Low-taxed profit of MNEs

Felix Hugger and Ana Cinta González Cabral are Economists, and Pierce O’Reilly is a Senior Tax Economist, all at the Organisation for Economic Co-Operation and Development (OECD)

It is well understood that multinational enterprises (MNEs) have an incentive to report some of their profit in low-tax jurisdictions or investment hubs (see, for exmaple, Beer et al 2020 for a summary of the literature). At the same time, many jurisdictions typically considered ‘high-tax’ offer various incentives which can lead to substantially reduced tax rates.

The detailed assessment of the size and distribution of low-taxed profit of large MNEs is a topic of strong policy interest globally (Toubal et al 2020), and particularly relevant given the introduction of a Global Minimum Tax of 15% for MNEs with total annual revenues exceeding €750 million (OECD 2021).

In this column, we provide insights on the distribution of low-taxed profit across and within countries. We thus move beyond the dichotomy of low- versus high-tax jurisdictions often based on average tax rates, which neglects the extent to which MNE affiliates can be subject to low tax rates in generally high-tax jurisdictions through tax incentives.

The analysis draws on aggregated country-by-country reporting data that contain information on the distribution of effective tax rates (ETRs) that MNEs faced in different jurisdictions for the years 2017-2020. Country-by-country reporting data are increasingly used to study the global activities of large MNEs (eg. Bratta et al 2021, Fuest et al 2022, Garcia-Bernardo and Janský 2024). These data are complemented with additional data sources to estimate the full distribution of the ETR of MNEs in a comprehensive set of 222 jurisdictions.

Finally, we combine the information on ETR distributions with data on the amount of profit reported in each jurisdiction to study the taxation of global MNE profit. Details on the methodology are outlined in Hugger et al (2023).

The results of the analysis should be interpreted with consideration of the limitations of the data used. Aggregated country-by-country reporting data are a relatively new data source and suffer from some data quality and coverage issues. Some well-known issues such as double counting of dividends are addressed in our work, but the corrections are based on estimates only. In addition, we rely on imputations to fill gaps in the data and the data only covers MNEs with revenues above €750 million.

An assessment of global low-taxed profit that focuses only on jurisdictions with low average tax rates may overlook more than half of global low-taxed profit. This reflects the widespread use of tax incentives amongst many jurisdictions across the world

More than $2 trillion of low-taxed MNE profit per year

MNEs play a key role in today’s globalised economy and are often highly profitable (Langenmayr 2013, Hebous 2020). We estimate that large MNEs reported on average $5,929 billion in net profit (profits minus losses) per year between 2017 and 2020.

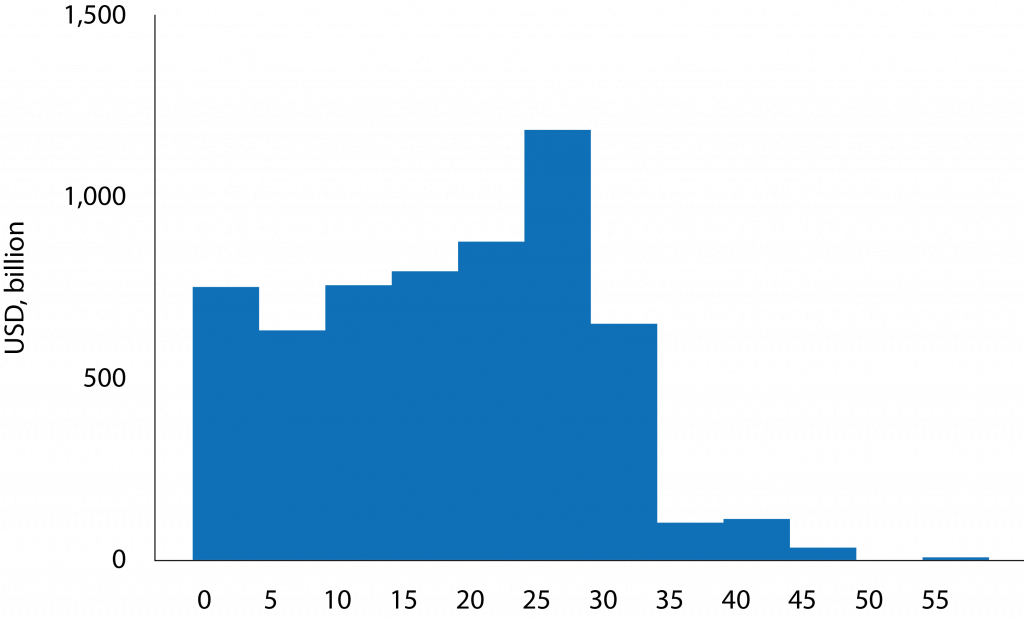

Figure 1 shows the distribution of this profit across ETR groups. The values shown are averages across the sample period. Over the full sample, the profit of large MNEs is taxed at a profit-weighted average effective tax rate of 19.1%. At the same time, a substantial share of profit is taxed at much lower rates.

More than a third ($2,143 billion) of total global profit reported in our sample period is taxed at an ETR below 15%. We define this profit as ‘low-taxed’. In our sample, 12.7% of all profit ($753 billion) is taxed at an ETR of less than 5%, which we call ‘very low-taxed’. Only 4.6% ($272 billion) of average annual net profit is taxed at an ETR that exceeds 35%.

Figure 1. Global distribution of MNE profit across ETR bins

Note: Distribution of profit of large MNEs across ETR bins, averaged over the period 2017-2020. Bins have a width of five percentage points. The average sum of global profits of large MNEs is $5,929 billion per year.

Source: Hugger et al (2023).

Some low-taxed profit in most jurisdictions

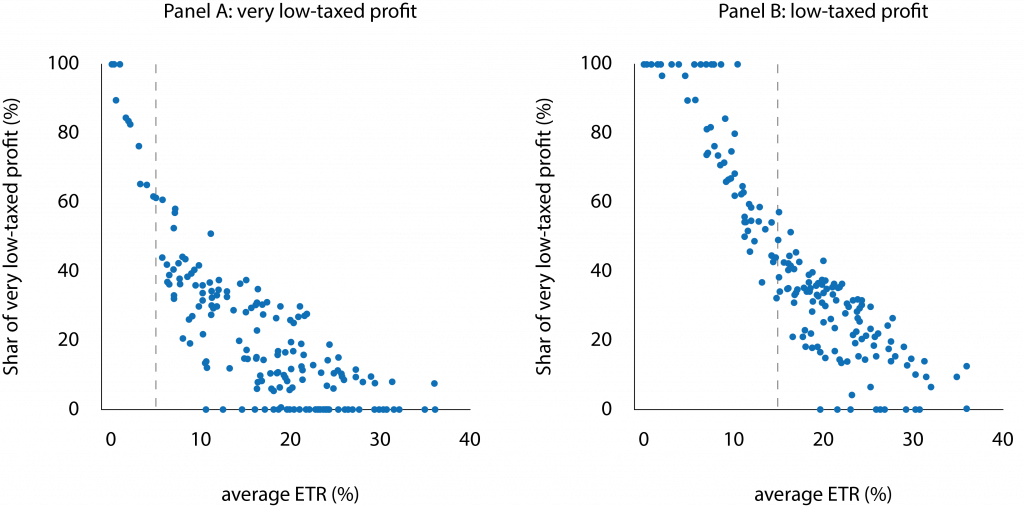

Our data highlight the importance of investigating the distribution of ETRs within jurisdictions when assessing global low-taxed profit. Panel A of Figure 2 plots the share of very low-taxed profit (taxed at an ETR below 5%) in total profit reported in a jurisdiction against the average ETR of the jurisdiction.

Panel B considers the shares of low-taxed profit (taxed at an ETR of less than 15%) in the same way. These scatter plots show that the shares of very low and low-taxed profit are decreasing with higher average ETRs, as would be expected.

There are some jurisdictions in which all profit is low-taxed; in a small number of jurisdictions all profit is very low-taxed. This includes jurisdictions that simply do not have a corporate income tax system in place. On the other end of the spectrum, there are jurisdictions that tax all profit of large MNEs at an ETR higher than 15%.

The main contribution of our work is analysing the jurisdictions in between – those in which some MNE profit is taxed at high rates, but a proportion is also low-taxed. These jurisdictions clearly represent the vast majority of our comprehensive sample. Many jurisdictions that have average ETRs well above 15% still tax substantial shares of profit at very low rates.

Figure 2. Share of very low-taxed and low-taxed profit vs. average ETRs

Note: Panel A: very low-taxed profit compared to the average ETR in a jurisdiction; Panel B: low-taxed profit compared to the average ETR in a jurisdiction. Each dot is a jurisdiction observation. Vertical lines indicate 5% in Panel A and 15% in Panel B. Values shown are averages across the years 2017-2020 for both shares of low-taxed profit and ETRs. Very low-taxed is defined as all profit taxed at ETRs below 5%; low-taxed profit is defined as all profit taxed at ETRs below 15% and includes very low-taxed profit.

Source: Hugger et al (2023).

More than half of low-taxed profit is reported in jurisdictions with high average tax rates

Going beyond average tax rates and investigating the distribution of ETRs on MNE profit within jurisdictions is important to understand the extent to which jurisdictions with high average ETRs tax some of their profit at much lower rates. This creates low-taxed profit in high tax jurisdictions which is often overlooked but sizeable.

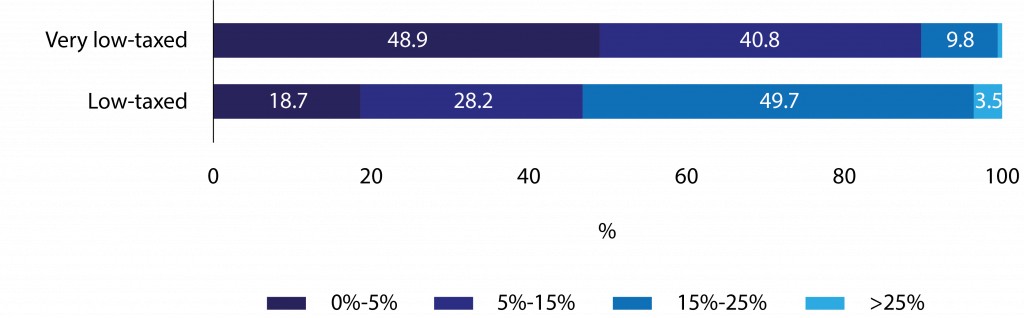

To illustrate this observation, we divide our sample into four groups based on their average ETR on MNE profit, and assess the contribution of each group to total global low-taxed profit of $2,143 billion per year (see Figure 3).

More than half (53.2%) of all low-taxed profit is reported in jurisdictions with average ETRs above 15%, which are typically not considered to be low tax jurisdictions. Only 18.7% of total global low-taxed profits are reported in jurisdictions with average ETRs below 5%.

Figure 3. Global very low-taxed profit by ETR group

Note: Distribution of very low and low-taxed profit over income groups (Panel A) and ETR groups (Panel B). Very low-taxed is defined as all profit taxed at ETRs < 5%; low-taxed profit is defined as all profit taxed at ETRs < 15% and includes very low-taxed profit. Labels for values <0.5% are supressed to improve readability. The value for jurisdictions with ETRs above 25% in Panel B is 0.4% for low-taxed profit.

Source: Hugger et al (2023).

The distribution of low-taxed profit matters for tax policy reform

Our analysis of the distribution of ETRs within jurisdictions suggests that an assessment of global low-taxed profit that focuses only on jurisdictions with low average tax rates may overlook more than half of global low-taxed profit. This reflects the widespread use of tax incentives amongst many jurisdictions across the world.

It highlights that tax competition, and the pressure to tax MNEs at low rates, extends well beyond a small set of jurisdictions commonly considered to be low-tax. In most jurisdictions worldwide, at least some of the profit of MNE affiliates in their jurisdiction is subject to a low ETR.

These issues are also relevant in the context of international tax reform discussions, including the coordinated reform of the global corporate tax system initiated by the G20/OECD Inclusive Framework on BEPS to introduce a Global Minimum Tax based on a 15% ETR.

The relevance of low-taxed profit in high tax jurisdictions implies that domestic minimum taxes could raise considerable revenue not only in jurisdictions with low average rates, but also in jurisdictions with average rates above the minimum tax. This could mean that the impacts of the reform may be more widespread than commonly considered.

The insights gained provide a good starting point for further research on the global taxation of MNEs as well as the potential impact of corporate tax reform both at the national and international level. Our further work builds on the results presented here to investigate the effects of the introduction of the global corporate minimum tax (Hugger et al. 2024a, Hugger et al 2024b).

References

Beer, S, R de Mooij and L Liu (2020), “International Corporate Tax Avoidance: A Review of the Channels, Magnitudes, and Blind Spots”, Journal of Economic Surveys 34(3): 660-688.

Bratta, B, V Santomartino and P Acciari (2021), “New patterns of profit shifting emerge from country-by-country data”, VoxEU.org, 28 June.

Dharmapala, D (2014), “What do we know about base erosion and profit shifting? A review of the empirical literature”, Fiscal Studies 35(4): 421-448.

Fuest, C, F Hugger and F Neumeier (2022), “Corporate profit shifting and the role of tax havens: Evidence from German country-by-country reporting data”, Journal of Economic Behavior & Organization 194: 454-477.

Garcia-Bernardo, J, and P Janský (2024), “Profit shifting of multinational corporations worldwide”, World Development 177: 106527.

Hebous, S (2020), “Global Firms, National Corporate Taxes: An Evolution of Incompatibility”, IMF Working Paper, No. 20/178.

Hugger, F, A González Cabral and P O’Reilly (2023), “Effective tax rates of MNEs: New evidence on global low-taxed profit”, OECD Taxation Working Papers, No. 67, Paris: OECD Publishing.

Hugger, F, A González Cabral, M Bucci, M Gesualdo and P O’Reilly (2024a), “The Global Minimum Tax and the taxation of MNE profit”, OECD Taxation Working Papers, No. 68, Paris: OECD Publishing.

Hugger, F, A González Cabral, M Bucci, M Gesualdo and P O’Reilly (2024b), “How the Global Minimum Tax changes the taxation of multinational companies”, VoxEU.org, 20 June.

Langenmayr, D (2013), “Why do multinationals pay loss profit tax? The inherent limitations of the arm’s length principle”, VoxEU.org, 8 September.

OECD (2021), Statement on a Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy, Paris: OECD.

Toubal, F, B Souillard, J Martin, M Parenti and S Laffitte (2020), “International corporate taxation after COVID-19: Minimum taxation as the new normal”, VoxEU.org, 14 April.

This article was originally published on VoxEU.org.