the value of manufactured goods imports into the EU. This was more than double the 5 percent of the import value of manufactured goods falling into the ‘problematic’ category in 2001.

For non-fuel raw materials, 22 percent of products were in monopolistic markets in 2019. While the share of value of non-fuel raw materials in monopolistic markets did not change significantly over the time period in question, many more of the highly concentrated goods categories were classified as ‘critical raw materials’ in 2019 than in 2001.

Similarly, many more of the highly concentrated manufactured goods imports are ‘high tech’ goods, with the share increasing from 25 percent to 43 percent. A significant part of the increase can be directly attributed to China. It was the main source country for 20 percent of the highly concentrated import categories in 2001, with this share more than doubling to 49 percent in 2019.

Meanwhile, the share of the US in concentrated EU imports roughly halved in almost all categories (for an analysis of the trends, see Welslau and Zachmann, 2023).

Table 1. Breakdown of highly concentrated import markets

Note: HT = high tech goods according to classification by the United States Census Bureau; CRM = critical raw materials as defined by the European Commission.

Source: Bruegel based on Eurostat.

Overall, EU imports of both raw materials and manufactured goods were much more concentrated in 2019 than in 2001. This shows that a high degree of market concentration is not merely a feature of a few goods categories that might have been supported through strategic Chinese industrial policy, but rather the effect of an increase in market concentration across the entire spectrum of imports.

Therefore, a strategy to limit import concentration cannot be focused only on strategic imports, as potential targets for import bans are plentiful and new ones are likely to arise in an overall concentrated market environment. An effective diversification strategy should therefore aim to lower the degree of market concentration more generally.

It is also important to note that import dependencies alone are not necessarily concerning. Among the categories of goods for which Mejean and Rousseaux (2024) found the EU to be reliant on highly concentrated import markets are, for instance, artificial flowers and camping flasks.

While shocks in the countries of origin would likely lead to EU import disruptions in these sectors, it seems implausible that these shocks would cause social welfare losses significant enough to warrant government intervention.

There are important precedents for the weaponisation of import vulnerabilities. These include the Chinese threat to ban exports of certain critical raw materials during a 2010 trade dispute with Japan38, and recent export restrictions on critical minerals39.

However, most cases of economic coercion by China have either directly targeted companies operating on its markets or exports to China. This stands in contrast to the almost exclusive focus of economic security on risks stemming from Western imports from China.

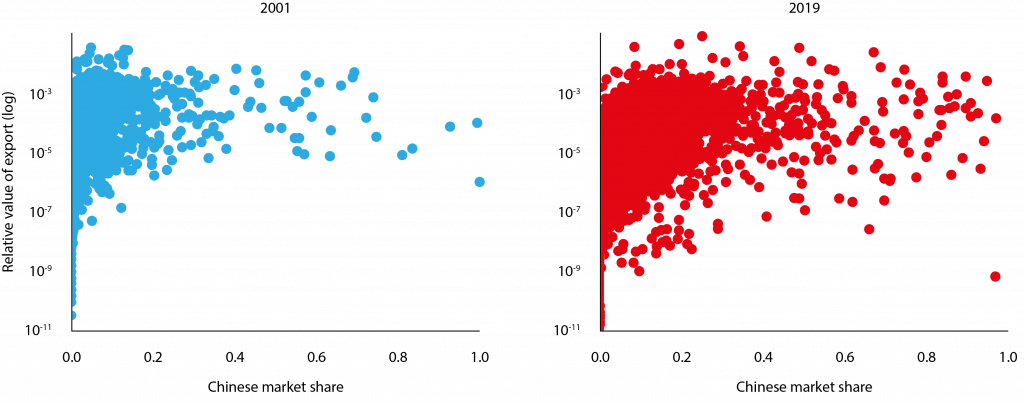

As Adachi et al (2022) showed and the Australian and Lithuanian cases illustrate, imports from China are not typically the primary vulnerability for economic coercion. Instead, these past experiences have shown that China tends to weaponise access to its domestic market for foreign exporters.

Given that a market must be sufficiently large to have monopolistic power as an export destination, China is virtually the only country of concern to the EU for this type of risk40. While other countries can also harm EU export interests, they are unlikely to be sufficiently large to inflict significant damage.

Therefore, we use in Figure 6 Chinese market shares as proxy for export vulnerabilities instead of the HHI index. The economic importance of an export is measured by its relative value (it’s share of total exports to China). A product in the lower left corner is of relatively low value and is not exported a lot to China, whereas a product in the upper right corner is of high value with most of it being exported to China.

Overall, a large shift to the right is evident. In other words, there is now a much larger number of products where a Chinese embargo on EU exports would inflict significant harm, increasing the number of potential targets for Chinese restrictions.

Figure 6. Concentration of EU export markets

Source: Bruegel based on Eurostat.

As in the case of the increasing import concentration, the increase in Chinese market shares in exports represents a structural shift rather than something that is product-specific. A focused strategy on the most exposed exports might limit some potential harm in the short term, but the number of potential targets is so high that broader diversification is necessary and overarching policy instruments are required.

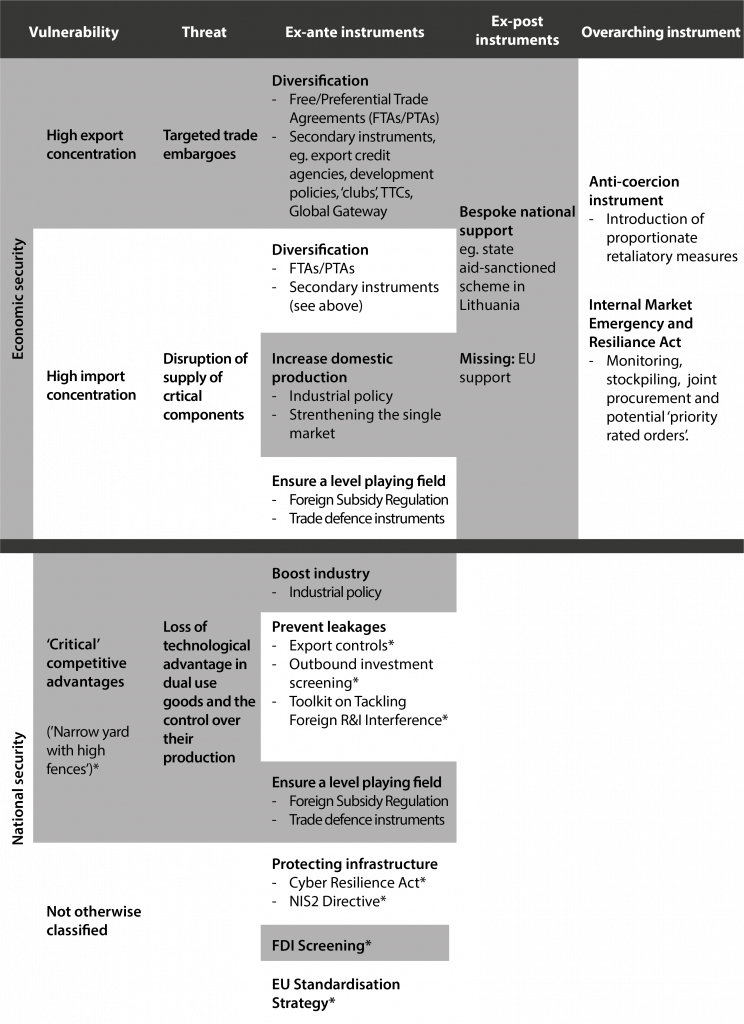

6 Instruments of economic security

The increased exposure of the EU to economic security risks has rightly drawn the attention of policymakers. Various initiatives have been proposed with the aim of increasing the resilience of the European economy against such risks. Given the different types of threat, these initiatives rightly include a wide range of instruments41.

Table 2 provides an overview of the policy instruments relevant to the economic-security debate, including both those announced under the auspices of economic security but that are in fact more pertinent to national security, and policies relevant to addressing economic security risks that have not yet been put forward.

We distinguish them depending on the nature of the threat (eg. whether it targets exports or imports)42 and the intended timing of implementation (pre-emptive, ex-post or both, which we term ‘overarching’). It is noteworthy that many of these policies have the potential to improve the resilience of the European economy in areas beyond responding to economic security threats.

As mentioned, Table 2 includes a number of policies mentioned in the Commission’s Economic Security Strategy but that are arguably more concerned with non-economic risks. The downsides to many cyber-attacks or research interference are not primarily economic in nature.

The Commission has declared certain technologies to be of particular concern because of “the enabling and transformative nature of the technology; the risk of civil and military fusion; and the risk of misuse of the technology for human rights violations” (European Commission, 2023d).

The latter two criteria are not relevant in terms of our narrow definition of economic security. The former, which the Commission defines as assessing the technology’s “potential and relevance for driving significant increases of performance and efficiency and/or radical changes for sectors, capabilities, etc”, could fall under the remit of economic security only in sectors where high degrees of technological complexity create monopolies, as described earlier.

Table 2. Instruments of economic security

Note: Includes current/proposed EU policy measures, as well as those we believe are missing. * denotes policies or ambitions put forward under the umbrella of economic security that generally fall outside of our definition43.

Source: Bruegel.

In the following, we discuss the role of some instruments in more details, as part of four complementary strategies to enhance economic security: mapping of vulnerabilities; diversification of imports and exports; industrial policy and technology security in strategic sectors; and ex-post policies to help redress political damage.

6.1 Mapping vulnerabilities

The first step of responding to economic security concerns is to identify risks. Global value chains are enormously complex and not all dependencies are direct (Qiu et al 2023). Coercive measures can go beyond direct bilateral trade, as was the case with China’s actions against Lithuania.

As such, a detailed understanding of the EU’s dependencies on other countries for both exports and imports is necessary. This would allow authorities to identify potential vulnerabilities ahead of shocks, and assist affected firms, in particular SMEs, to diversify their supply chains and mitigate the risk in question.

Hackenbroich et al (2022) argued that there may be scope for an EU body to carry out detailed data analysis for this purpose.

Monitoring supply chains by requesting, and in some instances requiring, firms in strategic sectors to disclose information on their suppliers, stocks and productive capacities is a key, and controversial44, component of the proposed EU Internal Market Emergency and Resilience Act45.

Similarly, the European Chips Act entails mapping and monitoring the semiconductor supply chain to assess ex-ante risks of potential import disruptions46. Depending on the importance of a sector, a balance has to be found between the administrative burden on firms and the benefits from further insights. For instance, informational requirements should be higher on those sectors flagged by Mejean and Rousseaux’s method (2024) as being at risk.

However, awareness of risks alone does not directly lead to mitigation measures; economic incentives have to align as well. While over 95 percent of firms surveyed in the EIB Investment Survey (European Investment Bank, 2023) had experienced some form of disruption to international trade, less than half of them had changed or were planning to change their sourcing strategies.

Even when potential downsides are large enough to warrant a change in sourcing, there might not be readily available alternatives. This leads us to the next strategy.

6.2 Diversification

Since monopolistic power is a necessary condition for effective economic coercion, trade diversification is the most effective strategy to reduce vulnerabilities, as it can lead to more competition across a wide range of imports and exports.

While precise results change depending on the criteria used to determine dependence, there has been significant churning in the products in which the EU has been overly import dependent (Vicard and Wibaux, 2023).

Failing to further comprehensively diversify both imports and exports will likely lead to more goods falling into the concerning range of high export or import concentration. Otherwise, in focusing on individual goods in structurally concentrated markets, policymakers will be constantly racing to address different areas of concern.

To achieve greater diversification, a combination of policy tools offers the most promising avenue. First and foremost, free and preferential trade agreements (FTAs/PTAs) open new markets for both exporters and importers.

The EU has made progress in broadening its level of trade covered under PTAs. As of 2020, half of extra-EU exports were covered by reciprocal PTAs, up 8 percentage points from 2010 as trade agreements with Canada, Japan and Korea came into force (Dadush and Dominguez Prost, 2023)47.

The December 2023 agreements48 between the EU and Chile, an important exporter of some CRMs, to enhance and modernise their existing FTA, also shows how these agreements are not static, and should be updated if needed to reflect the increased focus on economic security.

However, mainly because of domestic political pressure, the EU has struggled to conclude trade agreements with major trading partners such as the Mercosur countries, while even negotiations with close allies like Australia have proven difficult49.

Besides the difficulty of ratifying FTAs, there are other limits to relying on FTAs for diversification. Many of the products for which the EU has problematic import dependencies do not have significant tariffs precisely because there is no European industry that would justify protective measures.

Where Most Favoured Nation (MFN) tariffs offered to all WTO members are already very low, the EU cannot offer significantly better market access through an FTA compared to the access that, for instance, China has. This is the case for CRMs, many of which have no tariffs at all applied to them (Le Mouel and Poitiers, 2023).

Therefore, a diversification strategy must complement FTAs with external financial instruments50. The European Commission aims to harmonise and streamline European development assistance under the umbrella of the Global Gateway.

Beyond its primary objective of promoting economic development globally, this initiative has as a stated goal to support the EU by “strengthening the resilience of its supply chains, and to opening up more trade opportunities for the EU economy” (European Commission, 2021b, p.2).

To an extent, this is indeed already happening. In October 2023 the EU signed Memoranda of Understanding under the Global Gateway framework with both the Democratic Republic of Congo and Zambia to deepen cooperation around the development of resilient value chains for critical raw materials, which could help to improve import diversification51.

More should be done in this area, such as potentially investing in infrastructure in northern Africa to further diversify European energy imports (as argued by Rizzi and Varvelli, 2023).

Export credit agencies (ECAs) should play an important role in this strategy, including the potential creation of a European export credit agency. ECAs are state-owned or publicly financed bodies that are used to support exports by providing a range of financing instruments (primarily insurance and guarantees, but also loans) at below market rates to de-risk trade.

Going beyond facilitating direct exports, they can also be used to support investments in third countries which, if targeted appropriately, can ultimately improve diversification of supply. A European ECA could compliment the 24 national ECAs (European Commission, 2023c)52. The support in question is significant, with EU ECAs in 2021 insuring projects amounting to approximately €90 billion (Schlögl et al 2023).

The ECAs’ funding could be boosted and applied strategically to support the objective of economic security. It will not be commercially viable in a high-wage economy to produce many of the products for which the EU is reliant on imports from China. Some raw materials do not exist in Europe, or local resistance to their extraction could be too high.

In such cases, ECAs can play a critical role in promoting investments in alternative sourcing in partner countries (Le Mouel and Poitiers, 2023). Export-promotion offices could also be useful to help firms identified as being overly reliant on a particular export market to identify and access new markets.

The Enterprise Europe Network (EEN), a Single Market Programme-funded umbrella of national SME support organisations (including chambers of commerce and government agencies) already offers assistance to SMEs in the areas of ‘resilience’ and ‘internationalisation’. This role, however, could be boosted, with awareness of the network at just 9 percent among SMEs53.

6.3 Targeted industrial policy and interventions

For sectors that combine a high degree of dependency with a high degree of economic importance, diversification might not be enough to safeguard economic security. There are very few sectors from which macroeconomically significant impacts might arise because of supply chain shocks.

As noted, concerns beyond economic outcomes, such as defence and health, may justify such policies in other areas, but this group should also be limited. Three types of strategies are possible: (i) maintaining strategic reserves; (ii) growing domestic production; or (iii) improving productive capacities in third countries.

In some cases, stockpiling a certain buffer level will often be the most cost-effective option, but it is not always feasible. Certain goods (like medicines) might spoil, and in certain fast-moving sectors (for instance PVs), technology quickly becomes obsolete. As such, this should play only a limited role.

The global trend thus far has been to prioritise boosting domestic supply via industrial policy. Examples include the European Chips Act and the Net Zero Industry Act in the EU, the Inflation Reduction Act and CHIPS and Science Act in the US, and the K-Chips Act in Korea.

However, competing policies have led to costly subsidy races even among likeminded partners, and heavy-handed reshoring policies can have unintended consequences. Javorcik et al (2022) estimated that friend-shoring could generate global real GDP losses as high as 4.6 percent.

Reshoring drug production to avoid shortages could lead to prices increasing by up to 30 percent (Galdin, 2023). Import restrictions have likely contributed to shortages of infant formula in the US54.

Meanwhile, producing green technology in Europe would lead to much higher decarbonisation costs, slowing the green transition and Europe’s attempts to diversify away from Russian hydrocarbons. In the EU, the emphasis on national state aid also poses risks to the single market (see Kleimann et al 2023; Tagliapietra et al 2023)55.

In the instances in which increasing domestic production is justified, a bespoke strategy should be designed for the sector in question that aims to minimise distortions and leverage the comparative advantages of the EU in that area.

For instance, McWilliams et al (2024) argued that an EU industrial policy for the solar panel industry should focus on recycling and innovation, not import substitution. Given the different abilities of EU countries to support their domestic industries, a ‘Europeanisation’ of state-aid tools such as the Important Projects of Common European Interests (IPCEIs) will be indispensable if single market fragmentation is to be avoided.

Currently, IPCEIs and similar policies, such as the European Chips Act and funding for clean tech through the Temporary Crisis and Transition Framework, rely on national funding. While they have to be part of a common European framework, individual projects are chosen via opaque processes by EU countries based on (sometimes competing) national interests. Project selection should rather be based on more thorough, transparent methodologies (Poitiers and Weil, 2022).

Internationalising industrial policy provides a very promising avenue to increasing the security of supply while simultaneously minimising protectionism, though international policy coordination will be challenging. Variations of this approach include critical raw materials (CRM) ‘clubs’ and the establishment of clean-tech partnerships to leverage different countries’ relative comparative advantages, as proposed by García-Herrero et al (2023).

Beyond growing domestic production, technology security measures (such as export controls or outbound investment screening) to prevent diffusion in the aforementioned key sectors at risk of complexity-driven monopolisation, must also be complemented by policies that reinforce and strengthen existing advantages, through support for R&D, skilled immigration and via bespoke industrial policies.

In addition, policymakers must be aware of the risk of reciprocity in these measures (as was the case with China in 202356) and should therefore be judicious in their application.

In sum, there may be cases in which the risks associated with supply disruption warrant application of industrial policy to promote alternative supply chains, either in the EU or in other countries, or the imposition of technology security measures.

However, policymakers should not pretend that this is a cost-free approach, and need to weigh losing the gains from trade against the potential welfare losses from supply chain disruptions. If they opt for industrial policy, how exactly they choose to design this approach, in particular to minimise any protectionist elements, is critically important.

6.4 Ex-post instruments

While some goods and industries are of such strategic importance that they warrant state intervention, as discussed above, it would be prohibitively expensive to do so for all smaller industries that are exposed to economic security risks (think for instance again of the artificial flower industry identified by Mejean and Rousseaux, 2024).

Therefore, ex-ante policies alone will not suffice. Ex-post policies can help deter targeted attacks against such industries and can soften their impact when they do occur. The first instrument in this regard is the Internal Market Emergency and Resilience Act.

In cases of severe supply chain disruptions or the risk thereof, this law allows the EU to impose reporting obligations and build-up strategic stockpiles and, in case of crisis, it lists the potential ways in which the EU can intervene in supply chains (Ragonnaud, 2024).

However, the primary ex-post EU instrument to this end is the new Anti-Coercion Instrument (ACI, Regulation (EU) 2023/2675), a wide- ranging trade defence instrument intended to be applied in retaliation in cases of economic coercion against an EU country. To quote the Commission, “the primary objective of the ACI is deterrence”57, and it will therefore be considered a success if it is never used. However, if triggered, the retaliatory measure could apply in virtually all areas of economic policy.

This instrument should be complemented with another instrument that helps share the burden of economic coercion. This would entail providing affected firms with financial and perhaps logistical support to enable them to find new markets for their exports or imports.

The logic behind supporting firms is twofold: it removes the ability of adversaries to target groups and inflict political damage on European countries, which they could try to leverage to change policy, and it supports firms that will likely have suffered a serious shock to their business model through no fault of their own.

While in most cases the economic damage from economic coercion will be small enough that national government could finance support for affected workers and firms, there would be several benefits from setting up an EU-wide tool.

EU solidarity assistance would reinforce the signal that an attack against one country is an attack against all and would disincentivise divide-and-rule strategies on the part of third countries58.

It would also potentially allow firms in other countries that are indirectly affected by the coercive measures (eg. German firms that export to China but use Lithuanian components, in the case of sanctions against Lithuania) to be supported without the need for new state-aid schemes to be approved in each country.

Such a measure to fortify the joint EU response will become more important as other European countries, such as Czechia, pursue foreign policy akin to that of Lithuania (McVicar, 2023).

The challenge of this proposed instrument is that it introduces the potential for moral hazard. If firms believe that the EU will bail them out in the event of supply chain disruption, they may choose to deepen their exposure to geopolitical risks, rather than diversifying, increasing their potential exposure to economic coercion.

Similarly, countries themselves could feel emboldened to pursue foreign policy beyond the EU consensus, safe in the knowledge that their firms will be supported by other member states59.

Therefore, any new ex-post instrument should be accompanied by new incentives for companies to diversify their supply chains and customer bases to limit potential abuse through moral hazard, as well as further progress on common foreign policy.

Part of this could be accomplished through the nature of the support itself. For instance, limiting support to capped, concessional loans with strict terms of use would reduce any perverse incentives to double down on critical imports from China.

Eligibility requirements should also be used to minimise these risks: receiving state aid could be made conditional on previously having fulfilled certain reporting obligations, having conducted risks assessments (‘supply chain stress testing’) or on companies insuring themselves against certain economic security risks in private markets60.

There could be some symbiosis with the supply chain monitoring detailed previously, with firms operating in dependent sectors required to demonstrate diversification efforts before being deemed eligible for support, for example.

Overall, there is a need to strike a balance in both the nature of the instrument and the eligibility: too generous and lenient and there is the risk of moral hazard; too frugal and restrictive and the instrument could become pointless, unable to adequately support those negatively impacted and therefore failing to negate the political pressure points61.

For the success of both the deterrence value of the ACI and any EU-wide support scheme, a common or at least strongly coordinated foreign policy is a prerequisite. All EU countries should have to underwrite the potential backlash against a forceful application of the ACI and be willing to pay for EU assistance for affected companies, even if they did not necessarily agree with the action that provoked the coercion in question.

As detailed in Hackenbroich et al (2022), when considering their responses, countries must weigh up both the underlying policy and the value of preserving EU solidarity and unity against coercion, which will likely be successful if it succeeds in dividing member states.

With Lithuania, this was not the case, as other EU countries appeared unwilling to pay a price for a foreign policy action taken by Lithuania alone. Despite public proclamations of outrage by other EU countries, there was neither material support nor immediate retaliation against China for what even the Commission described as ‘discriminatory trade measures’62.

In contrast to the US, which promised a $600 million export credit agreement to Lithuania63, and Taiwan, which established both a loan and investment fund focused on Central and Eastern Europe of approximately €190 million and €1 billion respectively64, the only response from the EU was to allow Lithuania to provide state aid from its own finances (Box 2) and to file a complaint to the WTO65.

This failed to send a message of European unity, nor did it create a precedent that could serve as deterrence against future economic coercion.

Therefore, it is unlikely that any additional support scheme could be introduced in the absence of further progress on aligning foreign policy.

7 Conclusion

The rise in global geopolitical tensions has coincided with deeper economic integration of EU and non-democratic countries, and an increase in the market concentration of EU imports. While the EU benefits from this trade in many ways, the links have also created economic security risks beyond traditional trade wars.

To counter these risks, the EU should invest in a deeper understanding of its supply chains and pursue targeted industrial policies in a small number of carefully selected industries of strategic importance.

However, the depth of exposure to economic coercion and other shocks stems from structurally more concentrated imports and exports. Unless the EU manages to diversify its trading relationships, many products will remain exposed.

While it is difficult to inflict macroeconomically-relevant harm through economic coercion alone, there are many products over which pressure could be applied on politically important constituencies.

Therefore, the EU should invest in ex-post policies that mitigate economic harm where it occurs. Such policies, taken together with deterrence through the threat of defensive measures under the ACI, would disincentivise the use of economic coercion against the EU.

However, for ex-post policies to be effective, a more common foreign policy is necessary, as otherwise common burden-sharing and unified responses are not credible.

Endnotes

1. Jean Pisani-Ferry, ‘The Geopolitical Conquest of Economics’, Project Syndicate, 30 September 2021.

2. For a discussion see Hillman (2022).

3. The G7 wants “coordinate our approach to economic resilience and economic security that is based on diversifying and deepening partnerships and de-risking, not de-coupling”. See G7 Hiroshima Leaders’ Communiqué of 20 May 2023.

4. “Many of you have heard the term ‘small yard, high fence’ when it comes to protecting critical technologies. The concept has been citied at think tanks and universities and conferences for years. We are now implementing it.” Remarks by National Security Advisor Jake Sullivan on the Biden-Harris Administration’s National Security Strategy on 13 October 2022.

5. We focus predominantly on China because of the documented potential exposure of EU firms to Chinese shocks; see for instance the survey results reported in Attinasi et al (2023). See Box 1 for a discussion of the US.

6. Given the potential for technological advantages to give monopolistic powers to semiconductor firms, coupled with the immense capacity for economic coercion in this sector, we believe that the 2023 export controls introduced by the Netherlands on advanced semiconductor manufacturing equipment are one of the very few instances in which technological defence measures can be justified by economic security arguments; for an English translation of the justification given by the Dutch government, see: https://csis-website-prod.s3.amazonaws.com/s3fs-public/2023-07/230721_CSISTranslations_Dutch_Export.pdf.

7. Article XXI of the General Agreement on Tariffs and Trade.

8. J Brunsden, S Fleming, A Williams and J Politi, ‘EU and US end Airbus-Boeing trade dispute after 17 years’, Financial Times, 15 June 2021.

9. See European Commission Questions and Answers of 10 July 2023, ‘EU-US Data Privacy Framework’.

11. See The White House, ‘G7 Leaders’ Statement on Economic Resilience and Economic Security’, 20 May 2023.

12. See The White House, ‘Joint Statement by President Biden and President von der Leyen’, 10 March 2023.

13. See European Commission, ‘Speech by President von der Leyen on EU-China relations to the Mercator Institute for China Studies and the European Policy Centre’, 30 March 2023.

14. See The White House, ‘FACT SHEET: CHIPS and Science Act Will Lower Costs, Create Jobs, Strengthen Supply Chains, and Counter China’, 9 August 2022.

15. “It’s important to recognize this is a national security action, not an economic one … This executive order protects our national security interests … Again, I want to be clear: This is a national security action, not an economic one.” The White House, ‘Background Press Call by Senior Administration Officials Previewing Executive Order on Addressing U.S. Investments in Certain National Security Technologies and Products in Countries of Concern’, 10 August 2023.

16. See European Commission press release of 10 September 2019, ‘The von der Leyen Commission: for a Union that strives for more’.

17. See German Association of the Automotive Industry, https://www.vda.de/en/news/facts-and-figures/annual-figures/exports.

18. “Beijing frequently restricts trade by targeting imports of agricultural goods or commodities. Only on rare occasions has it employed or threatened to employ export restrictions, as was the case with rare earths to Japan in 2010” (Adachi et al 2022).

19. See Lim and Ferguson (2019) for a discussion of the use of boycotts by China during the dispute with South Korea regarding the THADD missile defence programme.

20. The Economist, ‘How rare-gas supply adapted to Russia’s war’, 30 March 2023.

21. Some analysis has also pointed to Australia deciding to exclude Huawei from 5G infrastructure as a cause for the Chinese response; see Hackenbroich et al (2022).

22. The justifications given for these different de-facto import embargoes were both imaginative and spurious. For instance, mandatory testing for traces of heavy metal was introduced for the import of crustaceans, with the testing period long enough that live lobster exports could not survive the process (Buckland et al 2023).

23. The value of Australian exports to China did grow slightly over this period, because of an increase in the price of iron ores, a key input into the Chinese economy and overwhelmingly the largest component of Australian exports to China- averaging over 50 percent of monthly bilateral exports in 2019.

24. As detailed by Urden (2023b): “China started buying coal from Indonesia, which then cut its sales to India and elsewhere. India boosted its purchases of Australian coal that had previously gone to China”. Japan and Korea also massively increased their purchases of Australian coal over this period. This also coincided with energy shortages following the Russian invasion of Ukraine, which meant that coal prices increased significantly.

25. See Casey Hall and Xiaoyu Yin, ‘China’s wine market ready to welcome likely return of Aussie wine as ties improve’, Reuters, 3 November 2023.

26. Reports estimate it at two billion litres, see for example Rabobank news release, ‘“Swimming in wine” – navigating oversupply in Australia’s wine industry’.

27. UN Comtrade data shows that Australian wine imports actually increased steadily each year between 2019 and 2022, which seems to suggest limits on the wine industries’ ability to diversify into the domestic market.

28. For instance, in May 2021, Lithuania became the first country to withdraw from the China-CEEC initiative.

29. The standard practice to avoid Chinese disapproval has been to allow institutions that represent the city of Taipei, not Taiwan. For more details on the actions undertaken by Lithuania, see Andrijuaskas (2022).

30. See Foreign Minister Gabrielius Landsbergis’ comments in Milda Seputyte and Natalia Drozdiak, ‘Lithuania Says Businesses Remain Wary on China Trade’, Bloomberg, 28 November 2023.

31. Dominique Patton and Andrias Sytas, ‘China suspends Lithuanian beef, dairy, beer imports as Taiwan row grows’, Reuters, 10 February 2022.

32. The decrease in Lithuanian imports and exports visible from late 2022 onwards was accounted for largely by the economic slowdown in trading partners and was unrelated to the Chinese actions.

33. This is unsurprising given the well-documented dominance of China in this supply chain.

34. The experiences also match those of South Korea during the THAAD dispute of 2016-17 (Lim and Ferguson, 2019).

36. We focus on individual goods categories rather than market values, as harm to an individual industry might come even from a low value if an indispensable import is affected.

35. Gabija Sabaliauskaitė, ‘”Invega“ stabdo paskolas nukentėjusiems nuo Kinijos veiksmų: iš 130 mln. Eur paskolų suteikta už 3 mln. Eur’, Verslo žinios, 6 February 2022.

37. See Mejean and Rousseaux (2024) for both a more detailed discussion of how to identify dependencies and a more comprehensive data exercise.

38. For a discussion, see Le Mouel and Poitiers (2023).

39. Mai Nguyen and Eric Onstad, ‘China’s rare earths dominance in focus after it limits germanium and gallium exports’, Reuters, 21 December 2023.

40. For a discussion of the role of security concerns with regards to the US, see Box 1.

41. Due to capacity constraints, we do not consider here general policy measures to improve the single market, even if these measures could improve the competitiveness of European firms, thus likely contributing to the economic security of the EU. For a discussion on these measures, see Kleimann et al (2023).

42. Some have attempted to argue that potentially losing current comparative advantages in critical technologies constitute a threat to economic security, given that it may result in future import dependencies. In our view, this is currently too many degrees removed to fall under economic security concerns.

43. As discussed previously, there are some rare instances involving technology-induced monopoly that legitimise the use of technology security tools to maintain economic security.

44. See Sultan et al (2023), for example.

45. Formerly called the Single Market Emergency Instrument (SMEI).

46. See European Commission, ‘European Chips Act: Monitoring and crisis response’, undated.

47. If intra-EU trade is also included, the average of EU countries’ exports covered by reciprocal PTAs was 81 percent.

48. For more information on the Advanced Framework Agreement and Interim Trade Agreement, see European Commission press release of 13 December 2023, ‘EU and Chile sign modern and ambitious trade and political agreements’.

49. Negotiations between the EU and the Mercosur states on a deal began in 2000 and only concluded with an agreement in June 2019. Five years later, EU ratification is still awaited. The October 2023 breakdown in EU-Australian trade agreement negotiations also fails to bode well for the prospect of new deals on the horizon.

50. Article 5 of Regulation (EU) 2021/947 establishing the Neighbourhood, Development and International Cooperation Instrument (NDICI, the EU’s primary international development tool) states that the EU should “seek to promote increased synergies and complementarities” between trade policy and sustainable development”. See https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX%3A32021R0947.

51. European Commission press release of 26 October 2023, ‘Global Gateway: EU signs strategic partnerships on critical raw materials value chains with DRC and Zambia and advances cooperation with US and other key partners to develop the “Lobito Corridor”’.

52. The Commission has raised concerns that national ECAs “do not follow overarching EU interest and policies… and can be also in competition with one another” (European Commission 2023b, p.7). It also argued that better coordination between national ECAs and EU and national development finance agencies could lead to better outcomes across a range of policy areas, including the sourcing of CRMs and “the trade aspects of EU geopolitical strategies” (European Commission, 2023b, p. 39).

53. Source: Flash Eurobarometer 537 (2023); Firms would likely be more aware of their local branches of the EEN, such as national export promotion offices.

54. Gabriella Beaumont-Smith, ‘Rock-a-Bye Trade Restrictions on Baby Formula’, Cato at Liberty, 10 May 2022.

55. This already at a time when concerns are growing over single market fragmentation due to the relaxing of state aid rules following Russia’s invasion of Ukraine; see Théo Bourgery-Gonse, ‘EU subsidy race is on – and Germany is winning it’, Euractiv, 12 September 2023.

56. See Reuters, ‘China export curbs choke off shipments of gallium, germanium for second month’, 20 October 2023.

57. European Commission, ‘Questions & Answers regarding the Anti-Coercion Instrument’, undated.

58. This was a feature of Chinese measures against Lithuania, as it sought to pressure German industry to intervene. See for instance Andrius Sytas and John O’Donnell, ‘German big business piles pressure on Lithuania in China row’, Reuters, 21 January 2022.

59. This same moral hazard applies to the ACI, as discussed in Hackenbroich et al (2022).

60. To reduce the administrative burden, we would propose limiting these additional requirements to larger firms, with SMEs covered regardless.

61. The lack of uptake of the Lithuanian support scheme warrants consideration.

62. See European Commission press release of 26 April 2022, ‘State aid: Commission approves €130 million Lithuanian scheme to support companies affected by discriminatory trade restrictions’.

63. Andrius Sytas, ‘Lithuania to get U.S. trade support as it faces China fury over Taiwan’, Reuters, 19 November 2021.

64. Giedre Peseckyte, ‘Taiwan encourages companies to invest in Lithuania to deepen bilateral cooperation’, Euractiv, 3 October 2023.

65. European Commission press release of 7 December 2022, ‘EU requests two WTO panels against China: trade restrictions on Lithuania and high-tech patents’.

References

Adachi, A, A Brown and M Zenglein (2022) ‘Fasten your seatbelts: How to manage China’s economic coercion’, MERICS China Monitor, 25 August, Mercator Institute for China Studies.

Aiyar, S, J Chen, CH Ebeke, R Garcia-Saltos, T Gudmundsson, A Ilyina … JP Trevino (2023) ‘Geoeconomic Fragmentation and the Future of Multilateralism’, Staff Discussion Note SDN/2023/001, International Monetary Fund.

Andrijauskas, K (2022) ‘An Analysis of China’s Economic Coercion Against Lithuania’, mimeo, Council on Foreign Relations.

Attinasi, MG, D Ioannou, L Lebastard and R Morris (2023) ‘Global production and supply chain risks: insights from a survey of leading companies’, in ECB Economic Bulletin 7/2023, European Central Bank.

Baqaee, DJ Hinz, B Moll, M Schularick, FA Teti, J Wanner and S Yang (2024) ‘What if? The Effects of a Hard Decoupling from China on the German Economy’, chapter 4 in J Pisani-Ferry, B Weder Di Mauro and J Zettelmeyer (eds) Paris Report 2: Europe’s Economic Security, CEPR Press.

Babina, T, B Hilgenstock, O Itskhoki, M Mironov and E Ribakova, (2023) ‘Assessing the Impact of International Sanctions on Russian Oil Exports’, mimeo.

Buckland, A, A Duncan, M Farhad, A Hailemariam, D Kiely, V Sanchez Arenas and P Sotiraakopoulos (2023) ‘Trading Up: International trade features and the Western Australian economy’, Focus on Industry Report Series 8, Bankwest Curtin Economics Centre.

Dadush, U (2021) ‘What to make of the EU-US deal on steel and aluminium?’ Bruegel Blog, 4 November.

Dadush, U and E Dominguez Prost (2023) ‘The problem with preferential trade agreements’, Analysis, Bruegel.

Darvas, Z, C Martins, L Moffat and N Poitiers (2023) ‘EU trade and investment relations with Ukraine and with Russia before Russia’s illegal invasion of Ukraine in 2022’, Briefing requested by the INTA Committee, European Parliament.

Department of Commerce (2018) The Effect of Imports of Steel on the National Security, US Department of Commerce.

European Commission (2021a) ‘Strategic dependencies and capacities’, Commission Staff Working Document, European Commission May 2021.

European Commission (2021b) ‘The Global Gateway’, JOIN(2021) 30 final.

European Commission (2022) ‘State Aid SA.102002 (2022/N) – Lithuania; The Incentive Financial Instrument: Direct loans to business entities affected by third party actions’, C(2022) 2846 final.

European Commission (2023a) ‘European Economic Security Strategy’, JOIN(2023) 20 final.

European Commission (2023b) ‘Main outcomes of the mapping of external financial tools of the EU’, Joint Staff Working Document, SWD(2023) 96.

European Commission (2023c) ‘Feasibility Study on an EU Strategy on Export Credits’, Final Report, DG TRADE.

European Commission (2023d) ‘Commission recommendation on critical technology areas for the EU’s economic security for further risk assessment with Member States’, C(2023) 6689 final.

European Investment Bank (2023) EIB Investment Survey 2023.

Fajgelbaum, P, PK Goldberg, PJ Kennedy, A Khandelwal and D Taglioni (2023) ‘The US-China Trade War and Global Reallocations’, NBER Working Paper No. 29562, National Bureau of Economic Research.

Farrell, H and AL Newman (2019) ‘Weaponized Interdependence: How Global Economic Networks Shape State Coercion’, International Security 44 (1): 42–79.

Felbermayr, G, A Kirilakha, C Syropoulos, E Yalcin and YV Yotov (2020) ‘The global sanctions data base’, European Economic Review 129: 103561.

Galdin, A (2023) ‘Resilience of Global Supply Chains and Generic Drug Shortages’, mimeo.

García-Herrero, A, H Grabbe and A Kaellenius (2023) ‘De-risking and decarbonising: a green tech partnership to reduce reliance on China’, Policy Brief 19/2023, Bruegel.

Georgitzikis, K and E D’Elia (2022) ‘Rare Gases (Krypton, Neon, Xenon): Impact assessment for supply security’, Science for Policy Brief, Joint Research Centre, European Commission.

Hackenbroich, J, F Medunic and P Zerka (2022) ‘Tough trade: The hidden costs of economic coercion’, Policy Brief, February, European Council on Foreign Relations.

Hansen, R (2023) ‘Date with history: How the oil crisis changed the world’, The World Today, Chatham House, 29 September.

Harrell, P, E Rosenberg and E Saravalle (2018) China’s use of coercive economic measures, Center for a New American Security.

Hillman, J (2022) ‘China’s Entry into the WTO – A Mistake by the United States?’ mimeo.

Hufbauer, G, J Schott, K Elliott and B Oegg (2007) Economic sanctions reconsidered, Peterson Institute for International Economics.

Jaravel, X and I Mejean (2021) ‘A data-driven resilience strategy in a globalized world,’ Notes du CAE 64: 1-12, Conseil d’Analyse Economique.

Javorcik, B, L Kitzmueller, H Schweiger and MA Yıldırım (2022) ‘Economic Costs of Friend-Shoring’, Working Paper 274, European Bank of Reconstruction and Development.

Kleimann, D, N Poitiers, A Sapir, S Tagliapietra, N Véron, R Veugelers and J Zettelmeyer (2023) ‘How Europe should answer the US Inflation Reduction Act’, Policy Contribution 04/2023, Bruegel.

Kleinhans, J and N Baisakova (2020) ‘The Global Semiconductor Value Chain: A Technology Primer for Policy Makers’, Policy Brief, Stiftung Neue Verantwortung.

Le Mouel, M and N Poitiers (2023) ‘Why Europe’s critical raw materials strategy has to be international’, Analysis, Bruegel.

Leonard, MJ Pisani-Ferry, E Ribakova, J Shapiro and G Wolff (2019) ‘Redefining Europe’s economic sovereignty’, Policy Brief 09/2019, Bruegel.

Lim, DJ and V Ferguson (2019) ‘Chinese Economic Coercion during the THAAD Dispute’, The ASAN Forum, 28 December.

Maruyama, W and A Wolff (2023) ‘Saving the WTO from the national security exception’, PIIE Working Paper 23-2, Peterson Institute for International Economics.

McVicar, D (2023) ‘How the Czech Republic Became One of Taiwan’s Closest European Partners and What It Means for EU-China Relations’, Blog Post, 24 April, Council on Foreign Relations.

McWilliams, B, S Tagliapietra and C Trasi (2024) ‘Smarter European Union industrial policy for solar panels’, Policy Brief 02/2024, Bruegel.

Mejean, I and P Rousseaux (2024) ‘Identifying European trade dependencies’, chapter 3 in J Pisani-Ferry, B Weder Di Mauro and J Zettelmeyer (eds) Paris Report 2: Europe’s Economic Security, CEPR Press.

Mulder, N (2022) The economic weapon: The rise of sanctions as a tool of modern war, Yale University Press.

Poitiers, N and P Weil (2021) ‘A new direction for the European Union’s half-hearted semiconductor strategy’, Policy Contribution 17/2021, Bruegel.

Qiu, H, H Song Shin and L Zhang (2023) ‘Mapping the realignment of global value chains’, Bank of International Settlements Bulletin 78.

Ragonnaud, G (2024) ‘Internal Market Emergency and Resilience Act (IMERA)’, Briefing – EU Legislation in Progress, European Parliamentary Research Service, PE 739.338.

Rizzi, A and A Varvelli (2023) ‘Opening the Global Gateway: why the EU should invest more in the Southern Neighbourhood’, Policy Brief 03/2023, European Council on Foreign Relations.

Schlögl, L, D Pfaffenbichler and W Raza (2023) ‘Aligning European export credit agencies with EU policy goals’, In-Depth Analysis for the European Parliament Directorate-General for External Policies.

Sultan, S, C Rusche, H Bardt and B Busch (2023) ‘Single Market Emergency Instrument – A Tool with Pitfalls’, Intereconomics 58(3): 160-166

Tagliapietra, S, R Veugelers and J Zettelmeyer (2023) ‘Rebooting the European Union’s Net Zero Industry Act’, Policy Brief 06/2023, Bruegel.

Uren, D (2023a) ‘Why China’s coercion of Australia failed’, The Strategist, 27 April, The Australian Strategic Policy Institute.

Uren, D (2023b) ‘Despite the risks, Australian exports to China are booming again’, The Strategist, 22 August, The Australian Strategic Policy Institute.

US Department of Justice (2010) Horizontal Merger Guidelines, US Department of Justice and the Federal Trade Commission.

Vicard, V and P Wibaux (2023) ‘EU Strategic Dependencies: A Long View’, Policy Brief 2023-41, CEPII.

Welslau, L and G Zachmann (2023) ‘Is Europe failing on import diversification?’ Bruegel Blog, 20 February.