AI looks increasing likely to become what technologists call a general-purpose technology. Michael Barr discusses the rapid evolution of AI and the potential impact of generative AI on the labour market and the economy

united states

Building a new Western century

For the last year there has been turbulence in the US-EU partnership. Marco Rubio argues that the new alliance should focus on advancing mutual interests and new frontiers, unshackling ingenuity, creativity, and the dynamic spirit to build a new Western century

The shifting landscape of trade and investment

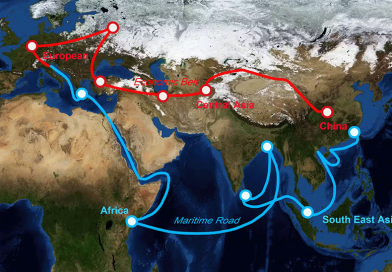

China’s BRI has reorganised global value chains. Yasuyuki Todo, Shuhei Nishitateno and Sean Brown reveal that the initiative has triggered strategic and divergent responses among major investor countries, depending on their economic and political relationships with China

Can the World Trade Organization survive?

The foundations of the multilateral trading system have been shaken. Petros Mavroidis argues that reviving the WTO will require a determined effort from the key stakeholders to address issues that the membership has previously avoided

The flawed rationale behind America’s reciprocal tariffs

The Trump administration imposed ‘reciprocal tariffs’ using powers granted under the International Emergency Economic Powers Act. Gene Grossman and Alan Sykes argue that the tariffs do not meet two core requirements for the exercise of emergency powers under the Act

Trump’s tariffs as fiscal folly

In 2025 the US government underwent a large fiscal switch. Kimberly Clausing and Maurice Obstfeld evaluate tariffs as a broad tool of fiscal policy, reviewing both tax policy and macroeconomic considerations, and concludes that this fiscal switch will leave most Americans worse off