EU power-sector decarbonisation

Conall Heussaff is a Research Analyst and Georg Zachmann a Senior Fellow at Bruegel

Executive summary

Meeting Europe’s 2030 climate targets will require massive clean-electricity investment. To facilitate these investments, state-backed de-risking schemes such as contracts for difference (CfDs) are needed. Their role in supporting renewables has been consolidated by the European Union’s recently agreed electricity market design reform.

Under such state-backed schemes, the distribution of costs between the market and the state will depend on the balance of supply and demand. Lower demand will decrease spot-market prices, reducing market costs but increasing the cost to CfD-issuing states.

If electrification of European energy demand does not keep pace with the electricity supply expansion, tens of billions of euros annually could be channelled through state contracts, generating costs that must ultimately be recovered from consumers.

A cost-efficient, managed transition will require European coordination of electricity supply, demand and network investments. Clean electricity supply and demand should be synchronised through a combination of state interventions and market mechanisms. Undersupply of clean power will mean a failure to meet climate targets, but oversupply can be costly too.

To manage the costs of renewable de-risking schemes and to accelerate energy-system decarbonisation, flexible electricity systems should be promoted, policies to encourage electrification could be implemented and cost-recovery arising from state-backed renewable support schemes should be fair.

1 Clarity in supply, uncertainty in demand

Europe has massive plans for deployment of renewable energy. Hundreds of billions of euros must be invested annually in solar and wind electricity generation capacity to meet European Union power-sector decarbonisation targets (Zachmann et al 2024).

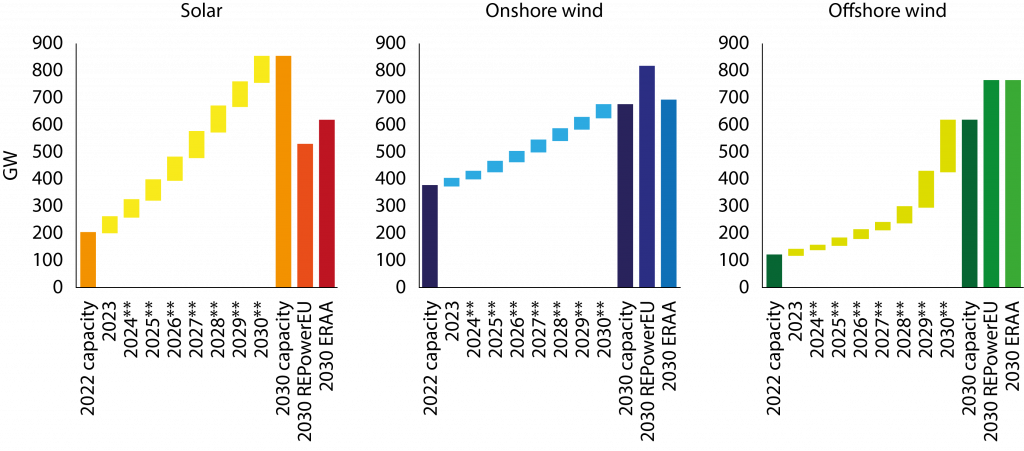

On the supply side, bold commitments are being made: the solar industry expects capacity installation to far exceed the level needed to meet the EU’s 2030 targets for renewable deployment, though the wind sector, especially offshore wind, needs to speed up (Figure 1).

This deployment will need to be financed through a mixture of private and public schemes, with public schemes likely to play a bigger role, especially because a reform of the EU’s electricity market design rules agreed in early 2024 places long-term state-backed contracts at centre stage in electricity policy1.

National investment options for European countries include mechanisms to support backup capacity, flexibility options such as batteries and, most importantly, renewable support schemes (Zachmann et al 2023). The challenge will be to coordinate these supply investments efficiently and maximise benefits for European citizens.

Figure 1. Projected annual EU renewable capacity installations vs. renewable targets

Note: ERAA is an annual assessment of the adequacy of Europe’s power system adequacy for the next decade. The installed capacities assumed by ERAA (dashed bars in the chart) are based on National Energy and Climate Plans. The legally binding Renewable Energy Directive (Directive (EU) 2023/2413) targets are slightly less than the REPowerEU targets, which are part of the EU response to the 2022 energy crisis (see here).

Source: Bruegel based on European Commission (2023), ENTSO-E’s European Resource Adequacy Assessment (ERAA; ENTSO-E, 2023), SolarPower Europe (2023) and WindEurope (2024).

Though such investment is needed urgently to decarbonise the electricity sector, it is complicated by significant uncertainty about future electricity consumption. Falling industrial activity during the 2022 energy crisis led in 2023 to the lowest European electricity demand in twenty years. Demand is projected to recover by 2026 because of industrial recovery, data-centre growth2, heat-pump installations and electric vehicle (EV) sales (IEA, 2024).

Electricity demand also varies according to external factors including economic activity and weather conditions. But more structurally, an electricity demand increase can be expected as more EVs hit the road, heat pumps are installed in homes, industrial processes are electrified and electricity is used to make synthetic fuels.

But how much demand will increase exactly is unclear. Though electrified heating and transport will in principle contribute to rising electricity demand up to 2030, the rate of electrification in these sectors in recent years has been stagnant3. Such uncertainty feeds into notable discrepancies between official projections of 2030 electricity demand (Figure 2).

Figure 2. Future European electricity demand is uncertain (TWh)

Note: all figures are final electricity consumption, correcting for self-consumption of power plants and transmission and distribution losses. ENTSO-E (2024) provides a gross demand time series for each country for various climate years. The 2030 figure cited above takes the mean of all climate years and reduces by 5 percent to account for self-consumption and grid losses.

Source: Bruegel based on IEA (2024), European Commission (2024)4 and ENTSO-E (2024).

Demand for electricity in the next decade could feasibly vary by up to 20 percent, even though Europe’s electricity supply targets are fixed. A potential clean electricity supply-demand mismatch will impact final consumer electricity costs, depending on how renewable investments are financed.

The consequences of potentially large mismatches must be examined, especially given the growing centrality of the state in the energy transition. Because of the way typical state-backed contracts for electricity are designed, a supply surplus will lead to more money moving from electricity consumers to electricity producers via the state.

To ensure that electricity system costs are paid for fairly and continue to provide investment and operational signals, national governments must design state-backed electricity supply contracts carefully both in terms of payment to producers and the recovery from consumers.

Long-term state-backed contracts are needed to protect consumers and stimulate investment, yet it should be recognised that they will lead to a structural change in the role of the state in European electricity markets.

Much of the electricity-sector investment risk associated with potential supply-demand imbalances will shift to public entities and may become liabilities for state budgets. Therefore, a fundamental energy policy challenge will be cost recovery and distribution of the revenues from long-term state-backed contracts for electricity supply.

To manage this challenge, policy needs to find a balance between efficient electricity system operation, investment incentives and social fairness. We discuss this balance in this Policy Brief.

Section 2 discusses the role of long-term contracts in the electricity sector. Section 3 illustrates the potential magnitude of financial flows in electricity markets. Section 4 addresses the key policy question: how should the costs of state-backed contracts be paid? Section 5 sets out the options to synchronise electricity supply and demand throughout the energy transition. Section 6 concludes with some recommendations.

2 Allocating renewable investment risk

Most new renewable projects in the EU receive some form of state backing. Over 70 percent of new wind and solar capacity installed in 2023 and 2024 involved some form of public support contract (selected countries; Figure 3).

State support for renewables is not new – feed-in-tariffs, for example (an administratively determined fixed price for certain electricity generators), were important in the initial expansion of renewables, especially solar in Germany in the early 2000s.

However, Europe is now moving to a system that will be dominated by renewables, meaning that state-backed schemes are becoming a major channel for financial flows in the electricity system. Given these trends – massive renewable capacity expansion and state contracts as the primary financing option – European countries are likely to be the counterparty to long-term contracts for electricity supply worth hundreds of billions of euros in the coming years.

Figure 3. Most clean-electricity investment is state-backed (installed capacity, 2023-2024)

Source: Bruegel based on IEA (2023).

Among the national investment options available to European countries, contracts for difference (CfDs) have been designated as the best-practice state instrument for providing direct price support to electricity generation technologies including wind and solar5. CfDs will therefore play a central role in supporting and de-risking renewables6.

Other instruments are available to remunerate renewable projects, including long-term bilateral contracts between large-scale electricity consumers and specific generation plants (power purchase agreements, PPAs), or merchant investments, referring to generation projects that do not sign long-term contracts at all but instead rely on spot market prices to cover their initial investment costs. The European PPA market (including the United Kingdom) signed contracts for 16.2 gigawatts of capacity in 2023, a growth of 37 percent from 2018 (Pexapark, 2024).

Nevertheless, challenges remain in matching buyers and sellers for PPAs as there are only a certain number of consumers with large enough energy demand and strong enough credit lines to enter into multi-decadal contracts for electricity supply. Merchant renewable plants are also rare as project financiers perceive the reliance on uncertain, volatile spot market prices as risky.

Consequently, CfDs and other similar schemes are the primary financing option for most new renewable projects.

CfDs are long-term (typically 15 years or more), competitively auctioned financial contracts between generation assets and publicly-backed entities. The auctions usually take place in a staggered process over a period of several years, with each auction seeking to procure a certain level of generation capacity.

Prospective projects bid in the form of strike prices, which are prices for supplied electricity set at a level sufficient to cover the lifetime costs of a project and provide a return on investment7.

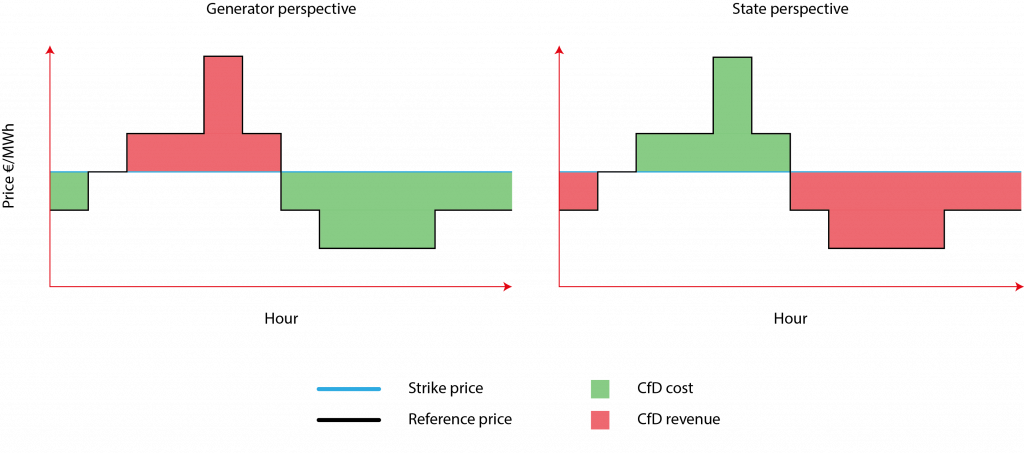

The strike price guarantees a fixed return for electricity over the period of the contract by varying the payout to the generator in relation to a reference price, typically the spot market electricity price (known as the day-ahead price in Europe) (Figure 4).

When the reference price is below the strike price, CfD holders receive a premium on their produced electricity that is equal to the difference between the reference price and the strike price. Conversely, when the reference price exceeds the strike price, CfD holders must pay back the difference between the prices.

Thus, the CfD holder receives the strike price for their produced electricity in every hour. Though CfD design is governed by some EU principles, exact implementation is at the discretion of EU countries, meaning that many different CfD designs might be tried across Europe8.

Figure 4. CfD design from the generator and state perspectives

Source: Bruegel.

CfDs were pioneered in the United Kingdom and used initially to provide a premium to wind projects that were uncompetitive relative to incumbent fossil-fuel generation. Now, with solar and wind project costs having fallen in the last decade (Lazard, 2024), CfDs have taken on a new role: simultaneously creating suitable conditions for renewable investment while protecting consumers against high power prices.

The effective fixed price of the contract reduces the market risk for the generation project. Wind and solar lifetime costs are dominated by capital expenditure (the operational costs are almost zero), meaning that the cost of capital determines to a great extent the project cost. By minimising market risk through a CfD, projects can reduce their costs of capital significantly (Beiter et al 2023).

From the state perspective, when the market price exceeds the strike price (for example, during a price shock driven by fossil-fuel costs, as during the energy crisis), CfD holders pay back the extra revenues earned above the strike price (Figure 4). This provides a hedge against high prices for the state, and, by proxy, the consumer.

EU electricity market design rules require states to distribute the revenues of CfDs to consumers in a fair way. However, it is less clear how the costs of CfDs, if they materialise, should be recovered from consumers.

The dual benefits of CfDs in both protecting consumers and reducing investment risk are delivered through a reallocation of the market risk associated with renewable investments. Consumers are protected from the risk of high prices and renewable projects are protected against the risk of low prices – but this risk of low returns from low prices does not disappear.

The downside risk of the contract is assumed by the CfD counterparty and ultimately rests with whoever the cost of the contracts are recovered from – consumers, present taxpayers or future generations. The state is well-suited to bear this risk, but it is important to consider how it will allocate that risk to consumers9.

From the state perspective, several potential liabilities could arise from CfD contracts, related to electricity demand, renewable electricity supply and the CfD strike price. Lower electricity demand will cause lower spot market electricity prices, all else being equal. As demand falls, more expensive fossil fuel units will be used less and wind and solar, with their very low marginal costs, will set the price in more hours10.

Lower spot market prices will lead to higher CfD costs, as states pay out the difference between the reference price and the CfD strike price (although costs from the wholesale market will decrease). More renewable output will similarly drive down the price of electricity, as cheap marginal-cost wind and solar push out fossil fuels from the merit order.

Finally, higher CfD strike prices, because of, for example, inflationary or supply-chain pressures in the wind industry, would also lead to more costs for governments, as the difference between the reference price and the strike price becomes larger.

Such electricity market dynamics are already emerging in the real world. For example, the early months of 2024 saw extremely low spot market prices in Spain and Greece because of high renewable output11.

To ensure that electricity system costs are paid for fairly and continue to provide investment and operational signals, national governments must design state-backed electricity supply contracts carefully both in terms of payment to producers and the recovery from consumers

3 Stylised scenario analysis

We assess how the risk factors set out above might impact the extent to which electricity costs are channelled through CfDs, and how the state could recover such costs, using the DISC model (Box 1).

Box 1. DISC

The Dispatch and Contracts (DISC) model is applied to illustrate potential cashflows between electricity market players in different scenarios.

DISC is a highly stylised representation of the electricity system and the associated financial exchanges, developed by Zachmann et al (2023). Based on electricity demand, generation availability and generation cost data, DISC outputs the optimal hourly production of different generation types and the hourly spot market price. Storage behaviour is modelled heuristically in a similar approach to Zerrahn et al (2018). Interconnection and crossborder electricity flows between countries is not represented. The hourly spot market price and generation outputs are combined with assumptions about contract design, volume and price for different generation types to model electricity market cashflows. A core assumption of the DISC framework is that the operation of the electricity system and contractual arrangements are independent12. Annex 1 provides details about DISC’s structure and assumptions.

For the purposes of this policy brief, we modelled for 2030 five EU country (Germany, France, Italy, Spain and Poland) electricity systems, constituting 61 percent of projected European electricity demand. We also modelled an idealised interconnected European system called EU5, with no transmission constraints (or infinite interconnection capacity) and combining demand and generation capacities for all five countries.

The model’s baseline scenario uses assumptions from ENTSO-E’s 2023 European Resource Adequacy Assessment (ERAA)13 to project the operation of a stylised electricity system and corresponding electricity wholesale prices in 2030.

On the contract side, it is assumed that the price of CfDs follows recent auction results (see annex 2) and that the current share of state-backed and market-based financing schemes in IEA (2023) is mapped onto all renewable capacity for the five countries in question. The design of CfDs includes an hourly payout based on the strike price, reference price and renewable output.

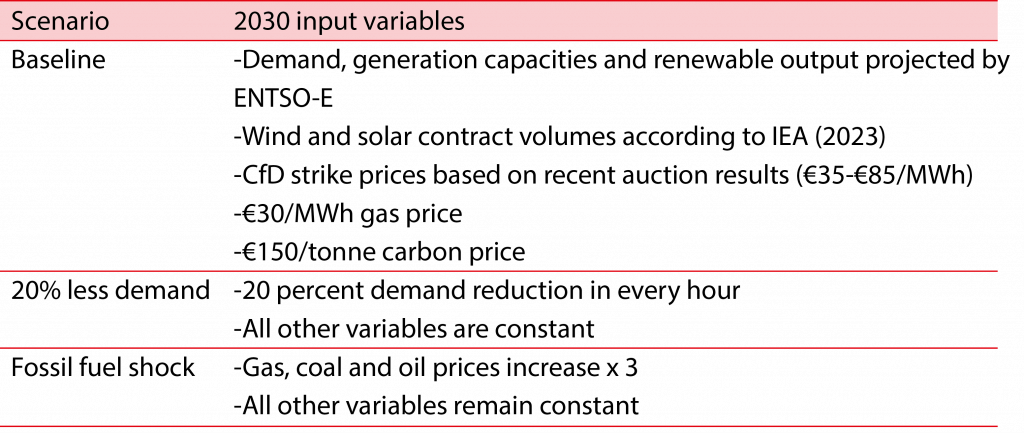

Two other scenarios were explored, ‘20% less demand’ and ‘Fossil fuel shock’, each varying from the baseline values (Table 1).

Table 1. DISC modelling scenarios

Source: Bruegel.

The stylised scenario analysis is not intended to provide a complete picture of future electricity market functioning, or even to make predictions about future cashflows. The purpose is to explore the dynamics between the physical electricity system and the associated cashflows, and most importantly, the costs for consumers.

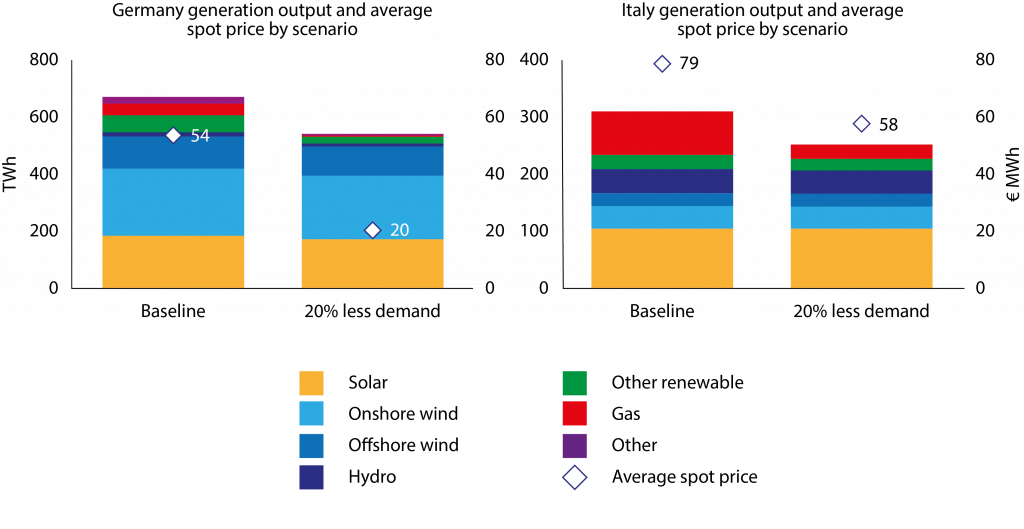

Figure 5 shows the effects of falling demand on the costs of CfDs for European countries. The 20 percent reduction was chosen as a feasible downside scenario of future electricity demand based on the variation between projections shown in Figure 2. The change in CfD costs between the baseline scenario and the ‘20% less demand’ scenario is striking.

Figure 5. Annual CfD liability increases with falling demand

Source: Bruegel.

With the drop in demand, every country either sees an increase in CfD costs or a decrease in CfD revenues, as would be expected. The different results for each country are a function of their CfD strike-price levels, their overall volume of CfDs and their spot-price sensitivity to changes in demand.

For Germany, nearly all renewable output is covered by CfDs, CfD prices are quite high and the price drops significantly between scenarios (from an annual average of €54/MWh in the baseline scenario to €20/MWh in the ‘20% less demand’ scenario).

Consequently, Germany’s annual CfD costs triple from €6.7 billion to a total level of €23.5 billion. It should be noted that while a much larger share of the total cost is channelled through the state, total costs still fall in the ‘20% less demand’ scenario.

For Italy, the effect is somewhat different. Even in the ‘20% less demand’ scenario, revenues are still earned from CfDs as the spot price is on average still higher than the strike price across the year. This is because of the dominant role of gas-fired generation in Italy’s power mix, even in 203014.

The average wholesale price only falls from €78/MWh in the baseline scenario to €58/MWh in the ‘20% less demand’ scenario, as gas continues to set the marginal price in many hours of the year.

The contrast between Germany and Italy highlights the major role of the underlying generation mix on electricity prices and the associated financial flows in electricity markets (Figure 6).

Despite the urgent importance of ramping up renewable deployment, there is a risk that certain countries could build out too many renewables that don’t add value to the system, leaving consumers or taxpayers to foot the sizeable bill for these inefficient investments if state-backed contracts continue to be the primary financing option. Weak demand growth could further increase these costs.

Figure 6. The change in spot market price with falling demand depends on the generation mix

Note: The greater role played by gas-fired generation in the Italian power mix in the modelling results leads to the higher overall prices in both scenarios. Germany has a large volume of renewable output which sets the price in many hours when demand is 20 percent less, while Italy still relies on gas to meet demand.

Source: Bruegel.

Overall, from the five country results in Figure 5, the model results illustrate that 20 percent lower electricity demand than expected in 2030 could lead to annual increases in CfD costs for European countries of tens of billions of euros.

As the DISC modelling framework does not account for cross-border flows between countries, an ‘EU5’ system, combining the demand, generation capacities and renewable output of the five selected countries, was also modelled. This represents an idealised scenario in which there are no interconnection capacity constraints between European countries.

The results show similar dynamics to the individual country modelling. Annual CfD costs for the EU5 increase from €4.4 billion in the baseline scenario to €26.2 billion in the ‘20% less demand’ scenario, showing that there is a substantial increase in CfD costs with less demand.

However, there is a saving of €3.6 billion compared to the sum of CfD costs for the five independent systems (12 percent of the total CfD costs of the five independent countries), highlighting the benefit of electricity-system integration through crossborder interconnection.

Even with a fully interconnected system, the share of CfD costs in the total costs of the EU5 system increases from 4 percent in the baseline scenario to 31 percent in the ‘20% less demand’ scenario, emphasising the potential for increased financial flows via the state.

In real-world electricity markets, capacity constraints between neighbouring countries have complex effects on wholesale prices. Generation capacity might affect crossborder prices in some hours and not in others, depending on the cost of supply and level of demand in each country and the available crossborder interconnection capacity.

There is an inverse relationship between CfD costs and wholesale (or spot market) costs. As CfD costs increase due to lower wholesale prices and resultant increasing CfD costs, the cost of electricity bought by consumers from the wholesale market itself decreases. The opposite is also true.

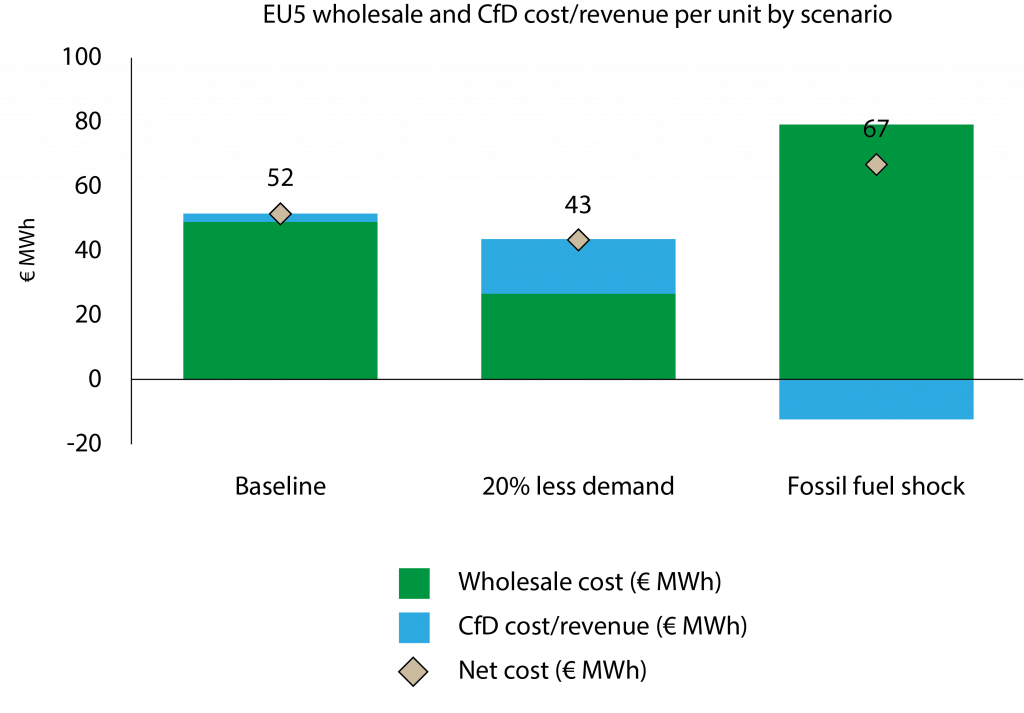

When wholesale market costs increase due to increased spot prices, the costs of CfDs decrease and can even become revenues if the average spot price rises above the CfD strike price. Figure 7 illustrates this relationship for the EU5 system, showing the price per cost category for all three scenarios.

Figure 7. Wholesale costs are inversely proportional to CfD costs

Source: Bruegel.

In the baseline scenario, CfD strike prices are close to wholesale prices, meaning that there is very little cost to European countries for CfDs. However, as prices fall in the ‘20% less demand’ scenario, wholesale costs decrease, but CfD costs increase. For the ‘fossil-fuel shock’ scenario, wholesale prices increase massively primarily because of the increase in the gas price (echoing the effects seen in the 2022 energy crisis), while CfDs become a source of revenue. The stabilising effect of CfDs is clear.

CfDs hedge against price shocks while allocating the risk arising from low prices to whoever is the final counterparty. As role of CfDs in electricity markets grows, more money will flow between consumers and generators via the state.

The reformed EU electricity market design is clear that the revenues from CfDs should be distributed evenly to consumers, ensuring a fair outcome whenever the electricity market faces a price shock. What is unclear is how the costs of CfDs should be recovered.

4 How should CfD costs be recovered?

As we have shown, low electricity demand could contribute to low electricity spot prices, with a large share of the total cost of electricity shifting to CfDs. As CfDs are mediated through the state, the recovery of these costs then becomes a major energy policy question.

When electricity is exchanged directly on spot markets, the allocation of costs and revenues is simply determined by the market participants marking the bids and offers. With costs and revenues channelled through the state, the allocation is less clearcut.

The agreed text of the 2024 EU electricity market reform (see footnote 1) states that the revenues from CfDs should be distributed in a way that “avoids distortions to competition and trade in the internal markets.” It does not say how the costs of CfDs should be recovered.

The current approach to CfD cost recovery in EU countries is typically to place a levy on retail electricity consumption (ie. households and small businesses) and to exempt energy-intensive industry, although the exact approach to industrial consumers varies by country15.

Such an approach, which allocates the risk of the renewable part of the electricity system to a subset of consumers, has been sustainable to date as CfD costs have typically been a small share of the total final bill paid by retail consumers (shown in the baseline scenario in Figure 7).

But as more and more renewables are financed through state-backed schemes, and if wholesale electricity prices fall because of increasing renewables, CfD and similar costs will take up a larger share of the total system costs. The current approach will lead to unfair outcomes as this likely shift in cost components unfolds.

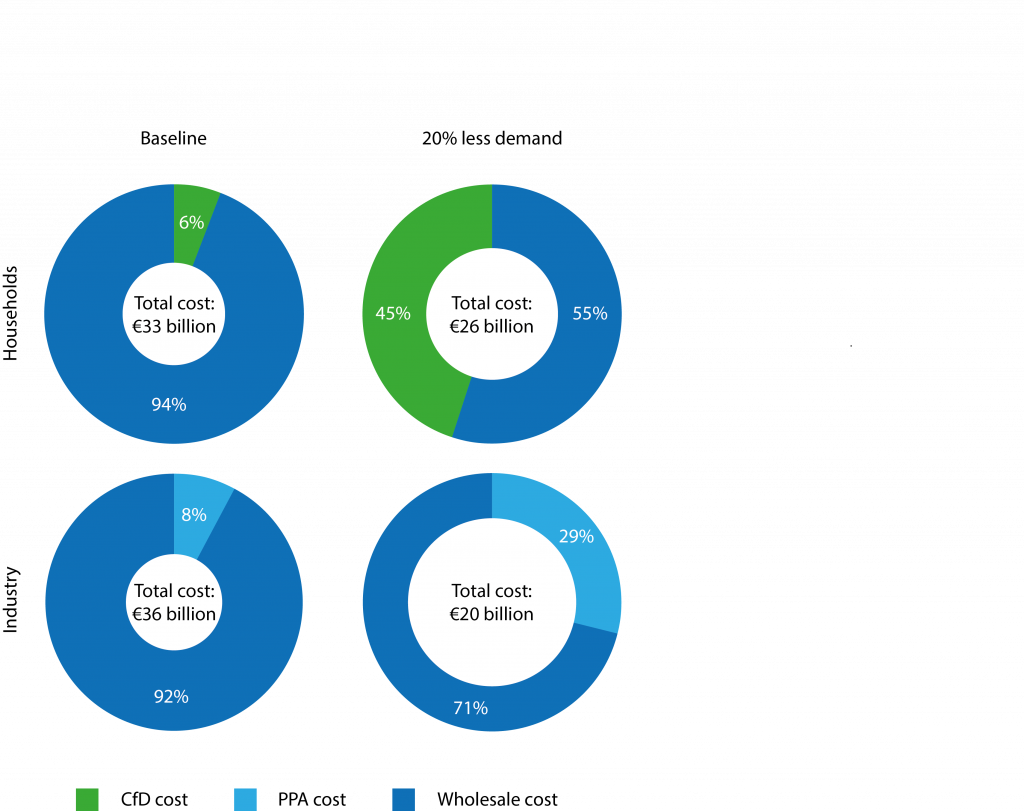

A more granular look at the modelling results from DISC highlights this trend. Taking the results from modelling EU5 (the stylised integrated European electricity system), Figure 8 compares the share of wholesale costs, PPA costs and CfD costs for households and industry in 2030, between the baseline and ‘20% less demand’ scenarios.

For illustrative purposes, these results assume that industrial consumers pay a fixed price for a fixed volume electricity of PPAs, accounting for almost 6 percent of renewable production at prices similar to recent PPA contracts.

Importantly, the results in Figure 8 assume that all industrial consumers are exempt from paying for CfD costs. This is an upper bound of the real-world approach to CfD cost recovery, in which most energy-intensive consumers do not pay for CfDs, while levies on other industrial consumers vary.

Figure 8. Illustrative 2030 EU5 household electricity cost components: current approach

Note: Area of each doughnut is proportionate to total annual cost.

Source: Bruegel.

CfD costs as a share of total costs increase disproportionately for households when demand falls, becoming a large share of the total cost paid by households. As no industrial consumers pay for CfDs in this stylised scenario, their costs decrease with falling demand, and the fixed costs associated with their PPA contracts take an increasing share of costs, while the share of wholesale costs falls.

Because CfDs become a larger part of the total system costs and industrial consumers do not pay, households actually pay more overall than industrial consumers in the ‘20% less demand’ scenario.

If a fairer approach to cost recovery is taken, with a so-called ‘CfD levy’ placed on the electricity used by all consumers, thereby allocating the costs of renewables evenly, the picture changes significantly. The share of costs becomes balanced and proportionate to electricity consumption (Figure 9).

In both demand scenarios, the shares of CfD costs and wholesale costs take up roughly the same share of total costs for both household and industrial consumers.

Figure 9. Illustrative 2030 EU5 household electricity cost components: even approach

Source: Bruegel.

Beyond fairness considerations, recovery methodologies that put the costs of CfDs onto a subset consumers may result in weak incentives for consumers to invest in clean-energy technologies, such as heat pumps and EVs. If demand goes down, prices should decrease accordingly, increasing the incentive to invest in electrification, eventually increasing demand and balancing the market.

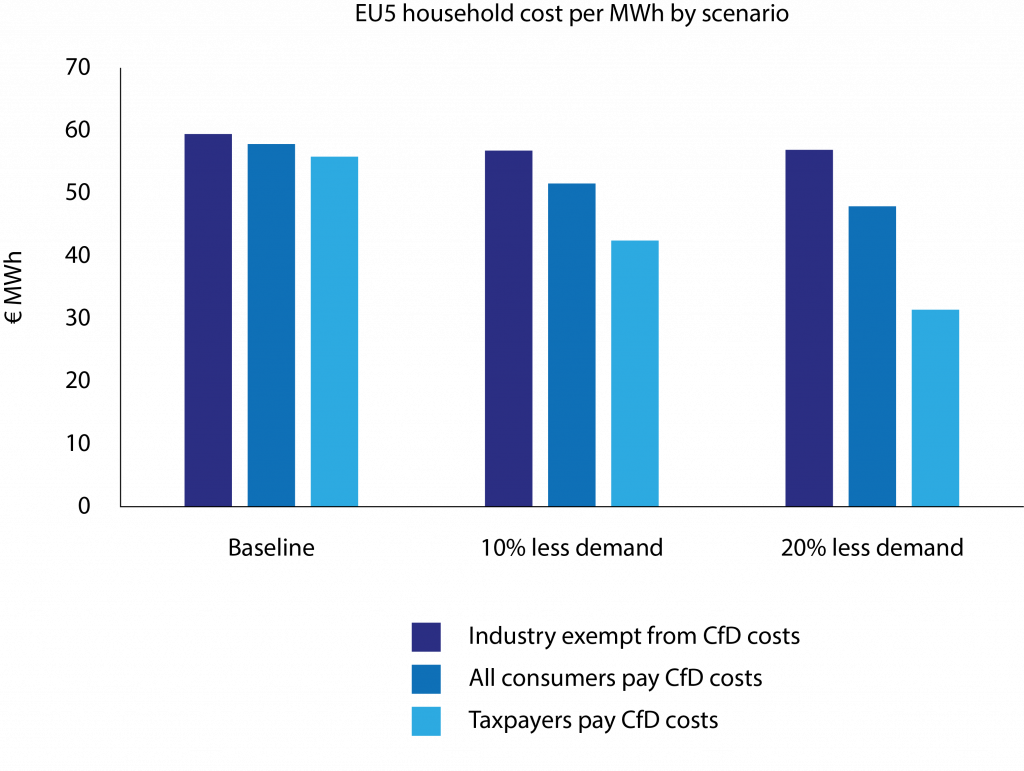

Under the current dominant cost-recovery approach, households could see their unit cost of electricity remain quite stable even as demand falls significantly.

The ‘even approach’ – recovering CfD costs from all consumers on the same basis – restores these signals compared to the current approach, although they remain muted. A further option would be to have taxpayers cover CfD costs and remove them from electricity bills entirely (Figure 10).

Figure 10. How CfD costs are recovered could significantly affect final consumer prices

Source: Bruegel.

Ensuring that households feel that the energy transition is fair is critical to maintain support for climate policies. Burdening a subset of consumers with all CfD costs would be an unfair distributive policy.

In an extreme case in which electricity demand does not keep up with supply and households still face significant electricity costs arising from the CfD cost-recovery design, public opposition could build against climate and energy policies.

The 2022 energy crisis showed that even technical energy-policy areas such as wholesale electricity markets can come under scrutiny if citizens feel that policy choices are unfairly imposing costs.

Furthermore, if CfD costs become a substantial portion of the total costs of electricity generation, different approaches to CfD cost recovery in different countries could lead to competitiveness issues in Europe, as some countries might continue to exempt energy-intensive industries while others take a more even approach (McWilliams et al 2024). Germany has already moved to financing renewable energy expansion through the federal budget16.

Other European countries could consider following suit to recover CfD costs in a way that delivers appropriate price signals to all consumers.

The European Commission as the EU’s competition authority will have a significant role to play in monitoring the national implementation of CfD schemes. European countries may seek to provide preferential electricity prices or lump-sum transfers to certain consumers, while burdening others with a disproportionately large share of the costs.

To ensure that electricity policy does not incentivise inefficient dispatch and investment decisions, and that is it not used for stealth industrial policy and/or social policy, the Commission should scrutinise the proposed CfD scheme designs for both the distribution of revenues and the recovery of costs.

What matters, in terms of incentives to invest in electrification, is whether this increase in final bills changes the cost differential between the clean-energy technology and its fossil-fuel alternative. For heating, the difference in cost between a gas boiler and a heat pump depends on the cost of gas, the upfront investment in the gas boiler and the heat pump, efficiency parameters and the electricity price.

Similarly for transport, the cost difference between an internal combustion engine vehicle and an EV depends on the upfront cost for each vehicle, fuel costs and electricity costs.

In the context of state-backed contracts for clean energy and recovery of their costs, policymakers must avoid a vicious cycle in which overinvestment in surplus electricity leads to higher costs for consumers, diminishes the incentive for electrification just when it is most needed and exacerbates the initial problem of supply-demand imbalance.

5 Electricity supply and demand synchronisation

The state’s growing role in supporting electricity supply, from subsidising small amounts of renewable generation to becoming the central guarantor for the majority of the electricity system, raises questions about whether European countries’ supply-side power system investments entail substantial fiscal risk.

If demand does not grow as anticipated, oversupply of electricity (or underdevelopment of demand) can be costly and inefficient, potentially leading to complex distributional questions about who should pay for the system. Better coordination between supply and demand is needed to mitigate these risks, potentially through targeted electricity demand stimulus.

In Europe’s integrated wholesale electricity markets, investments in neighbouring countries can have significant crossborder effects that influence prices and affect the market value of renewables and other essential clean-energy technologies, such as batteries.

Therefore, coordination is important to all parties. States could address these spillovers through jointly funded regional auctions and EU-backed contracts, with volumes and award criteria based on a regional assessment of clean-electricity supply needs.

Within countries, coordination of supply and demand investments could be tightened by introducing sectoral electrification targets in National Energy and Climate Plans (NECPs). Such targets would need to be aligned with the renewable energy targets already reported in the NECPs.

Targeted electricity demand stimulus could help reduce the costs associated with over-supply. For example, if electrification of heating and transport happens more slowly than expected, finance ministries could expect significant liabilities from CfDs (section 3).

In such a scenario, policies to drive rapid electrification of transport and heating would not only help with emissions mitigation, but would also be fiscally prudent, provided that the public money spent on demand-side policies does not exceed the expected liability from CfDs.

Such an intervention could simply be to remove CfD costs from all electricity bills, instead shifting the liability to national budgets. This would strengthen the relationship between falling demand and falling prices, creating a short-term pull for additional demand through the electrification of energy services.

Alternatively, instead of electricity price intervention, countries could temporarily provide additional support for capital investment in electrification technologies, for example through targeted tax credits or interest-free loans.

However, such interventions should still incentivise energy-efficient investments to limit the additional future investment needs, in both generation and networks.

6 Conclusions

Our stylised analysis shows that, if electricity demand does not grow as anticipated, de-risking the huge clean electricity supply capacity needed for the energy transition could lead to annual costs of tens of billions of euros being channelled through the state rather than the market.

This transfer risk between market-based financial flows and public counterparties could have a significant fiscal impact and also introduces hazardous incentives for states to reduce their exposures – for example by trying to inflate wholesale electricity prices or supporting inefficient electricity consumption.

Europe needs cheap, clean power to reduce its carbon emissions and strengthen its economic security, but to ensure a cost-effective transition, policymakers should watch for potential inefficiencies. Respecting three policy principles can mitigate the risk of substantial costs for European countries while decarbonising the energy system.

First, system-friendly renewable deployment is essential. The overall risk of inefficient supply investments should be reduced, irrespective of how these costs are distributed.

State-backed contracts such as CfDs should incentivise renewables that provide value to the system and can generate electricity during periods of high demand. Several proposals have been made for CfD designs that can nudge wind and solar projects to places with sufficient grid capacity to transmit the clean power to demand areas, or that will produce power that is complementary to other assets (Morawiecka and Scott, 2024).

Flexibility will also be increasingly important as more variable solar and wind is deployed. Flexibility can facilitate efficient matching of supply and demand in a decarbonised system and is a characteristic of technologies: interconnection, to take advantage of geographical averaging in renewable outputs; demand response, enabling consumers to respond to system conditions; and storage, to shift clean electricity from times of abundant supply to high demand.

Each of these technologies can increase offtake in periods of high renewable output, simultaneously reducing the carbon intensity of electricity and reducing the need for states to pay for surplus supply. Coordinated investments involving neighbouring states – for example, through joint auctions – could also help maximise the value of clean-electricity supply.

Second, huge investment in clean electricity is a necessity, but excess electricity supply is costly too. Therefore, demand incentives need to be retained and strengthened while ensuring that energy efficiency is prioritised.

With the build out of massive renewable electricity generation capacity, governments will have a growing fiscal incentive to drive heating and transport electrification to ensure that there is sufficient electricity demand for the state-backed supply.

Inefficient incentives such as inflated electricity prices or wasteful consumption should be guarded against. Instead, governments should encourage the electrification of energy services that must anyway be decarbonised to meet Europe’s climate targets.

Electrification could be incentivised, for example, through temporary electricity price reductions (for example by shifting support scheme costs to the budget) or through tax incentives for specific clean-energy technologies such as heat pumps and EVs. The European Commission could set out a list of policy options for encouragement of electrification, similar to the policy toolbox that was provided during the energy crisis (European Commission, 2021).

The introduction of electrification targets in NECP reporting could also lead to better coordination of electricity supply and demand throughout the energy transition. At present, there are clear targets for clean-electricity supply, while electricity demand targets are ambiguous.

Third, CfD costs should be recovered fairly. Electricity will become the primary energy carrier in a decarbonised system. How to recover the costs is becoming both a social policy choice and an industrial policy choice.

As state-backed schemes becomes more central, all electricity consumers must pay their shares of these schemes fairly and the costs should not burden a subset of consumers, specifically small businesses and households. Disproportionate costs for households could hamper public support for the energy transition while reducing the incentives for electrification.

EU rules are clear that the revenues from such schemes should be distributed evenly to consumers in a non-distortive fashion; the same should be applied to the costs, through an even levy on all electricity consumption or potentially through the national budget.

If a levy is chosen, it should be charged on a monthly or annual basis to preserve the short-term signals for demand response, especially as consumers are further empowered to engage actively in electricity markets. If the budgetary route is chosen, incentives for energy efficiency and demand response in the remaining price signals should nevertheless be retained.

The EU is embarking on a clean-energy investment wave, in which most renewable electricity generation will be secured through state contracts. Thanks to their near-zero marginal costs and the merit-order mechanism in Europe’s internal electricity market, renewable expansion will likely exert downward pressure on electricity prices, possibly leading to a new norm of low wholesale power prices in many hours.

To head off fiscal risks, Europe needs a managed transition in which all parts of the clean-electricity system – generation, networks, flexibility and consumption – develop in unison. Energy demand should be monitored carefully and governments should intervene if necessary to stimulate electrification to avoid substantial costs for states and, ultimately, citizens.

Endnotes

1. The amended EU Electricity Market Design Regulation (Regulation (EU) 2024/1747) was published in the EU Official Journal on 26 June 2024. The reform’s main aim was to respond to the gas-driven price spikes that impacted consumers during the 2022 energy-price crisis by giving consumers greater protection and incentivising deployment of renewables.

2. The growing thirst for power from data centres and particular artificial intelligence (AI) is especially hard to predict as it is dependent on the rate of innovation in the sector and the diffusion of AI products in the broader economy.

3. According to Eurostat, between 2012 and 2022, the share of renewable energy sources in transport increased from 6.1 percent to 9.6 percent, while the share of renewable energy sources in heating and cooling increased from 19 percent to 24.9 percent.

4. The European Commission’s 2040 Impact Assessment provides different assessments of final electricity consumption in 2030. Table 10 in Part 1 suggests that about 2,931 terawatt hours will be the final electricity consumption level (converting 33 percent of 764 Mtoe of final energy demand), while Figure 18 in Part 3 gives a figure of 2810 TWh for final electricity consumption. See European Commission (2024).

5. This designation is contained in Article 19d of the amended EU Electricity Market Design Regulation (Regulation (EU) 2024/1747).

6. The boundary between de-risking and support is blurry. CfDs reduce the risk of future market revenues for renewable projects while providing a lower expected return, thereby de-risking without providing support. However, depending on auction outcomes, CfDs could also provide higher returns than expected from the market, thereby acting as a subsidy. Such distinctions are project-specific, yet they highlight the risks of CfDs as a public instrument.

7. Wind and solar generation lifetime costs are dominated by initial capital costs, but their marginal costs are close to zero. As the strike prices bid by renewable projects in state-support auctions must cover the lifetime costs, they are typically much higher than the marginal costs that renewable assets bid in short-term spot markets.

8. Renewable support scheme and CfD design can vary significantly in terms of auction structure, the reference price, the type of payout and other factors. We assume CfDs payouts to be calculated based on actual output and an hourly spot market reference price. See Morawiecka and Scott (2024) for a deeper discussion of renewable support scheme design.

9. One proposal for risk management on behalf of states is for government agencies to sell parts of their CfD contracts on forward markets a few years before delivery (Schlecht et al 2023).

10. European wholesale electricity markets follow a marginal pricing approach in which the most expensive unit needed to meet demand determines the price.

11. Julien Jomaux, ‘Solar and the need for flexibility’, GEM Energy Analytics, 13 May 2024.

12. In reality, the incentives created by contract designs impact the operation of the system. For a discussion on the impacts of CfDs on system operation, see ENTSO-E (2024).

13. ERAA includes projections for each country of hourly electricity demand, hourly renewable output and generation capacities. The marginal costs of different generation types is based on a range of sources (see annex 1).

14. DISC baseline scenario results suggest that gas-fired generation could make up 6 percent of total generation in Germany compared to 21 percent of total generation in Italy in 2030.

15. For a breakdown of electricity cost components by country and consumer, see Sgaravatti (2024).

16. Bundesregierung news of 27 April 2022, ‘Relief for electricity consumers’.

References

Beiter, P, J Guillet, M Jansen, E Wilson and L Kitzing (2023) ‘The Enduring Role of Contracts for Difference in Risk Management and Market Creation for Renewables’, Nature Energy 9: 20-26.

ENTSO-E (2024) ‘Sustainable Contracts for Difference (CfDs) Design’, Position Paper, February.

European Commission (2021) ‘Tackling rising energy prices: a toolbox for action and support’, COM(2021) 660 final.

European Commission (2023) ‘Commission Staff Working Document Implementing The REPowerEU Action Plan: Investment Needs, Hydrogen Accelerator and Achieving the Bio-Methane Targets’, SWD(2022) 230 final.

European Commission (2024) ‘Commission Staff Working Document Impact Assessment Report accompanying the document Securing our future Europe’s 2040 climate target and path to climate neutrality by 2050 building a sustainable, just and prosperous society’, SWD(2024) 64 final.

IEA (2023) Renewable Energy Market Update, International Energy Agency.

IEA (2024) Electricity 2024 Analysis and forecast to 2026, International Energy Agency.

Lazard (2024) Levelised Cost of Energy+.

McWilliams, B, G Sgaravatti, S Tagliapietra and G Zachmann (2024) ‘Europe’s under-the-radar industrial policy: intervention in electricity pricing’, Policy Brief 2024/01, Bruegel.

Morawiecka, M and D Scott (2024) ‘Balancing act. Two-sided contracts for difference for a speedy, cost-efficient and equitable energy transition’, Blueprint Deep Dive, Regulatory Assistance Project.

Pexapark (2023) European PPA Market Outlook 2024.

Schlecht, I, C Maurer and L Hirth (2023) ‘Financial Contracts for Differences’, Working Paper, ZBW – Leibniz Information Centre for Economics.

Sgaravatti, G (2024) ‘Electricity Tariffs Dashboard’, Bruegel Dataset, 16 May.

Solar Power Europe (2023) EU Market Outlook for Solar Power 2023-2027.

WindEurope (2024) Wind energy in Europe: 2023 Statistics and the outlook for 2024-2030.

Zachmann, G, C Batlle, F Beaude, C Maurer, M Morawiecka and F Roques (2024) ‘Unity in power, power in unity: why the EU needs more integrated electricity markets’, Policy Brief 2024/03, Bruegel.

Zachmann, G, L Hirth, C Heussaff, I Schlecht, J Mühlenpfordt and A Eicke (2023) The design of the European electricity market, Study requested by the ITRE Committee, European Parliament,

Luxembourg.

Zerrahn, A, WP Schill and C Kemfert (2018) ‘On the economics of electrical storage for variable renewable energy sources’, European Economic Review 108.

This article is based on Bruegel Policy Brief Issue no14/24 | July 2024.