Finternet: the financial system for the future

Agustín Carstens is General Manager of the Bank for International Settlements, and Nandan Nilekani is the Co-Founder and Chairman of Infosys Limited and Founding Chairman of the Unique Identification Authority of India (UIDAI)

Abstract

This paper lays out a vision for the Finternet: multiple financial ecosystems interconnected with each other, much like the internet, designed to empower individuals and businesses by placing them at the centre of their financial lives. It advocates for a user-centric approach that lowers barriers between financial services and systems, thus promoting access for all.

The envisioned system leverages innovative technologies such as tokenisation and unified ledgers, underpinned by a robust economic and regulatory framework, to dramatically expand the range and quality of financial services.

This integration aims to foster greater participation, offer more personalised services and improve speed and reliability, all while reducing costs for end users. Most of the technology needed to achieve this vision exists and is fast improving, driven by efforts around the world.

This paper provides a blueprint for how key technical characteristics like interoperability, verifiability, programmability, immutability, finality, evolvability, modularity, scalability, security and privacy can be incorporated, and how varied governance norms can be embedded. Delivering this vision requires proactive collaboration between public authorities and private sector institutions.

The paper serves as a call for action for these entities to establish a strong foundation. This would pave the way for a user-centric, unified and universal financial ecosystem brought into the digital era that is inclusive, innovative, participatory, accessible and affordable, and leaves no one behind.

1. Introduction

In recent decades, advances in digital technology have transformed our lives. We see the consequences everywhere: in the way we shop, in how we consume news and entertainment and in our interactions with friends, family and colleagues. Tasks that were once expensive, complex and time-consuming, like making an overseas phone call or booking a hotel room in an unfamiliar city, can now be done with the flick of a finger.

Glimpses of the potential of digital innovation are also apparent in the financial system. The widespread deployment of mobile and fast payment systems has made the act of buying goods and services – perhaps the most ubiquitous financial transaction – easier, cheaper and more secure.

Meanwhile, in some jurisdictions, verifiable digital identity systems have helped hundreds of millions of people to open bank accounts, build savings, insure themselves and access loans for the first time.

But there are too few of these examples. Large swathes of the financial system are stuck in the past. Many transactions still take days to complete and rely on time-consuming clearing, messaging and settlement systems. Some even involve physical paper trails.

Even within countries, a lack of adaptive interconnectedness means that different parts of the financial system often do not talk to each other. The barriers to transactions that cross national borders are larger still.

The failure to develop a modern financial system has many costs. Some are visible: transferring assets takes too long, fails too often and costs too much. Others are hidden: beneficial activities do not take place, and access to financial services is needlessly limited by a financial system dominated by legacy systems.

The costs of an antiquated financial system are particularly stark in emerging market and developing economies (EMDEs). For many of their residents, financial services are not merely sub-standard, but not available at all. As a result, they still use cash as their only means of payment, borrow from informal sources and save their money ‘under the mattress’.

Lack of access to financial services prevents people from increasing their incomes, improving their skills, expanding their opportunities and making full use of the digital economy.

To build a financial system fit for the future, we need to agree on the vision we want to achieve. In this paper, we propose the concept of the ‘Finternet’: multiple financial ecosystems interconnected with each other, much like the internet, designed to empower individuals and businesses by placing them at the centre of their financial lives. It would lower barriers between different financial services and systems, drastically reducing the complex clearing and messaging chains and other frictions that hinder today’s financial system.

According to our vision, individuals and businesses would be able to transfer any financial asset they like, in any amount, at any time, using any device, to anyone else, anywhere in the world. Financial transactions would be cheap, secure and near-instantaneous. And they would be available to anyone, ensuring financial inclusion by meeting the needs of currently underserved segments of the population.

Compared with what is available today, the Finternet would offer broader access, better risk management, increased information availability and lower transaction costs. New, personalised financial services would emerge, fostering more ‘complete’ markets and improving welfare.

Such a vision is ambitious. Some aspects may be unattainable. But the potential gains are enormous. Hence, we should do all we can to turn it into reality.

The good news is that much of the technology to deliver a better financial system is there. We can represent financial assets – whether they be money, shares, bonds, real estate or insurance contracts – in digital form. We can send those assets around the world with the push of a button. And we can use digital tools to verify instantaneously and with certainty that the individuals and businesses involved in transactions comply with all relevant laws and regulations.

What we lack is the means to bring the various components of the financial system together. Financial ecosystems contain many moving parts. Individual participants seeking to break down silos and realise efficiencies face a daunting array of legal, regulatory and institutional hurdles.

The benefits of a more efficient financial system would be distributed broadly, not least to individuals and small businesses through lower costs, more choice and better services. But the rents from maintaining existing barriers are quite concentrated.

As a result, changes to the financial system, when they are eventually made, tend to be gradual and piecemeal. Improvements in processes, systems and infrastructure are constrained by the need to account for legacy architecture where progress has not been so rapid.

There is thus a strong rationale for public authorities to play a catalytic role, working with private sector counterparts to assemble the complete financial, technological and governance architecture needed to bring the future financial system into being (see Box A).

‘Unified ledgers’, an important building block of the Finternet, are a promising vehicle to turn our vision of an efficient future financial system into reality. These are digital platforms that bring together multiple financial asset markets – such as for wholesale tokenised central bank money, tokenised commercial bank deposits and other tokenised assets, including company shares, corporate or government bonds and real estate, to name just a few – as executable objects on common programmable platforms.

In doing so, unified ledgers would provide an economic and financial architecture to realise the full potential of tokenisation and other novel financial technologies, supported by robust legal and governance arrangements and modern technological underpinnings. Once on a ledger, assets could be transferred immediately, safely and securely, with less reliance on the external verification processes or messaging systems that make today’s financial system so costly, slow and, in some cases, unreliable.

Grounded on a digital-first approach and leveraging tokenisation, unified ledgers would improve existing financial transactions, by making them cheaper, faster and safer. They would also make entirely new financial products and transactions possible.

While the Finternet, including unified ledgers, offers benefits to all economies, there are particular benefits in EMDEs. These are the jurisdictions where access to and use of financial and payment products is currently most circumscribed. And they are the ones where the gains from using new technologies to broaden participation in economic activity and to provide new opportunities for individuals to invest, to protect themselves through insurance and to ensure the safe custody of their assets is the greatest.

Bridging the gap between vision and reality will be a challenge. The coordination problems and vested interests that hinder improvements to existing financial infrastructures will also need to be overcome to deploy entirely new ones. Institutions looking to foster the development of unified ledgers and associated financial architectures will need to decide where to start and how to make the inevitable compromises to get things moving without sacrificing bigger gains in the future.

The existence of these challenges is not cause for delay, however. Rather, it increases the urgency to take the first steps by experimenting and exploring alternative approaches.

In this paper, we lay out a blueprint to help public authorities and private institutions take the first step. In Section 2, we first lay out our vision for the Finternet and describe how recent advances in digital technology could help bring it to fruition.

In Section 3, we describe the economic rationale for unified ledgers – a promising vehicle to turn our vision of the future financial system into reality – as well as the technical, regulatory and legal building blocks needed to bring the ledgers together.

Section 4 proposes eight fundamental design considerations that we feel must be a core part of the Finternet. That said, we acknowledge upfront that there can be no one-size-fits-all solution. Each jurisdiction will need to chart its own course to build the Finternet, based on its own laws, regulations and the existing state of the financial system. Section 5 concludes.

Box A

Now is the right time for the Finternet

The financial services landscape is on the cusp of a transformative shift, influenced by several converging trends. These promise to reshape how over 8 billion individuals and 300 million businesses access and interact with financial ecosystems. These trends present both opportunities and challenges, requiring nuanced, forward-thinking policy and technological frameworks to harness their potential.

Throughout history, the convergence of underlying technologies and trends, like the industrial revolution’s combination of mechanisation, steam power and mass production, or the digital age’s blend of the internet, GPS and smartphones, has created new innovation playgrounds. This led to seismic shifts in human society and economic structures. We believe that we stand on the threshold of a similar opportunity in financial services. This is driven by:

Increasing economic aspirations and participation of individuals and businesses: the rise of the digital age has amplified the economic aspirations and capabilities of individuals and businesses. It has also heightened expectations for more accessible, personalised, affordable and efficient financial services.

The surge in formalisation of informal activities, entrepreneurial ventures and market participation reflects the wide range of financial needs and applications. This expanding landscape of economic activity necessitates a financial system robust enough to support the evolving and diverse needs of an interconnected, digitally empowered population.

Clear intent from regulatory agencies: there is a clear regulatory intent to harness the potential of financial innovations in a safe and controlled manner. This is reflected in initiatives like open finance, open banking, tokenisation of central bank money, digital asset regulation, introduction of fast payment systems and many others across multiple jurisdictions.

While most of these initiatives start with a broader vision, they often become siloed at the time of implementation. Therefore, there is a need for an architecture that supports a unified approach. This can ensure that the initial broad vision can be maintained and realised effectively.

Universal access: the proliferation of smartphones and the expansion of internet access are pivotal in democratising access to financial services, enabling digital applications and allowing user-centric experiences for a wider demographic.

While smartphones and internet connectivity will drive the adoption of digital-first solutions, applications in the Finternet would be accessible through various means, including feature phones and assisted modes, ensuring no individual is left behind.

Advances in cryptographic technology: recent progress in cryptographic methods and technologies has significantly enhanced the capabilities of financial systems, offering features like programmability, immutability, composability, interoperability and verifiability. When leveraged well, these technological advances enable more secure, efficient and seamless interactions across different financial platforms and systems.

Advances in computing and artificial intelligence (AI): AI is set to revolutionise financial services, enhancing identity verification, fraud management, underwriting and advisory services. Advances in cloud computing and other computational technologies have enabled the development of sophisticated AI tools.

These technologies, including voice-based interfaces and multilingual experiences, are breaking down traditional barriers, making financial services accessible to a wider audience, including people with disabilities or non-native language speakers, and ensuring inclusiveness in the financial ecosystem. The emergence of large language models and other forms of generative AI is a significant technological advance, with cloud infrastructure playing a crucial role in processing and analysing vast data volumes.

This evolution in AI can transform financial systems, particularly in fraud detection, where AI models can quickly identify and respond to suspicious activities, enhancing security. Generative AI can streamline many back-office tasks, lowering costs and reducing processing times in activities like document scanning, transcription, data entry, customer request screening and text summarisation.

Additionally, AI’s ability to detect novel data patterns helps financial institutions better understand customer needs and creditworthiness. It also streamlines compliance processes, such as know-your-customer checks, reducing costs and improving speed and accuracy.

2. A vision for a more technologically advanced financial system

Financial systems lie at the core of modern market economies. They are the venue where individuals and businesses save, borrow, invest and insure themselves. When operating efficiently and affordably, financial systems fulfil two primary objectives.

First, they provide a means for individuals to safeguard their financial well-being. Second, they channel financial resources into generating economic activity, which is vital for spurring new ideas and innovations. Well-functioning financial systems help to foster growth and development, in doing so benefiting all members of society. In contrast, poorly functioning financial systems harm a country’s economic performance and, more importantly, the well-being of its citizens.

It follows that improving the functioning of the financial system is an important public policy objective. Technological advances could bring the financial system closer to people and businesses at lower cost and with greater efficiency. But technology alone is not enough.

It needs to be combined with an efficient economic and financial architecture and robust governance and regulatory arrangements. To assemble all three components, a coherent vision of what the financial system should deliver is essential.

In this section, we first describe what we see as the key shortcomings of today’s financial system. We then explain how technology could help to overcome many of these shortcomings. Finally, we present a vision of the future financial system.

Throughout history, the convergence of underlying technologies and trends, like the industrial revolution’s combination of mechanisation, steam power and mass production, or the digital age’s blend of the internet, GPS and smartphones, has created new innovation playgrounds

2.1 Shortcomings of the current financial system

In many respects, today’s financial system is still serving the past, not the future. It has numerous shortcomings. Many fall within three broad categories: speed, cost and reduced availability.

Speed: the financial system is too slow

The vast increases in the speed of information flows and communications that have transformed many aspects of everyday life have not left a commensurate imprint on the financial system. Admittedly, there have been improvements in retail payments, with the introduction of fast payment systems being notable examples (Aurazo et al (2024), Bech et al (2020), Frost et al (2024)).

But these are the exception. Many financial asset transactions, such as those involving shares, bonds or real estate, still take days to settle and, for many individuals, are difficult, if not impossible, to access.

Antiquated clearing, messaging and settlement systems are a significant source of delays. Even when individuals use sophisticated front-end interfaces to make supposedly ‘digital’ transactions, behind the scenes, movements of money and other financial assets often rely on the owners of siloed proprietary databases to initiate and process transfers.

These databases often operate with different technical standards and governance arrangements, connected through third-party messaging systems that may not interact smoothly with each other1. In some cases, the exchange of physical contracts is still required. Particularly in crossborder transactions, differences in time zones and business hours can slow the process further.

Compliance with regulatory requirements, such as those related to anti-money laundering and combating the financing of terrorism (AML/CFT) rules, are another source of delay. The regulations themselves are, of course, critical to deter illicit activity and preserve the integrity and stability of the financial system. But their implementation is often manual, bespoke and inefficient.

For example, the same verification of customer identity may be repeated several times in a single transaction. The resulting inefficiencies can fall as heavily upon individuals and businesses making legitimate transactions as they do on those making illicit ones. These compliance costs have been increasing rapidly due to the greater sophistication of criminal threats to the system and rising regulatory expectations.

Costs: the financial system is too costly

Slow transactions are costly ones. Particularly in EMDEs, delays between the execution of trades and their settlement tie up working capital, forcing businesses to hold large cash reserves or rely on expensive forms of borrowing like credit cards to tide themselves over. For individuals, long waits for wages and government transfers to appear in their bank accounts may leave them with no alternative but to seek out short-term loans, often at high interest rates.

Settlement delays also create so-called ‘counterparty risk’, ie. the risk that one or more participants will not provide the money or financial assets to deliver on their side of the transaction. To mitigate these risks, participants in financial transactions are often required to post collateral, which comes with its own associated financial costs.

Manual processes can also lead to errors. Reliance on external verification and messaging systems means that participants in financial transactions often have an incomplete view of the actions of other parties and cannot track the progress of their payments in real time.

Extensive auditing, compliance and other back-office costs are required to monitor the progress of payments and other financial transactions and confirm their progress. Errors or inconsistencies in messages between financial institutions may go undetected and then take time to resolve. This too imposes costs on users of financial services.

Lack of competition is another source of costs. Some of these costs are explicit, in the form of high prices or fees for services. Such costs can be particularly large for individuals and firms making low-value transactions or crossborder payments. The cost of sending crossborder remittances, for example, averages 6.3% of the total cost of the payment (FSB (2023), World Bank (2023)). Other costs are less visible, such as poor service quality or the handicapping of innovation.

Access and availability: the range of financial services and products is too limited

The combination of slow systems, high costs and a lack of competition ultimately limits the range of financial services on offer. High costs, for example, can make certain financial services uneconomical in some locations, especially rural and low-income areas. The contraction of crossborder correspondent banking networks in recent decades is a prime example.

Absence of choice leads individuals to make sub-optimal decisions, such as maintaining large balances in cash accounts at low interest rates or, as noted above, relying on expensive forms of credit, like credit cards, for borrowing.

In many cases, a combination of challenging geography and old technology also hinders access to financial services. In some EMDEs with relatively poor transportation connections, even basic financial services, like the provision of physical notes and coins, may be lacking (Jahan et al (2019)).

The deployment of digital financial services as a complement to existing ones, accessible through mobile phones and other electronic devices, offers the prospect of overcoming many of these geographical challenges. But in many jurisdictions these are still limited to a relatively basic set of financial assets and services.

There are also immense hidden costs in terms of potentially worthwhile transactions and products that never materialise. To name just one example, trade finance procedures – which can lead to significant delays between the time when businesses produce goods and services and the time when they receive payment – could be significantly streamlined through the use of smart contracts to enable conditional, or partial payment2.

However, such contracts are difficult, if not impossible, to implement in today’s financial system. This represents a significant deadweight loss of economic opportunity. As a result, markets are unnecessarily incomplete. And incomplete markets are not conducive to higher welfare.

In the extreme, individuals may be unable to access financial services at all. Despite considerable progress in recent decades, 1.4 billion adults are still excluded from the financial system (Demirgüç-Kunt et al (2022)). And even if they have some access, the extent of financial system participation is often limited.

According to the World Bank’s Findex database, while 76% of adults had a transaction account, only 55% owned a debit or credit card and 59% made a digital payment in 2021. Access to credit and savings is even more constrained, with only 28% of adults borrowing from a formal financial institution and 29% saving money in the financial system.

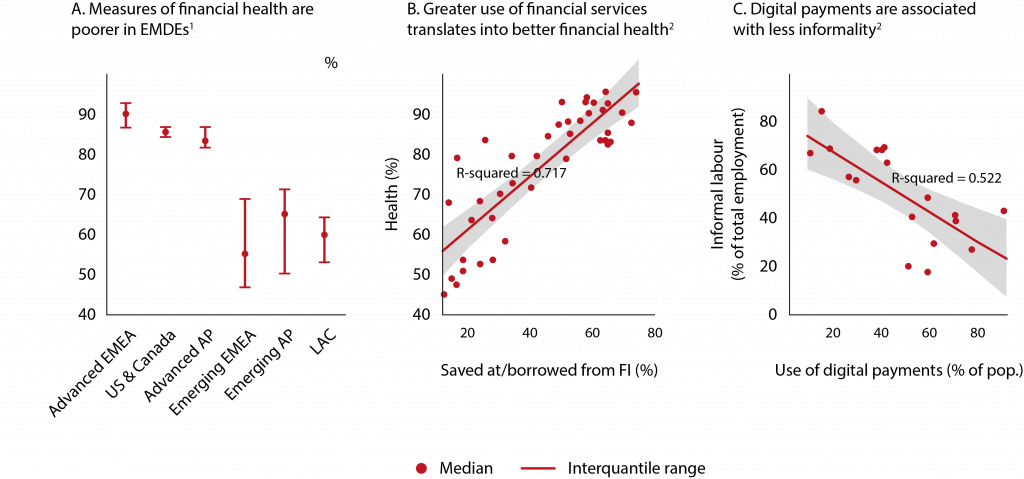

Lack of access to financial services is particularly acute in EMDEs (Graph 1.A). Only a quarter of adults in these jurisdictions use a savings account, and about half borrow – with more than half of this coming from informal sources (Demirgüç-Kunt et al (2022)). Access to credit or savings products is even lower in some regions, such as Latin America and the Caribbean (Graph 1.B), and among certain demographic groups such as those defined by age, gender or education3.

Meanwhile, small businesses in EMDEs often have insufficient credit for working capital. Lack of retail access to investment and insurance constrains households from accumulating wealth or building resilience. In most EMDEs, insurance premiums per capita (‘insurance density’) are less than $1,000 per year; premiums relative to GDP (‘insurance penetration’) are less than half the level in advanced economies (AEs) (Graph 1.C).

Graph 1. Access to financial services has improved, but gaps remain

1. The graph shows the percentage of adults who hold a financial institution or mobile money account. 2. The graph shows the percentage of adults who hold a financial institution (FI) or mobile money account, who made a digital or debit card payment and saved or borrowed via financial institution. 3. Insurance density is defined as premium per capita in 2022. Insurance penetration is defined as premium as a percentage of GDP in 2022. Includes life and non-life premiums (including health).

Sources: World Bank Global Financial Inclusion (Global Findex) Database; Swiss Re Institute; BIS.

The inability to access financial services lowers welfare. Measures of financial health – defined as the extent to which a person or family can successfully manage their financial obligations and have confidence in their financial future – are much lower in EMDEs than in AEs (Graph 2.A; Cantú et al (2024)).

Limited access to financial services hinders individuals’ ability to manage risks and save for the future (Dupas et al (2013)). It also impairs small businesses’ ability to invest in productive activities, thus stifling growth and development (Banerjee and Duflo (2014)).

Ultimately, access to credit and financial services is instrumental in empowering individuals to escape poverty by investing in human capital and other income-generating activities and enhancing overall economic inclusion.

Graph 2. The link between financial inclusion and financial health

1. Financial health is estimated as one minus the average fraction of survey respondents that are very worried about medical expenses, saving for old age, paying bills and affording education or rely on family and friends for funds in case of an emergency. 2. Each dot represents a country in 2021. The x-axis indicates the average fraction of survey respondents that save or borrow in a financial institution. The y-axis is one minus the average fraction of survey respondents that are very worried about medical expenses, saving for old age, paying bills and affording education or rely on family and friends for funds in case of an emergency.

Sources: Aguilar et al (2024); World Bank Global Financial Inclusion (Global Findex) Database; BIS.

2.2 Technology-driven opportunities

Recent technological innovations have the potential to overcome many shortcomings of today’s financial system.

Some progress has already been made. In many jurisdictions, smartphones have facilitated payments and lowered transaction costs. Digital identity systems have made it easier and cheaper to open bank accounts (D’Silva et al (2019)).

The use of alternative data, such as those generated by quick response (QR) payments and fast payments, has underpinned digital credit. This has benefited individuals and small businesses (Beck et al (2022)) and broadened access to credit by substituting for collateral (Gambacorta et al (2022), Aurazo and Franco (2024)).

Meanwhile, novel retail investment and insurance platforms have created new pathways to help individuals build wealth and diversify risks. In some countries, fast payment systems have emerged as a key innovation. The remarkably fast adoption of these systems holds lessons for other novel financial technologies (see Box B).

The benefits of such innovations are clear. In aggregate, there is a positive correlation between use of borrowing and savings products and measures of financial health (Graph 2.B). Greater use of digital payments is associated with less economic informality, ie. a smaller share of the ‘shadow economy’ (Graph 2.C).

This may reflect the use of digital payments to merchants, and digital payments for payroll, in creating a data trail that helps to formalise previously unrecorded (cash-based) activities (Aguilar et al (2024)).

Box B

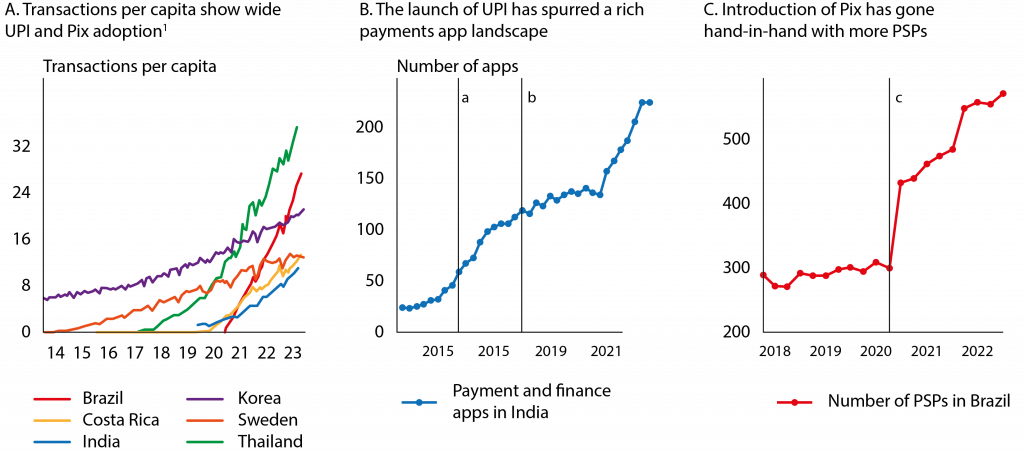

Fast payment systems: lessons for digital public infrastructure

Fast payment system (FPS) are now available to households and businesses in around 119 jurisdictions; in others, authorities plan to implement an FPS in the coming years. The success of FPS in terms of adoption and usage varies across jurisdictions, as does the role of central banks, which can be a catalyst, overseer or operator.

Recent experiences suggest that certain design features of FPS are particularly important to spur user uptake (Frost et al (2024)). Thailand’s PromptPay, India’s Unified Payments Interface (UPI) and Brazil’s Pix are three examples that stand out as they have achieved remarkable success in driving the adoption of digital payments (Graph B1.A).

They have also facilitated private sector innovation and the entry of new payment service providers (PSPs) (Graphs B1.B and B1.C). These FPS share a number of features: (i) a user-centric design, with a number of use cases; (ii) a robust infrastructure for settlement; (iii) a rulebook for participation, eg. mandatory participation of large banks; and (iv) a framework for governance that includes a strong role for the public sector, in particular the central bank.

In addition, these FPS include open application programming interfaces (APIs) and aliases (eg. mobile phone numbers) to initiate transactions, and low transaction costs.

Notably, both UPI and Pix allowed room for private sector (non-bank) participation. In fact, UPI payments (developed by the Reserve Bank of India and the National Payments Corporation of India) only took off when third-party application providers (now dominant) were allowed to connect in 2018.

The private sector played a crucial role in bringing UPI to the financially excluded, through innovations such as all-in-one quick response (QR) codes and audio-based payment confirmation, targeted at small merchants in areas with poor internet connectivity.

Pix has also encouraged private sector innovation by adopting standardised APIs specified by the Central Bank of Brazil, which enabled merchants to integrate Pix payments into their online shopping experience through QR codes. Additionally, innovators leveraged Pix QR codes to pay for tolls and gain access to private buildings.

These examples highlight the importance of having both regulatory oversight and private sector participation in achieving public policy goals.

Graph B1. Fast payment systems in India and Brazil

a. Introduction of UPI 1.0. b. Introduction of UPI 2.0. c. Introduction of Pix.

1. Monthly data.

Sources: Central Bank of Brazil; World Bank; National Payments Corporation of India; Sensor Tower; BIS.

Successful though these innovations have been, their widespread use is still restricted to a small – though growing – number of jurisdictions. Further gains from broader adoption of these technologies are still possible. Meanwhile, other technological innovations that have yet to enter the mainstream offer the prospect of further progress.

Tokenisation is a leading example. Tokenisation involves generating a digital representation of financial or real assets that reside on a programmable platform (Aldasoro et al (2023)). Traditionally, financial systems have separated databases – which record claims on financial assets (eg. a land title registry, or a bank’s record of customer deposits) – from the governance rules and applications that allow users to transact these assets (eg. an e-banking app).

Tokenisation removes the distinction between the two as all the information required for the transaction of a financial asset (eg. ownership, rules and logic governing transfers) resides in one place.

This greatly simplifies the mechanism for trading assets, while also enabling more complex pre-programmed and contingent asset transfers, which would not be feasible in a non-tokenised environment.

Adoption of tokenised financial assets could ease many of the bottlenecks that exist in the current financial system. Tokenisation fundamentally reshapes the process of financial transactions. Instead of long, complex sequences of messages passed back and forth between financial institutions, the tokens themselves trade, along with all of the ownership, value and regulatory information that would typically be recorded in databases.

While tokenisation does not eliminate the role of intermediaries, it changes the nature of that role. Intuitively, intermediaries in a tokenised environment primarily serve a governance role, as the curator of the rules governing the transfer of tokens, rather than as a bookkeeper which records individual transactions on behalf of account holders.

By reducing the dependency on the clearing and messaging systems, tokenised assets allow for atomic settlement – that is the synchronous and simultaneous settlement of multiple legs of a single financial transaction – thereby reducing counterparty risk and lessening collateral requirements. Programmability could also make viable some contingent financial transactions, which are infeasible in today’s financial system.

Tokenisation also provides greater scope for composability, whereby several transactions are bundled into a single executable package. Features such as these open the door to the development of entirely new financial products to help individuals and businesses save, invest and insure themselves.

In sum, tokenised financial assets would offer individuals and businesses faster service, lower costs and greater choice than their traditional alternatives.

The emergence of large language models and other forms of generative artificial intelligence (AI) is another technological advance that could materially influence the financial system. Application of AI models could deliver a step change in the volume and types of data that financial institutions can process.

Generative AI, in particular, could streamline many back office tasks, lowering costs and processing times. For example, scanning, transcribing or verifying documents, data entry, screening customer requests or summarising texts can all be done more effectively when supported by AI. AI models can locate previously unidentified data patterns, helping financial institutions to predict the financial needs, or borrowing ability, of their customers more accurately.

Moreover, AI models could also help financial institutions automate compliance procedures, such as know-your-customer (KYC) checks, greatly reducing their cost while increasing their speed.

But technology is not an end in itself. The benefits of tokenised assets, and other forms of financial innovation, are limited so long as the assets exist in isolation. For example, trading a tokenised asset in exchange for a non-tokenised counterpart would still require a sequence of messages to link the tokenised and non-tokenised systems.

Clearing and settlement could still be subject to lengthy delays and points of failure. And, if the legal and regulatory framework governing tokenised assets is undeveloped, such a trade may not even be possible.

To unlock the full benefits of tokenisation, it is necessary to bring multiple tokenised assets together on common platforms, with the backing of a robust governance and regulatory framework. This, however, is a more ambitious project than simply offering existing financial assets or services in a more technologically advanced form.

Hence, in order to proceed it is necessary to first identify the tangible objectives one wants to achieve. That is, one needs to pursue a vision for the future financial system. We next turn to this vision.

2.3 The Finternet: a vision for the future financial system

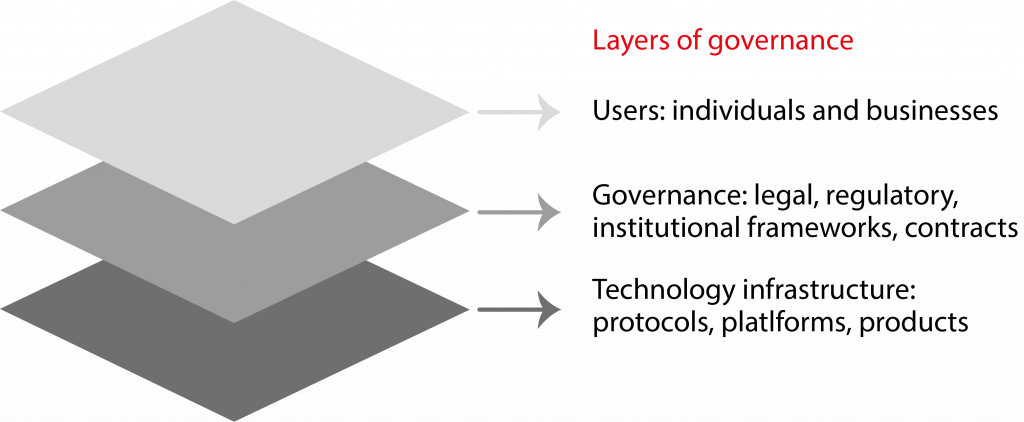

We introduce the concept of the Finternet as a vision for the future financial system. This vision entails a network of interoperable financial ecosystems, with individuals and businesses positioned at the centre of their financial interactions. The system rests on three foundational pillars.

These are: (i) an economically sound architecture; (ii) the integration of advanced technologies; and (iii) a robust regulatory and governance structure.

The design of the economic architecture should put its users at the centre. Individuals and businesses should have the greatest possible control over the financial transactions they make, and the time and way in which they make them. Financial services should be cheap, secure, reliable and easily accessible.

To fulfil this vision, the financial system will need to make full use of innovative technology to enhance user experiences. At the same time, it cannot rely on specific technological platforms, architectures or data standards. Technology will continue to advance, and so the financial system needs to remain adaptable to technological progress. And within that flexibility it should empower users to interact with financial services through a range of devices and interfaces.

The paper proposes an approach that integrates essential technological features such as interoperability, verifiability, programmability, modularity, scalability, security and data empowerment4.

The adoption of the system can occur in stages, allowing different participants to integrate and go live at their own pace. This phased approach accommodates the varying readiness and capacities of entities within the ecosystem, ensuring a smooth transition to the new financial framework.

Promoting user choice also means dismantling the barriers and silos that exist in the current financial system. Instead of sluggish clearing and messaging systems, minimum transaction values, manual processes and delayed settlement, individuals should have control over what financial assets they trade, in what amount and at what time.

An open and efficient financial system should foster robust competition, encouraging new entrants and keeping existing service providers nimble. This will promote continuous innovation within the financial industry and lower costs for consumers.

To allow users to take full advantage of this competitive playing field, it will be necessary to ensure that individuals have control over their financial data, including by supporting multiple verifiable identities to enable enhanced privacy while maintaining accountability.

Not everything should change. Many of the key underpinnings of today’s financial system, such as the two-tier structure with a clear role for the public and private sector, should remain in place. Central bank money should still serve as the trusted foundation of the financial system, with settlement in wholesale central bank money on the central bank’s balance sheet being the determinant of finality in financial transactions.

Commercial banks should retain a key role as intermediaries between savers and investors and as providers of commercial bank money. But even in these cases, the assets that these institutions offer to the public should take on more advanced technological representations, in the form of wholesale tokenised central bank money and tokenised commercial bank deposits5.

Robust governance will remain essential. To maintain trust in the security and integrity of the financial system, all participants should comply fully with all regulatory and legal obligations. This includes measures to safeguard individual privacy and business confidentiality. Here, too, the application of technology will be a critical enabler of security, speed and efficiency.

Public authorities will play an important role in the future financial system. Through the development of digital public infrastructure, they can establish the platforms, rulebooks and regulatory protections required to deliver an open and efficient financial system (see Box C for lessons from digital public infrastructure in India). And, as suppliers of central bank money, they will continue to provide the foundational asset for the entire monetary and financial system.

With this infrastructure and regulatory base in place, private institutions will have freedom to compete and innovate to deliver better, faster and cheaper services to their customers.

Box C

Lessons from digital public infrastructure in India

The implementation of digital public infrastructure (DPI) illustrates the profound impact that interoperability, a unified approach, universality, evolvability, user-centricity and modularity can have on the financial ecosystem.

As recognised by the Global Partnership for Financial Inclusion under the G20, DPIs are instrumental in enhancing the access, usage and quality of financial services, thus driving innovation and competition.

This box provides a brief review of examples from India (see also Alonso et al (2023), Ardic Alper et al (2019), D’Silva et al (2019) and Tiwari et al (2022)).

Aadhaar: it exemplifies universality and user-centricity through its biometric-based, verifiable identity mechanism issued to over 1.3 billion individuals. By facilitating a presence-less customer onboarding process, Aadhaar has reduced transaction costs from $15 to $0.07, thereby extending banking and dematerialised account access across all segments of society.

This infrastructure has significantly accelerated financial inclusion, enabled bank accounts for all, and bridged traditional gender and age disparities in financial participation within a mere nine years – a task that would have otherwise spanned several decades.

Unified Payments Interface (UPI): as a hallmark of interoperability and a unified system built by the Reserve Bank of India and the National Payments Corporation of India, UPI has revolutionised digital payments, enabling comprehensive transaction modalities across peer-to-peer, peer-to-merchant and government-to-person payments (see also Box A).

UPI’s facilitation of 117.6 billion transactions ($2.2 trillion) in 2023 underscores the scalability of the digital payment system and the pivotal role of digital payment infrastructures in democratising financial services and fostering inclusion.

Leveraging Aadhaar and digital payments, India’s direct benefit transfers (DBT) have not only optimised welfare scheme deliveries but also effected substantial fiscal savings by curtailing leakages in excess of $30 billion.

Account Aggregators (AA): the AA system champions user-centricity and modularity, granting individuals and entities sovereign control over their financial data. This enables individuals to use their data as ‘digital capital’ for accessing financial services. The facilitation of over $2.4 billion in loans since its launch signals the potential of consent-based, machine-readable data in broadening financial inclusion and reducing fraud.

It is an example of how multiple financial regulators (the Reserve Bank of India, the Securities and Exchange Board of India, Insurance Regulatory and Development Authority of India, the Pension Fund Regulatory and Development Authority, and India’s Ministry of Finance) and market players (through the Sahamati Foundation) came together to enable an interoperable and unified ecosystem across diverse sectors for the user.

Open Networks: the implementation of Open Transaction Networks (OTNs) for commerce, mobility and other sectors particularly through the Open Network for Digital Commerce (ONDC), exemplifies the lowering of transaction costs and barriers to entry, thereby cultivating an environment ripe for innovation, competition and market expansion. The ONDC, underpinned by the Beckn protocol, is pioneering a significant shift in the transaction economy, demonstrating how open, protocol-based systems can fundamentally alter market dynamics and foster inclusive growth.

In sum, these DPI components collectively underscore the benefits that can be realised through the strategic application of the foundational digital principles we highlight in this paper. For policymakers, these examples offer compelling evidence of the dramatic and far-reaching success that can be achieved in financial inclusion and the broader economic landscape through the thoughtful implementation of digital infrastructure.

3. From vision to reality

How can we transform the vision for the Finternet into reality? In this section we outline a promising vehicle to take us there: a token-based financial system, supported by unified ledgers. We first describe the concept, its economic and financial rationale and basic technological architecture.

Following this high-level overview of the concept, we lay out the nuts and bolts of how the architecture of the Finternet could look in practice. Finally, we discuss the regulatory, legal and governance questions that authorities will need to address for unified ledgers, and the Finternet more broadly, to function effectively in a real-world setting.

3.1 Unified ledgers as a vehicle for an improved financial system

Unified ledgers provide a ‘common venue’ (ie. a shared programmable platform) where digital forms of money and other financial assets co-exist. They aim to provide a quantum leap over existing financial infrastructure by seamlessly integrating transactions and opening the door to entirely new types of economic arrangements.

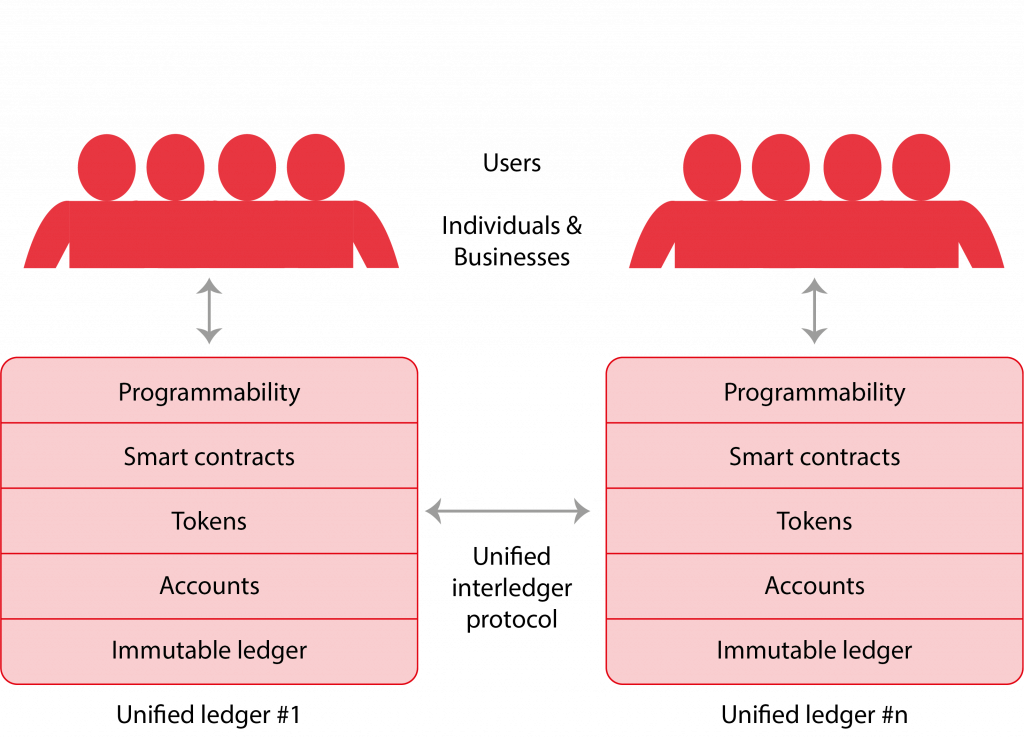

The concept of unified ledgers does not mean ‘one ledger to rule them all’ – a single ledger that encompasses all financial assets and transactions in an economy. Depending on the needs of each jurisdiction, multiple ledgers could coexist. Application programming interfaces (APIs) could connect these ledgers to each other and other parts of the financial system that exist outside the Finternet.

The functions of individual ledgers could evolve over time, and ledgers might even merge as overlaps in scope expanded. The role of unified ledgers could also vary by jurisdiction. In economies where individuals already have access to a broad range of reasonably efficient and competitive retail financial services, the main role of unified ledgers might initially be to enhance the efficiency of wholesale financial services6. In jurisdictions with lower levels of financial inclusion, in particular in many EMDEs, unified ledgers might have a stronger retail focus.

Unified ledgers have two defining characteristics. The first is that they combine all the components needed to complete financial transactions – financial assets, ownership records, rules governing their use and other relevant information – in a single venue. The second is that money and other financial assets exist on the ledgers as executable objects.

This means that they can be transferred electronically using pre-programmed ‘smart contracts’. Together, these design features allow individuals and businesses to move money and other assets safely and securely, with less need for external authentication and verification processes or reliance on external clearing, messaging or settlement systems.

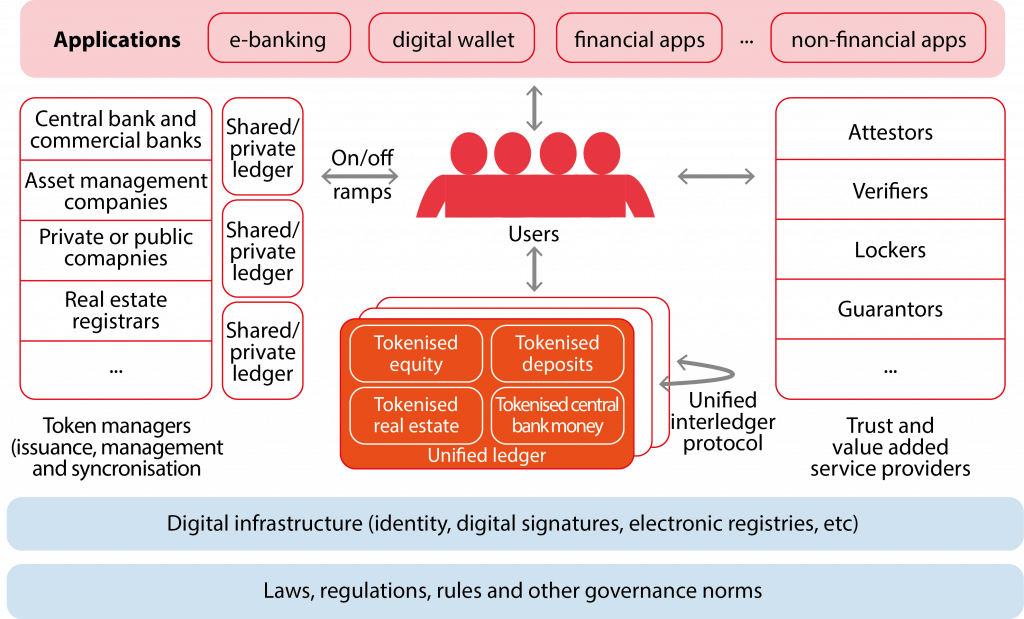

The structure of the Finternet can be described in terms of a series of building blocks (Graph 4). The unified ledgers themselves would contain digital representations of central and commercial bank money and other tokenised financial assets. Within a given ledger, different types of assets would reside in separate partitions that would be owned and operated by their respective operating entities, which we refer to as token managers.

The ledgers would also include the information necessary for their operation, such as the data required to ensure the secure and legal transfer of money and assets (eg. digital identity and laws, regulations and rules governing transactions) as well as real-world information sourced from outside the ledger.

Meanwhile, a diverse ecosystem of trust and value service providers would help verify the identity and preserve the security of users of the system and their financial assets.

Individuals and businesses would interact with the ledgers through applications. These could exist in multiple forms and allow users to conduct transactions within individual ledgers, between ledgers or in exchange for assets that exist outside the Finternet.

For example, an individual’s e-banking app might record their tokenised deposits that reside on a unified ledger alongside their non-tokenised deposits that exist in a traditional database. The apps would allow users to execute transactions directly, or through smart contracts, enabling a far greater degree of flexibility and customisability than is available in today’s financial system.

Graph 4. The high-level architecture of the Finternet

Source: Authors’ elaboration.

While unified ledgers could in principle contain any financial asset, tokenised money is a core requirement. Money provides the basic unit of account to denominate transactions. And, as the means of payment, it represents one side of almost all financial transactions.

As in today’s financial system, the monetary system in the unified ledger system would have two tiers. Central bank money would represent the first tier and commercial bank money the second.

Settlement of commercial banks’ accounts on the central bank’s balance sheet is the ultimate guarantee of finality of any financial transaction. As such, wholesale central bank money is a necessary foundation for any unified ledger. Tokenised wholesale central bank money would play a similar role to reserves in today’s financial system, but offer the enhanced functionalities afforded by tokenisation.

Some central banks might also choose to issue tokenised central bank money in retail form – a digital equivalent of today’s banknotes – to provide additional choice for users.

Commercial bank money would exist on unified ledgers in the form of tokenised deposits7. These assets would provide the natural retail complement to wholesale tokenised central bank money. As in today’s financial system, commercial bank money would serve as the primary means of payment for most individuals and businesses.

And it would be supported with the same institutional arrangements, including regulation, supervision, deposit insurance and settlement on the central bank balance sheet that exists today, thereby ensuring the singleness of money8.

Besides central and commercial bank money, unified ledgers could in principle contain an almost infinite variety of other financial and non-financial assets. All that is required is that the assets exist in tokenised form. Tokenising assets involves costs as well as benefits.

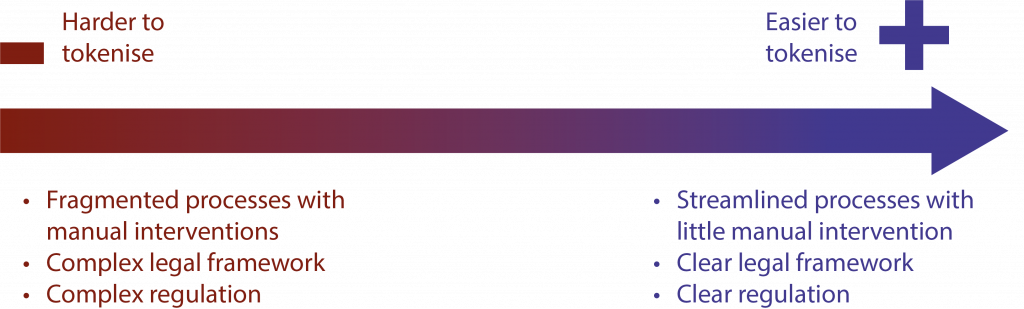

One can view candidates for tokenisation as lying on a continuum (Graph 5; Aldasoro et al (2023)). At one end are assets in systems that require frequent manual workflow procedures and have complex legal and regulatory frameworks. Residential real estate could be one example. Tokenising these assets would involve multiple challenges, although the potential gains from doing so successfully would be significant.

At the other end are financial assets in digital, mostly automated systems with streamlined processes and clear legal and regulatory frameworks. Government bonds, at least in AEs, are an example of this type of asset. While these assets would be the least costly to tokenise, they might deliver smaller benefits than some others as their transactions are already relatively fast, cheap and convenient9.

The mix of assets that exist on unified ledgers is likely to evolve over time. It could also vary across jurisdictions, depending on their specific needs as well as their institutional and legal arrangements.

Graph 5. The tokenisation continuum

Source: Aldasoro et al (2023).

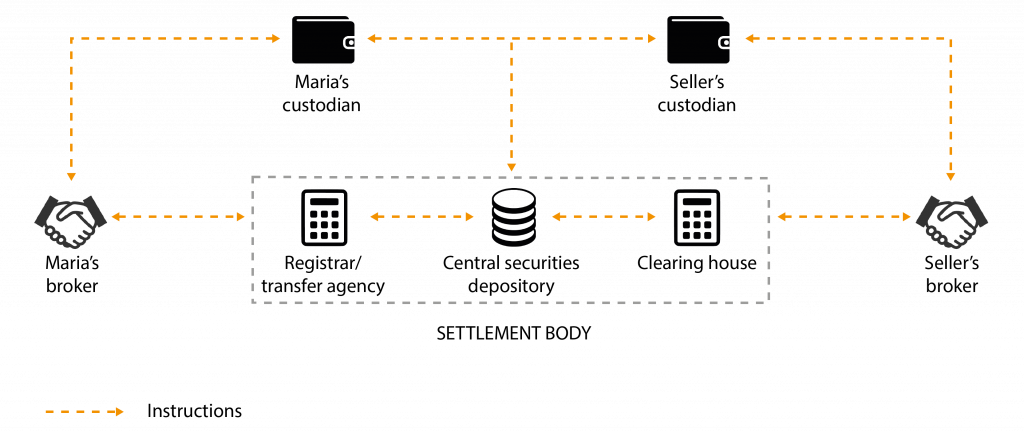

To understand the transformational possibilities of unified ledgers, consider a simple financial transaction: Maria’s decision to purchase a security (eg. a share in a company). In today’s financial system, this seemingly basic transaction would require a complex series of messages between multiple parties (Graph 6). Maria would start the process by contacting her broker. The broker, in turn, would buy the shares or direct the trade through a market maker.

At this point, several other parties may be involved to execute and settle the transaction. For example, a central securities depository will be responsible for electronically managing the securities. They, in turn, must verify the identity of the participants in the transaction and ensure reconciliation and confirmation of what is being settled with the relevant third parties (eg. clearing agents).

An equivalent process will also occur for the seller of the securities on the other side of the transaction. This ‘settlement cycle’ could take several days, with the lengthy messaging chains creating multiple points of failure.

Graph 6. Securities settlement in today’s financial system

Source: BIS (2023).

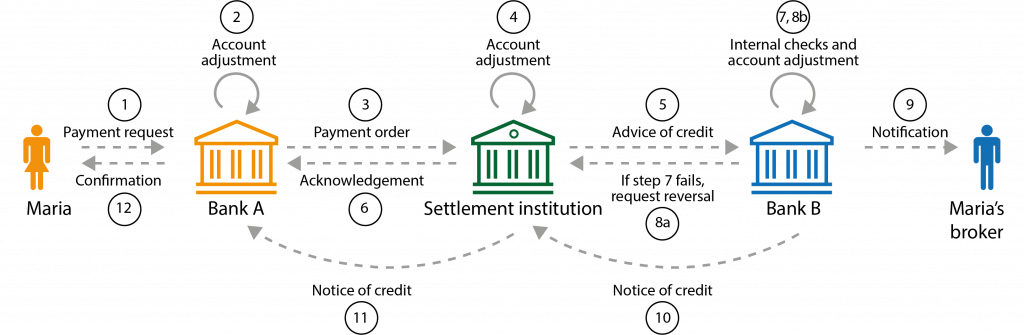

Moreover, the transfer of the security is only one part of the transaction. The other part would involve the banking system (Graph 7). As part of the share transaction, Maria would send a payment request to her bank, referred to here as Bank A (step 1). The bank would respond by debiting Maria’s account by the transfer amount together with any fees (step 2) and sending a payment order to the settlement system (step 3).

The settlement system debits Bank A’s settlement account and credits the account of Maria’s broker, Bank B (step 4). It then sends an advice of credit with a reference number to Bank B (step 5). This follows an acknowledgement with a reference number to Bank A (step 6). Bank B must ensure that Maria’s broker has an account and perform any KYC or AML/CFT checks (step 7).

If any of these checks fail, then Bank B will need to send a reversal request to the settlement institution (step 8a). Otherwise, Bank B credits Maria’s broker’s account (step 8b) and sends a message confirming the account adjustment (step 9).

In some systems, additional approvals and confirmation messages are necessary (steps 9 and 10). If Maria and her broker had been residents of different countries, multiple correspondent banks would have been involved. Each message would take time, creating a lag between the execution of the transaction and its settlement. A single failure at any point on the chain would be enough to stop the transaction from completing. In fact, any actions already taken would have to be undone, a costly process that involves manual actions.

Graph 7. Bank settlement in today’s financial system

Source: BIS (2023).

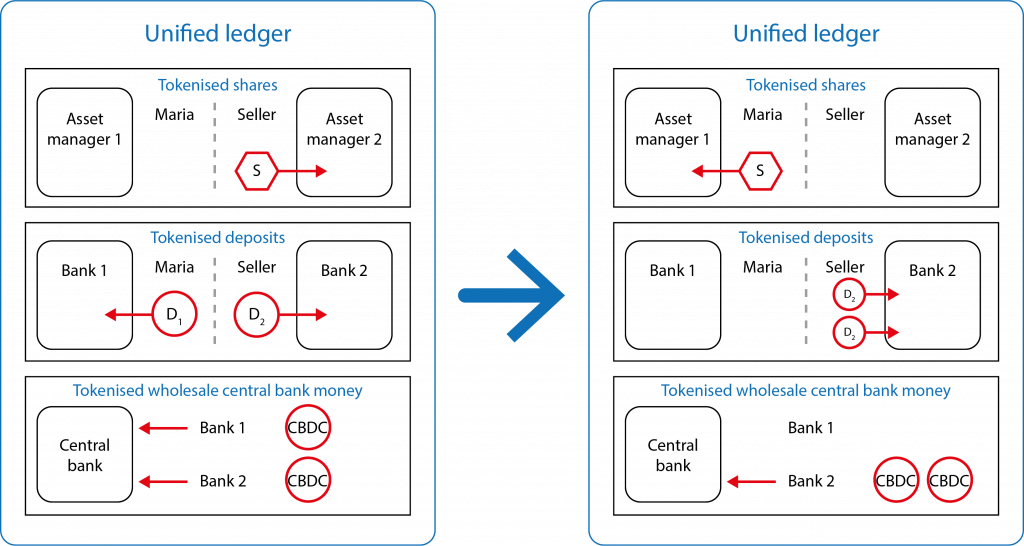

Now consider instead how the transaction could work on a unified ledger. All of the assets involved in the transaction – the securities being traded, Maria and her broker’s bank accounts and the banks’ reserves held at the central bank – could in principle exist on the same ledger.

Moreover, the assets would be tokenised and hence be programmable. All information that would ordinarily be stored in financial institutions’ databases is contained within the tokens and may be modified through smart contracts. The execution of the transaction would prompt a synchronous movement of the share tokens into Maria’s digital wallet, a change in the amount of tokenised deposits in Maria’s accounts and a transfer of wholesale central bank money from Maria’s bank to those of the individual who sold her the securities (Graph 8).

If all of the assets exist on the same ledger and are governed by a common set of governance arrangements and security protocols, the need for messaging flows would be vastly reduced and the execution, clearing and settlement of the transaction would take place synchronously.

Graph 8. Asset transfers on a unified ledger

Source: BIS (2023).

Essentially, unified ledgers have the potential to resolve many of the pain points in the current financial system.

Financial services would be faster, more secure and more transparent. With less reliance on external verification and messaging, delays between the execution of a transaction (when a user agrees to buy or sell a financial asset or enter into a financial contract) and its settlement (when the asset transfer actually takes place) could shrink dramatically.

Eliminating lengthy messaging chains would also reduce the scope for errors in financial transactions. These could in many cases now be recorded, tracked and transferred on a single platform. And, if errors do occur, they would be easier to identify and correct because unified ledgers would create a single, permanent, tamper-proof historical record of transactions that enhances trust and transparency.

Moreover, it would be possible to complete all legs of a financial transaction simultaneously and with conditionality, ie. the transaction will only take place if certain conditions have been met.

Regulatory compliance would be simpler. Asset programmability would make it possible to embed adherence to relevant rules and regulations within the tokens and transaction instructions in the system10. In other words, policy would exist as code. Meanwhile, verifiable digital identification and seamless data transfers across a ledger would greatly ease financial institutions’ compliance with KYC rules.

At the same time, unified ledgers could also enhance user privacy and user control over data. Crucially, information about users and their transactions could be digitally protected. Subject to user consent, it could shared with other users or financial service providers only on a strictly ‘need to know’ basis.

As well as improving existing processes, unified ledgers would enable entirely new financial products. Increased efficiency and enhanced verifiability would make viable financial services that today’s financial system cannot provide, either because they are too costly or because the information required to provide them is too dispersed.

Bringing multiple assets onto shared ledgers would allow them to be combined in novel ways, giving users access to financial services better tailored to their wants and needs. Services would also be more flexible, with the composability of asset tokens making it easier for financial institutions to offer low-value services.

Box D

Use cases of unified ledgers and tokenisation

Many interesting real-world applications involve the tokenisation of assets. These range from financial securities to real assets, such as commodities or real estate (BIS (2023)). This box serves to spark the imagination on how unified ledgers could be used in the real world:

Investment and government bonds: picture Aarav, an individual in India, who discovers that investments, including government bonds, are revolutionised through unified ledgers. This system democratises access to financial assets, allowing Aarav and his family to own fractions of bonds, making it possible to build wealth with limited savings. This significantly broadens the investor base and enhances market liquidity. Project Genesis of the BIS Innovation Hub explores this potential in the context of green bonds.

Access to credit: now consider Lee Min-su’s small bakery, a cherished local business in Seoul. Tokenised lending applications could dismantle the financial barriers that have long stood in its way, reducing the costs of loan origination. Loans for her are managed automatically, from payment to collateral management, with alternative data providing better insights into credit risk. This is not a distant dream, but a direction in which Project Dynamo of the BIS Innovation Hub is already headed.

Insurance: imagine the impact on Carlos, a coffee farmer in Brazil, who benefits from transformed insurance through unified ledgers offering parametric microinsurance policies. These policies provide customised protection plans to Carlos and his community, allowing them to cope better with the uncertainties of farming. Dynamic insurance policies use real-time weather data and adapt to changing risk profiles, bringing hope and security.

Crossborder payments: finally, imagine Sofia, a nurse from the Philippines working in the United States. With the advent of tokenised money, Sofia finds peace of mind knowing that her hard-earned money can be sent back home more efficiently, securely and affordably than ever before. The process is seamless, ensuring that her family receives the support they need promptly. Project Agorá of the BIS Innovation Hub is exploring how tokenised commercial bank deposits can enhance the speed, cost and reliability of crossborder money transfers.

The stories of Aarav, Lee Min-su, Carlos and Sofia could be merely the beginning of an era brought forth by unified ledgers and tokenisation. This burgeoning technological landscape promises to herald a future ripe for entrepreneurial innovation. The potential applications are boundless.

Unified ledgers could also bolster financial inclusion, particularly in EMDEs. By lowering costs, they would reduce an important barrier that currently locks many people out of the financial system11. By bringing together multiple assets in one digital location, they would enable individuals and businesses to make use of a broader array of financial services.

Financial services would be more accessible – individuals who hold tokenised bank deposits on a unified ledger would find it easier to access alternative savings vehicles. The existence of physical infrastructure, like bank branches, would cease to be such a constraint on access to financial services, because the unified ledger would exist digitally and be accessible in various ways through a range of devices.

And because individuals would be better able to control and share their data, the lack of verifiable identity documents or credit history would cease to be such a large constraint on financial access. Box D discusses potential use cases of unified ledgers and highlights ongoing work to making these use cases a reality.

3.2 The nuts and bolts of the Finternet

We now delve into some of the specific design and technological aspects of the Finternet. We first provide an in-depth description of unified ledgers, which would serve as the core of the system. We then discuss the necessary steps to safeguard the security of the system.

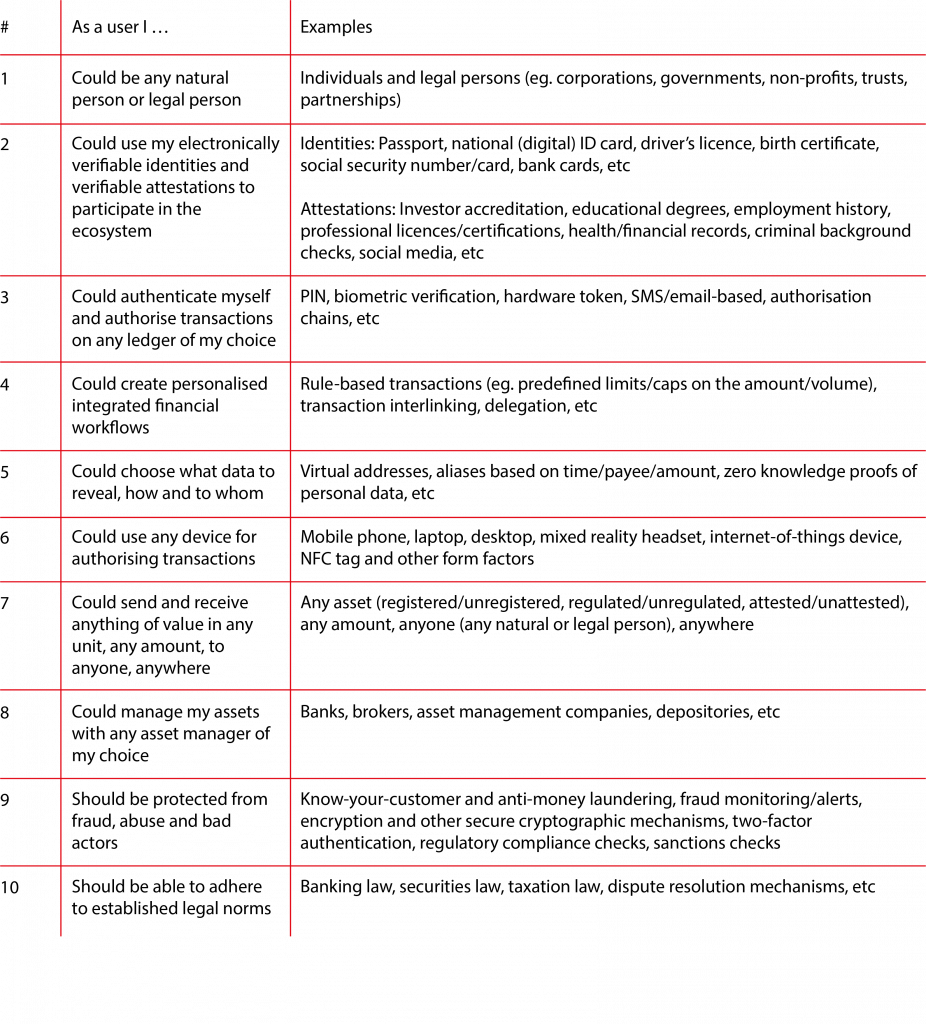

User-centric Finternet

Delivering universal access to high-quality financial services is central to our vision. Such access is only possible when we place users – be they individuals or businesses – at the core of financial interactions. The key attributes of such a user-centric system, summarised in Table 1, provide a blueprint for a digital economy that is truly by and for the user.

The Finternet represents all the key components and foundational technologies that collectively constitute the solution of unified ledgers and are brought together in a unified manner for the user. It builds upon existing legal frameworks within countries and internationally, serving as a digital extension of traditional legal frameworks.

By aligning with laws and regulations, the Finternet adapts to established principles of permissible actions and consequences of non-compliance, ensuring operations remain compliant with both national and international standards.

It leverages existing infrastructure, including identity systems, digital signature certificate systems, connectivity, registrars and registries, and digital public infrastructure, along with any other reusable services available within a jurisdiction.

Given these strong foundations, let us walk through the end-to-end flow of a user navigating this system.

Initiating the journey with user onboarding. Our journey starts with users, both individuals and businesses, who aim to manage their assets with ease and security. Upon entering the Finternet, users can create an account with any unified ledger of their choice. They may also create multiple accounts across multiple unified ledgers. Every account is linked to a globally resolvable virtual address, and these addresses are human-readable.

A user may set up multiple such addresses (transient or permanent) depending on their use cases, and if desired on multiple ledgers. Users provide their virtual addresses to others for tokens to be issued into or requested from their accounts.

In this ecosystem, users are endowed with unparalleled control over their assets. They have the flexibility to create and manage multiple accounts and sub-accounts, tailor their authentication and authorisation protocols for each account and engage in a wide range of transactions across the Finternet.

This level of control and flexibility underscores the user-centric ethos of the Finternet. This ensures that users are not just participants but active architects of their financial journey.

Table 1. Key characteristics of a user-centric Finternet

Sources: Authors’ elaboration.

The unified interledger protocol – a mechanism that ensures seamless interoperability across ledgers – is a cornerstone of the system. It allows users to open their account in any ledger and facilitate transactions between any ledger. The protocol ensures the integrity and consistency of transactions across different ledgers, providing finality through strong technical guarantees that once a transaction, such as an asset transfer, is completed, it is secure and irreversible.

For financial transactions, establishing trusted user identity is important. Trusted identity, crucial for both natural and legal persons, is anchored in verifiability, using digital signatures to accurately authenticate participants’ identities.

Features such as portability and permanence make these identities functional across various platforms. This ensures consistency while being adaptable for updates over time. Self-describing identities streamline access, eliminating external verification needs and making the system inclusive, bridging divides across technical capabilities and geographic locations.

Moreover, identity is central to the enforcement of rules and policies within the system, necessitating features like traceability, accountability and observability directly tied to identity management. The ‘only submit it once’ approach should be adopted as it specifically addresses the redundancy in submitting KYC and other identity documents, and these identity credentials can be attached to the user’s profile for reuse.

Users can have their assets tokenised by token managers. Tokens within the Finternet are digital representations of assets that facilitate the ownership, transfer and management of value in a digital format.

These versatile tokens can represent a diverse array of assets, ranging from traditional, tangible assets like real estate and artwork to intangible assets such as intellectual property and company shares, as well as inherently digital assets like digital currencies or virtual goods which exist on the unified ledger.

Managed on the unified ledger and settled atomically, these tokens ensure that transactions are executed completely, reducing the risk of partial transaction failures and reinforcing the system’s security and trustworthiness.

Each token on the Finternet is not only a digital representation of an asset but also carries core data and metadata that detail its characteristics and function, and the rules governing its use. The core data encapsulates essential information about the token, such as its type (eg. whether it is a utility, security or currency token), ownership details and transaction history.

Meanwhile, the metadata provide additional context and specifications about the token’s functionality, including verifiable credentials, attestations and any specific rules or regulations it must adhere to. This metadata can outline restrictions on transferability, eligibility criteria for holders or compliance requirements based on jurisdictional laws or sector-specific regulations.

By embedding both core data and detailed metadata, tokens within the Finternet offer a rich, multi-dimensional digital asset that can interact seamlessly within the digital ecosystem. This structure ensures that each token not only represents a piece of value but is also accompanied by a comprehensive set of information that enables secure, transparent and regulated interactions, enhancing the utility and governance of digital assets within the unified ledger ecosystem.

The process of tokenisation sits at the core of the Finternet. This is where assets are converted into digital tokens by token managers – entities that could range from central banks and commercial banks to asset management companies and private corporations.

These digital tokens represent a direct link to the user’s assets, encapsulating the principles of ownership, value and trust in a digital form. Each token is governed by a set of rules and regulations, ensuring that every transaction adheres to the stringent compliance and security standards set forth by the token managers.

For example, tokenised deposits may follow regulations around KYC, transaction limits and crossborder restrictions, while tokenised shares could be subject to specific securities laws, detailing permissible buyers and sellers. Conversely, detokenisation allows users to convert digital tokens back to their original or traditional asset forms or to other digital formats, thereby unlocking their value for both conventional and digital use.

A robust infrastructure of on-ramps and off-ramps supports the system, ensuring a seamless transition of assets between the digital and traditional economies. Tailored to accommodate the specific needs of different asset types, this setup adeptly handles the complexities of regulatory and registration requirements, effectively merging the traditional economic systems with the digital-first domain.

Token managers play a pivotal role in ensuring regulatory compliance for these tokens. Token managers might also maintain their own private or shared ledgers outside the Finternet, allowing for synchronisation between the unified ledger and their proprietary ledgers.

This flexibility facilitates easy adoption, as token managers can issue tokens to users independently of the Finternet’s internal asset management standards. It also provides mechanisms for the reproduction and recovery of tokens in case of loss. This comprehensive approach makes the digital economy more accessible, secure and user-friendly, catering to a broad spectrum of digital and traditional asset transactions.

Additionally, users have the autonomy to manage tokens they create, acting as their own token managers. However, a key characteristic of the Finternet is that users can only produce tokens for themselves and not for others. This ensures that a user cannot produce unauthorised tokens on behalf of other token managers.

Enhancing transactions with trust and value-added services. As users transact within the Finternet, a suite of trust and value-added services augment their journey. These services, provided by entities such as attestors, verifiers, lockers and guarantors, infuse additional layers of security and credibility into the tokens. They play a crucial role in building a foundation of trust within the ecosystem, making transactions safer and more reliable.

Trusted data takes a central role in transitioning to a digital-first financial landscape, where transactional information becomes transparent, immutable and directly verifiable. This evolution marks a significant departure from traditional methods, establishing a framework where data integrity is paramount. Trusted data encompass a wide array of financial interactions, from transaction histories to asset ownership records, ensuring that each piece of data is securely recorded and resistant to tampering.

This level of data reliability and security is instrumental in detecting and preventing financial crimes, enhancing the effectiveness of regulatory compliance and fostering trust among participants. It supports the development of predictive analytics and risk management tools, enabling proactive measures against fraud and other financial irregularities.

Trusted identity and data serve as cornerstones to facilitate dynamic contracting, substantially enhancing the network effects associated with asset tokenisation. Smart contracts automate the execution of agreements between parties securely and efficiently, streamlining transactions and fostering trust within the ecosystem.

Users can access a diverse ecosystem of applications to interact with unified ledgers. On the Finternet, applications will serve as versatile tools for individuals and businesses to manage an extensive array of financial aspects, encompassing banking, investments, insurance and beyond. Innovative applications will emerge, enabling the management of diverse asset types, such as real estate, paintings, digital assets and shares, offering a consolidated view of one’s financial and asset portfolios.

Individuals will benefit from these apps, which facilitate not only traditional financial transactions such as domestic and crossborder payments but also dealings in unique asset classes, enhancing the fluidity of personal and investment finance.

Moreover, these applications will enable personalised financial planning, with AI-driven insights suggesting optimal investment strategies, insurance coverage adjustments and savings plans tailored to individual goals and risk profiles. Businesses will access a suite of applications designed to streamline financial operations and enhance decision-making, manage cash flows, access varied financing options and optimise investment decisions.

They will also engage in business-to-business (B2B) transactions, supply chain finance and real-time invoicing and payment processing. Together, these can foster a more dynamic economic environment.

A diverse range of developers and entrepreneurs can develop applications on the Finternet, each focused on solving specific problems for their target customers. By leveraging the underlying trust and robust infrastructure that the Finternet offers, they can innovate and create tailored solutions that meet the unique needs of various user segments.

Across these diverse interactions, the applications in the Finternet will not only simplify financial management but also introduce levels of customisation and efficiency previously unattainable. This will enable all users to make informed decisions and achieve financial resilience and growth in an interconnected digital world. That, in turn, will ensure that everyone, from individuals to small and large businesses and society as a whole, benefit from these advances.

Unified ledgers: a secure, immutable and programmable backbone. Unified ledgers offer the capacity to manage a wide spectrum of assets, each distinguished by its legal status, market behaviour and security level.

This diversity necessitates a nuanced understanding of asset classifications, ranging from registered assets, like real estate and vehicles, which benefit from legal protections and enhanced transactional security, to unregistered assets, such as privately sold artwork, which, despite offering privacy, may face challenges in ownership verification and liquidity.

The distinction between regulated assets, like publicly traded securities, and unregulated assets, including some digital tokens, highlights the varying degrees of investor protection and market integrity.

Moreover, the differentiation between attested assets, which provide verified assurances of authenticity, and unattended assets, which lack formal validation, underscores the importance of establishing clear guidelines to manage the risks of fraud and disputes. These distinctions are vital for designing regulatory frameworks that leverage the benefits of tokenisation while mitigating its inherent risks.

Diving deeper into the core characteristics of unified ledgers across different components such as programmability, smart contracts, tokens and account management, we have outlined an architecture diagram (Graph 9).

Graph 9. Architecture diagram for unified ledgers

Source: Authors’ elaboration.

At its core, users leverage this system to perform a spectrum of financial activities, from transactions to asset management, facilitated by an array of user-friendly interfaces and applications. This system’s hallmark – programmability – enables the customisation and automation of financial operations, allowing for the creation of bespoke financial products and services that cater to distinct user needs.

A pivotal advance within this system is its foundation of immutability. This characteristic heralds a departure from traditional ledger technologies fraught with inefficiencies and vulnerabilities, towards a unified, interoperable network of ledgers resistant to errors, fraud and unauthorised alterations.

Immutability in unified ledgers ensures that once a transaction is recorded, it becomes irreversible, establishing a permanent, tamper-proof historical record. This shift from traditional databases, which cannot guarantee immutability across organisations, to technologies that do such as distributed ledgers, signifies a pivotal advance.

The characteristic of immutability within these ledgers underscores the fact that the entities providing the ledger cannot alter or insert data post-recording. This reliance on technology over people, processes and legal frameworks to ensure the immutability of records denotes a critical evolution. Traditional databases lack this cross-organisational immutability, necessitating dependence on human oversight, procedural checks and legal protections to maintain data integrity.

However, in unified ledgers, immutability is guaranteed by code, employing cryptographic methods that make altering history computationally infeasible. The linkage of each new record to the previous one requires exponential resources to change, making any attempt at tampering or historical revision nearly impossible.

In an immutable ledger, mechanisms can be implemented to either block fraudulent transactions or issue compensatory ones as a form of reversal and rollback in cases of fraud.